Key Insights

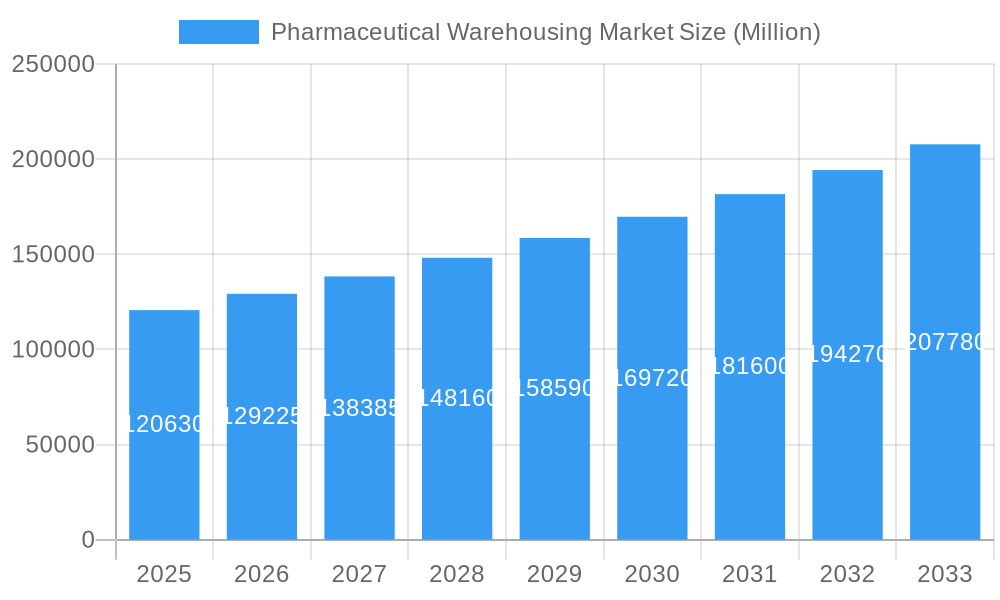

The global pharmaceutical warehousing market, valued at $120.63 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for temperature-sensitive pharmaceutical products, stringent regulatory requirements for storage and handling, and the expansion of the pharmaceutical industry itself are major contributors to this growth. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and other applications). Cold chain warehousing is expected to dominate due to the rising need for specialized storage facilities for sensitive drugs and vaccines. Growth within the pharmaceutical factory segment will likely outpace other application segments due to the high volumes of pharmaceutical products managed during manufacturing and distribution. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is anticipated to witness the fastest growth rate in the forecast period due to expanding healthcare infrastructure and increasing pharmaceutical production in countries like India and China. Competitive pressures are driving innovation in warehousing technologies, including automated systems and advanced inventory management solutions. However, the high initial investment costs associated with such technologies and the potential for supply chain disruptions could pose challenges to market growth.

Pharmaceutical Warehousing Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a sustained Compound Annual Growth Rate (CAGR) of 6.82%, reflecting the enduring demand for reliable and efficient pharmaceutical warehousing solutions. This growth will be influenced by ongoing advancements in logistics and technology, increasing focus on patient safety and product integrity, and a rise in outsourcing of warehousing and logistics activities by pharmaceutical companies. While challenges remain, including fluctuating regulatory environments and potential labor shortages, the long-term outlook for the pharmaceutical warehousing market remains positive, fueled by a steady increase in global pharmaceutical production and distribution. The market's segmentation will also continue to evolve, with niche players specializing in specific therapeutic areas and offering advanced value-added services gaining traction.

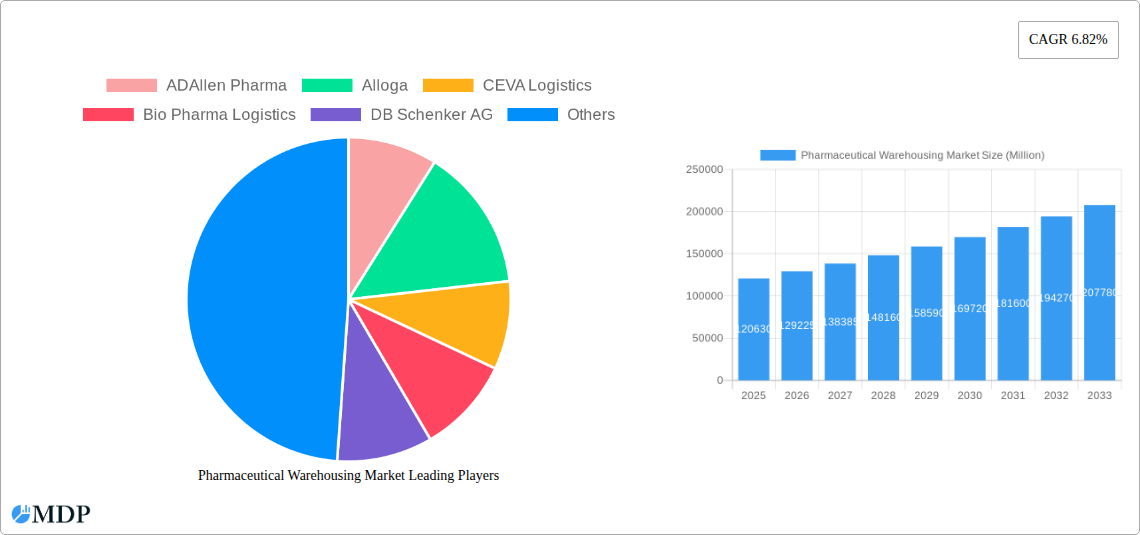

Pharmaceutical Warehousing Market Company Market Share

Pharmaceutical Warehousing Market: A Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the Pharmaceutical Warehousing Market, offering valuable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

Pharmaceutical Warehousing Market Dynamics & Concentration

The pharmaceutical warehousing market is characterized by a moderately concentrated landscape with several key players vying for market share. The market's dynamics are shaped by several factors, including:

- Innovation Drivers: Technological advancements in cold chain logistics, automation, and warehouse management systems (WMS) are driving efficiency and reducing operational costs. The growing adoption of AI and IoT in warehouse operations is further enhancing visibility and optimizing processes.

- Regulatory Frameworks: Stringent regulations governing the storage and handling of pharmaceutical products, particularly concerning temperature-sensitive drugs, influence warehousing infrastructure and operational procedures. Compliance costs and the need for specialized facilities create both challenges and opportunities for market participants.

- Product Substitutes: While direct substitutes are limited, the market faces indirect competition from alternative logistics solutions like specialized transportation networks and outsourcing to third-party logistics providers (3PLs).

- End-User Trends: The increasing demand for specialized pharmaceutical warehousing services, driven by growing healthcare expenditure and the rise of personalized medicine, presents significant growth opportunities. Pharmaceutical companies are increasingly outsourcing warehousing functions to focus on core competencies.

- M&A Activities: Consolidation through mergers and acquisitions (M&A) is prevalent in the industry. The number of M&A deals in the past five years has averaged xx per year, indicating a drive for expansion and market share growth. Larger players are strategically acquiring smaller companies with specialized capabilities or strong regional presence. Market share is relatively evenly distributed amongst the top 10 players, with no single entity commanding a dominant position exceeding 20%.

Pharmaceutical Warehousing Market Industry Trends & Analysis

The pharmaceutical warehousing market is witnessing robust growth, primarily driven by the expanding pharmaceutical industry and the increasing need for efficient and secure storage and distribution of pharmaceutical products. The market's CAGR during the forecast period is estimated at xx%, with significant penetration in both developed and developing economies. Key trends shaping the market include:

- Technological Disruptions: Automation, robotics, and AI-powered solutions are revolutionizing warehouse operations, enhancing efficiency, and minimizing human error.

- Growth Drivers: Rising healthcare expenditure, growth in the pharmaceutical and biotechnology sectors, stringent regulatory requirements promoting quality control and the increasing demand for temperature-sensitive drug storage are key growth drivers.

- Consumer Preferences: End-users (pharmaceutical companies, hospitals, pharmacies) increasingly demand advanced warehousing solutions that ensure product integrity, traceability, and timely delivery.

- Competitive Dynamics: The market is characterized by both intense competition among established players and the emergence of new entrants, especially in niche segments. This competitive landscape drives innovation and forces players to optimize efficiency and improve service offerings.

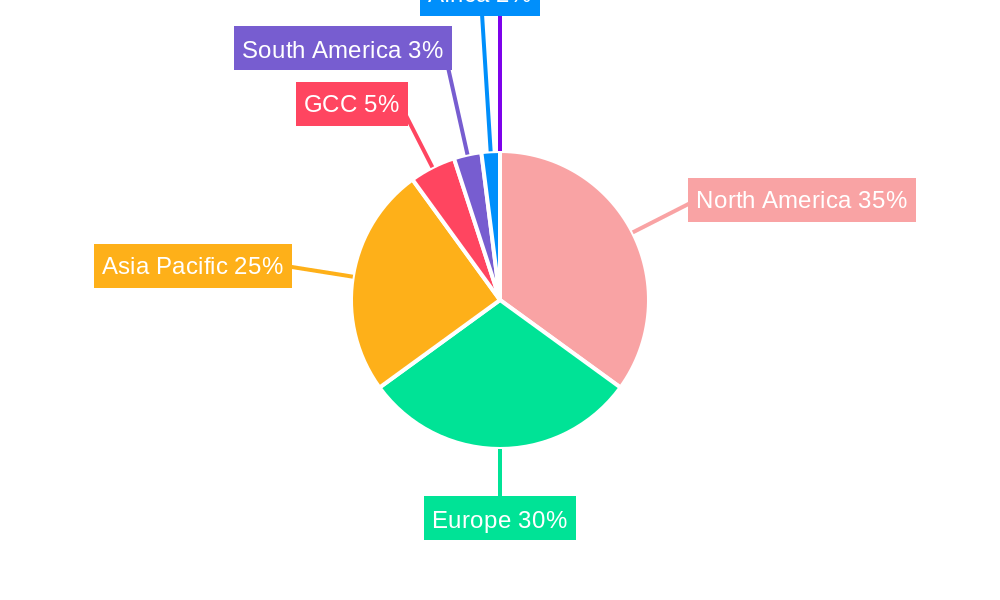

Leading Markets & Segments in Pharmaceutical Warehousing Market

The North American region currently dominates the pharmaceutical warehousing market, followed by Europe and Asia-Pacific. This dominance is driven by factors such as well-established healthcare infrastructure, high pharmaceutical consumption, and stringent regulatory frameworks.

- By Type: Cold chain warehousing commands a larger market share due to the increasing demand for temperature-sensitive pharmaceutical products. The Non-Cold Chain Warehouse segment is expected to experience steady growth driven by the storage of non-temperature-sensitive pharmaceuticals.

- By Application: Pharmaceutical factories are the major consumers of warehousing services, followed by pharmacies and hospitals. The "Other Applications" segment includes research institutions, clinical trial sites and distributors, showing moderate yet consistent growth.

Key Drivers by Region:

- North America: Robust healthcare infrastructure, high pharmaceutical spending, and advanced technological adoption.

- Europe: Stringent regulatory compliance, growing demand for specialized cold chain solutions.

- Asia-Pacific: Rapid economic growth, increasing healthcare expenditure, and the expansion of pharmaceutical manufacturing facilities.

Pharmaceutical Warehousing Market Product Developments

Significant advancements in cold chain technologies, including advanced refrigeration systems, real-time temperature monitoring devices, and automated storage and retrieval systems (AS/RS), are enhancing the efficiency and safety of pharmaceutical warehousing. The integration of blockchain technology for enhanced traceability and security is also gaining traction. These innovations are creating competitive advantages by improving operational efficiency and ensuring product integrity.

Key Drivers of Pharmaceutical Warehousing Market Growth

The pharmaceutical warehousing market's growth is primarily propelled by several key factors:

- Technological Advancements: Automation, AI, and IoT integration are increasing warehouse efficiency and reducing operational costs.

- Stringent Regulations: Stricter regulations on drug storage and handling drive demand for compliant warehousing facilities.

- Rising Healthcare Expenditure: Growing healthcare budgets globally are increasing the volume of pharmaceutical products requiring storage and distribution.

Challenges in the Pharmaceutical Warehousing Market

The pharmaceutical warehousing market faces several challenges:

- Regulatory Compliance: Maintaining compliance with stringent regulations related to temperature control, security, and data management is complex and costly.

- Supply Chain Disruptions: Global supply chain vulnerabilities, such as geopolitical instability or natural disasters, can disrupt warehousing operations.

- Competition: Intense competition from established players and new entrants necessitates continuous innovation and efficiency improvements. This competition keeps profit margins under pressure, affecting profitability.

Emerging Opportunities in Pharmaceutical Warehousing Market

The market presents several promising opportunities:

- Technological Integration: Further integration of AI, IoT, and blockchain technologies can enhance traceability, security, and efficiency in warehousing.

- Strategic Partnerships: Collaborations between pharmaceutical companies and specialized warehousing providers can optimize supply chains.

- Market Expansion: Growth in emerging economies presents significant opportunities for market expansion, particularly in cold chain solutions.

Leading Players in the Pharmaceutical Warehousing Market Sector

- ADAllen Pharma

- Alloga

- CEVA Logistics

- Bio Pharma Logistics

- DB Schenker AG

- Rhenus SE and Co

- TIBA

- Pulleyn Transport Ltd

- WH BOWKER LTD

- DACHSER Group SE

Key Milestones in Pharmaceutical Warehousing Market Industry

- June 2023: Akums establishes a 70,186,56 sqm central warehousing facility in Haridwar, India, dedicated to finished goods, boosting local pharmaceutical storage capacity.

- September 2022: CEVA Logistics launches the Ceva Chill Hub, a 10,000 sq ft multi-temperature facility offering comprehensive logistics solutions, highlighting advancements in cold chain management.

Strategic Outlook for Pharmaceutical Warehousing Market

The pharmaceutical warehousing market is poised for sustained growth, driven by technological innovations, increasing healthcare expenditure, and the expanding pharmaceutical industry. Strategic partnerships, investments in advanced technologies, and a focus on regulatory compliance will be crucial for success in this dynamic market. The focus on enhancing efficiency, reliability, and security through technology will be key to capturing market share and achieving long-term growth.

Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Other Applications

Pharmaceutical Warehousing Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of the North America

-

2. Europe

- 2.1. Spain

- 2.2. Belgium

- 2.3. United Kingdom

- 2.4. Russia

- 2.5. Germany

- 2.6. France

- 2.7. Italy

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. China

- 3.3. India

- 3.4. Indonesia

- 3.5. Japan

- 3.6. Malaysia

- 3.7. Vietnam

- 3.8. Thailand

- 3.9. Rest of APAC

-

4. GCC

- 4.1. UAE

- 4.2. Saudi Arabia

- 4.3. Qatar

- 4.4. Rest of GCC

-

5. South America

- 5.1. Argentina

- 5.2. Brazil

- 5.3. Chile

- 5.4. Rest of South America

-

6. Africa

- 6.1. South Africa

- 6.2. Egypt

- 6.3. Rest of Africa

- 7. Rest of the World

Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Pharmaceutical Warehousing Market

Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Population4.; Increase in Warehousing Services

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Technological Innovation is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. GCC

- 5.3.5. South America

- 5.3.6. Africa

- 5.3.7. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. North America Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by BY Type

- 6.1.1. Cold Chain Warehouse

- 6.1.2. Non-Cold Chain Warehouse

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pharmaceutical Factory

- 6.2.2. Pharmacy

- 6.2.3. Hospital

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by BY Type

- 7. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by BY Type

- 7.1.1. Cold Chain Warehouse

- 7.1.2. Non-Cold Chain Warehouse

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pharmaceutical Factory

- 7.2.2. Pharmacy

- 7.2.3. Hospital

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by BY Type

- 8. Asia Pacific Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by BY Type

- 8.1.1. Cold Chain Warehouse

- 8.1.2. Non-Cold Chain Warehouse

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pharmaceutical Factory

- 8.2.2. Pharmacy

- 8.2.3. Hospital

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by BY Type

- 9. GCC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by BY Type

- 9.1.1. Cold Chain Warehouse

- 9.1.2. Non-Cold Chain Warehouse

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pharmaceutical Factory

- 9.2.2. Pharmacy

- 9.2.3. Hospital

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by BY Type

- 10. South America Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by BY Type

- 10.1.1. Cold Chain Warehouse

- 10.1.2. Non-Cold Chain Warehouse

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pharmaceutical Factory

- 10.2.2. Pharmacy

- 10.2.3. Hospital

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by BY Type

- 11. Africa Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by BY Type

- 11.1.1. Cold Chain Warehouse

- 11.1.2. Non-Cold Chain Warehouse

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Pharmaceutical Factory

- 11.2.2. Pharmacy

- 11.2.3. Hospital

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by BY Type

- 12. Rest of the World Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by BY Type

- 12.1.1. Cold Chain Warehouse

- 12.1.2. Non-Cold Chain Warehouse

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Pharmaceutical Factory

- 12.2.2. Pharmacy

- 12.2.3. Hospital

- 12.2.4. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by BY Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 ADAllen Pharma

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Alloga

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CEVA Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bio Pharma Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 DB Schenker AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rhenus SE and Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TIBA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pulleyn Transport Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 WH BOWKER LTD

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DACHSER Group SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ADAllen Pharma

List of Figures

- Figure 1: Global Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 3: North America Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 4: North America Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 9: Europe Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 10: Europe Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 15: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 16: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: GCC Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 21: GCC Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 22: GCC Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 23: GCC Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: GCC Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: GCC Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 27: South America Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 28: South America Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Africa Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 33: Africa Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 34: Africa Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Africa Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Africa Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Africa Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 39: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 40: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 41: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 2: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 5: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: USA Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of the North America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 12: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 23: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Australia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Indonesia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Malaysia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Vietnam Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 35: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: UAE Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Qatar Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of GCC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 42: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Argentina Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Brazil Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Chile Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of South America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 49: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 51: South Africa Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Egypt Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Rest of Africa Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 55: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Warehousing Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the Pharmaceutical Warehousing Market?

Key companies in the market include ADAllen Pharma, Alloga, CEVA Logistics, Bio Pharma Logistics, DB Schenker AG, Rhenus SE and Co, TIBA, Pulleyn Transport Ltd, WH BOWKER LTD, DACHSER Group SE.

3. What are the main segments of the Pharmaceutical Warehousing Market?

The market segments include BY Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 120.63 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Population4.; Increase in Warehousing Services.

6. What are the notable trends driving market growth?

Technological Innovation is driving the market.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

June 2023: Akums set up a central warehousing facility in the Haridwar Industrial Estate. The facility will be situated on a 70,186,56 sqm campus and will be dedicated to warehousing finished goods. It will provide warehousing, handling, and services to various plants in and around the Haridwar area. Trained stores and logistics staff will support the different plants. Phase I of the project comprises a built-up area of 30,610,2 sq. mt and a ground coverage of 28,215,61 sq. mt. This phase includes 17 standalone blocks dedicated to storing Pharma's finished goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence