Key Insights

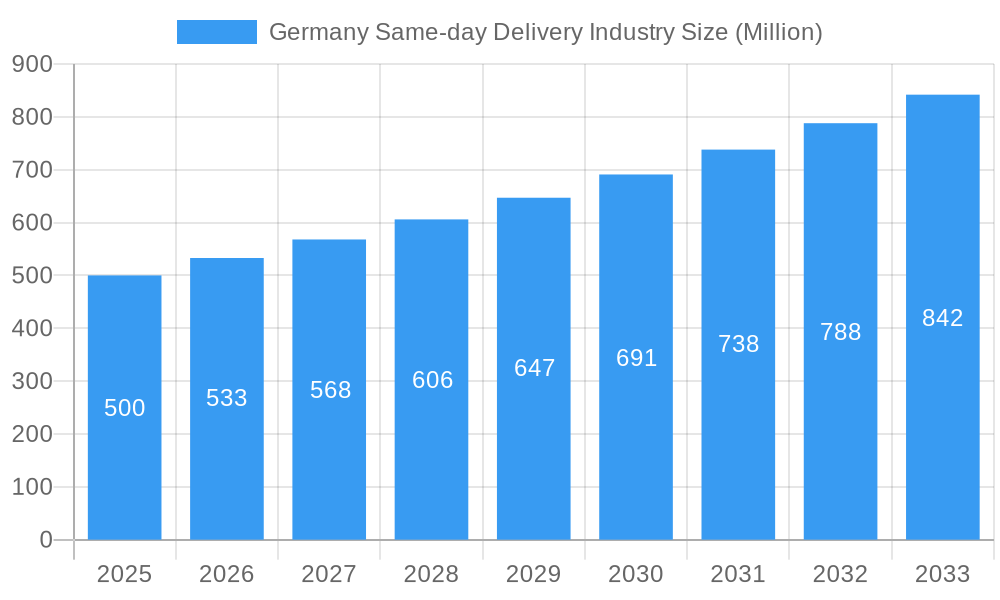

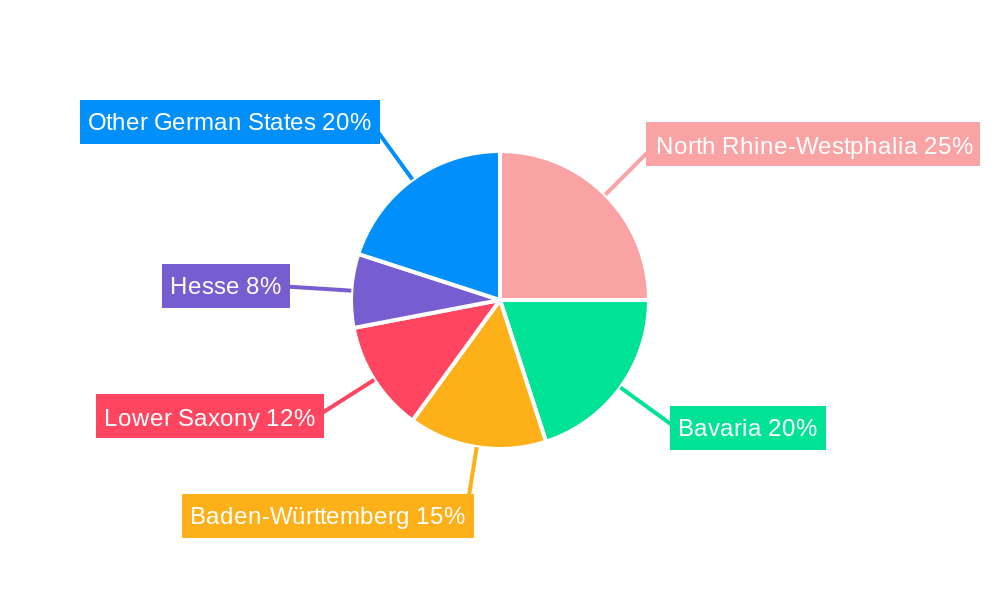

The German same-day delivery market is poised for substantial expansion, driven by escalating e-commerce adoption and a growing consumer demand for expedited shipping. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 20.2%, with the market size anticipated to reach 11.29 billion by 2025. Key market segments fueling this growth include the e-commerce sector, particularly in high-density regions such as North Rhine-Westphalia, Bavaria, and Baden-Württemberg, where consumers prioritize immediate gratification. The increasing necessity for time-sensitive deliveries in healthcare and financial services further bolsters market dynamism. Analysis of segment breakdowns by weight and transport mode underscores the inherent logistical complexities and diverse operational requirements within this sector. Potential growth restraints, including infrastructure limitations and rising fuel costs, are acknowledged but are expected to be outweighed by the sustained strength of primary market drivers.

Germany Same-day Delivery Industry Market Size (In Billion)

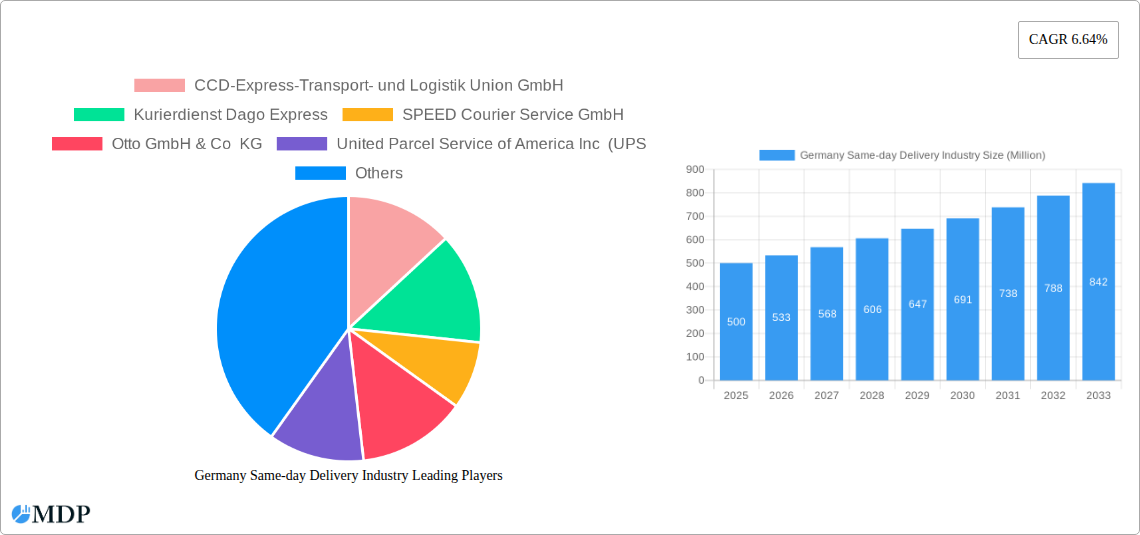

The competitive arena is characterized by a blend of global logistics leaders and agile, specialized German couriers. Established international providers guarantee service consistency and extensive delivery networks nationwide. Concurrently, smaller, regional entities are successfully catering to niche markets and localized delivery needs, fostering a competitive environment that offers diverse options for both consumers and businesses. The market trajectory suggests a potential for consolidation, wherein larger entities may acquire smaller competitors to enhance their operational scope and service portfolios, ultimately leading to improved efficiency and scalability of same-day delivery services across Germany. Future growth will be contingent upon strategic adaptation to evolving consumer preferences, integration of technological advancements such as sophisticated route optimization and real-time tracking systems, and a persistent commitment to sustainable delivery practices.

Germany Same-day Delivery Industry Company Market Share

Germany Same-Day Delivery Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a deep dive into the dynamic Germany same-day delivery industry, offering invaluable insights for stakeholders from 2019 to 2033. With a focus on market size, key players, and future trends, this report is essential for strategic decision-making. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report analyzes a market estimated at xx Million in 2025 and projects significant growth in the coming years.

Germany Same-day Delivery Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market forces shaping the German same-day delivery sector. The market exhibits moderate concentration, with several major players and numerous smaller operators. The top five players – DHL, UPS, FedEx, GLS, and DPD – hold an estimated xx% market share collectively in 2025. Innovation is driven by advancements in logistics technology, including route optimization software and autonomous delivery vehicles. Regulatory frameworks, including environmental regulations and data privacy laws, significantly influence industry operations. Product substitutes, such as in-house delivery options for large retailers, exert competitive pressure. E-commerce growth fuels demand, while M&A activity remains relatively low, with an estimated xx deals in the past five years.

- Market Share (2025): Top 5 players: xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Route optimization software, autonomous delivery vehicles

- Regulatory Impacts: Environmental regulations, data privacy laws

Germany Same-day Delivery Industry Industry Trends & Analysis

The German same-day delivery market is characterized by robust growth, driven by the booming e-commerce sector and increasing consumer demand for speed and convenience. The market is expected to exhibit a CAGR of xx% from 2025 to 2033. Market penetration is high in urban areas but remains lower in rural regions. Technological advancements, such as the adoption of AI-powered logistics systems and drone delivery, are transforming industry operations. Consumer preferences are shifting towards greater transparency and traceability in delivery processes. Intense competition among existing players and the emergence of new entrants are shaping the market dynamics. This competitive landscape is also driving the need for improved efficiency and cost optimization across the industry.

- CAGR (2025-2033): xx%

- Market Penetration (Urban Areas, 2025): xx%

- Key Trends: E-commerce growth, technological advancements, increased competition.

Leading Markets & Segments in Germany Same-day Delivery Industry

The e-commerce segment is the dominant end-user industry, accounting for an estimated xx% of total market value in 2025. Road transport is the primary mode of delivery, although air freight plays a significant role for time-sensitive shipments. Light and medium weight shipments account for the majority of deliveries. Domestic deliveries represent a larger market segment compared to international shipments. Key drivers for market leadership include strong e-commerce growth, well-developed road infrastructure, and a dense population in urban centers.

- Dominant End-User Industry: E-commerce (xx% in 2025)

- Primary Mode of Transport: Road

- Dominant Shipment Weight: Light & Medium Weight Shipments

- Dominant Destination: Domestic

- Key Drivers: E-commerce growth, strong road infrastructure, dense urban population.

Germany Same-day Delivery Industry Product Developments

Recent product innovations focus on enhanced tracking capabilities, improved delivery scheduling, and specialized packaging solutions for fragile goods. The integration of technology such as Artificial Intelligence (AI) and Machine Learning (ML) has improved route optimization, delivery predictions and overall efficiency. The market is witnessing the adoption of sustainable delivery options, such as electric vehicles and optimized routes to reduce carbon footprint. These innovations are aimed at improving customer experience and gaining a competitive edge in this market.

Key Drivers of Germany Same-day Delivery Industry Growth

Growth is fuelled by several factors: the exponential growth of e-commerce, particularly in urban areas, the increasing demand for faster delivery options among consumers, and ongoing technological advancements in logistics and delivery solutions. Government initiatives aimed at supporting digital transformation are also promoting the industry's expansion.

Challenges in the Germany Same-day Delivery Industry Market

The industry faces challenges such as rising fuel costs, labor shortages, and increasing regulatory compliance requirements. Congestion in urban areas causes delivery delays and increases operational costs, potentially impacting profitability. Intense competition from established players and new entrants requires constant innovation and cost optimization to maintain market share.

Emerging Opportunities in Germany Same-day Delivery Industry

Opportunities exist in expanding into rural areas, developing specialized delivery services for niche markets (e.g., healthcare, pharmaceuticals), and leveraging emerging technologies, such as drone delivery and autonomous vehicles. Strategic partnerships with e-commerce platforms and other logistics providers can unlock further growth potential.

Leading Players in the Germany Same-day Delivery Industry Sector

- CCD-Express-Transport- und Logistik Union GmbH

- Kurierdienst Dago Express

- SPEED Courier Service GmbH

- Otto GmbH & Co KG

- United Parcel Service of America Inc (UPS)

- DHL Group

- FedEx

- International Distributions Services (including GLS)

- La Poste Group

Key Milestones in Germany Same-day Delivery Industry Industry

- October 2022: GLS Germany commences construction of a new 9,200 square-meter distribution center in Potsdam.

- October 2022: CCD-Express launches its new subdomain, www.ccd-express.de.

- February 2023: Kurierdienst Dago Express launches a new online booking tool.

Strategic Outlook for Germany Same-day Delivery Industry Market

The German same-day delivery market presents significant growth opportunities for companies that can effectively adapt to the evolving technological landscape, customer expectations, and competitive environment. Focusing on technological innovations, strategic partnerships, and optimized operations will be crucial for success in this dynamic sector. The market's future growth will be driven by the continued expansion of e-commerce, the adoption of advanced logistics technologies, and the increasing demand for speed and convenience in deliveries.

Germany Same-day Delivery Industry Segmentation

-

1. Mode Of Transport

- 1.1. Air

- 1.2. Road

- 1.3. Others

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. End User Industry

- 4.1. E-Commerce

- 4.2. Financial Services (BFSI)

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Primary Industry

- 4.6. Wholesale and Retail Trade (Offline)

- 4.7. Others

Germany Same-day Delivery Industry Segmentation By Geography

- 1. Germany

Germany Same-day Delivery Industry Regional Market Share

Geographic Coverage of Germany Same-day Delivery Industry

Germany Same-day Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Same-day Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Air

- 5.1.2. Road

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. E-Commerce

- 5.4.2. Financial Services (BFSI)

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Primary Industry

- 5.4.6. Wholesale and Retail Trade (Offline)

- 5.4.7. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CCD-Express-Transport- und Logistik Union GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kurierdienst Dago Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SPEED Courier Service GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Otto GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Parcel Service of America Inc (UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Distributions Services (including GLS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 La Poste Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 CCD-Express-Transport- und Logistik Union GmbH

List of Figures

- Figure 1: Germany Same-day Delivery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Same-day Delivery Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Same-day Delivery Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Germany Same-day Delivery Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: Germany Same-day Delivery Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Germany Same-day Delivery Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Germany Same-day Delivery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Germany Same-day Delivery Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 7: Germany Same-day Delivery Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: Germany Same-day Delivery Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Germany Same-day Delivery Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Germany Same-day Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Same-day Delivery Industry?

The projected CAGR is approximately 20.2%.

2. Which companies are prominent players in the Germany Same-day Delivery Industry?

Key companies in the market include CCD-Express-Transport- und Logistik Union GmbH, Kurierdienst Dago Express, SPEED Courier Service GmbH, Otto GmbH & Co KG, United Parcel Service of America Inc (UPS, DHL Group, FedEx, International Distributions Services (including GLS), La Poste Group.

3. What are the main segments of the Germany Same-day Delivery Industry?

The market segments include Mode Of Transport, Shipment Weight, Destination, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.29 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

February 2023: Kurierdienst Dago Express launched a new online booking tool for courier services, which will be operational from March.October 2022: GLS Germany celebrated the groundbreaking ceremony for a new company in the south of Potsdam with project partner Aurelis Real Estate. A 9,200 square-meter distribution center is being built on an area of over 50,000 square meters in Drewitzer Strasse.October 2022: The subdomain www.ccd-express.de is launched as a part of the ccd-express.de domain name falling under the country-code top-level domain .de. The web servers' location is in Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Same-day Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Same-day Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Same-day Delivery Industry?

To stay informed about further developments, trends, and reports in the Germany Same-day Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence