Key Insights

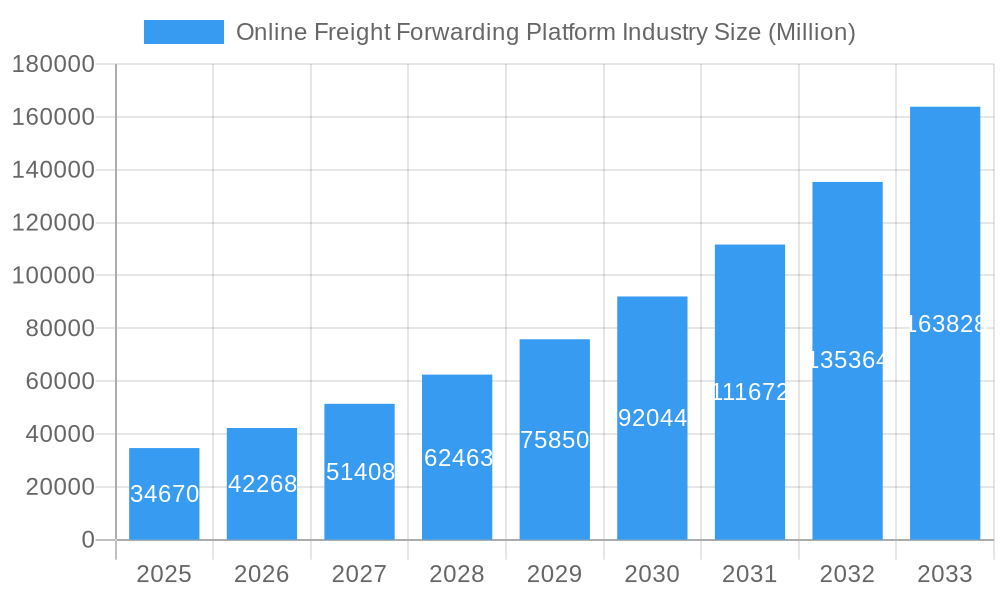

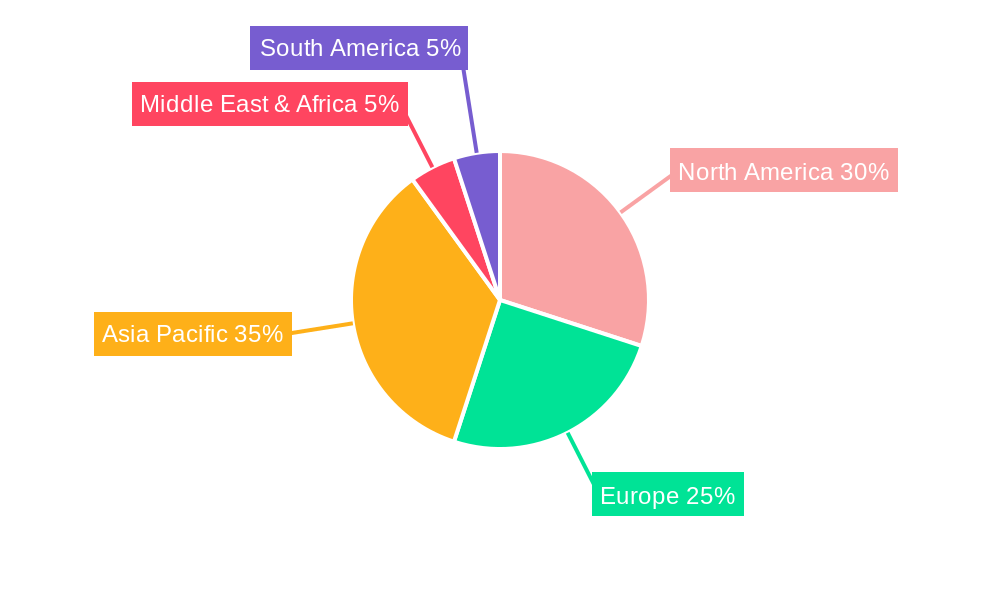

The online freight forwarding platform industry is experiencing robust growth, projected to reach a market size of $34.67 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 21.77%. This surge is fueled by several key factors. E-commerce expansion necessitates efficient and transparent logistics solutions, driving demand for digital platforms that streamline the freight forwarding process. Furthermore, technological advancements like AI-powered route optimization, real-time tracking, and automated documentation are enhancing operational efficiency and reducing costs, making online freight forwarding increasingly attractive to businesses of all sizes. Increased supply chain complexities and the need for greater visibility into shipments also contribute to market growth. The industry is segmented by mode of transport (land, sea, air), with each segment contributing to overall growth, although the precise breakdown requires further data. Leading players like Flexport, DHL Group, and Kuehne + Nagel are investing heavily in technology and expanding their global reach to capitalize on market opportunities. However, challenges remain. Cybersecurity risks associated with handling sensitive data and the need for robust customer support are crucial considerations. Regulatory compliance across different geographical regions also presents complexities. The competitive landscape is dynamic, with established players facing competition from innovative startups offering specialized services. Future growth will depend on continued technological innovation, strategic partnerships, and effective management of regulatory hurdles. The Asia-Pacific region, driven by its booming e-commerce sector and manufacturing hubs, is anticipated to hold a significant market share, followed by North America and Europe.

Online Freight Forwarding Platform Industry Market Size (In Billion)

The forecast period (2025-2033) promises sustained expansion, with a potential acceleration in growth due to increased adoption of digital solutions across diverse industries. This accelerated adoption will lead to increased competition, necessitating strategic mergers, acquisitions, and technological advancements for companies to maintain a competitive edge. The successful players will be those that effectively balance cost optimization, technological innovation, robust customer service, and compliance with evolving regulations. Expansion into emerging markets, customized solutions for niche sectors, and the integration of advanced analytics for predictive insights will play pivotal roles in shaping the future of the online freight forwarding platform industry.

Online Freight Forwarding Platform Industry Company Market Share

Online Freight Forwarding Platform Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Online Freight Forwarding Platform industry, projecting robust growth from 2025 to 2033. Leveraging extensive market research and data analysis covering the period 2019-2024 (Historical Period), this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study's Base Year is 2025, with projections extending to the Estimated Year of 2025 and the Forecast Period of 2025-2033. Key players analyzed include Flexport, DHL Group, FreightHub, Kuehne + Nagel International AG, Agility Logistics Pvt Ltd, Fleet, InstaFreight, Turvo, iContainers, Twill, KN Freight Net, Transporteca, and Kontainers – though this list is not exhaustive. The report segments the market by mode of transport (Land, Sea, Air), offering granular analysis and revealing key market trends.

Online Freight Forwarding Platform Industry Market Dynamics & Concentration

The online freight forwarding platform market is a dynamic ecosystem shaped by intense competition, rapid technological evolution, and an ever-changing regulatory landscape. While established giants like Flexport and DHL Group continue to hold substantial market sway, with estimated market shares of xx% and xx% respectively in 2025, the industry is experiencing a surge of innovative startups and specialized providers. Market concentration remains moderate, indicated by a projected Herfindahl-Hirschman Index (HHI) of xx in 2025. Key catalysts for innovation include the sophisticated application of AI for logistics optimization, the integration of blockchain for unparalleled supply chain transparency, and the proliferation of digital freight marketplaces that connect shippers and carriers more efficiently. Navigating diverse and evolving regulatory frameworks across different jurisdictions presents both challenges and opportunities, influencing operational costs and compliance mandates. Traditional freight forwarding methods persist as a competitive alternative, necessitating continuous platform enhancement. End-user demand is clearly shifting towards comprehensive digitalization, advanced automation, and real-time cargo visibility, directly influencing the development of platform features and service portfolios. Mergers and acquisitions (M&A) have been a defining characteristic of recent years, with an estimated xx significant deals executed between 2019 and 2024, driven by strategic imperatives such as achieving economies of scale, integrating cutting-edge technologies, and expanding global reach.

- Market Share: Flexport (xx%), DHL Group (xx%), Emerging Players & Niche Providers (xx%) (2025 Estimates)

- M&A Activity: xx Strategic Consolidations & Acquisitions (2019-2024)

- Key Innovation Drivers: Advanced AI for Predictive Analytics & Route Optimization, Blockchain for Immutable Record-Keeping, Real-time IoT Integration, Digital Freight Exchange Platforms

- Regulatory Environment: Highly variable by region, necessitating agile compliance strategies and impacting cross-border logistics efficiency.

Online Freight Forwarding Platform Industry Industry Trends & Analysis

The online freight forwarding platform industry is experiencing exponential growth, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of e-commerce, globalization of supply chains, and a rising demand for efficient and transparent logistics solutions. Technological disruptions, such as the implementation of Internet of Things (IoT) devices and advanced analytics, are transforming operational efficiency and visibility. Consumer preferences are shifting towards user-friendly platforms with real-time tracking, predictive analytics, and seamless integration with existing ERP systems. The competitive landscape is highly dynamic, with existing players expanding their capabilities and new entrants disrupting the market with innovative solutions. Market penetration is steadily increasing, with an estimated xx% of global freight forwarding transactions occurring through online platforms in 2025.

Leading Markets & Segments in Online Freight Forwarding Platform Industry

The online freight forwarding platform market is geographically diverse, with strong presence across multiple regions. However, North America and Europe currently represent dominant markets, accounting for an estimated xx% and xx% of the global market, respectively, in 2025. Within the segment breakdown by mode of transport, Sea freight dominates, representing approximately xx% of the total market due to its cost-effectiveness for large-volume shipments.

Key Drivers for Dominance:

- North America: Strong e-commerce growth, developed logistics infrastructure, high technology adoption.

- Europe: Large manufacturing base, extensive trade networks, well-established digital infrastructure.

- Sea Freight: Cost-effectiveness, suitability for high-volume goods, established global shipping networks.

Online Freight Forwarding Platform Industry Product Developments

Recent years have witnessed significant product innovations within the online freight forwarding platform space. These advancements largely center on improving operational efficiency, enhancing visibility and control, and simplifying the overall shipping process. The integration of artificial intelligence (AI) and machine learning (ML) for route optimization, predictive analytics, and automated document processing has been pivotal. Platforms are increasingly integrating with other supply chain management systems, allowing for end-to-end visibility and seamless data exchange. This focus on user experience, real-time tracking, and efficient processes is driving market adoption and creating competitive advantages for platforms that offer cutting-edge solutions.

Key Drivers of Online Freight Forwarding Platform Industry Growth

The robust expansion of the online freight forwarding platform industry is propelled by a confluence of powerful forces. Foremost among these are rapid technological advancements, including the transformative capabilities of AI for intelligent logistics orchestration and the enhanced security and traceability offered by blockchain technology, which collectively streamline operations and foster unprecedented transparency. The exponential growth of global e-commerce serves as a primary demand generator, creating an insatiable need for agile, scalable, and cost-effective logistics solutions. Furthermore, supportive regulatory environments in key economic blocs, which actively promote digitalization and simplify international trade procedures, significantly contribute to market proliferation. Finally, the persistent drive for operational cost reduction and the paramount importance of building resilient supply chains compel businesses to embrace online platforms, unlocking enhanced efficiency, visibility, and strategic control over their logistics operations.

Challenges in the Online Freight Forwarding Platform Industry Market

The online freight forwarding platform industry faces several challenges that could hinder its growth. Regulatory hurdles, varying across different countries, can increase compliance costs and limit market expansion. Supply chain disruptions, such as port congestion or geopolitical instability, directly impact operational efficiency and delivery timelines. The highly competitive market environment, with both established players and agile startups vying for market share, intensifies pressure on pricing and profitability. These factors can lead to reduced margins and create operational inefficiencies if not properly addressed.

Emerging Opportunities in Online Freight Forwarding Platform Industry

The online freight forwarding platform industry is poised for substantial long-term growth, fueled by a landscape ripe with emerging opportunities. Continued technological breakthroughs, particularly the widespread adoption of automation, sophisticated artificial intelligence, and advanced blockchain applications, promise to unlock further gains in operational efficiency and data integrity. Strategic collaborations and partnerships with a diverse range of logistics service providers (LSPs) are crucial for expanding service offerings, enhancing network coverage, and creating integrated end-to-end solutions. Significant potential lies in expanding into burgeoning geographical markets characterized by high e-commerce penetration and increasing demand for international shipping services. These evolving opportunities collectively point towards a future where online freight forwarding platforms are not just facilitators but central orchestrators of intricate global supply chains.

Leading Players in the Online Freight Forwarding Platform Industry Sector

- Flexport

- DHL Group

- FreightHub

- Kuehne + Nagel International AG

- Agility Logistics Pvt Ltd

- Fleet

- InstaFreight

- Turvo

- iContainers

- Twill

- KN Freight Net

- Transporteca

- Kontainers

Key Milestones in Online Freight Forwarding Platform Industry Industry

- 2020: Accelerated adoption and recognition of digital freight forwarding platforms as a critical element of supply chain resilience, largely driven by the disruptions of the COVID-19 pandemic.

- 2021: A wave of significant strategic investments by leading players focused on enhancing technological infrastructure, expanding service portfolios, and penetrating new international markets.

- 2022: A pronounced increase in merger and acquisition (M&A) activity, signaling a trend towards market consolidation and the strategic acquisition of innovative technologies and customer bases.

- 2023: Major advancements in AI-driven optimization tools, delivering enhanced capabilities in dynamic route planning, predictive analytics, and overall logistics management efficiency.

- 2024: A heightened and growing emphasis on environmental sustainability within the industry, catalyzing the development and widespread adoption of carbon-neutral shipping solutions and eco-friendly logistics practices.

Strategic Outlook for Online Freight Forwarding Platform Market

The future of the online freight forwarding platform market is bright, driven by continuous technological innovation, expanding global trade, and the increasing demand for efficient and transparent logistics solutions. Strategic opportunities lie in further integrating AI and blockchain technologies for enhanced automation and security, expanding into underserved markets, and forging strategic partnerships to broaden service offerings. A focus on sustainability and compliance will become increasingly critical, shaping future market leadership. The market is poised for continued growth, driven by these factors and the ongoing digital transformation of the global supply chain.

Online Freight Forwarding Platform Industry Segmentation

-

1. Mode of Transport

- 1.1. Land

- 1.2. Sea

- 1.3. Air

Online Freight Forwarding Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Netherlands

- 2.4. United Kingdom

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. South Korea

- 3.9. Rest of Asia Pacific

- 4. Middle East

-

5. South Africa

- 5.1. Egypt

- 5.2. GCC Countries

- 5.3. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Chile

- 6.3. Rest of South America

Online Freight Forwarding Platform Industry Regional Market Share

Geographic Coverage of Online Freight Forwarding Platform Industry

Online Freight Forwarding Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Growth in E-Commerce driving Digital Freight Forwarding Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Land

- 5.1.2. Sea

- 5.1.3. Air

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. South Africa

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. North America Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.1.1. Land

- 6.1.2. Sea

- 6.1.3. Air

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7. Europe Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.1.1. Land

- 7.1.2. Sea

- 7.1.3. Air

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8. Asia Pacific Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.1.1. Land

- 8.1.2. Sea

- 8.1.3. Air

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9. Middle East Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.1.1. Land

- 9.1.2. Sea

- 9.1.3. Air

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10. South Africa Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.1.1. Land

- 10.1.2. Sea

- 10.1.3. Air

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11. South America Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11.1.1. Land

- 11.1.2. Sea

- 11.1.3. Air

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Flexport

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 FreightHub

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kuehne + Nagel International AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Agility Logistics Pvt Ltd**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fleet

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 InstaFreight

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Turvo

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 iContainers

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Twill

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 KN Freight Net

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Transporteca

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Kontainers

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Flexport

List of Figures

- Figure 1: Global Online Freight Forwarding Platform Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 3: North America Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 4: North America Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 7: Europe Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 8: Europe Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 11: Asia Pacific Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 12: Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 15: Middle East Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 16: Middle East Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South Africa Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 19: South Africa Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 20: South Africa Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South Africa Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 23: South America Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 24: South America Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 4: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 9: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 17: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Singapore Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Malaysia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Indonesia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 28: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 30: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Egypt Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: GCC Countries Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 35: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Chile Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Freight Forwarding Platform Industry?

The projected CAGR is approximately 21.77%.

2. Which companies are prominent players in the Online Freight Forwarding Platform Industry?

Key companies in the market include Flexport, DHL Group, FreightHub, Kuehne + Nagel International AG, Agility Logistics Pvt Ltd**List Not Exhaustive, Fleet, InstaFreight, Turvo, iContainers, Twill, KN Freight Net, Transporteca, Kontainers.

3. What are the main segments of the Online Freight Forwarding Platform Industry?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.67 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Growth in E-Commerce driving Digital Freight Forwarding Market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Freight Forwarding Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Freight Forwarding Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Freight Forwarding Platform Industry?

To stay informed about further developments, trends, and reports in the Online Freight Forwarding Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence