Key Insights

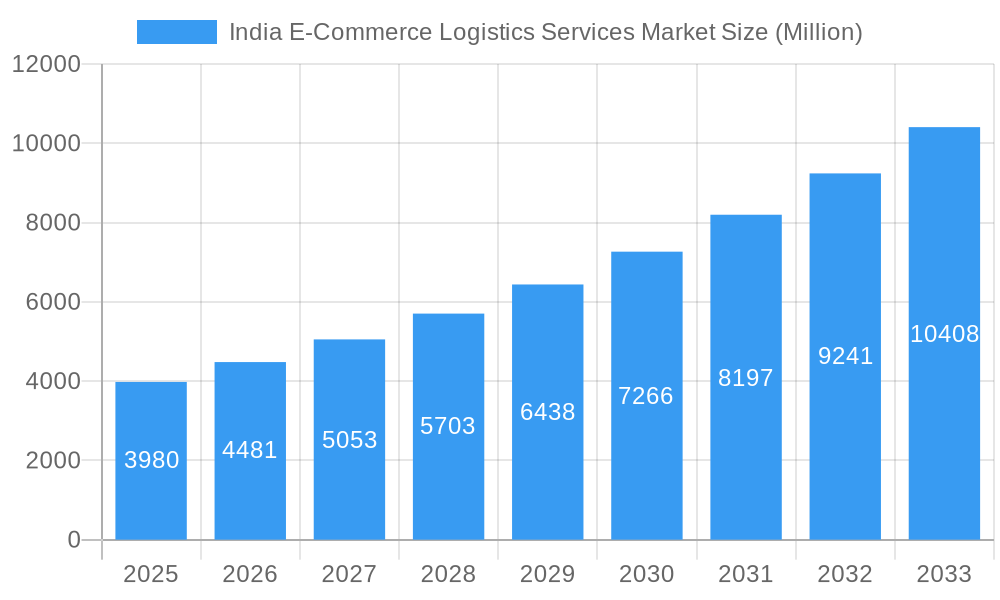

The India e-commerce logistics services market is experiencing robust growth, projected to reach \$3.98 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.72% from 2025 to 2033. This expansion is fueled by several key drivers. The surge in online shopping, particularly in fashion and apparel, consumer electronics, and home appliances, is significantly boosting demand for efficient and reliable logistics solutions. Furthermore, the increasing adoption of technology, such as advanced warehousing systems, real-time tracking, and data analytics, is streamlining operations and enhancing delivery speeds. The rise of omnichannel retail strategies, catering to both B2B and B2C customers, further fuels market growth. While challenges exist, such as infrastructure limitations in certain regions and the need for skilled labor, these are being addressed through strategic investments and government initiatives. The market is segmented by service type (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (with fashion apparel, consumer electronics, and home appliances leading the way). Key players like DHL, FedEx, Blue Dart, Mahindra Logistics, and several prominent Indian companies are actively shaping the competitive landscape through strategic partnerships, technological advancements, and expansion into new markets. The market's geographic dispersion across North, South, East, and West India reflects varying levels of e-commerce penetration and infrastructure development. The projected growth trajectory indicates a promising future for the sector, driven by increasing digitalization and a burgeoning middle class. Over the forecast period, the market is poised for further consolidation, with larger players potentially acquiring smaller logistics providers to gain scale and market share.

India E-Commerce Logistics Services Market Market Size (In Billion)

The market's growth is expected to be uneven across different segments. While the transportation segment currently dominates, value-added services like labeling and packaging are experiencing particularly rapid growth, driven by the need for enhanced product protection and brand experience. The B2C segment is anticipated to remain the larger contributor to overall market revenue, although B2B e-commerce is also showing substantial growth. International/cross-border e-commerce logistics is emerging as a significant area of opportunity, requiring specialized services and infrastructure to meet evolving customer expectations and international trade regulations. The consistent CAGR suggests a strong underlying trend of increasing e-commerce adoption and a growing need for sophisticated logistics support across India. The market's success will rely on further infrastructure development, technological innovation, and effective regulatory frameworks.

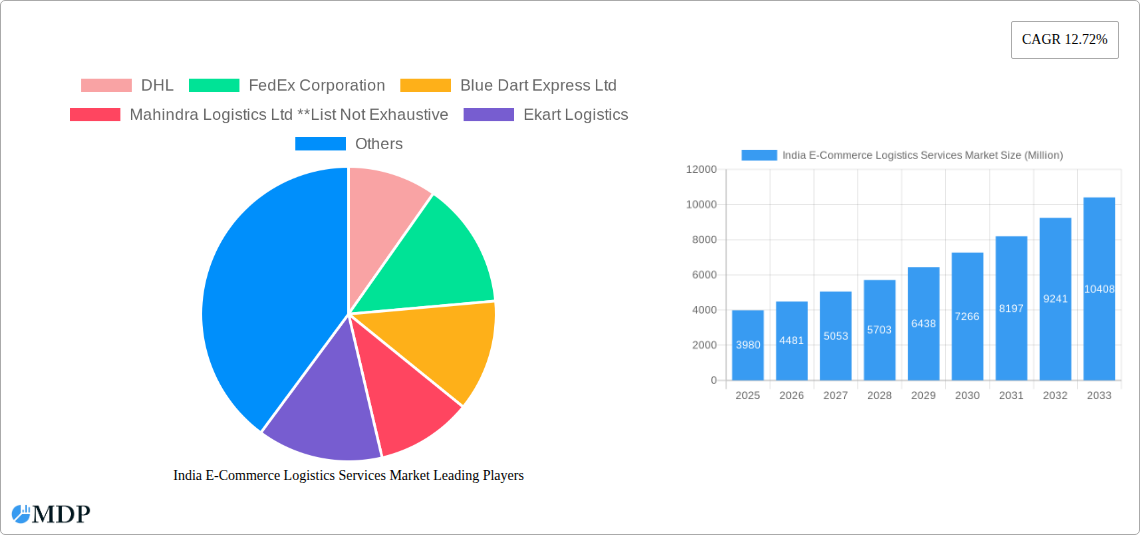

India E-Commerce Logistics Services Market Company Market Share

India E-Commerce Logistics Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India E-commerce Logistics Services Market, offering crucial insights for stakeholders, investors, and industry professionals. With a detailed examination spanning the period from 2019 to 2033, this report projects a market valued at XX Million in 2025, revealing significant growth opportunities and challenges within this dynamic sector. The report utilizes a robust methodology, incorporating data from 2019-2024 (Historical Period), establishing 2025 as the Base Year, and projecting market trends until 2033 (Forecast Period).

India E-Commerce Logistics Services Market Dynamics & Concentration

The Indian e-commerce logistics market is experiencing rapid growth, driven by the booming e-commerce sector and increasing consumer demand. Market concentration is moderate, with several large players and a significant number of smaller, regional players vying for market share. Key players such as DHL, FedEx Corporation, Blue Dart Express Ltd, Mahindra Logistics Ltd, Ekart Logistics, Delhivery Pvt Ltd, Xpress Bees, Gati-Kintetsu Express Private Limited, Ecom Express Logistics, DTDC, and Shadowfax are shaping the competitive landscape. Innovation in areas like automated warehousing, drone delivery, and AI-powered route optimization is driving market evolution. The regulatory framework, while evolving, is generally supportive of e-commerce growth, although challenges remain in areas like infrastructure development and last-mile delivery. Product substitutes are limited, with the focus primarily on improving efficiency and reducing costs within the existing services. End-user trends point towards increasing demand for faster, more reliable, and cost-effective delivery options, along with personalized services. The M&A landscape is active, with several significant deals in recent years further consolidating the market. While exact figures for market share and M&A deal counts are proprietary to this report, it is estimated that the top five players collectively hold approximately 60% of the market share in 2025, while the remaining 40% is distributed amongst numerous smaller players and regional operators. M&A activity is projected to remain robust in the forecast period, potentially leading to further market consolidation.

India E-Commerce Logistics Services Market Industry Trends & Analysis

The Indian e-commerce logistics market is characterized by robust growth driven by several factors. The rising adoption of e-commerce across both urban and rural areas is a major driver. Technological advancements like improved tracking systems, automation in warehouses, and the deployment of new technologies are enhancing efficiency and reducing costs. Changing consumer preferences favor faster delivery, increased transparency, and convenient return policies, prompting logistics companies to adapt their services. Competitive dynamics are highly intense, with players competing on price, speed, and service quality. This leads to continuous innovation and improvement in the industry. The market is anticipated to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to increase significantly, as more businesses transition to e-commerce and consumers increasingly rely on online shopping for a wider range of products. The increasing adoption of mobile commerce is also fueling the growth of the market.

Leading Markets & Segments in India E-Commerce Logistics Services Market

The Indian e-commerce logistics market is diverse, with significant variations across different segments. While precise market share data is detailed in the full report, several key factors contribute to the dominance of certain segments:

By Service: Transportation remains the largest segment, driven by the need for efficient delivery networks. Warehousing and inventory management are witnessing rapid growth due to the increasing need for efficient storage and inventory control. Value-added services like labeling and packaging are gaining traction as businesses seek enhanced customer experience and streamlined operations.

By Business: The B2C segment currently holds a larger market share, however the B2B segment is rapidly expanding due to the growth in online wholesale and business-to-business transactions.

By Destination: The domestic segment constitutes the majority of the market share, driven by the extensive reach of e-commerce within India. The international/cross-border segment shows strong growth potential, fueled by the increasing participation of Indian businesses in global e-commerce.

By Product: Fashion and apparel, consumer electronics, and beauty and personal care products are significant segments, showcasing high demand for e-commerce logistics. However, segments like home appliances, furniture, and other products (toys, food products, etc.) are also experiencing rapid growth due to changing consumer preferences and improved logistical capabilities.

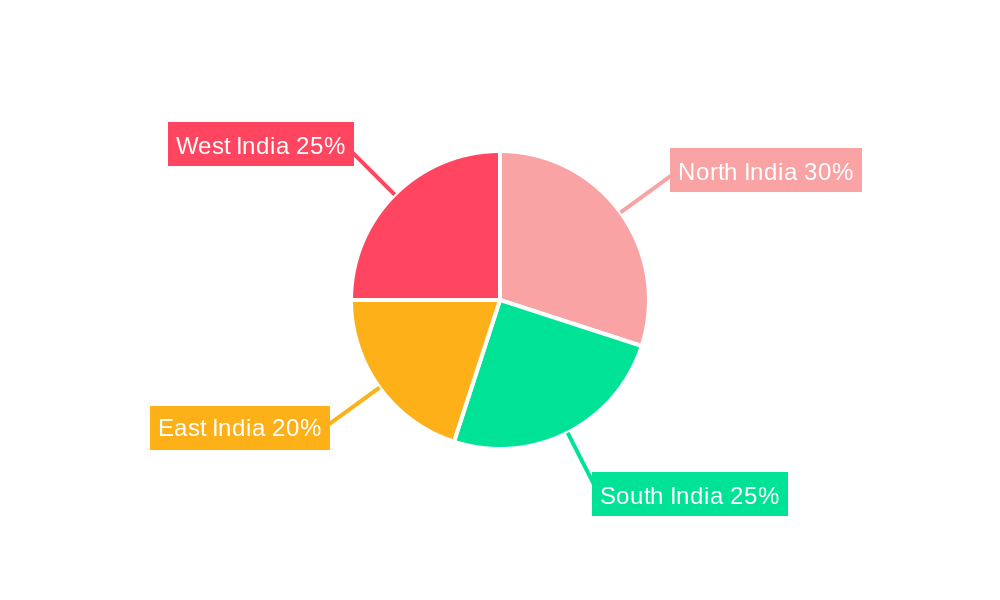

The dominance of specific regions within India is largely determined by factors such as population density, economic activity, and infrastructure development. Metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai generally exhibit higher market activity, but tier-2 and tier-3 cities are also showing significant growth.

India E-Commerce Logistics Services Market Product Developments

Recent product innovations have focused on improving efficiency, visibility, and customer experience. Companies are adopting technologies like artificial intelligence (AI) and machine learning (ML) for route optimization, predictive analytics, and automated warehousing. Blockchain technology is being explored to enhance transparency and security in supply chain management. The integration of various services, such as last-mile delivery and reverse logistics, is gaining prominence, creating a comprehensive logistical solution. Companies are also introducing specialized services catering to specific product categories, such as temperature-controlled transportation for perishable goods. This focus on providing tailored solutions is a crucial element of the competitive landscape.

Key Drivers of India E-Commerce Logistics Services Market Growth

Several key factors are driving the growth of India's e-commerce logistics services market:

Technological advancements: Automation, AI, and big data analytics are significantly increasing efficiency and accuracy.

Government initiatives: Policies promoting digitalization and infrastructure development are creating a supportive environment.

Rising disposable incomes: Increased purchasing power fuels online shopping and the demand for effective logistics.

Improved infrastructure: Investments in transportation networks and warehousing facilities are enhancing logistical capabilities.

Challenges in the India E-Commerce Logistics Services Market Market

Despite the impressive growth, the sector faces several challenges:

Infrastructure limitations: Inadequate road networks and warehousing facilities in certain regions present logistical bottlenecks. This can lead to higher transportation costs and delivery delays.

Regulatory hurdles: Complex regulations and licensing procedures can sometimes hamper business operations and expansion.

Competition: The high level of competition necessitates constant innovation and cost optimization to maintain market share. This can put pressure on profit margins for some operators.

Emerging Opportunities in India E-Commerce Logistics Services Market

The market presents exciting opportunities:

Expansion into tier 2 and 3 cities: Significant growth potential exists in less developed regions as e-commerce penetration expands.

Strategic partnerships: Collaborations between logistics companies and e-commerce platforms can lead to enhanced service offerings and economies of scale.

Technological innovations: Adoption of new technologies like drone delivery and autonomous vehicles can revolutionize logistics.

Leading Players in the India E-Commerce Logistics Services Market Sector

- DHL

- FedEx Corporation

- Blue Dart Express Ltd

- Mahindra Logistics Ltd

- Ekart Logistics

- Delhivery Pvt Ltd

- Xpress Bees

- Gati-Kintetsu Express Private Limited

- Ecom Express Logistics

- DTDC

- Shadowfax

Key Milestones in India E-Commerce Logistics Services Market Industry

August 2023: Delhivery launched its new digital shipping platform, Delhivery One, aimed at small and medium enterprises and D2C brands, offering streamlined shipping services and discounted rates. This significantly lowers the barrier to entry for smaller businesses.

July 2023: Ekart expanded its services to include B2B air and surface transportation solutions, leveraging its extensive network to cater to the growing needs of businesses across India. This move strengthens its position as a comprehensive supply chain solutions provider.

Strategic Outlook for India E-Commerce Logistics Services Market Market

The Indian e-commerce logistics market is poised for sustained growth, driven by technological innovation, expanding e-commerce adoption, and supportive government policies. Strategic opportunities exist in expanding into underserved markets, forging strategic partnerships, and adopting cutting-edge technologies. Companies that adapt to changing consumer preferences and effectively manage logistical challenges will be best positioned to thrive in this dynamic sector. The long-term potential is substantial, with continued growth projected throughout the forecast period, promising significant returns for investors and stakeholders.

India E-Commerce Logistics Services Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services (Labeling, Packaging )

-

2. Business

- 2.1. By B2B

- 2.2. By B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross Border

-

4. Product

- 4.1. Fashion and Appareal

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, Etc.)

India E-Commerce Logistics Services Market Segmentation By Geography

- 1. India

India E-Commerce Logistics Services Market Regional Market Share

Geographic Coverage of India E-Commerce Logistics Services Market

India E-Commerce Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Poor Infrastructure and Last-Mile Delivery

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce Sales is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India E-Commerce Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services (Labeling, Packaging )

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. By B2B

- 5.2.2. By B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross Border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Appareal

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, Etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FedEx Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Dart Express Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Logistics Ltd **List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ekart Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delhivery Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xpress Bees

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gati-Kintetsu Express Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Express Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DTDC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shadowfax

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: India E-Commerce Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India E-Commerce Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: India E-Commerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: India E-Commerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: India E-Commerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: India E-Commerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: India E-Commerce Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India E-Commerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: India E-Commerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: India E-Commerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: India E-Commerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: India E-Commerce Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India E-Commerce Logistics Services Market?

The projected CAGR is approximately 12.72%.

2. Which companies are prominent players in the India E-Commerce Logistics Services Market?

Key companies in the market include DHL, FedEx Corporation, Blue Dart Express Ltd, Mahindra Logistics Ltd **List Not Exhaustive, Ekart Logistics, Delhivery Pvt Ltd, Xpress Bees, Gati-Kintetsu Express Private Limited, Ecom Express Logistics, DTDC, Shadowfax.

3. What are the main segments of the India E-Commerce Logistics Services Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives.

6. What are the notable trends driving market growth?

Growth in e-Commerce Sales is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Poor Infrastructure and Last-Mile Delivery.

8. Can you provide examples of recent developments in the market?

Aug 2023: Listed logistics giant Delhivery launched a new digital shipping platform, Delhivery One, to offer logistics support to small and medium enterprises, along with D2C brands, across the country. Delhivery said Delhivery One integrates shipping services such as post-purchase communication, analytics, international shipping, one-click integration with sales channels, NDR management, and more. The new platform allows smaller businesses to ship without a minimum order value and with a minimum wallet recharge of INR 500. It also offers discounted shipping rates on heavier parcels above 5 kg.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India E-Commerce Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India E-Commerce Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India E-Commerce Logistics Services Market?

To stay informed about further developments, trends, and reports in the India E-Commerce Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence