Key Insights

The refuse compactor market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 3.4% from 2024 to 2033. This growth is propelled by increasing urbanization and subsequent rise in waste generation, driving demand for efficient waste management solutions. Growing environmental consciousness and stringent regulations are further accelerating the adoption of compactors to optimize landfill utilization and reduce transportation expenses. Technological innovations, including enhanced automation, data analytics, and improved compactor durability, are also key growth catalysts. The market is segmented by compactor type (vertical, horizontal, self-contained), application (commercial, industrial, residential), and technology (hydraulic, pneumatic). Key market players such as GE Appliances, Husmann Umwelttechnik GmbH, and Wastequip LLC are contributing to a competitive landscape that may evolve with new market entrants and strategic alliances.

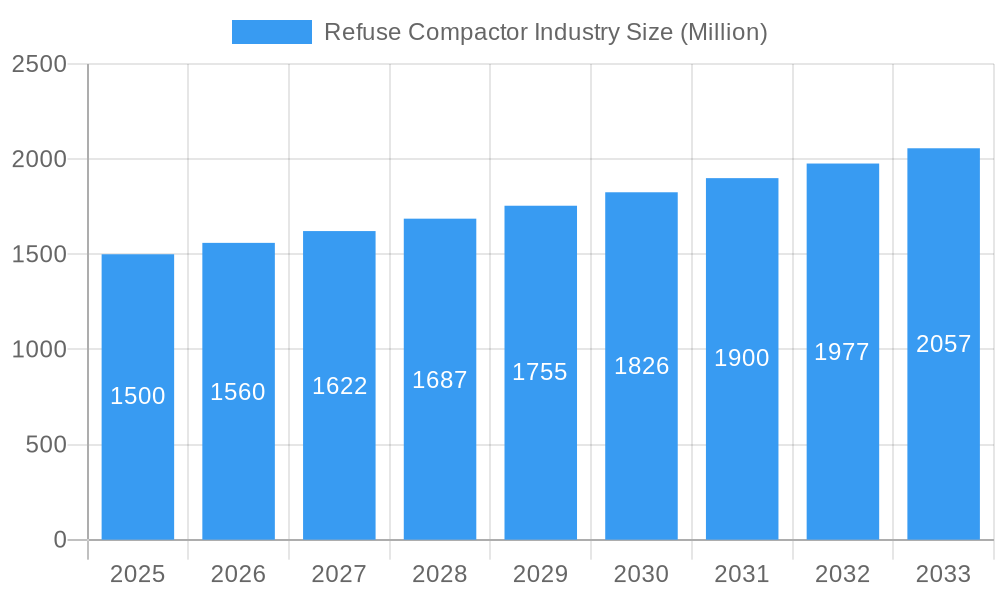

Refuse Compactor Industry Market Size (In Million)

Market performance is influenced by economic conditions, raw material availability, and manufacturing costs. Wider adoption of advanced compactor technologies, especially in emerging markets, will be crucial for overall growth. The residential sector offers substantial opportunities, fueled by growing homeowner interest in sustainable waste practices. Collaborations between manufacturers and waste management firms are expected to expedite market expansion and improve waste collection efficiency. Regional dynamics, including varying waste generation patterns and regulatory frameworks, will shape market performance, with North America and Europe currently leading in market share. The global refuse compactor market size is estimated at 280 million in the base year 2024.

Refuse Compactor Industry Company Market Share

Refuse Compactor Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Refuse Compactor Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future trends and opportunities within the $XX Million industry.

Refuse Compactor Industry Market Dynamics & Concentration

The global refuse compactor market is currently experiencing a dynamic evolution, fueled by a confluence of escalating urbanization, increasingly stringent environmental mandates, and a pronounced emphasis on optimizing waste management processes. Market concentration remains moderate, with the leading ten enterprises collectively commanding approximately XX% of the global market share as of 2024. A significant trend is the ongoing drive for innovation, particularly in advanced automation, intelligent waste management solutions, and the utilization of sustainable materials, all of which are acting as potent growth catalysts. Regulatory frameworks, which exhibit considerable regional variance, exert a substantial influence on adoption rates and the pace of technological advancement. The presence of product substitutes, such as incineration and anaerobic digestion technologies, introduces an element of competitive pressure. Concurrently, end-user preferences are leaning towards highly efficient waste management practices, thereby stimulating demand. The historical period under review was marked by a notable XX M&A transactions, underscoring a trend towards industry consolidation.

- Market Share: Top 10 Players – Approximately XX% (2024)

- M&A Activity (2019-2024): A total of XX deals recorded, indicating active consolidation.

- Key Innovation Drivers: Automation, Smart Waste Management Integration, Development of Sustainable Materials, Enhanced Durability, and Energy Efficiency.

- Regulatory Impact: Varying regional regulations significantly influence market penetration and R&D focus.

- Competitive Landscape: Moderate concentration with increasing strategic partnerships and acquisitions.

Refuse Compactor Industry Industry Trends & Analysis

The refuse compactor industry is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several factors. Increasing urbanization in developing economies leads to exponential waste generation, creating a strong demand for efficient waste compaction solutions. Technological disruptions, particularly in the form of IoT-enabled compactors and intelligent waste management systems, are enhancing operational efficiency and data-driven decision-making. Consumer preferences are shifting toward environmentally friendly and sustainable solutions, pushing manufacturers to prioritize energy efficiency and reduced environmental impact. Competitive dynamics are shaping the market, with companies focusing on product differentiation, technological innovation, and strategic partnerships. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Leading Markets & Segments in Refuse Compactor Industry

The North American refuse compactor market currently holds the largest market share, driven by stringent environmental regulations, robust infrastructure, and high waste generation rates.

- Key Drivers in North America:

- Stringent environmental regulations

- Well-developed waste management infrastructure

- High per capita waste generation

- Government initiatives promoting sustainable waste management

The European market is also witnessing substantial growth, fueled by increasing environmental awareness and government support for sustainable waste management practices. Asia-Pacific is a rapidly expanding market, experiencing significant growth due to urbanization and industrialization, although infrastructure development poses a challenge in certain regions. The commercial segment holds a dominant market share, reflecting the high demand from businesses and industrial facilities.

Refuse Compactor Industry Product Developments

Recent product innovations within the refuse compactor industry are keenly focused on achieving superior compaction ratios, extending product lifespan through enhanced durability, and seamless integration with sophisticated smart waste management systems. The applications of these advanced compactors are remarkably diverse, spanning residential complexes, commercial establishments, industrial facilities, and municipal waste management operations. Competitive differentiation is increasingly being achieved through the incorporation of advanced automation features, real-time remote monitoring capabilities, and powerful data analytics for operational optimization. A discernible and significant trend is the industry's collective shift towards the development and adoption of compactors that exhibit reduced energy consumption and a minimized environmental footprint, aligning with global sustainability goals.

Key Drivers of Refuse Compactor Industry Growth

The robust growth trajectory of the refuse compactor industry is underpinned by several pivotal factors. Foremost among these are technological advancements, notably the integration of automation and the Internet of Things (IoT), which are instrumental in boosting operational efficiency and curtailing associated costs. Increasingly stringent governmental regulations pertaining to waste management are acting as a powerful catalyst for the adoption of modern compaction solutions. Furthermore, robust economic growth, particularly within emerging economies, is directly correlating with increased waste generation, thereby necessitating the implementation of more advanced waste management strategies. Growing environmental consciousness among the global populace is also a significant contributor, further amplifying the demand for sustainable and eco-friendly waste compaction technologies.

Challenges in the Refuse Compactor Industry Market

Despite its growth, the refuse compactor industry is not without its hurdles. A primary challenge remains the substantial initial investment cost associated with acquiring these advanced systems. Fluctuations in raw material prices can also exert considerable pressure on manufacturing costs, impacting profitability. The market is characterized by intense competition, with numerous players vying for market share. Navigating the complexities of varying regulatory frameworks and compliance requirements across different geographic regions presents ongoing challenges for manufacturers. Supply chain disruptions, a persistent global issue, can significantly impede production schedules and delivery timelines. The industry is also inherently susceptible to economic downturns, which can lead to a reduction in overall demand. These combined challenges are projected to contribute to a potential XX% reduction in profit margins by 2033 if not strategically addressed.

Emerging Opportunities in Refuse Compactor Industry

The refuse compactor industry is poised for growth driven by the increasing adoption of smart waste management systems and the integration of IoT technologies. Strategic partnerships between manufacturers and waste management companies will accelerate market penetration. Expansion into developing economies with high waste generation rates presents significant growth potential. Technological breakthroughs, such as advanced materials and energy-efficient designs, will further enhance market appeal.

Leading Players in the Refuse Compactor Industry Sector

- GE Appliances

- Husmann Umwelttechnik GmbH

- PTR Baler & Compactor

- Marathon Equipment Company

- Capital Compactors Ltd

- Compactor Management Company

- Genesis Waste Handling Private Limited

- Precision Machinery Systems

- ACE Equipment Company

- Wastequip LLC (Wastequip LLC)

List Not Exhaustive

Key Milestones in Refuse Compactor Industry Industry

- September 2021: Wastequip launched Wasteware, a cloud-based solution for waste and recycling management, enhancing data analytics and operational efficiency.

- February 2022: The New Town Kolkata Development Authority planned the construction of 15 compactor stations, signifying investment in waste management infrastructure in emerging markets.

Strategic Outlook for Refuse Compactor Industry Market

The refuse compactor market holds significant growth potential, particularly in emerging markets experiencing rapid urbanization and industrialization. Strategic investments in research and development, focusing on technological innovation and sustainable solutions, will be crucial for success. Partnerships with waste management companies and municipalities will enhance market penetration and brand visibility. Expanding product portfolios to cater to diverse needs and exploring new applications will ensure long-term growth and profitability.

Refuse Compactor Industry Segmentation

-

1. Product Type

- 1.1. Portable

- 1.2. Stationary

-

2. Waste Type

- 2.1. Dry Waste

- 2.2. Wet Waste

-

3. Application

- 3.1. Residential

- 3.2. Agricultural

- 3.3. Municipal

- 3.4. Commercial

- 3.5. Industrial

Refuse Compactor Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Europe

- 6. Rest of the World

Refuse Compactor Industry Regional Market Share

Geographic Coverage of Refuse Compactor Industry

Refuse Compactor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia-Pacific to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Dry Waste

- 5.2.2. Wet Waste

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Agricultural

- 5.3.3. Municipal

- 5.3.4. Commercial

- 5.3.5. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Europe

- 5.4.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.2. Market Analysis, Insights and Forecast - by Waste Type

- 6.2.1. Dry Waste

- 6.2.2. Wet Waste

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Residential

- 6.3.2. Agricultural

- 6.3.3. Municipal

- 6.3.4. Commercial

- 6.3.5. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Latin America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.2. Market Analysis, Insights and Forecast - by Waste Type

- 7.2.1. Dry Waste

- 7.2.2. Wet Waste

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Residential

- 7.3.2. Agricultural

- 7.3.3. Municipal

- 7.3.4. Commercial

- 7.3.5. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.2. Market Analysis, Insights and Forecast - by Waste Type

- 8.2.1. Dry Waste

- 8.2.2. Wet Waste

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Residential

- 8.3.2. Agricultural

- 8.3.3. Municipal

- 8.3.4. Commercial

- 8.3.5. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.2. Market Analysis, Insights and Forecast - by Waste Type

- 9.2.1. Dry Waste

- 9.2.2. Wet Waste

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Residential

- 9.3.2. Agricultural

- 9.3.3. Municipal

- 9.3.4. Commercial

- 9.3.5. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Europe Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.2. Market Analysis, Insights and Forecast - by Waste Type

- 10.2.1. Dry Waste

- 10.2.2. Wet Waste

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Residential

- 10.3.2. Agricultural

- 10.3.3. Municipal

- 10.3.4. Commercial

- 10.3.5. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of the World Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.2. Market Analysis, Insights and Forecast - by Waste Type

- 11.2.1. Dry Waste

- 11.2.2. Wet Waste

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Residential

- 11.3.2. Agricultural

- 11.3.3. Municipal

- 11.3.4. Commercial

- 11.3.5. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Appliances

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Husmann Umwelttechnik GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PTR Baler & Compactor

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Marathon Equipment Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Capital Compactors Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Compactor Management Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Genesis Waste Handling Private Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Precision Machinery Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ACE Equipment Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Wastequip LLC **List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Refuse Compactor Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 5: North America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 7: North America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: Latin America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Latin America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 13: Latin America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 14: Latin America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Latin America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Latin America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 21: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 22: Asia Pacific Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 29: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: Middle East and Africa Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 35: Europe Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Europe Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 37: Europe Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 38: Europe Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 39: Europe Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Europe Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Europe Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of the World Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 43: Rest of the World Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of the World Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 45: Rest of the World Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 46: Rest of the World Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 47: Rest of the World Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Rest of the World Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 49: Rest of the World Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 3: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Refuse Compactor Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 7: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 11: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 15: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 19: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 23: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 26: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 27: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refuse Compactor Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Refuse Compactor Industry?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, GE Appliances, Husmann Umwelttechnik GmbH, PTR Baler & Compactor, Marathon Equipment Company, Capital Compactors Ltd, Compactor Management Company, Genesis Waste Handling Private Limited, Precision Machinery Systems, ACE Equipment Company, Wastequip LLC **List Not Exhaustive.

3. What are the main segments of the Refuse Compactor Industry?

The market segments include Product Type, Waste Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 280 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia-Pacific to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: The New Town Kolkata Development Authority has planned to set up 15 compactor stations in different locations across New Town to facilitate a daily waste collection and disposal system. The compactor stations will be constructed at an estimated cost of about Rs 4.1 crore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refuse Compactor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refuse Compactor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refuse Compactor Industry?

To stay informed about further developments, trends, and reports in the Refuse Compactor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence