Key Insights

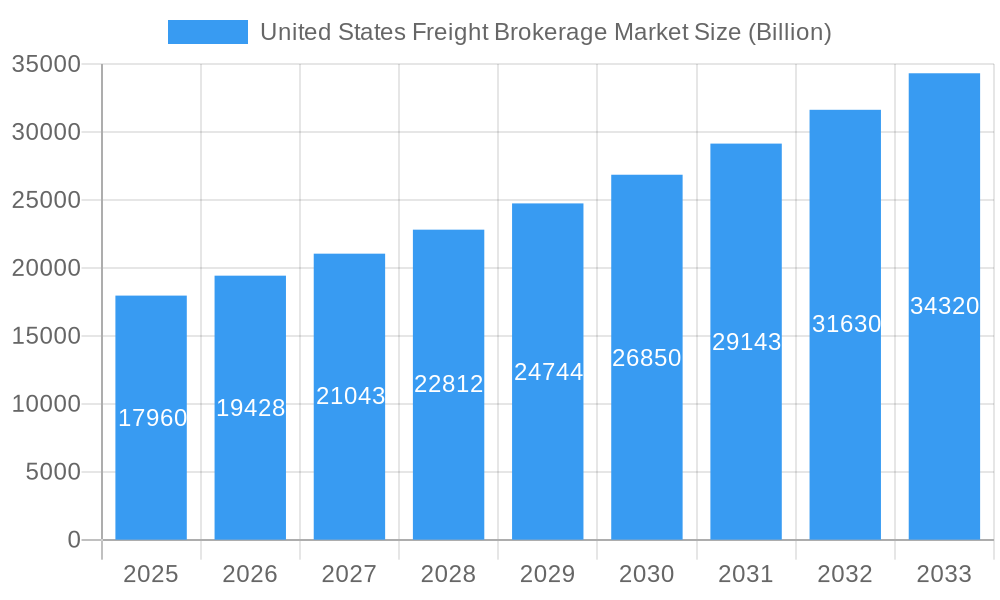

The United States freight brokerage market, a dynamic sector facilitating the efficient movement of goods, is experiencing robust growth. With a 2025 market size estimated at $17.96 billion and a projected Compound Annual Growth Rate (CAGR) of 8.35% from 2025-2033, the market's trajectory indicates significant expansion. Key drivers include the increasing e-commerce penetration fueling higher demand for last-mile delivery solutions, the ongoing need for supply chain optimization among businesses of all sizes, and the expanding adoption of advanced technologies such as digital freight matching platforms and transportation management systems (TMS). The market is segmented by service type (Less-than-Truckload (LTL), Full-Truckload (FTL), and other services) and end-user industry (manufacturing, automotive, oil & gas, etc.), reflecting the diverse needs of shippers across various sectors. The dominance of large players like Coyote Logistics, C.H. Robinson, and XPO Logistics is evident, though the market also features numerous smaller, specialized brokers catering to niche segments. The growth is further influenced by ongoing trends such as the integration of artificial intelligence (AI) and machine learning (ML) into freight management systems, improving efficiency and reducing costs.

United States Freight Brokerage Market Market Size (In Billion)

Constraints on market growth include fluctuating fuel prices, driver shortages impacting capacity availability, and economic downturns impacting shipping volumes. However, the long-term outlook remains positive due to the persistent need for efficient and reliable freight transportation. The North American region, specifically the United States, is expected to retain a significant market share, driven by its large and diverse economy. Growth in other regions like Asia-Pacific is projected to increase, fueled by expanding e-commerce and industrialization. Furthermore, the increasing complexity of global supply chains necessitates the expertise of freight brokers, solidifying their role as crucial intermediaries in the logistics landscape. This continued demand, coupled with technological advancements, positions the U.S. freight brokerage market for sustained and substantial expansion over the forecast period.

United States Freight Brokerage Market Company Market Share

United States Freight Brokerage Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Freight Brokerage Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete historical and future perspective on market trends, opportunities, and challenges. The market is projected to reach a value of XX Billion by 2033.

United States Freight Brokerage Market Market Dynamics & Concentration

The United States freight brokerage market is a dynamic and evolving landscape, shaped by a complex interplay of economic forces, technological innovation, and strategic maneuvers. Market consolidation is a prominent trend, with a handful of major players commanding a significant portion of the market share. Leading entities such as Coyote Logistics, Total Quality Logistics, Hub Group, Landstar System Inc, CH Robinson, KAG Logistics Inc, SunteckTTS, BNSF Logistics LLC, XPO Logistics Inc, and Uber Freight operate alongside a vast network of smaller and regional operators. Projections for 2025 estimate the combined market share of the top 10 players to be approximately 60%, underscoring the concentrated nature of the industry.

- Market Concentration & M&A Activities: The market exhibits moderate to high concentration, with leading firms actively pursuing strategic mergers and acquisitions (M&A) to broaden their geographic reach, diversify service portfolios, and integrate advanced technological capabilities. The period between 2019 and 2024 saw an average of approximately 15 M&A deals annually, reflecting a concerted effort towards consolidation and expansion.

- Innovation Drivers: Technological advancements are at the forefront of market innovation. Digital freight matching platforms, sophisticated data analytics, and the increasing adoption of artificial intelligence (AI) and machine learning are revolutionizing operational efficiency, enhancing predictive capabilities, and elevating the customer experience through greater transparency and proactive issue resolution.

- Regulatory Frameworks: The market operates within a robust framework of federal and state regulations governing trucking and transportation. These regulations significantly influence pricing strategies, necessitate adherence to stringent safety standards, and dictate operational practices. Shifts in regulations concerning driver hours of service, emissions, or carrier compliance can have a profound impact on operational costs and capacity availability.

- Product Substitutes & Competition: While freight brokerage remains central, the market faces competition from alternative transportation modes, particularly for long-haul shipments. Rail and intermodal transport offer viable alternatives, compelling freight brokers to continuously refine their service offerings, optimize pricing, and emphasize their unique value propositions in terms of flexibility, speed, and door-to-door solutions.

- End-User Trends & Demand: The relentless growth of e-commerce and escalating consumer expectations for faster delivery times are placing significant pressure on the freight brokerage sector. This necessitates the provision of more agile, reliable, and expedited shipping solutions. Key end-user industries such as manufacturing, automotive, and retail are experiencing substantial growth, directly contributing to increased demand for brokerage services.

United States Freight Brokerage Market Industry Trends & Analysis

The US freight brokerage market is experiencing robust growth, fueled by several key factors. The increasing volume of goods transported, driven by e-commerce expansion and industrial activity, forms a core foundation for market expansion. Technological disruption, particularly the rise of digital freight platforms, is streamlining operations, enhancing transparency, and improving efficiency across the supply chain. This leads to cost optimization and improved customer service.

Consumer preferences are increasingly shifting towards faster delivery times and enhanced visibility into the shipment process. This pushes freight brokers to adopt advanced technologies and develop flexible, customizable services. Competitive dynamics are shaping the market, with companies differentiating themselves through specialized services, technology-driven solutions, and enhanced customer support. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Market penetration of digital freight platforms is expected to reach xx% by 2033.

Leading Markets & Segments in United States Freight Brokerage Market

The US freight brokerage market is geographically diverse, with significant activity across all regions. However, certain segments dominate in terms of volume and revenue generation.

By Service:

- FTL (Full Truckload): This segment holds the largest market share due to the high demand for transporting large volumes of goods over long distances. Key drivers include the robust manufacturing and retail sectors.

- LTL (Less-than-Truckload): This segment experiences strong growth, driven by smaller businesses and the increasing need for cost-effective transportation of smaller shipments.

- Other Services: This segment includes specialized services like intermodal transportation and expedited shipping, catering to specific industry needs and offering niche opportunities.

By End User:

- Manufacturing and Automotive: This sector remains the largest end-user segment, driving significant demand for freight brokerage services due to the complex supply chains involved in production and distribution.

- Distributive Trade (Wholesale and Retail): The rapid growth of e-commerce is significantly boosting demand for faster and more efficient delivery options, driving the expansion of this segment.

- Oil and Gas, Mining, and Quarrying: This sector is characterized by large-scale transportation needs, which are significantly influenced by fluctuating commodity prices and project timelines.

- Other end-user segments, including Agriculture, Fishing and Forestry, Construction, and Others (Telecommunications, Pharmaceuticals etc.), exhibit varied growth levels, influenced by economic cycles and industry-specific trends.

United States Freight Brokerage Market Product Developments

Recent product developments in the US freight brokerage market are largely centered on the strategic leverage of technology to drive enhanced efficiency, transparency, and customer satisfaction. Advanced digital freight platforms are now offering features such as real-time shipment tracking, seamless automated booking processes, and intelligent, optimized routing algorithms. The integration of AI and machine learning capabilities is proving instrumental in improving the precision of shipment-to-carrier matching, leading to tangible benefits like accelerated transit times and reduced overall logistics costs. These innovations are directly responding to the market's persistent demand for greater speed, improved visibility throughout the supply chain, and enhanced cost-effectiveness.

Key Drivers of United States Freight Brokerage Market Growth

Several compelling factors are propelling the growth trajectory of the United States freight brokerage market:

- E-commerce Expansion: The exponential and ongoing expansion of the e-commerce sector is a primary catalyst, creating sustained and increasing demand for efficient, reliable, and scalable transportation solutions to move goods from distribution centers to consumers.

- Technological Advancements: The widespread adoption and continuous evolution of digital platforms are fundamentally streamlining brokerage operations, significantly improving supply chain transparency, and leading to substantial cost reductions through automation and better resource allocation.

- Economic Growth: A robust and expanding economy directly correlates with increased industrial production, heightened manufacturing activity, and greater consumer spending, all of which translate into higher volumes of freight requiring transportation and brokerage services.

- Infrastructure Development: Strategic investments in and ongoing development of critical infrastructure, including extensive road networks, modern ports, and intermodal facilities, are crucial for facilitating smoother, faster, and more efficient transportation operations, thereby supporting market growth.

- Supply Chain Resilience Initiatives: In response to recent global disruptions, companies are increasingly focusing on building more resilient supply chains. Freight brokers play a vital role in providing flexibility and diverse transportation options, contributing to this resilience and driving demand.

Challenges in the United States Freight Brokerage Market Market

The US freight brokerage market faces several challenges:

- Driver shortages: A persistent shortage of qualified truck drivers is leading to capacity constraints and increased transportation costs. This impacts the ability to meet increasing demand, potentially leading to delays and increased prices.

- Fuel price volatility: Fluctuations in fuel prices directly impact transportation costs, creating uncertainty for freight brokers and their clients.

- Increased regulatory scrutiny: Stricter regulations on safety, emissions, and driver hours of service add operational complexity and potentially increase costs. Compliance is a significant challenge.

- Intense competition: The market is highly competitive, with numerous established players and new entrants constantly vying for market share.

Emerging Opportunities in United States Freight Brokerage Market

Several opportunities exist for long-term growth in the US freight brokerage market:

- Expansion into niche markets: Specializing in particular industries or transportation modes can create competitive advantages.

- Strategic partnerships: Collaborations with technology providers or other logistics companies can lead to synergistic growth.

- International expansion: Expanding operations into new geographic markets can broaden the customer base and increase revenue streams.

- Sustainability initiatives: Adopting environmentally friendly practices can attract environmentally conscious clients.

Leading Players in the United States Freight Brokerage Market Sector

- Coyote Logistics

- Total Quality Logistics

- Hub Group

- Landstar System Inc

- CH Robinson

- KAG Logistics Inc

- SunteckTTS

- BNSF Logistics LLC

- XPO Logistics Inc

- Uber Freight

- Worldwide Express

- Schneider

- Echo Global Logistics

- GlobalTranz

- J.B. Hunt Transport Inc.

- 6-3 Other Companies (comprising a significant number of smaller and niche players)

Key Milestones in United States Freight Brokerage Market Industry

- August 2023: Convoy launches a just-in-time (JIT) trucking service, offering delivery within 15 minutes of scheduled arrival, significantly enhancing flexibility and responsiveness for shippers.

- February 2023: Echo Global Logistics introduces EchoInsure+, a comprehensive cargo insurance product integrated into its EchoShip platform, improving risk management and client protection.

Strategic Outlook for United States Freight Brokerage Market Market

The United States freight brokerage market is projected to continue its robust growth trajectory, fueled by sustained economic expansion, rapid technological advancements, and the persistent evolution of the e-commerce landscape. Key strategic opportunities lie in the adept utilization of emerging technologies to optimize operational efficiencies, the targeted expansion into specialized or niche market segments offering higher margins, and the cultivation of strategic partnerships to establish and maintain a competitive edge. The market is well-positioned for substantial expansion throughout the foreseeable future, presenting considerable opportunities for both established industry leaders and innovative new entrants.

United States Freight Brokerage Market Segmentation

-

1. Service

- 1.1. LTL

- 1.2. FTL

- 1.3. Other Services

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

United States Freight Brokerage Market Segmentation By Geography

- 1. United States

United States Freight Brokerage Market Regional Market Share

Geographic Coverage of United States Freight Brokerage Market

United States Freight Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country

- 3.4. Market Trends

- 3.4.1. FTL Service Has Gained Momentum in the Country in Recent Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Freight Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. LTL

- 5.1.2. FTL

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coyote Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total Quality Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Landstar System Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CH Robinson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAG Logistics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SunteckTTS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BNSF Logistics LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Uber Freight**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Worldwide Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Schneider

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Echo Global Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 GlobalTranz

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 J B Hunt Transport Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Coyote Logistics

List of Figures

- Figure 1: United States Freight Brokerage Market Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: United States Freight Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 2: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 3: United States Freight Brokerage Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 4: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 5: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 6: United States Freight Brokerage Market Revenue Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Freight Brokerage Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the United States Freight Brokerage Market?

Key companies in the market include Coyote Logistics, Total Quality Logistics, Hub Group, Landstar System Inc, CH Robinson, KAG Logistics Inc, SunteckTTS, BNSF Logistics LLC, XPO Logistics Inc, Uber Freight**List Not Exhaustive 6 3 Other Companie, Worldwide Express, Schneider, Echo Global Logistics, GlobalTranz, J B Hunt Transport Inc.

3. What are the main segments of the United States Freight Brokerage Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 Billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country.

6. What are the notable trends driving market growth?

FTL Service Has Gained Momentum in the Country in Recent Years.

7. Are there any restraints impacting market growth?

4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country.

8. Can you provide examples of recent developments in the market?

August 2023: Digital logistics provider and freight brokerage Convoy unveiled an offering for just-in-time (JIT) trucking, with a pledge of delivery within 15 minutes of the set arrival time. Convoy spotted an opening for a more flexible service that gives shippers the ability to scale up and down in response to fast-changing conditions. Its new JIT service leverages a network of over 400,000 trucks and the IT infrastructure to find matching carriers to meet specific shipper requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Freight Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Freight Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Freight Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Freight Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence