Key Insights

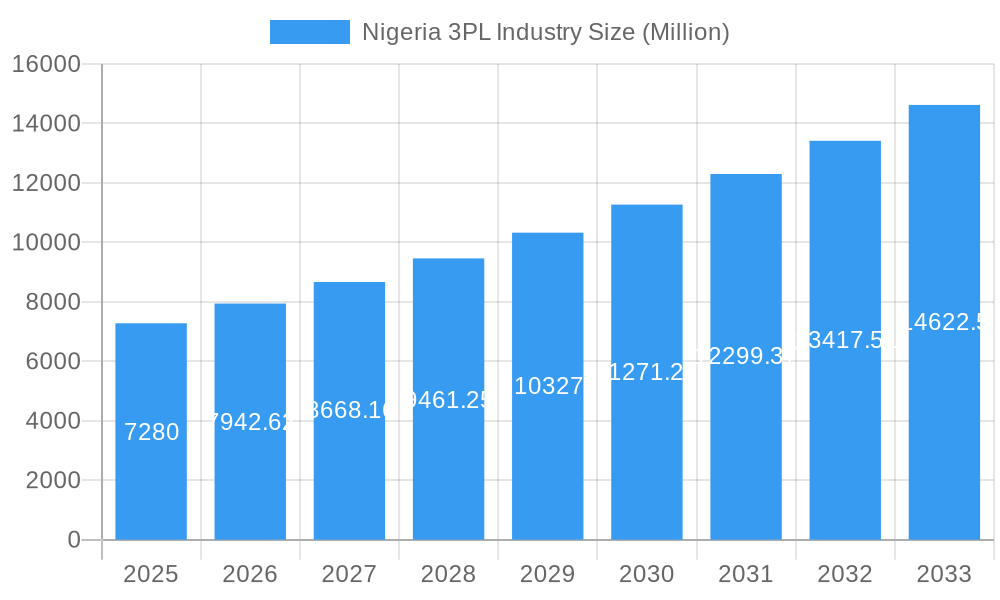

The Nigerian 3PL (Third-Party Logistics) industry, valued at $7.28 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.98% from 2025 to 2033. This expansion is driven by several factors. The rise of e-commerce in Nigeria is fueling demand for efficient warehousing, distribution, and last-mile delivery solutions. The growth of manufacturing and automotive sectors, coupled with increasing oil and gas activities, necessitates reliable and cost-effective logistics solutions. Furthermore, the ongoing infrastructural development within the country, while still facing challenges, is gradually improving transportation networks and facilitating smoother logistics operations. The pharmaceutical and healthcare sectors, prioritizing secure and temperature-controlled transportation, also significantly contribute to market growth. Key players like DHL, UPS, and Maersk, alongside local operators, are competing for market share, leading to innovation and improved service offerings.

Nigeria 3PL Industry Market Size (In Billion)

However, challenges remain. Infrastructure limitations, including inadequate road networks and port congestion, continue to hinder operational efficiency and increase transportation costs. Regulatory complexities and bureaucratic hurdles also pose obstacles. Despite these challenges, the long-term outlook for the Nigerian 3PL industry remains positive. Continued growth in key sectors, the adoption of advanced technologies such as digital logistics platforms and improved supply chain management practices, and increased foreign investment will propel further expansion in the coming years. The focus on enhancing domestic transportation management alongside international services will be crucial in shaping the future of the sector. Competitive pricing, efficient service delivery, and adaptation to the evolving needs of diverse end-users will be vital for success in this dynamic market.

Nigeria 3PL Industry Company Market Share

Nigeria 3PL Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the burgeoning Nigeria 3PL (Third-Party Logistics) industry, offering invaluable insights for investors, stakeholders, and industry professionals. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. Expect detailed analysis of market size (valued in Millions USD), key players, and segment-specific growth projections. This report is your definitive guide to understanding and navigating the complexities of the Nigerian 3PL landscape.

Nigeria 3PL Industry Market Dynamics & Concentration

The Nigerian 3PL market is a dynamic and evolving landscape, characterized by a moderate level of concentration and significant growth potential. Currently, a few dominant players, including global giants like DHL, UPS, and MSC, command substantial market share. However, a vibrant ecosystem of regional and local providers actively competes, contributing significantly to the market's overall size and dynamism. The market is projected to reach an estimated value of [Insert Current Market Value in Million USD] Million USD by 2025. This growth is propelled by rapid technological advancements, the ever-increasing demands of the burgeoning e-commerce sector, and evolving customer expectations for speed and reliability. While regulatory frameworks are still developing, they play a crucial role in shaping operational strategies and investment decisions. The competitive landscape is further influenced by the availability of substitute services, such as in-house logistics management, which compels 3PL providers to continuously innovate and offer compelling value-added services to retain and attract clients. Mergers and acquisitions (M&A) are becoming increasingly prevalent, indicating a trend towards industry consolidation and the pursuit of economies of scale and synergistic benefits.

- Market Share: DHL ([Insert DHL Market Share]%), UPS ([Insert UPS Market Share]%), MSC ([Insert MSC Market Share]%), Others ([Insert Others Market Share]%)

- M&A Deal Count (2019-2024): [Insert M&A Deal Count] deals

- Key Innovation Drivers: Advanced technological adoption (e.g., AI, IoT), evolving customer demands for personalized and on-demand services, rapid e-commerce expansion, and the need for sustainable logistics solutions.

- Regulatory Framework: Actively developing, with a focus on improving trade facilitation, streamlining customs processes, and enhancing infrastructure. This evolving framework presents both opportunities and challenges for operational efficiency and investment.

- Product Substitutes: In-house logistics management, informal logistics providers, and the development of direct-to-consumer fulfillment models.

- End-User Trends: Exponential growth in e-commerce driving demand for fast, reliable, and traceable last-mile delivery. Increasing demand for specialized services like cold chain logistics, reverse logistics, and cross-border fulfillment.

Nigeria 3PL Industry Industry Trends & Analysis

The Nigerian 3PL industry is poised for robust and sustained growth, with a projected Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR]% during the forecast period of 2025-2033. This impressive growth trajectory is underpinned by a confluence of powerful economic and technological forces. The escalating adoption of e-commerce across the nation is a primary catalyst, necessitating sophisticated and scalable logistics solutions. Furthermore, the expansion of key sectors such as manufacturing, oil and gas, and automotive, all of which rely heavily on efficient supply chain management, is significantly contributing to market expansion. Technological disruptions are at the forefront, with an increasing embrace of advanced analytics for demand forecasting, automation in warehousing and fulfillment, and real-time tracking technologies that provide unprecedented visibility and control over the supply chain. Consumer preferences are rapidly evolving, with a growing emphasis on faster delivery times, greater transparency in the fulfillment process, and a demand for a wider array of value-added services. The competitive landscape is marked by both intense price competition and the formation of strategic alliances aimed at enhancing service offerings and market reach. As more Small and Medium-sized Enterprises (SMEs) and larger corporations recognize the strategic advantage of outsourcing their logistics, market penetration of 3PL services is steadily increasing. The expanding middle class and rising disposable incomes further bolster demand for goods and services, indirectly fueling the growth of the logistics sector. The government's ongoing commitment to improving national infrastructure, including transportation networks and port facilities, is also a critical enabler, creating a more favorable operating environment for 3PL providers.

Leading Markets & Segments in Nigeria 3PL Industry

The Nigerian 3PL market exhibits diverse growth across various segments and end-users. While Lagos and other major urban centers dominate the market, growth is visible across various regions. The Distributive Trade (wholesale and retail, including e-commerce) segment is currently the leading end-user sector, fueled by the rapid expansion of e-commerce platforms. International Transportation Management is experiencing high growth due to increased cross-border trade.

By Service:

- Domestic Transportation Management: Driven by growing intra-state trade and increasing need for efficient delivery solutions within Nigeria.

- International Transportation Management: Fueled by growing import and export activities and increased global trade.

- Value-added Warehousing and Distribution: Growing rapidly due to demand for advanced warehousing solutions, inventory management, and supply chain optimization.

By End-User:

- Distributive Trade (Wholesale and Retail, including e-commerce): The leading segment, driven by the rapid expansion of e-commerce and increased consumer demand.

- Manufacturing & Automotive: Significant growth expected due to investments in the manufacturing sector.

- Oil & Gas and Chemicals: Demand for specialized logistics services.

- Pharma & Healthcare: Growing demand for temperature-sensitive logistics and supply chain solutions.

- Construction: Increased demand for construction materials and logistics services.

Key Drivers:

- Economic Policies: Government initiatives supporting infrastructure development and trade liberalization.

- Infrastructure Development: Improvements in roads, ports, and other infrastructure significantly improve efficiency.

- Technological Advancements: Adoption of advanced logistics technologies enhances efficiency and transparency.

Nigeria 3PL Industry Product Developments

Recent product innovations focus on technology integration, including advanced warehouse management systems (WMS), transportation management systems (TMS), and route optimization software. These solutions enhance efficiency, transparency, and cost-effectiveness, offering significant competitive advantages. The increasing adoption of IoT (Internet of Things) devices for real-time tracking and data analytics further strengthens these offerings. This market focus on technological integration reflects a strong market fit with the evolving needs of Nigerian businesses seeking enhanced supply chain visibility and control.

Key Drivers of Nigeria 3PL Industry Growth

The Nigerian 3PL industry is propelled by several interconnected factors that are shaping its accelerated growth. Foremost among these are significant technological advancements, including the widespread adoption of sophisticated Warehouse Management Systems (WMS), Transportation Management Systems (TMS), automation in sorting and picking, and the implementation of Internet of Things (IoT) devices for real-time asset tracking. These technologies are instrumental in optimizing operational efficiency, reducing transit times, and lowering overall logistics costs. The relentless expansion of the e-commerce sector is a monumental driver, creating a burgeoning demand for reliable, fast, and cost-effective last-mile delivery, as well as efficient warehousing and inventory management solutions. Concurrently, favorable government policies, such as initiatives aimed at improving trade facilitation, streamlining customs procedures, and investing in critical infrastructure projects like roads, railways, and port modernization, are creating a more conducive and efficient operating environment for logistics providers. The increasing foreign and local investment in manufacturing and industrial sectors also necessitates robust supply chain capabilities, further stimulating the demand for 3PL services.

Challenges in the Nigeria 3PL Industry Market

The Nigerian 3PL industry faces several challenges, including inadequate infrastructure (e.g., poor road networks impacting delivery times, leading to xx Million USD in losses annually), regulatory hurdles (creating complexities and uncertainty), and intense competition (placing pressure on pricing). Supply chain disruptions, such as port congestion and customs delays, further impact operational efficiency, causing estimated xx Million USD in annual losses. These factors combined significantly hamper overall market development.

Emerging Opportunities in Nigeria 3PL Industry

Significant long-term growth is anticipated due to emerging opportunities in the burgeoning e-commerce sector. Strategic partnerships between 3PL providers and e-commerce companies are increasing, and technological breakthroughs (such as drone delivery solutions) promise to revolutionize logistics operations. Expansion into underserved regions across Nigeria will unlock significant growth potential, while focusing on specialized logistics services will also allow for profitable market niche creation.

Leading Players in the Nigeria 3PL Industry Sector

- DHL International GmbH

- AGS Movers Lagos

- Bollore Transport and Logistics

- REDOXCORP SHIPPING & LOGISTICS LIMITED

- Creseada International Limited

- Redline Logistics

- ABC Transport

- MSC (Mediterranean Shipping Company)

- UPS (United Postal Services)

- GWX

- Maersk Line

- LOGISTIQ XPEDITORS LIMITED

Key Milestones in Nigeria 3PL Industry Industry

- June 2022: Bolloré Group's landmark sale of 100% of its African logistics arm, Bolloré Africa Logistics, to the MSC Group for a staggering 6.07 Billion USD. This transformative acquisition has significantly reshaped the African logistics landscape, fostering greater consolidation and creating new strategic opportunities within the Nigerian market.

- January 2022: Kuehne+Nagel's strategic expansion of its African network. This move enhanced its service reach, operational efficiency, and capabilities across the continent, including in Nigeria, demonstrating a commitment to serving the growing demand for integrated logistics solutions.

- [Insert New Milestone Date]: [Describe a relevant new milestone, e.g., a significant investment in a new distribution center, a strategic partnership for technological adoption, or a major government initiative impacting logistics.]

Strategic Outlook for Nigeria 3PL Industry Market

The Nigerian 3PL market presents a landscape brimming with long-term growth potential, fueled by the unceasing expansion of the e-commerce sector, ongoing improvements in national infrastructure, and a progressively supportive government policy environment. Strategic imperatives for success include substantial investments in cutting-edge technology to enhance efficiency and service offerings, the formation of strategic partnerships and alliances to expand market reach and capabilities, and a focused approach to expanding services into currently underserved or emerging regional markets within Nigeria. Furthermore, cultivating expertise in niche sectors such as cold chain logistics, pharmaceuticals, or specialized industrial goods, and consistently delivering tailored, value-added services, will be critical for achieving a significant competitive advantage and securing substantial market share in this dynamic environment.

Nigeria 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Nigeria 3PL Industry Segmentation By Geography

- 1. Niger

Nigeria 3PL Industry Regional Market Share

Geographic Coverage of Nigeria 3PL Industry

Nigeria 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. AfCFTA to Increase Intra Regional Trade

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL International GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AGS Movers Lagos

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bollore Transport and Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 REDOXCORP SHIPPING & LOGISTICS LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Creseada International Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Redline Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABC Transport

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MSC (Mediterranean Shipping Company)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UPS (United Postal Services)**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GWX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Maersk Line

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 LOGISTIQ XPEDITORS LIMITED

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DHL International GmbH

List of Figures

- Figure 1: Nigeria 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria 3PL Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Nigeria 3PL Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Nigeria 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Nigeria 3PL Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Nigeria 3PL Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Nigeria 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria 3PL Industry?

The projected CAGR is approximately 8.98%.

2. Which companies are prominent players in the Nigeria 3PL Industry?

Key companies in the market include DHL International GmbH, AGS Movers Lagos, Bollore Transport and Logistics, REDOXCORP SHIPPING & LOGISTICS LIMITED, Creseada International Limited, Redline Logistics, ABC Transport, MSC (Mediterranean Shipping Company), UPS (United Postal Services)**List Not Exhaustive, GWX, Maersk Line, LOGISTIQ XPEDITORS LIMITED.

3. What are the main segments of the Nigeria 3PL Industry?

The market segments include Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

AfCFTA to Increase Intra Regional Trade.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

June 2022: Following the exclusive negotiations announced on 20 December 2021 and the favorable opinions issued by each of the consulted employee representative bodies, the Bollore Group signed an agreement with the MSC Group for the sale of 100% Bolloré Africa Logistics, comprising Bollore Group's transport and logistics activities in Africa, on the basis of an enterprise value, net of minority interests, of 5.7 billion euros (6.07 USD billion).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria 3PL Industry?

To stay informed about further developments, trends, and reports in the Nigeria 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence