Key Insights

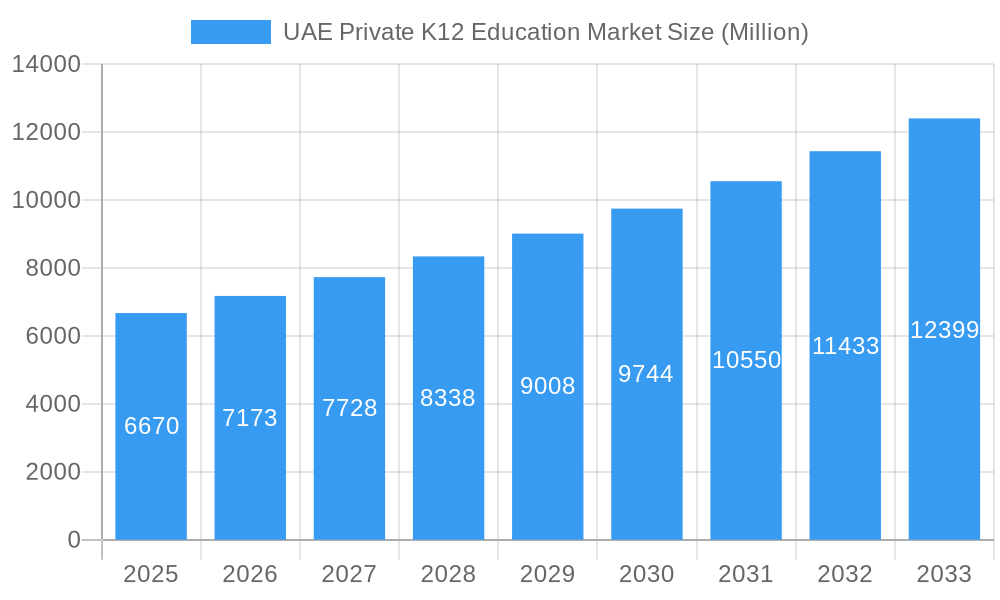

The UAE private K12 education market, valued at $6.67 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This expansion is fueled by several key factors. A burgeoning expatriate population, coupled with a rising demand for high-quality international curricula and enhanced educational facilities, significantly contributes to market growth. Parents are increasingly willing to invest in private education to secure better opportunities for their children, driving demand for diverse educational offerings, including British, American, and international baccalaureate programs. Furthermore, government initiatives promoting education excellence and attracting foreign investment in the education sector further bolster market expansion. Competitive pricing strategies adopted by established players and the entry of new schools offering specialized programs are also shaping the market landscape.

UAE Private K12 Education Market Market Size (In Billion)

However, challenges exist. The market faces potential restraints from fluctuating oil prices impacting the disposable income of some families, and increasing tuition fees might hinder access for lower-income households. Government regulations and stringent licensing requirements also pose hurdles for new entrants. Despite these challenges, the long-term outlook remains positive, driven by sustained population growth, increased parental spending on education, and the ongoing diversification of the UAE economy. The market is segmented by curriculum type (e.g., British, American, IB), school type (e.g., day schools, boarding schools), and location (e.g., Dubai, Abu Dhabi, other emirates). Leading players such as GEMS Education, Nord Anglia Education, and Dubai American Academy, alongside numerous other international and local schools, are actively shaping the competitive dynamics of this expanding market.

UAE Private K12 Education Market Company Market Share

UAE Private K12 Education Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Private K12 Education market, offering invaluable insights for investors, educators, and industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market dynamics, trends, and future opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

UAE Private K12 Education Market Dynamics & Concentration

The UAE's private K12 education market is characterized by a moderate level of concentration, with several large players holding significant market share. GEMS Education, for instance, commands a substantial portion, while other major players like Taleem, Esol Education, and Nord Anglia Education also contribute significantly. Market share fluctuations are influenced by factors such as mergers and acquisitions (M&A) activity, new school openings, and evolving parental preferences. Between 2019 and 2024, the market witnessed approximately xx M&A deals, primarily driven by expansion strategies and consolidation efforts. Innovation is a key driver, with schools investing in advanced technologies and pedagogical approaches to enhance the learning experience. The regulatory framework, while supportive of private education, also plays a role, influencing operational costs and curriculum standards. Product substitutes, such as online learning platforms, are gaining traction but haven't significantly disrupted the traditional school model yet. End-user trends indicate a growing demand for international curricula, specialized programs (STEM, arts, etc.), and personalized learning experiences.

- Market Concentration: Moderately concentrated, with a few dominant players.

- M&A Activity (2019-2024): Approximately xx deals.

- Innovation Drivers: Technological advancements, pedagogical innovations.

- Regulatory Framework: Supportive but influential on costs and standards.

- End-User Trends: Growing preference for international curricula and personalized learning.

UAE Private K12 Education Market Industry Trends & Analysis

The UAE private K12 education market is experiencing dynamic expansion, propelled by a confluence of powerful growth drivers. The nation's rapidly expanding affluent demographic, characterized by escalating disposable incomes, is a primary catalyst, fueling an insatiable demand for superior private educational institutions. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately **10-12%** over the forecast period (2025-2033), signaling sustained and robust market development. The pervasive influence of technological advancement is transforming classrooms, with the seamless integration of cutting-edge educational technology (EdTech) demonstrably enhancing learning outcomes, fostering greater efficiency, and personalizing the educational journey for students. Consumer preferences are increasingly sophisticated, with a clear tilt towards schools that offer specialized academic programs, renowned international curricula such as the International Baccalaureate (IB), British, and American frameworks, and a rich array of engaging extracurricular activities. The competitive landscape is vibrant, characterized by a dynamic interplay between well-established, legacy educational providers and agile, innovative new entrants, collectively driving a culture of continuous improvement and service excellence. While market penetration is notably high in densely populated urban centers, opportunities for expansion remain significant in less developed, yet emerging, regions.

- CAGR (2025-2033): Approximately 10-12%

- Market Penetration: High in urban areas; significant untapped potential in less developed regions.

- Key Growth Drivers: Sustained growth in disposable incomes, escalating demand for premium and international-standard education, pervasive integration of EdTech solutions, increasing focus on holistic student development.

- Competitive Dynamics: A sophisticated market with a healthy mix of large, established educational groups and innovative, niche providers.

Leading Markets & Segments in UAE Private K12 Education Market

Within the thriving UAE private K12 education sector, the **premium segment** stands out as the most dominant, meticulously crafted to cater to the discerning needs of high-net-worth families who prioritize unparalleled educational experiences. Geographically, **Dubai** continues to assert its position as the preeminent market. This leadership is underpinned by its remarkably robust and diversified economy, its world-class, well-established infrastructure, and its substantial and continuously growing expatriate population, which represents a significant consumer base for international educational standards. **Abu Dhabi** closely follows, representing another pivotal market, albeit one that often presents a slightly different demographic profile and a distinct set of educational priorities.

Key Drivers for Dubai's Continued Dominance:

- Exceptional Economic Strength: High and consistently rising disposable incomes directly translate into a strong demand for premium and elite educational offerings.

- World-Class Infrastructure: A mature ecosystem of cutting-edge schools, advanced learning facilities, and comprehensive supporting services ensures a superior educational environment.

- Vast and Diverse Expatriate Community: A significant influx of international residents fuels a persistent and substantial demand for schools that offer familiar international curricula and educational philosophies.

UAE Private K12 Education Market Product Developments

Recent product innovations focus on integrating technology for personalized learning, creating engaging digital learning environments, and providing specialized programs tailored to student interests and career goals. Schools are emphasizing STEM education, fostering creativity through arts programs, and adopting blended learning models to maximize student engagement. These developments aim to meet the evolving needs of students and families, gaining a competitive advantage in the market.

Key Drivers of UAE Private K12 Education Market Growth

The UAE's private K12 education market's growth is fueled by several factors, including:

- Government Support: Policies promoting education and foreign investment.

- Economic Growth: Increased disposable incomes lead to higher spending on education.

- Demographic Trends: A growing population with a high proportion of school-aged children.

- Technological Advancements: The integration of EdTech tools and resources enhances learning experiences.

Challenges in the UAE Private K12 Education Market

Challenges include:

- High Operating Costs: Maintaining high standards while managing expenses remains a challenge.

- Competition: The market is competitive, requiring constant innovation and service improvements.

- Regulatory Compliance: Navigating evolving regulations can be complex and costly.

Emerging Opportunities in UAE Private K12 Education Market

Emerging opportunities lie in expanding into underserved regions, offering niche programs (e.g., vocational training, specialized STEM), and leveraging technology for personalized learning and remote education solutions. Strategic partnerships with international institutions and EdTech companies will further enhance market reach and service capabilities.

Leading Players in the UAE Private K12 Education Market Sector

- GEMS Education

- Athena Education

- Taleem

- Esol Education

- Kings' Schools Group

- SABIS Education Services

- British International School

- Al-Mizhar American Academy

- Nord Anglia Education

- Dubai American Academy

- Glendale International School

- Deira International School

- The Arbor School

- Bloom Education

- Horizon International School

- Universal American School

- American School of Dubai

- Swiss International Scientific School, Dubai

- The British School, Al Khubairat (Abu Dhabi)

- Repton School Dubai

- Etihad Modern Education

- Raha International School

- School of Creative Science

- DHA (Dubai Heights Academy)

- Aldar Academies

- Note: This is not an exhaustive list but represents key influential entities.

Key Milestones in UAE Private K12 Education Market Industry

- May 2023: Glendale International School opens in Dubai, accommodating 3000 students.

- March 2023: Kings’ Education partners with Leap, enhancing study abroad options for students.

Strategic Outlook for UAE Private K12 Education Market Market

The UAE private K12 education market holds immense potential for continued growth. Strategic investments in technology, curriculum development, and strategic partnerships will be key to capturing future market share. The focus on personalized learning, international collaborations, and addressing the needs of diverse student populations will determine the success of leading players in the years to come.

UAE Private K12 Education Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic/UAE

- 2.4. Indian

- 2.5. Other Curricula

UAE Private K12 Education Market Segmentation By Geography

- 1. North Region

- 2. West Region

- 3. South Region

- 4. East Region

UAE Private K12 Education Market Regional Market Share

Geographic Coverage of UAE Private K12 Education Market

UAE Private K12 Education Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.4. Market Trends

- 3.4.1 Increased Rate of Population Growth

- 3.4.2 including Expatriates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic/UAE

- 5.2.4. Indian

- 5.2.5. Other Curricula

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West Region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic/UAE

- 6.2.4. Indian

- 6.2.5. Other Curricula

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic/UAE

- 7.2.4. Indian

- 7.2.5. Other Curricula

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic/UAE

- 8.2.4. Indian

- 8.2.5. Other Curricula

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic/UAE

- 9.2.4. Indian

- 9.2.5. Other Curricula

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GEMS Education

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Athena Education

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taleem

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Esol Education

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kings' Schools Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SABIS Education Services

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 British International School

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al-Mizhar American Academy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nord Anglia Education

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dubai American Academy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Glendale International School

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Deira International School**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 GEMS Education

List of Figures

- Figure 1: Global UAE Private K12 Education Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Private K12 Education Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 4: North Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 5: North Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 7: North Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 8: North Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 9: North Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 10: North Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 11: North Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 15: West Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 16: West Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 17: West Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 18: West Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 19: West Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 20: West Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 21: West Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 22: West Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 23: West Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 24: West Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 25: West Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: West Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 28: South Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 29: South Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: South Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 31: South Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 32: South Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 33: South Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 34: South Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 35: South Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 36: South Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 37: South Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 39: East Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 40: East Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 41: East Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 42: East Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 43: East Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 44: East Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 45: East Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 46: East Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 47: East Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 48: East Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 49: East Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: East Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 4: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 5: Global UAE Private K12 Education Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Private K12 Education Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 9: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 10: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 11: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 15: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 16: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 17: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 20: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 22: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 23: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 26: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 27: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 28: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 29: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Private K12 Education Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the UAE Private K12 Education Market?

Key companies in the market include GEMS Education, Athena Education, Taleem, Esol Education, Kings' Schools Group, SABIS Education Services, British International School, Al-Mizhar American Academy, Nord Anglia Education, Dubai American Academy, Glendale International School, Deira International School**List Not Exhaustive.

3. What are the main segments of the UAE Private K12 Education Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

6. What are the notable trends driving market growth?

Increased Rate of Population Growth. including Expatriates.

7. Are there any restraints impacting market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Glendale International School opened its doors to students aged 3 to 11 in Dubai. Singapore-based Global Schools Foundation announced the launch. Sprawling over 20,000 square meters, the new premises can accommodate 3000 students.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Private K12 Education Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Private K12 Education Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Private K12 Education Market?

To stay informed about further developments, trends, and reports in the UAE Private K12 Education Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence