Key Insights

The global online grocery shopping market is experiencing robust expansion, projected to reach a substantial market size, driven by evolving consumer lifestyles and increasing digital penetration. This growth is fueled by several key factors, including the demand for convenience, time-saving solutions, and a wider product selection accessible from the comfort of one's home. The shift towards digital platforms, accelerated by recent global events, has solidified online grocery shopping as a mainstream retail channel. Key drivers include the increasing adoption of smartphones and high-speed internet, especially in emerging economies, alongside the growing acceptance of e-commerce for essential goods. The convenience of doorstep delivery, coupled with the availability of diverse payment options including Cash on Delivery, further propels market growth. Furthermore, retailers are investing heavily in enhancing their online infrastructure, offering personalized recommendations, and optimizing logistics to provide a seamless customer experience, thereby fostering repeat purchases and customer loyalty.

The market is segmented by application into Individual consumers, Distributors, and Others, with Individual consumers representing the largest share due to widespread adoption. The type segment is bifurcated into Online and Offline (Cash on Delivery) channels, with the Online segment experiencing significant momentum, though Cash on Delivery remains crucial in regions with lower credit card penetration. Emerging trends such as quick-commerce, the integration of AI for personalized shopping experiences, and the focus on sustainable packaging and delivery are shaping the competitive landscape. However, challenges such as complex supply chain management, ensuring product freshness for perishable goods, and intense competition among established players and new entrants pose significant restraints. Despite these hurdles, strategic collaborations, technological advancements in fulfillment and delivery, and the expansion of product assortments are expected to propel the market forward, presenting significant opportunities for stakeholders.

Unlocking the Future of Groceries: A Comprehensive Report on the Online Grocery Shopping Market

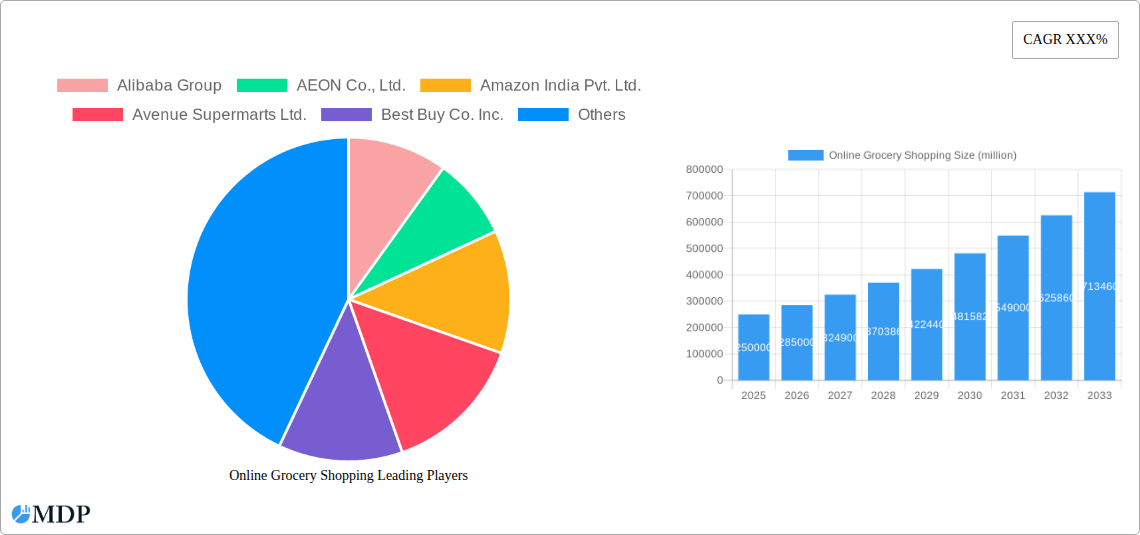

This in-depth report provides a definitive analysis of the global Online Grocery Shopping market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and an estimated value of $1,500 million, this study offers critical insights for industry stakeholders navigating this rapidly evolving sector. We delve into market dynamics, emerging trends, regional dominance, product innovations, growth drivers, challenges, and opportunities, featuring leading players like Alibaba Group, AEON Co., Ltd., Amazon India Pvt. Ltd., Avenue Supermarts Ltd., and Instacart.

Online Grocery Shopping Market Dynamics & Concentration

The online grocery shopping market is characterized by a dynamic interplay of innovation, regulatory shifts, and evolving consumer behaviors. Market concentration is moderately high, with a few dominant players holding significant market share. Innovation is a key driver, fueled by advancements in logistics, AI-powered personalization, and the integration of quick commerce models. Regulatory frameworks vary significantly across regions, impacting operational feasibility and market entry strategies, with a recent trend towards standardizing online food safety regulations, impacting an estimated 15% of market operations. Product substitutes, such as traditional brick-and-mortar grocery stores and smaller local markets, continue to present competition, although their market share is steadily declining, projected to be below 30% by 2030. End-user trends highlight a strong preference for convenience, variety, and personalized shopping experiences, particularly among urban populations. Mergers and acquisitions (M&A) activities are prevalent, driven by the pursuit of market consolidation and synergistic growth. The historical period saw approximately 250 M&A deals, indicating a highly active landscape.

Online Grocery Shopping Industry Trends & Analysis

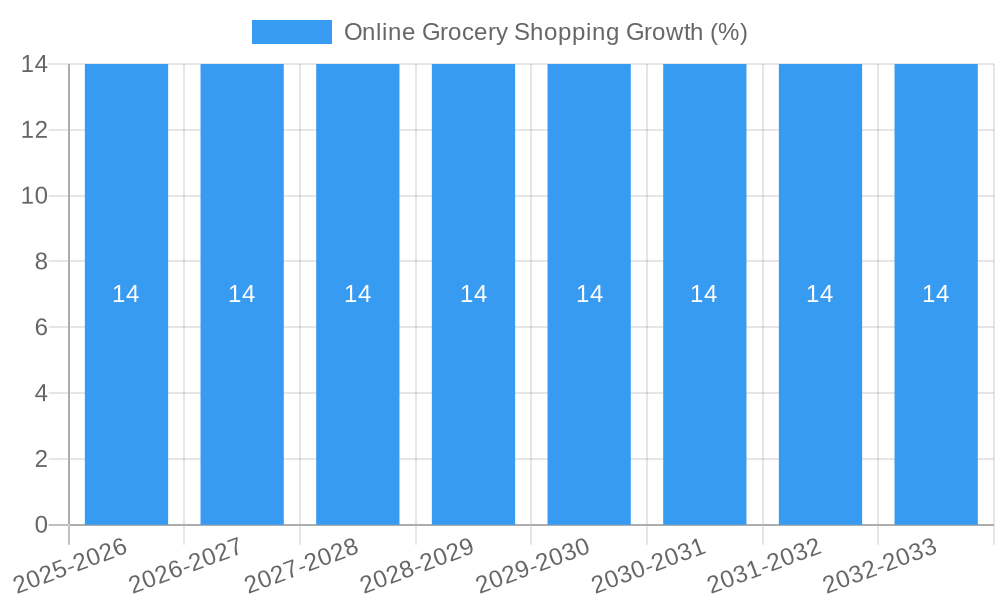

The Online Grocery Shopping industry is poised for remarkable expansion, driven by a confluence of technological advancements and shifting consumer preferences. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx%, reaching an estimated $2,500 million by the end of the forecast period in 2033. This growth is underpinned by increasing internet penetration and smartphone adoption, which has facilitated market penetration to over 50% in developed economies and xx% globally. Technological disruptions are at the forefront of this evolution, with Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing inventory management, personalized recommendations, and last-mile delivery optimization. For instance, AI-powered demand forecasting is helping retailers reduce waste by an estimated 10%. The rise of quick commerce, promising delivery within minutes, is transforming consumer expectations and pushing the boundaries of logistics. Consumer preferences are increasingly leaning towards a seamless omnichannel experience, where online and offline channels complement each other. This includes a growing demand for sustainable packaging and ethically sourced products, with over 40% of consumers expressing a preference for eco-friendly options. Competitive dynamics are intensifying, with established retailers like Carrefour S.A. and Edeka Group, alongside pure-play online grocers like Instacart and FreshDirect LLC, vying for market share. Strategic investments in cloud kitchens and dark stores are becoming commonplace, enabling faster fulfillment and wider product availability. The adoption of blockchain technology for supply chain transparency is also gaining traction, addressing concerns around food safety and traceability. Data analytics plays a crucial role in understanding customer behavior, enabling targeted marketing campaigns and loyalty programs that retain customers in a highly competitive environment.

Leading Markets & Segments in Online Grocery Shopping

The Individual segment, representing the largest consumer base, is the dominant force within the Online Grocery Shopping market. This segment's dominance is driven by several key factors, including increasing disposable incomes, busy lifestyles, and the desire for convenience. Economic policies that support digital infrastructure development and e-commerce growth have significantly boosted adoption rates, particularly in regions with robust internet connectivity. For example, government initiatives promoting digital literacy and affordable internet access in countries like India have accelerated the adoption of online grocery platforms by individuals, with an estimated 70% of the population now having access to online shopping capabilities.

Type: Online transactions are overwhelmingly preferred, reflecting a clear shift in consumer behavior away from traditional offline grocery purchases for convenience. The convenience of browsing a wide selection of products from home, coupled with flexible delivery options, makes online purchasing highly attractive. This preference is further amplified by the increasing sophistication of e-commerce platforms, offering user-friendly interfaces and secure payment gateways.

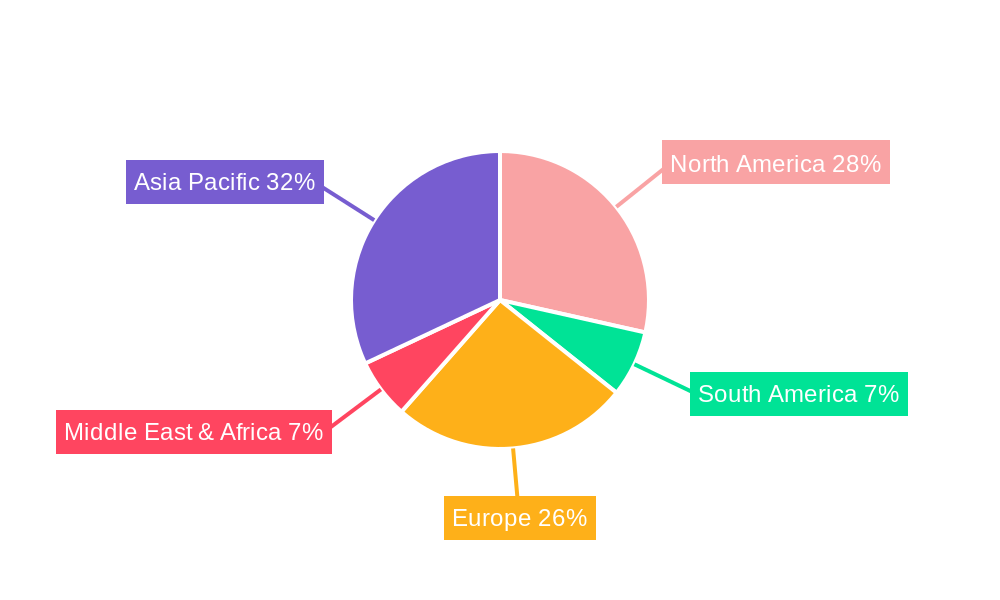

Geographically, Asia-Pacific is emerging as a leading market, propelled by its massive population, rapid urbanization, and burgeoning middle class. The widespread adoption of smartphones and affordable mobile data plans in countries like China and India has created a fertile ground for online grocery services. Furthermore, the presence of major e-commerce giants like Alibaba Group and Amazon India Pvt. Ltd. has fostered intense competition and rapid innovation, leading to diverse business models and competitive pricing strategies. The economic policies in these regions often favor e-commerce growth through favorable regulations and investment incentives, further accelerating market expansion. Infrastructure development, including improved logistics networks and warehousing facilities, also plays a crucial role in supporting the scalability of online grocery operations.

Online Grocery Shopping Product Developments

Product developments in the Online Grocery Shopping sector are characterized by a focus on enhancing user experience and operational efficiency. Innovations include AI-driven personalized recommendations, ensuring shoppers discover relevant products and reduce browsing time. The integration of augmented reality (AR) for visualizing products in a home environment is a growing trend. Furthermore, the development of specialized subscription boxes for curated meal kits and pantry staples offers convenience and caters to niche dietary needs, providing a competitive advantage for early adopters. Advancements in temperature-controlled packaging and last-mile delivery solutions are also crucial, ensuring product freshness and customer satisfaction.

Key Drivers of Online Grocery Shopping Growth

Several key factors are propelling the growth of the Online Grocery Shopping market. Technological advancements, particularly in AI and logistics, are streamlining operations and enhancing customer convenience. The increasing adoption of smartphones and widespread internet access globally is expanding the addressable market. Economic factors, such as rising disposable incomes and a growing middle class in emerging economies, are fueling consumer spending on online services. Regulatory support for e-commerce and digital payments in many countries also plays a vital role. For example, government initiatives promoting digital payments have seen a xx% increase in online transactions.

Challenges in the Online Grocery Shopping Market

Despite robust growth, the Online Grocery Shopping market faces significant challenges. Regulatory hurdles, including food safety standards and delivery regulations, can vary widely and be complex to navigate across different jurisdictions. Supply chain issues, such as maintaining product freshness during transit and managing inventory efficiently, remain critical concerns, impacting an estimated 18% of deliveries with quality issues. Intense competitive pressures from both established players and new entrants lead to price wars and high customer acquisition costs. Furthermore, logistical complexities in last-mile delivery, especially in densely populated urban areas, can lead to delays and increased operational expenses.

Emerging Opportunities in Online Grocery Shopping

Emerging opportunities in the Online Grocery Shopping market are centered around technological innovation and strategic market expansion. The integration of autonomous delivery vehicles and drones promises to revolutionize last-mile logistics, reducing delivery times and costs. Strategic partnerships between online grocers and meal kit providers, or even local farmers, can expand product offerings and cater to specialized consumer demands. Furthermore, tapping into underserved rural markets and developing localized e-commerce solutions presents a significant growth avenue. The increasing consumer demand for personalized shopping experiences and sustainable products opens doors for niche platforms and brands.

Leading Players in the Online Grocery Shopping Sector

- Alibaba Group

- AEON Co., Ltd.

- Amazon India Pvt. Ltd.

- Avenue Supermarts Ltd.

- Best Buy Co. Inc.

- Blinkit

- Carrefour S.A.

- Costco Wholesale Corporation

- Edeka Group

- Fresh Direct LLC

- Godrej Nature's Basket Ltd.

- Honestbee

- Instacart

- Natures Basket Limited.

- Peapod LLC

- Publix Super Markets Inc.

- Rakuten

Key Milestones in Online Grocery Shopping Industry

- 2019: Increased investment in AI for personalized recommendations and demand forecasting.

- 2020 (March): Global surge in online grocery orders due to the COVID-19 pandemic, leading to an estimated 100% increase in order volumes.

- 2021 (Q4): Rise of quick commerce models promising sub-30-minute deliveries.

- 2022 (H1): Growing emphasis on sustainable packaging and eco-friendly delivery options.

- 2023 (August): Expansion of drone delivery trials in select urban areas.

- 2024 (January): Increased adoption of dark stores and micro-fulfillment centers by major retailers.

Strategic Outlook for Online Grocery Shopping Market

The strategic outlook for the Online Grocery Shopping market is overwhelmingly positive, driven by sustained consumer adoption and continuous technological innovation. Growth accelerators include the further development of AI for hyper-personalization, optimizing both customer experience and operational efficiency. The expansion of quick commerce models and the exploration of autonomous delivery solutions will continue to redefine speed and convenience. Strategic partnerships and the expansion into untapped geographical markets, particularly in emerging economies, will unlock significant new revenue streams. Furthermore, a growing focus on sustainability and ethical sourcing will present opportunities for brands that align with evolving consumer values. The market is projected to witness continued consolidation and specialized niche offerings catering to diverse consumer needs.

Online Grocery Shopping Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Distributors

- 1.3. Others

-

2. Type

- 2.1. Online

- 2.2. Offline (Cash on Delivery)

Online Grocery Shopping Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Grocery Shopping REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Distributors

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Online

- 5.2.2. Offline (Cash on Delivery)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Distributors

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Online

- 6.2.2. Offline (Cash on Delivery)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Distributors

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Online

- 7.2.2. Offline (Cash on Delivery)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Distributors

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Online

- 8.2.2. Offline (Cash on Delivery)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Distributors

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Online

- 9.2.2. Offline (Cash on Delivery)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Grocery Shopping Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Distributors

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Online

- 10.2.2. Offline (Cash on Delivery)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Alibaba Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AEON Co. Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amazon India Pvt. Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Avenue Supermarts Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Best Buy Co. Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Blinkit

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carrefore S.A.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Costco Wholesale Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Edeka Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fresh Direct LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Godrej Nature's Basket Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Honestbee

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Instacart

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Natures Basket Limited.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Peapod LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Publix Super Markets Inc.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Rakuten

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Alibaba Group

List of Figures

- Figure 1: Global Online Grocery Shopping Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Grocery Shopping Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Grocery Shopping Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Grocery Shopping Revenue (million), by Type 2024 & 2032

- Figure 5: North America Online Grocery Shopping Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Online Grocery Shopping Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Grocery Shopping Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Grocery Shopping Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Grocery Shopping Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Grocery Shopping Revenue (million), by Type 2024 & 2032

- Figure 11: South America Online Grocery Shopping Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Online Grocery Shopping Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Grocery Shopping Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Grocery Shopping Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Grocery Shopping Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Grocery Shopping Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Online Grocery Shopping Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Online Grocery Shopping Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Grocery Shopping Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Grocery Shopping Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Grocery Shopping Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Grocery Shopping Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Online Grocery Shopping Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Online Grocery Shopping Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Grocery Shopping Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Grocery Shopping Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Grocery Shopping Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Grocery Shopping Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Online Grocery Shopping Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Online Grocery Shopping Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Grocery Shopping Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Grocery Shopping Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Online Grocery Shopping Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Online Grocery Shopping Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Online Grocery Shopping Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Online Grocery Shopping Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Online Grocery Shopping Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Grocery Shopping Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Grocery Shopping Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Online Grocery Shopping Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Grocery Shopping Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Grocery Shopping?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Online Grocery Shopping?

Key companies in the market include Alibaba Group, AEON Co., Ltd., Amazon India Pvt. Ltd., Avenue Supermarts Ltd., Best Buy Co. Inc., Blinkit, Carrefore S.A., Costco Wholesale Corporation, Edeka Group, Fresh Direct LLC, Godrej Nature's Basket Ltd., Honestbee, Instacart, Natures Basket Limited., Peapod LLC, Publix Super Markets Inc., Rakuten.

3. What are the main segments of the Online Grocery Shopping?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Grocery Shopping," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Grocery Shopping report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Grocery Shopping?

To stay informed about further developments, trends, and reports in the Online Grocery Shopping, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence