Key Insights

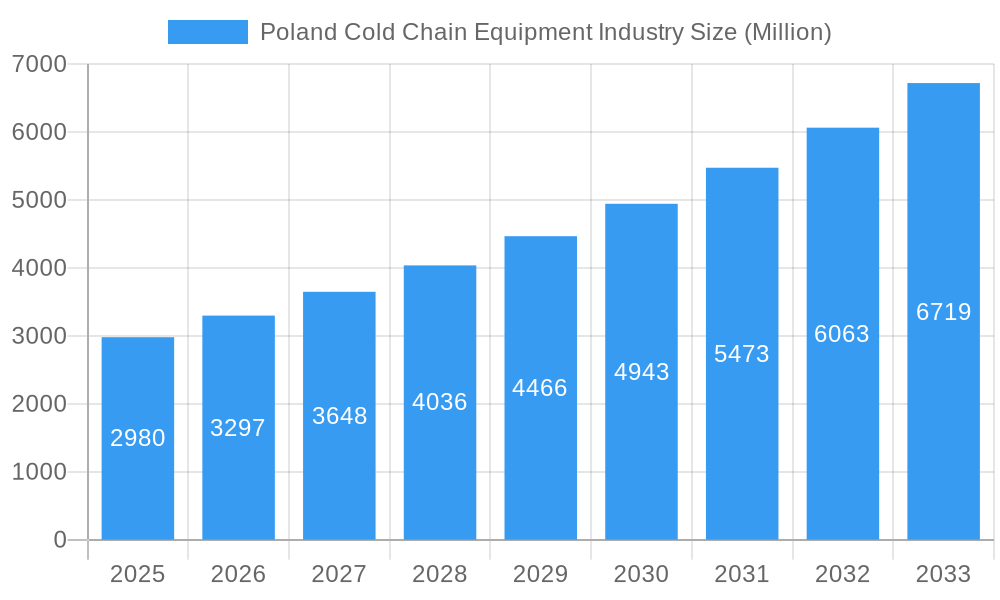

The Poland cold chain equipment market, valued at €2.98 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.45% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for fresh produce, dairy, meat, and processed food products, coupled with rising consumer awareness regarding food safety and quality, fuels the need for efficient cold chain solutions. Furthermore, Poland's burgeoning e-commerce sector and the growing preference for convenient online grocery shopping are significantly impacting the market. The expansion of the pharmaceutical and life sciences industries in Poland also contributes to the market's growth, as these sectors require stringent temperature-controlled storage and transportation for sensitive goods. Key segments within the market include chilled and frozen storage solutions, transportation services (ranging from trucking to specialized reefer containers), and value-added services like blast freezing, labeling, and inventory management. Leading players like Arrowsped, DHL, and Yusen Logistics are actively shaping the market landscape through strategic partnerships and investments in advanced cold chain technologies. While challenges such as the high initial investment costs associated with cold chain infrastructure and potential regulatory hurdles might exist, the overall market outlook remains positive, driven by strong domestic consumption and export opportunities within the European Union.

Poland Cold Chain Equipment Industry Market Size (In Billion)

The market segmentation reveals a diversified landscape. Horticulture, encompassing fresh fruits and vegetables, dominates the application segment, followed by dairy products and meat. The services segment showcases the importance of integrated cold chain solutions, with a high demand for comprehensive storage, transportation, and value-added services reflecting the desire for end-to-end temperature control and supply chain optimization. The significant growth in the market is largely fueled by the continuous development of infrastructure, technology advancements, and strong governmental support for enhancing the food processing and logistics sectors within Poland. This expansion is further augmented by the integration of modern technologies, like IoT and data analytics, for improving temperature monitoring, reducing waste, and enhancing overall efficiency across the cold chain.

Poland Cold Chain Equipment Industry Company Market Share

Poland Cold Chain Equipment Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Poland cold chain equipment industry, covering market dynamics, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an indispensable resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes extensive data analysis to offer actionable insights and forecasts for this rapidly evolving sector. The market size is predicted to reach xx Million by 2033.

Poland Cold Chain Equipment Industry Market Dynamics & Concentration

The Polish cold chain equipment market is characterized by a dynamic and evolving landscape, with a moderate to high level of concentration in key segments. Several established players and emerging innovators are vying for market share, driven by a confluence of factors. Market share data indicates that the top five players collectively command a significant portion of the market, estimated at approximately XX%. The relentless pursuit of improved operational efficiency, superior temperature control accuracy, and increasingly, sustainable and environmentally conscious practices, are the primary catalysts for innovation. The industry is heavily influenced by stringent national and European Union regulatory frameworks, particularly those pertaining to food safety, hygiene standards, and the traceability of temperature-sensitive goods. While product substitutes, such as advanced passive cooling systems, offer some competitive pressure, their adoption is largely confined to specific niche applications. The burgeoning consumer demand for a wider variety of fresh, minimally processed, and high-quality food products, coupled with an expanding food service sector, acts as a significant growth engine for the market. Mergers and acquisitions (M&A) activity within the sector, while not overly aggressive, suggests a healthy level of strategic consolidation and expansion. Approximately XX significant M&A deals have been recorded in the historical period (2019-2024), reflecting a degree of market maturity and the pursuit of synergistic growth. Key forward-looking trends include the accelerated adoption of cutting-edge technologies such as Internet of Things (IoT) sensors for real-time monitoring, advanced automation in warehousing and logistics, and the integration of predictive analytics to optimize cold chain operations.

- Estimated Market Share of Top 5 Players: XX%

- Number of M&A Deals (2019-2024): XX

- Key Innovation Drivers: Enhanced operational efficiency, precision temperature control, sustainable practices, and advanced traceability.

- Regulatory Influence: Stringent food safety, hygiene, and traceability standards mandated by national and EU regulations.

Poland Cold Chain Equipment Industry Industry Trends & Analysis

The Polish cold chain equipment industry is currently experiencing a period of robust and sustained growth. This expansion is underpinned by several powerful macroeconomic and behavioral drivers, including rising disposable incomes, the continuous expansion and modernization of retail infrastructure (both brick-and-mortar and online), and a discernible shift in consumer preferences towards convenient, readily available, and high-quality food products with extended shelf lives. The Compound Annual Growth Rate (CAGR) for this sector is impressively projected to be around XX% during the forecast period of 2025-2033, signaling strong future potential. Technological advancements are not merely influencing but actively transforming industry practices. This includes the widespread adoption of smart warehousing solutions, the pervasive implementation of IoT-enabled monitoring systems for real-time data capture and analysis, and a significant surge in the deployment of energy-efficient refrigeration technologies to reduce operational costs and environmental impact. This technological evolution is further amplified by evolving consumer demand for fresher produce and a broader array of processed food items that require sophisticated cold chain management. Competitive dynamics within the market are increasingly shaped by a combination of competitive pricing strategies, the comprehensiveness and quality of service offerings, and crucially, the technological sophistication and innovative capabilities of market participants. The market penetration of advanced cold chain solutions is steadily increasing, reaching an estimated XX% in 2025, indicating a significant ongoing digital and technological transformation.

Leading Markets & Segments in Poland Cold Chain Equipment Industry

The Polish cold chain equipment market is strategically segmented across various service categories, temperature types, and end-use applications to cater to diverse industry needs. Key service segments include specialized storage solutions, efficient refrigerated transportation, and a growing array of value-added services. Temperature types are broadly categorized into chilled and frozen segments, each with distinct equipment requirements. The application landscape is extensive, encompassing critical sectors such as horticulture, dairy, meat, fish, poultry, processed foods, pharmaceuticals, life sciences, and various chemical industries. While a comprehensive market analysis is ongoing, initial indicators point towards robust growth across virtually all identified segments. The refrigerated transportation segment, in particular, exhibits significant promise, driven by the meteoric rise of the e-commerce sector and the consequent surge in demand for timely and temperature-controlled delivery of perishable goods. Furthermore, value-added services such as blast freezing, specialized packaging, and sophisticated inventory management are experiencing a notable increase in traction as businesses seek to optimize their cold chain operations. Within the application segments, the dairy and processed food sectors stand out as major drivers of demand, reflecting the consumption patterns and industrial strengths of the Polish economy.

-

Key Market Drivers:

- Accelerating growth of the e-commerce sector, necessitating efficient last-mile cold chain logistics.

- Continuous expansion and modernization of retail infrastructure, increasing the need for distributed cold storage.

- Rising consumer demand for fresh, healthy, and convenient food options, extending the reach of cold chain requirements.

- Government support and strategic initiatives aimed at developing and modernizing the agricultural and food processing sectors.

-

Dominant and High-Growth Segments:

- Refrigerated Transportation: Expected to remain a dominant sector due to e-commerce and the logistics of fresh produce.

- Value-Added Services: Demonstrating high potential for growth as businesses seek to enhance efficiency and product quality.

- Dairy and Processed Food Applications: These sectors are foundational and represent significant, consistent drivers of demand for cold chain equipment.

Poland Cold Chain Equipment Industry Product Developments

Recent product innovations focus on energy efficiency, improved temperature control, and enhanced monitoring capabilities. Manufacturers are incorporating advanced technologies such as IoT sensors, smart refrigeration systems, and advanced data analytics to optimize cold chain operations. These innovations aim to reduce operational costs, minimize waste, and ensure product quality. The market is witnessing a growing demand for customized solutions tailored to specific customer needs and application requirements.

Key Drivers of Poland Cold Chain Equipment Industry Growth

The growth of the Poland cold chain equipment industry is fueled by several key factors. Firstly, rising disposable incomes and changing consumer preferences for fresh food are driving demand for effective cold chain solutions. Secondly, government initiatives promoting food safety and quality standards are creating a favorable regulatory environment. Finally, technological advancements in refrigeration and logistics are improving efficiency and reducing operational costs. These factors collectively create a powerful synergy that is boosting market expansion.

Challenges in the Poland Cold Chain Equipment Industry Market

The industry faces several challenges, including the high initial investment costs associated with adopting advanced technologies, the need for skilled labor, and maintaining consistently reliable cold chain infrastructure throughout the country. Supply chain disruptions, particularly in the wake of recent global events, pose a further obstacle. Increased competition and fluctuating energy prices also add to the operational complexities faced by industry players.

Emerging Opportunities in Poland Cold Chain Equipment Industry

The Polish cold chain equipment industry is ripe with significant and diverse growth opportunities. The burgeoning popularity of e-commerce, coupled with the continuous expansion and sophistication of the food processing industry, is creating substantial and sustained demand for advanced and integrated cold chain solutions. Furthermore, the strategic integration of emerging technological innovations, such as AI-powered logistics optimization and advanced automation systems, presents a transformative potential for streamlining operations, enhancing efficiency, and reducing operational costs across the entire cold chain. Strategic alliances and collaborations between equipment manufacturers, dedicated logistics providers, and diverse retail entities are increasingly crucial for fostering synergy, driving innovation, and accelerating overall market expansion and penetration. The ongoing digitalization of supply chains offers further avenues for innovation in real-time tracking, predictive maintenance, and enhanced visibility.

Leading Players in the Poland Cold Chain Equipment Industry Sector

- Arrowsped Sp z o o

- DHL

- Yusen Logistics

- Fastigo Logistics

- ARRA Group Sp z o o Sp k

- Raben Group

- ZBYNEK - Transport Spedycja

- United Parcel Service of America

- Artrans Transport

- Fructus Transport

Key Milestones in Poland Cold Chain Equipment Industry Industry

- 2020: Introduction of new energy-efficient refrigeration units by a major player.

- 2022: Implementation of stricter food safety regulations by the government.

- 2023: A significant investment in cold storage infrastructure by a leading logistics company.

- (Further milestones require specific data)

Strategic Outlook for Poland Cold Chain Equipment Industry Market

The Polish cold chain equipment market presents significant growth potential driven by increasing demand for fresh food, technological advancements, and supportive government policies. Strategic opportunities include expanding into niche markets, focusing on value-added services, and strengthening partnerships across the supply chain. By embracing innovation and adapting to evolving market dynamics, industry players can capitalize on this significant growth potential and establish a strong market position.

Poland Cold Chain Equipment Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

Poland Cold Chain Equipment Industry Segmentation By Geography

- 1. Poland

Poland Cold Chain Equipment Industry Regional Market Share

Geographic Coverage of Poland Cold Chain Equipment Industry

Poland Cold Chain Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arrowsped Sp z o o

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fastigo Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ARRA Group Sp z o o Sp k

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raben Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZBYNEK - Transport Spedycja

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Artrans Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fructus Transport

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arrowsped Sp z o o

List of Figures

- Figure 1: Poland Cold Chain Equipment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Equipment Industry?

The projected CAGR is approximately 10.45%.

2. Which companies are prominent players in the Poland Cold Chain Equipment Industry?

Key companies in the market include Arrowsped Sp z o o, DHL, Yusen Logistics, Fastigo Logistics**List Not Exhaustive, ARRA Group Sp z o o Sp k, Raben Group, ZBYNEK - Transport Spedycja, United Parcel Service of America, Artrans Transport, Fructus Transport.

3. What are the main segments of the Poland Cold Chain Equipment Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Equipment Industry?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence