Key Insights

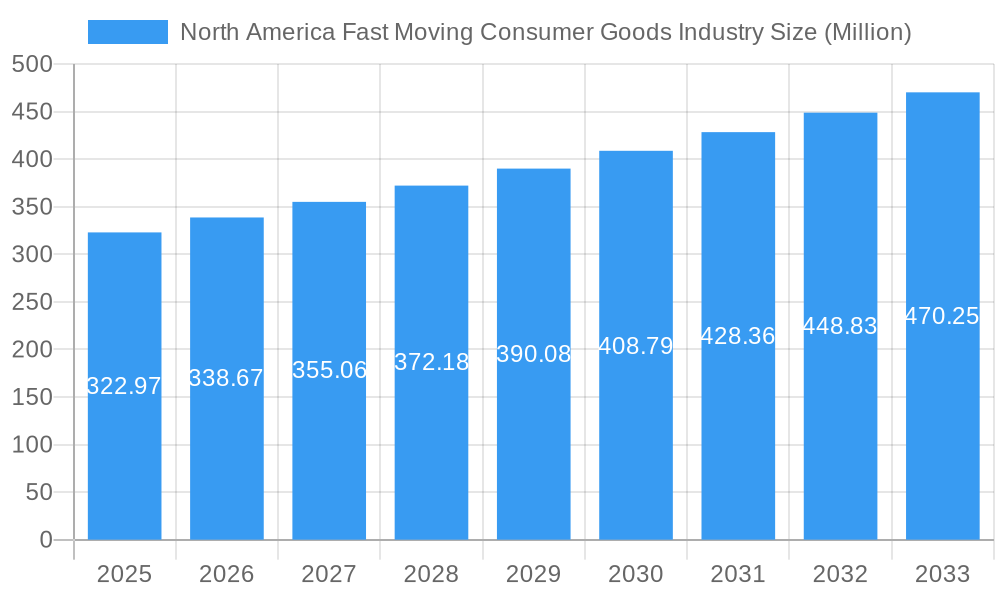

The North American Fast-Moving Consumer Goods (FMCG) logistics market, valued at $322.97 million in 2025, is projected to experience robust growth, driven by increasing e-commerce penetration, evolving consumer preferences for convenience and speed, and the growing demand for efficient supply chain solutions. The market's Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. The rise of omnichannel retail strategies necessitates sophisticated logistics networks capable of handling diverse fulfillment models, including same-day delivery and click-and-collect services. Furthermore, the growing emphasis on sustainable and ethical sourcing practices within the FMCG sector is influencing logistics choices, pushing for increased transparency and efficiency in the supply chain. Significant investment in technological advancements, such as automation, artificial intelligence, and data analytics, is also driving market expansion. Within the segments, transportation services, warehousing solutions, and efficient inventory management are experiencing the highest demand. The food and beverage segment remains the largest within the product category, given the ever-increasing consumer base, but personal care and household care segments are also exhibiting substantial growth. Major players like DB Schenker, DHL Group, FedEx, and Kuehne + Nagel are fiercely competitive, constantly innovating to meet growing demands for speed, efficiency, and cost-effectiveness.

North America Fast Moving Consumer Goods Industry Market Size (In Million)

The North American market dominance within the FMCG logistics sector stems from high consumer spending, advanced infrastructure, and a robust regulatory framework. While the United States represents the largest market share within North America, Canada and Mexico also contribute significantly, exhibiting strong growth potential due to increasing urbanization and rising disposable incomes. However, challenges remain, including labor shortages, fluctuating fuel prices, and the need for enhanced supply chain resilience to mitigate disruptions like those experienced during recent global events. Overcoming these hurdles will be pivotal in maximizing the growth opportunities within the North American FMCG logistics market, with a continued focus on technology integration and operational efficiency being critical for success.

North America Fast Moving Consumer Goods Industry Company Market Share

North America Fast Moving Consumer Goods (FMCG) Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Fast Moving Consumer Goods industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. It leverages rigorous data analysis and expert insights to deliver actionable intelligence, empowering informed decision-making. The report is essential for investors, businesses operating within the FMCG sector, and anyone seeking to understand the evolving landscape of this crucial industry.

North America Fast Moving Consumer Goods Industry Market Dynamics & Concentration

This section delves into the competitive landscape of the North American FMCG industry, examining market concentration, innovation drivers, and regulatory influences. We analyze the impact of mergers and acquisitions (M&A) activity, evolving end-user trends, the strategic importance of private label brands, and the persistent presence of product substitutes. The study period encompasses historical data from 2019-2024, with comprehensive estimations and forecasts extending through 2025-2033.

- Market Concentration: The North American FMCG market is characterized by a moderately concentrated structure. A few key players command a significant market share (estimated at approximately 65-70% for the top 5 players in 2025), but a vibrant ecosystem of agile, niche players significantly contributes to market diversity and innovation.

- Innovation Drivers: Technological advancements are pivotal. This includes the digitization of supply chains for enhanced efficiency, the exponential growth of e-commerce platforms offering direct consumer access, and the sophisticated application of AI for personalized marketing and product development. A strong and growing emphasis on sustainable packaging solutions and the development of healthier, more natural product formulations are also key innovation catalysts.

- Regulatory Frameworks: A robust regulatory environment significantly shapes market dynamics. Stringent food safety regulations, evolving nutritional labeling requirements (e.g., front-of-pack labeling), and increasing environmental compliance mandates (e.g., plastic reduction targets) are critical factors. Trade policies and international agreements also play a crucial role in market access and competition.

- Product Substitutes: The competitive pressure from private label brands remains a formidable force, offering consumers value-driven alternatives. Additionally, the burgeoning popularity of health-conscious and plant-based alternatives, as well as direct-to-consumer (DTC) brands, continues to challenge established FMCG giants.

- End-User Trends: Consumer preferences are undergoing a rapid evolution. Key trends include an intensified demand for convenience (e.g., ready-to-eat meals, subscription boxes), a heightened focus on health and wellness (e.g., organic, low-sugar, functional foods), and a significant commitment to sustainability (e.g., ethical sourcing, reduced waste). The pervasive expansion of e-commerce continues to fundamentally alter distribution channels and consumer purchasing habits.

- M&A Activities: The FMCG sector has consistently seen considerable M&A activity, driven by strategic imperatives such as consolidation for economies of scale, diversification of product portfolios, and expansion into emerging markets and product categories. The historical period (2019-2024) witnessed substantial deal-making (an estimated 150-200 major deals), and this trend is projected to remain robust in the forecast period as companies seek to adapt to evolving market demands and competitive pressures.

North America Fast Moving Consumer Goods Industry Industry Trends & Analysis

This section provides a comprehensive overview of the North American FMCG industry's evolution from 2019 to 2033. We explore market growth drivers, technological disruptions, changing consumer preferences, and competitive dynamics. The analysis incorporates key metrics like Compound Annual Growth Rate (CAGR) and market penetration. The base year for our analysis is 2025.

The North American FMCG market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market value of $xx Million by 2033. Key growth drivers include increasing disposable incomes, a growing population, and the rising popularity of e-commerce. However, macroeconomic uncertainties and changing consumer behaviors present challenges. Technological advancements in areas such as AI-powered personalization, precision agriculture, and improved logistics are transforming the industry. Market penetration of e-commerce within FMCG is expected to reach xx% by 2033.

Leading Markets & Segments in North America Fast Moving Consumer Goods Industry

This section identifies the leading regions, countries, and market segments within the North American FMCG market. We analyze the key drivers underpinning their dominance, considering economic policies, infrastructure development, demographic shifts, and evolving consumer behaviors. The analysis is structured around two primary segmentation frameworks: “By Service” (Transportation, Warehousing, Distribution, Inventory Management, and Other Value-added Services) and “By Product Category” (Food and Beverage, Personal Care, Household Care, and Other Consumables).

By Service:

- Transportation: The United States continues to lead this segment, supported by its extensive and advanced transportation infrastructure and high demand for efficient logistics solutions. Key drivers of growth include the ongoing advancements in cold chain logistics, the sophisticated development of last-mile delivery technologies, and the increasing adoption of electric and alternative fuel vehicles.

- Warehousing & Distribution: Major warehousing and distribution hubs are strategically concentrated in key metropolitan areas across the US and Canada, leveraging proximity to vast consumer bases. Significant investments in automation, robotics, and AI-powered warehouse management systems are driving substantial efficiency improvements and reducing operational costs within this segment.

- Inventory Management & Other Value-added Services: The demand for sophisticated, data-driven inventory management systems is experiencing rapid growth, fueled by the imperative for enhanced efficiency, optimized stock levels, and minimized waste. Value-added services, such as customized packaging, personalized labeling, kitting, and reverse logistics, are also becoming increasingly critical for competitive differentiation.

By Product Category:

- Food and Beverage: This segment represents the largest share of the North American FMCG market, with the US leading due to its substantial consumer base and diverse dietary preferences. The health and wellness megatrend is a primary influence, driving significant demand for organic, plant-based, functional, and minimally processed food and beverage options.

- Personal Care: The personal care segment is exhibiting robust and consistent growth. This is propelled by increasing disposable incomes, a growing consumer focus on personal hygiene, beauty, and self-care, and the continuous introduction of innovative, efficacy-driven products and sophisticated digital marketing campaigns.

- Household Care: Steady and reliable growth is observed in the household care segment, underpinned by the sustained demand for cleaning products, detergents, and other essential household goods. A significant and accelerating trend is the rising market share of sustainable, eco-friendly, and naturally derived cleaning solutions.

- Other Consumables: This broad category encompasses a variety of products such as pet food, baby care, stationery, and over-the-counter (OTC) pharmaceuticals. Growth patterns within this segment are diverse and highly dependent on specific product types, niche consumer trends, and innovation cycles.

North America Fast Moving Consumer Goods Industry Product Developments

The FMCG industry constantly witnesses new product innovations, driven by evolving consumer preferences and technological advancements. Key trends include the increasing demand for sustainable and eco-friendly products, the rise of personalized products, and the development of technologically advanced packaging solutions. Companies are leveraging data analytics to gain insights into consumer behavior and tailor product offerings accordingly. This results in greater product differentiation and enhanced competitive advantages.

Key Drivers of North America Fast Moving Consumer Goods Industry Growth

Several factors fuel the growth of the North American FMCG market. The expanding population and rising disposable incomes are key contributors. Technological advancements, especially in e-commerce and supply chain management, significantly improve efficiency and expand market reach. Favorable government policies and investments in infrastructure further boost growth.

Challenges in the North America Fast Moving Consumer Goods Industry Market

The North American FMCG industry is navigating a complex landscape of challenges. These include persistent upward pressure on raw material costs, increasing volatility and disruptions within global supply chains (exacerbated by geopolitical events and climate change), and intensified competition, particularly from agile private-label brands and emerging DTC players. Stringent and evolving regulatory requirements, coupled with rapidly shifting consumer preferences towards health, sustainability, and ethical sourcing, necessitate continuous adaptation and investment. These multifaceted challenges can significantly impact profitability, market share, and long-term business sustainability.

Emerging Opportunities in North America Fast Moving Consumer Goods Industry

Significant opportunities for growth and innovation abound within the North American FMCG market. The continued, rapid expansion of e-commerce, including rapid grocery delivery services and social commerce, presents new and direct avenues for market penetration and customer engagement. Technological innovations, such as the widespread adoption of AI for predictive analytics and personalized consumer experiences, and advanced automation in manufacturing and logistics, offer substantial opportunities for efficiency improvements, cost reduction, and enhanced product development. Furthermore, strategic partnerships, joint ventures, and targeted mergers and acquisitions can enable companies to swiftly expand their market reach, acquire new capabilities, and diversify their product portfolios in response to evolving consumer demands.

Leading Players in the North America Fast Moving Consumer Goods Industry Sector

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc

- XPO Logistics

- FedEx

- CEVA Logistics

- Agility Logistics

- Kuehne + Nagel

- Hellmann Worldwide Logistics

Key Milestones in North America Fast Moving Consumer Goods Industry Industry

- 2020: Increased demand for online grocery delivery due to pandemic-related lockdowns.

- 2021: Significant investments in automation and robotics within warehousing and distribution centers.

- 2022: Growing adoption of sustainable packaging solutions by leading FMCG brands.

- 2023: Launch of several innovative products with personalized features.

- 2024: Increased mergers and acquisitions within the sector.

Strategic Outlook for North America Fast Moving Consumer Goods Industry Market

The North American FMCG market presents significant growth opportunities in the coming years. Strategic partnerships, investments in technology, and a focus on sustainability will be crucial for success. Companies that adapt quickly to changing consumer preferences and technological advancements are well-positioned to capitalize on this potential. The market is poised for continued growth, driven by favorable demographics and increasing consumer spending.

North America Fast Moving Consumer Goods Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Fast Moving Consumer Goods Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Fast Moving Consumer Goods Industry Regional Market Share

Geographic Coverage of North America Fast Moving Consumer Goods Industry

North America Fast Moving Consumer Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. Increasing Growth in Food and Beverages Products are Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Canada North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Mexico North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 DB Schenker

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 APL Logistics**List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nippon Express

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 DHL Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 C H Robinson Worldwide Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 XPO Logistics

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 FedEx

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 CEVA Logistics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Agility Logistics

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kuehne + Nagel

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Hellmann Worlwide Logistics

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 DB Schenker

List of Figures

- Figure 1: North America Fast Moving Consumer Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fast Moving Consumer Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 7: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 11: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fast Moving Consumer Goods Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the North America Fast Moving Consumer Goods Industry?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, Hellmann Worlwide Logistics.

3. What are the main segments of the North America Fast Moving Consumer Goods Industry?

The market segments include Service, Product Category, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 322.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

Increasing Growth in Food and Beverages Products are Driving the Market Growth.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fast Moving Consumer Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fast Moving Consumer Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fast Moving Consumer Goods Industry?

To stay informed about further developments, trends, and reports in the North America Fast Moving Consumer Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence