Key Insights

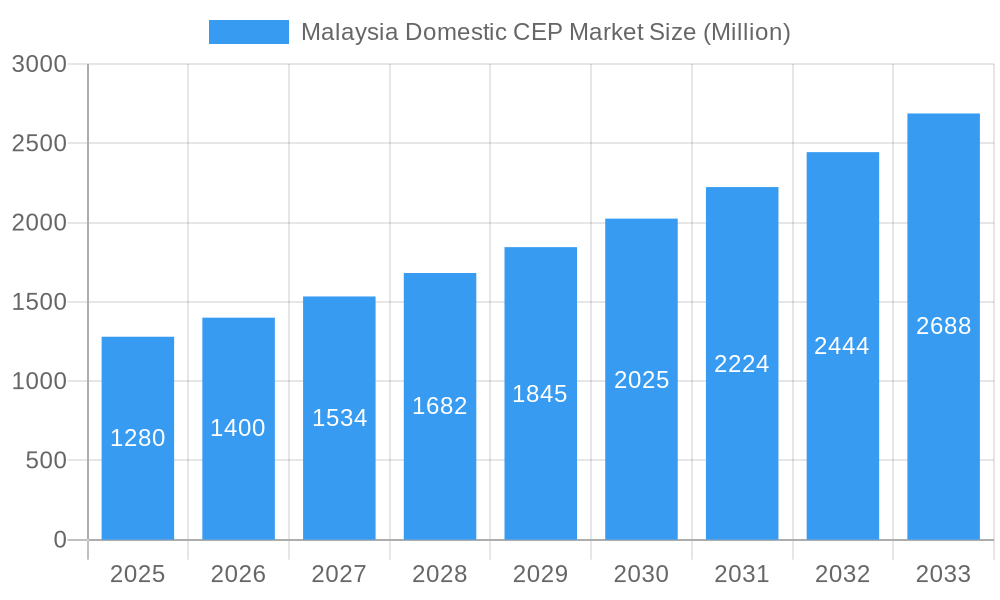

The Malaysian domestic courier, express, and parcel (CEP) market exhibits robust growth, projected to reach a market size of RM 1.28 billion in 2025. A compound annual growth rate (CAGR) of 9.24% from 2019 to 2024 suggests a thriving sector driven by the expanding e-commerce industry and increasing consumer demand for faster and more reliable delivery services. Key growth drivers include the rising adoption of online shopping, particularly in urban areas, fueled by increased internet and smartphone penetration. Furthermore, the government's initiatives to improve digital infrastructure and logistics capabilities are significantly boosting the market. However, challenges such as fluctuating fuel prices, competition among numerous players (including Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, and Ta-Q-Bin), and maintaining consistent service quality across a geographically diverse nation, pose potential restraints. The market segmentation likely includes services based on size and weight of parcels, delivery speed (e.g., next-day, standard), and specialized handling (e.g., fragile goods, temperature-sensitive items), although specific data is unavailable. Future market expansion will depend heavily on effective supply chain management, technological advancements (like automation and improved tracking systems), and the ability to adapt to evolving consumer expectations regarding delivery options and costs. The forecast period of 2025-2033 indicates continued market expansion, with a likely increase in market concentration as larger players consolidate their market share.

Malaysia Domestic CEP Market Market Size (In Billion)

The competitive landscape is highly fragmented, with both established national carriers and international players vying for dominance. Strategic partnerships, acquisitions, and expansion of service networks are likely to shape the market dynamics in the coming years. The focus on last-mile delivery optimization and improved customer service will be crucial for market success. Given the projected CAGR and market trends, it's anticipated that the market value will significantly surpass RM 1.28 billion by 2033, driven by consistent e-commerce growth and enhanced logistics infrastructure. Further research is necessary to provide precise figures for market segmentation and regional breakdowns, but the overall trend suggests a bright outlook for the Malaysian domestic CEP market.

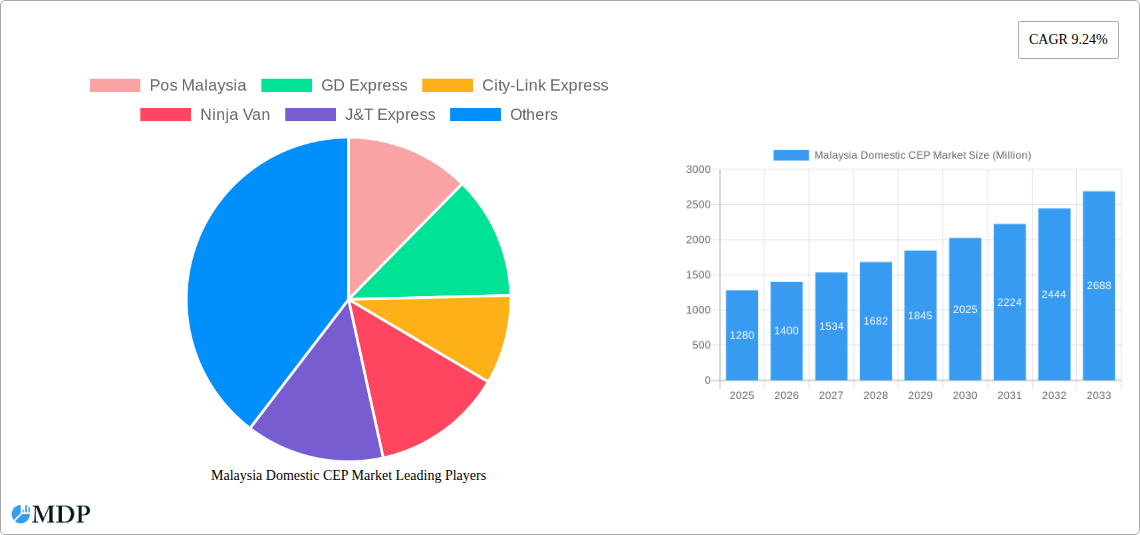

Malaysia Domestic CEP Market Company Market Share

Malaysia Domestic CEP Market Report: 2019-2033

Unlock the potential of Malaysia's rapidly expanding domestic Courier, Express, and Parcel (CEP) market with this comprehensive report. Analyzing the period from 2019 to 2033, with a focus on 2025, this report provides crucial insights for investors, businesses, and stakeholders seeking a competitive edge in this dynamic sector. Discover key trends, market forecasts, and growth opportunities within the Malaysian CEP landscape.

Malaysia Domestic CEP Market Market Dynamics & Concentration

The Malaysian domestic CEP market is characterized by a blend of established players and agile newcomers, leading to a moderately concentrated market. Pos Malaysia, with its extensive network, holds a significant market share, estimated at xx% in 2025. Other key players, including GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, and Ta-Q-Bin, collectively contribute to the remaining market share. The presence of numerous smaller companies adds to the competitive intensity.

Market concentration is further shaped by factors such as:

- Innovation Drivers: The rapid growth of e-commerce and the increasing demand for faster delivery services are driving innovation in areas like last-mile delivery solutions, automated sorting systems, and real-time tracking technology.

- Regulatory Frameworks: Government regulations impacting logistics, licensing, and data privacy influence market dynamics. The streamlining of regulations could enhance market efficiency and attract further investment.

- Product Substitutes: While traditional CEP services remain dominant, the emergence of alternative delivery models, such as crowd-sourced delivery platforms, presents a level of substitution.

- End-User Trends: Shifting consumer preferences towards convenience, speed, and transparency influence CEP providers' strategies. The demand for same-day or next-day delivery is particularly noticeable in urban areas.

- M&A Activities: The past five years have witnessed xx merger and acquisition deals within the Malaysian CEP sector, primarily driven by the consolidation efforts among smaller players aiming for improved operational efficiency and wider market reach.

Malaysia Domestic CEP Market Industry Trends & Analysis

The Malaysian domestic CEP market exhibits robust growth, fueled by several key factors. E-commerce expansion remains the primary driver, with an estimated CAGR of xx% from 2019 to 2024. Increased smartphone penetration and digital literacy further accelerate this trend. Market penetration of CEP services within the overall logistics sector is approximately xx% in 2025, demonstrating significant untapped potential.

Technological disruptions are reshaping the industry, with the adoption of artificial intelligence (AI) for route optimization and predictive analytics becoming more prevalent. This trend is coupled with increasing consumer expectations for seamless online shopping experiences, including transparent tracking and efficient returns management. Competitive dynamics are characterized by price wars and the constant drive to enhance service quality and delivery speed. This intensified competition leads to both innovation and operational optimization.

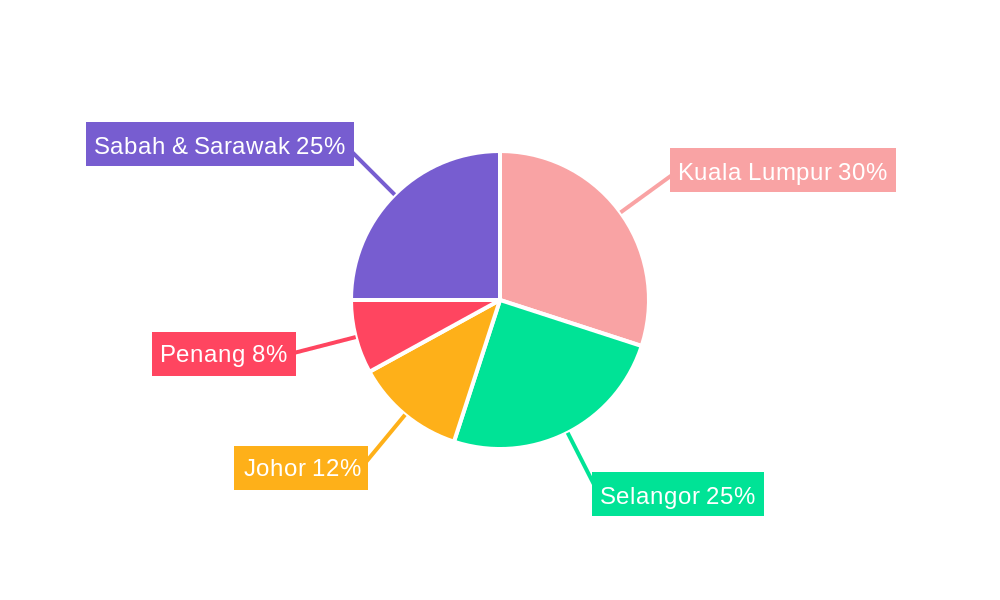

Leading Markets & Segments in Malaysia Domestic CEP Market

The Klang Valley, encompassing Kuala Lumpur and Selangor, remains the dominant region for the Malaysian domestic CEP market. This region's high population density, robust economic activity, and concentration of e-commerce businesses contribute to its market leadership.

Key drivers for this dominance include:

- Robust E-commerce Ecosystem: A large and rapidly growing e-commerce sector generates substantial demand for CEP services.

- High Population Density: Concentrated population centers facilitate efficient last-mile delivery.

- Developed Infrastructure: Well-established road networks and logistics hubs support efficient CEP operations.

Malaysia Domestic CEP Market Product Developments

Recent product innovations focus on enhancing speed, reliability, and specialization. The introduction of temperature-controlled transportation for perishable goods, as demonstrated by Ninja Van's expansion, signifies a notable development catering to growing demand in specialized sectors. Integration of advanced technologies, such as AI-powered routing and delivery optimization tools, also adds to product development trends. This improves efficiency and customer satisfaction. Furthermore, the rise of subscription-based delivery services for businesses and individuals reflects a focus on building customer loyalty.

Key Drivers of Malaysia Domestic CEP Market Growth

The Malaysian domestic CEP market's growth is propelled by a confluence of factors:

- E-commerce Boom: The rapid expansion of online retail fuels immense demand for CEP services.

- Technological Advancements: AI and automation enhance efficiency and reduce costs.

- Government Support: Supportive policies and infrastructure development facilitate market expansion.

Challenges in the Malaysia Domestic CEP Market Market

Several challenges impede market growth:

- Intense Competition: The market's fragmented nature results in aggressive pricing competition, impacting profitability.

- Infrastructure Limitations: Road congestion and underdeveloped infrastructure in certain regions hinder delivery efficiency.

- Rising Fuel Costs: Increased fuel prices add significantly to operational costs. The impact is estimated to be xx Million in lost revenue for the industry in 2025.

Emerging Opportunities in Malaysia Domestic CEP Market

Long-term growth is fueled by:

- Last-mile Delivery Innovations: Drone delivery and autonomous vehicles offer opportunities for enhanced efficiency.

- Strategic Partnerships: Collaborations between CEP providers and e-commerce platforms create synergistic advantages.

- Expansion into Rural Areas: Extending services to underserved areas unlocks significant market potential.

Leading Players in the Malaysia Domestic CEP Market Sector

- Pos Malaysia

- GD Express

- City-Link Express

- Ninja Van

- J&T Express

- DHL E-commerce

- Skynet

- ABX Express

- Nationwide Express

- Ta-Q-Bin

- 6 Other Companies

- 3 Other Companies

Key Milestones in Malaysia Domestic CEP Market Industry

- April 2024: Ninja Van expands services to include perishable goods.

- January 2024: DTDC enters the Malaysian market, establishing a Kuala Lumpur office.

Strategic Outlook for Malaysia Domestic CEP Market Market

The Malaysian domestic CEP market presents significant long-term growth potential. Continued e-commerce expansion, coupled with technological advancements and strategic partnerships, will drive future market development. Companies focusing on innovation, operational efficiency, and customer experience will be best positioned for success in this competitive landscape. The market is projected to reach xx Million in revenue by 2033.

Malaysia Domestic CEP Market Segmentation

-

1. Business Model

- 1.1. Business-to-business (B2B)

- 1.2. Customer-to-customer (C2C)

- 1.3. Business-to-consumer(B2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End User

- 3.1. Service

- 3.2. Wholesale and Retail

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Malaysia Domestic CEP Market Segmentation By Geography

- 1. Malaysia

Malaysia Domestic CEP Market Regional Market Share

Geographic Coverage of Malaysia Domestic CEP Market

Malaysia Domestic CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.4. Market Trends

- 3.4.1. Booming Smartphone Sales in E-Commerce Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Domestic CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Customer-to-customer (C2C)

- 5.1.3. Business-to-consumer(B2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Service

- 5.3.2. Wholesale and Retail

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pos Malaysia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GD Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 City-Link Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ninja Van

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL E-commerce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skynet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABX Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nationwide Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pos Malaysia

List of Figures

- Figure 1: Malaysia Domestic CEP Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Domestic CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 2: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 3: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Malaysia Domestic CEP Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Domestic CEP Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 10: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 11: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Malaysia Domestic CEP Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Domestic CEP Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Domestic CEP Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Malaysia Domestic CEP Market?

Key companies in the market include Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Malaysia Domestic CEP Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

6. What are the notable trends driving market growth?

Booming Smartphone Sales in E-Commerce Segment.

7. Are there any restraints impacting market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

8. Can you provide examples of recent developments in the market?

April 2024: Ninja Van, a local express logistics company, broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries.January 2024: DTDC, an express logistics company, announced its foray into the Malaysian market. This move was facilitated by its subsidiary, DTDC Global Express PTE Ltd, which inaugurated an office in Kuala Lumpur. The newly minted office, bolstering DTDC's presence in Southeast Asia, will primarily focus on providing advanced trans-shipment services to clients in Southeast Asia and the Australian peninsula, as per DTDC's official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Domestic CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Domestic CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Domestic CEP Market?

To stay informed about further developments, trends, and reports in the Malaysia Domestic CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence