Key Insights

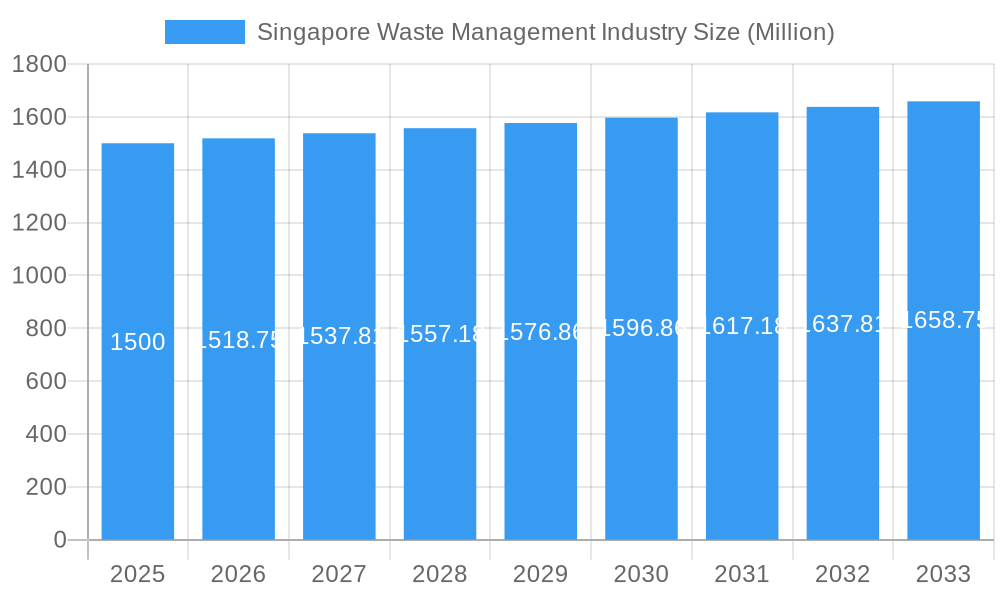

The Singapore waste management market, projected to reach $819.26 billion by 2025, is expected to experience a robust Compound Annual Growth Rate (CAGR) of 6.9%. This expansion is fueled by stringent environmental policies, increasing urbanization driving waste volumes, and a heightened commitment to sustainable practices including recycling and resource recovery. The market features established entities such as Sembcorp Environmental Management and Veolia, alongside specialized firms in e-waste recycling and industrial waste solutions. Government-led initiatives promoting a circular economy and investment in advanced waste treatment technologies are key growth accelerators.

Singapore Waste Management Industry Market Size (In Billion)

Key challenges include land scarcity, impacting landfill operations and costs, and price volatility of recyclable commodities. Technological innovations, such as AI-driven sorting and anaerobic digestion, present both opportunities and potential disruptions. Future market development hinges on industry adaptability through technological integration, optimized resource utilization, and sustained commitment to sustainability. Market segmentation includes residential, commercial, and industrial waste streams, each offering distinct growth avenues and operational considerations.

Singapore Waste Management Industry Company Market Share

Singapore Waste Management Industry: 2019-2033 Market Report - A Comprehensive Analysis

Dive deep into the dynamic Singapore Waste Management Industry with this comprehensive market report, covering the period 2019-2033. This in-depth analysis provides critical insights for stakeholders, investors, and industry professionals seeking to understand market trends, leading players, and future growth opportunities. The report leverages data from the base year 2025, with estimations for 2025 and forecasts extending to 2033. This report covers historical data from 2019-2024. Maximize your strategic advantage with this meticulously researched report.

Singapore Waste Management Industry Market Dynamics & Concentration

The Singapore waste management market, valued at S$XX Million in 2025, exhibits a moderately concentrated landscape. Key players such as Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, and CITIC Envirotech Ltd hold significant market share, though the exact figures remain proprietary. The industry is driven by stringent government regulations promoting recycling and waste reduction, alongside increasing environmental awareness among consumers. Product substitutes, such as composting and anaerobic digestion technologies, are gaining traction, presenting both opportunities and competitive challenges. The market has witnessed a steady stream of M&A activities in recent years, with xx major deals recorded between 2019 and 2024, primarily focused on consolidation and expansion into new waste streams. This trend is expected to continue, further shaping market concentration.

- Market Concentration: Moderately concentrated, with top players holding a significant, but not dominant, share.

- Innovation Drivers: Stringent environmental regulations, rising consumer awareness, and technological advancements.

- Regulatory Framework: Supportive policies emphasizing waste reduction, recycling targets, and sustainable waste management practices.

- Product Substitutes: Composting, anaerobic digestion, and other innovative waste treatment technologies.

- End-User Trends: Growing preference for sustainable waste management solutions among businesses and consumers.

- M&A Activities: xx major deals between 2019 and 2024, indicating consolidation and expansion.

Singapore Waste Management Industry Industry Trends & Analysis

The Singapore waste management industry is experiencing robust growth, driven by a multitude of factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a value of S$XX Million by 2033. This growth is fueled by increasing urbanization, rising waste generation, and government initiatives promoting sustainable waste management. Technological advancements, such as AI-powered waste sorting and advanced recycling technologies, are significantly disrupting traditional methods. Consumer preferences are shifting towards environmentally friendly waste disposal options, creating new opportunities for eco-conscious companies. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration of advanced recycling technologies is currently at xx% and is expected to increase to xx% by 2033.

Leading Markets & Segments in Singapore Waste Management Industry

While Singapore's waste management market is a national one, the leading segments are clearly defined. The industrial waste segment dominates due to the high volume of waste generated by manufacturing and industrial activities.

- Key Drivers for Industrial Waste Dominance:

- Stringent regulations on industrial waste disposal.

- High waste generation from various industrial sectors.

- Growing adoption of sustainable industrial practices.

The dominance of the industrial waste segment is primarily due to its high volume and the significant regulatory focus on its proper management. Government policies supporting sustainable industrial practices, combined with the considerable waste volume produced by Singapore's robust industrial sector, fuel this segment's growth.

Singapore Waste Management Industry Product Developments

Significant innovations are reshaping the waste management landscape. Advanced recycling technologies, AI-powered waste sorting systems, and improved waste-to-energy solutions are enhancing efficiency and sustainability. These innovations offer competitive advantages by reducing operational costs, improving resource recovery rates, and minimizing environmental impact. The market is seeing a significant push towards more efficient and sustainable waste management solutions.

Key Drivers of Singapore Waste Management Industry Growth

The industry’s expansion is driven by several key factors. Stringent government regulations promoting waste reduction and recycling are a primary driver. Technological advancements in waste processing and recycling technologies offer efficiency improvements. The increasing awareness of environmental concerns among businesses and consumers further fuels market growth by driving demand for sustainable waste management solutions. Finally, government investments in waste management infrastructure contribute to the market’s expansion.

Challenges in the Singapore Waste Management Industry Market

The industry faces several hurdles. High capital investment costs for advanced technologies can be a barrier to entry for smaller players. Fluctuations in commodity prices for recycled materials can impact profitability. Competition from established players can intensify, creating pressure on margins. These factors can collectively impact the overall market growth.

Emerging Opportunities in Singapore Waste Management Industry

The future holds exciting opportunities. Technological breakthroughs in waste-to-energy conversion and advanced recycling will unlock new revenue streams. Strategic partnerships between waste management companies and technology providers can foster innovation and efficiency. Expansion into new waste streams, such as e-waste and medical waste, will open up new market segments.

Leading Players in the Singapore Waste Management Industry Sector

- (If available, insert link here) Sembcorp Environmental Management Pte Ltd (Singapore)

- (If available, insert link here) Veolia Environmental S A

- (If available, insert link here) Colex Holdings Limited

- ECO Industrial Environmental Engineering Pte Ltd

- Envipure

- RICTEC PTE LTD

- Industrial Wastes Auction

- Recycling Partners Pte Ltd

- CH E-Recycling

- (If available, insert link here) CITIC Envirotech Ltd

- List Not Exhaustive

Key Milestones in Singapore Waste Management Industry Industry

- 2020: Implementation of new regulations on plastic waste management.

- 2022: Launch of a major waste-to-energy plant.

- 2023: Significant investment in advanced recycling technologies by a leading player.

- 2024: Merger between two prominent waste management companies.

- (Add more milestones with specific dates as available)

Strategic Outlook for Singapore Waste Management Industry Market

The Singapore waste management market is poised for substantial growth, driven by technological innovation, supportive government policies, and increasing environmental consciousness. Strategic partnerships and investments in advanced technologies will be crucial for companies seeking to thrive in this competitive landscape. The long-term outlook for the industry is positive, with opportunities for both expansion and diversification.

Singapore Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Bio-medical waste

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Recycling

Singapore Waste Management Industry Segmentation By Geography

- 1. Singapore

Singapore Waste Management Industry Regional Market Share

Geographic Coverage of Singapore Waste Management Industry

Singapore Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Recycling is a key trend in the Singaporean waste management industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Singapore Waste Management Industry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Environmental Management Pte Ltd (Singapore)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environmental S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colex Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ECO Industrial Environmental Engineering Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envipure

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RICTEC PTE LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indsutrial Wastes Auction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Recycling Partners Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CH E-Recycling

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CITIC Envirotech Ltd**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Singapore Waste Management Industry

List of Figures

- Figure 1: Singapore Waste Management Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Singapore Waste Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Singapore Waste Management Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Waste Management Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Singapore Waste Management Industry?

Key companies in the market include Singapore Waste Management Industry, Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, ECO Industrial Environmental Engineering Pte Ltd, Envipure, RICTEC PTE LTD, Indsutrial Wastes Auction, Recycling Partners Pte Ltd, CH E-Recycling, CITIC Envirotech Ltd**List Not Exhaustive.

3. What are the main segments of the Singapore Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 819.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Recycling is a key trend in the Singaporean waste management industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Waste Management Industry?

To stay informed about further developments, trends, and reports in the Singapore Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence