Key Insights

The global Finished Vehicles Logistics market is poised for substantial expansion, driven by escalating automotive production and burgeoning global demand. With an estimated market size of $257.52 billion in the base year 2025, the sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. Key growth drivers include the escalating need for efficient vehicle transportation, the widespread adoption of advanced logistics technologies like telematics for real-time tracking, and evolving e-commerce models influencing delivery strategies. The market is strategically segmented by activity, encompassing transport (rail, road, air, sea), warehousing, and value-added services, presenting diverse opportunities for logistics providers. Leading entities such as CMA CGM, Omsan Logistics, and XPO Logistics are actively shaping the market through strategic alliances, technological investments, and international expansion. The Asia-Pacific region, particularly China and India, is anticipated to be a significant growth hub due to robust automotive manufacturing capabilities. Despite potential challenges from volatile fuel prices and geopolitical instability, the Finished Vehicles Logistics market outlook remains overwhelmingly positive, supported by sustained growth in vehicle production and international trade.

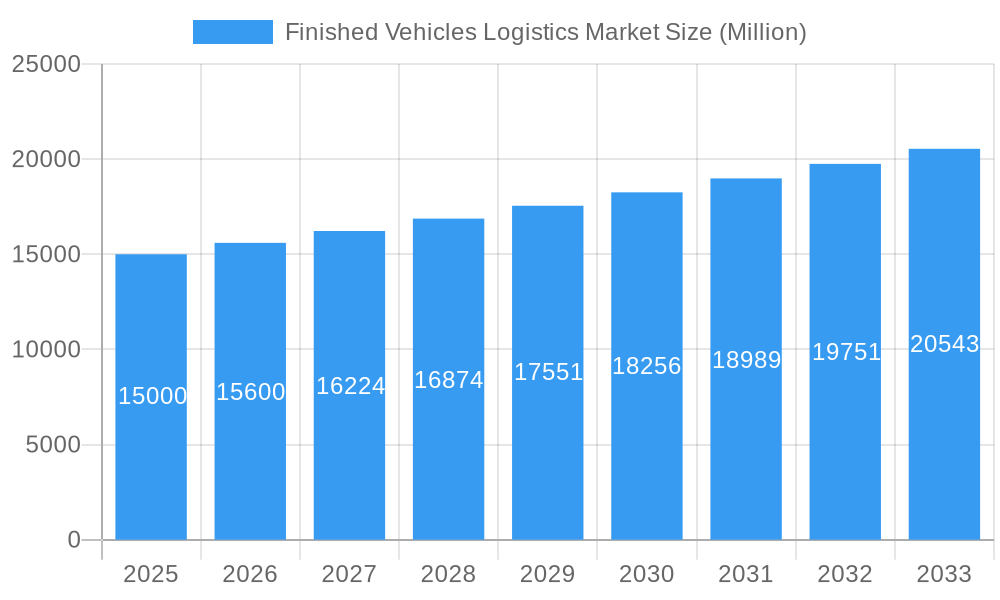

Finished Vehicles Logistics Market Market Size (In Billion)

The competitive arena features a blend of global logistics giants and specialized regional operators. Strategic imperatives for companies include supply chain optimization, technology integration, and enhanced value-added services such as pre-delivery inspections (PDI) and bespoke delivery solutions to secure market advantage. Growing environmental consciousness is also driving the adoption of sustainable logistics practices and investment in fuel-efficient transportation. The expanding electric vehicle (EV) manufacturing sector is set to unlock new market segments requiring specialized handling and transport. Furthermore, the optimization of last-mile delivery solutions will be critical for future market development. Regional infrastructure, regulatory frameworks, and market dynamics will continue to influence growth trajectories across various geographies.

Finished Vehicles Logistics Market Company Market Share

Finished Vehicles Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Finished Vehicles Logistics Market, offering actionable insights for stakeholders across the automotive and logistics industries. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report delves into market dynamics, industry trends, leading segments and players, and key milestones shaping the future of finished vehicle logistics. This report is invaluable for businesses seeking to navigate this dynamic market and capitalize on emerging growth opportunities. The market size is predicted to reach xx Million by 2033.

Finished Vehicles Logistics Market Market Dynamics & Concentration

The Finished Vehicles Logistics Market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the market is witnessing increased competition from smaller, specialized logistics providers focusing on niche segments. Market concentration is influenced by factors such as economies of scale, technological advancements, and strategic mergers and acquisitions (M&A) activities.

Market Concentration Metrics (Estimated):

- Top 5 players market share: 45%

- M&A deal count (2019-2024): 35

Innovation Drivers:

- Automation in warehousing and transportation.

- Development of advanced tracking and monitoring systems.

- Integration of blockchain technology for enhanced security and transparency.

Regulatory Frameworks:

- Stringent environmental regulations impacting transportation modes.

- International trade regulations impacting cross-border shipments.

- Safety and security regulations for vehicle handling and transportation.

Product Substitutes:

- Limited direct substitutes, but alternative transportation modes (e.g., rail vs. road) can impact market share.

End-User Trends:

- Increasing demand for just-in-time delivery models.

- Growing focus on supply chain resilience and risk mitigation.

- Preference for sustainable and environmentally friendly logistics solutions.

M&A Activities: The market has seen a significant number of M&A activities in recent years, driven by the need for expansion, technological integration, and geographic reach. These activities consolidate market share and lead to increased efficiency and service offerings.

Finished Vehicles Logistics Market Industry Trends & Analysis

The Finished Vehicles Logistics Market is experiencing robust growth, driven by the global automotive industry's expansion and evolving supply chain dynamics. Technological advancements are disrupting traditional logistics models, creating opportunities for innovation and efficiency improvements. Consumer preferences are shifting towards faster, more reliable, and sustainable delivery solutions, influencing service offerings and investment in new technologies. The market's competitive landscape is becoming more intense, with players vying for market share through strategic partnerships, investments in technology, and expansion into new geographical areas.

Key Trends:

- Growing adoption of digital technologies: This includes the use of IoT, AI, and big data analytics to optimize logistics operations, improve visibility, and enhance decision-making.

- Rise of e-commerce and its impact on last-mile delivery: The surge in online car sales is demanding more sophisticated and efficient last-mile delivery solutions.

- Increased focus on sustainability: The industry is under pressure to reduce its carbon footprint through the adoption of eco-friendly transportation modes and operational practices.

- Focus on supply chain resilience: Global disruptions have highlighted the need for greater flexibility and adaptability in supply chain management.

Market Growth Metrics (Estimated):

- CAGR (2025-2033): 5%

- Market Penetration of advanced technologies (2025): 20%

Leading Markets & Segments in Finished Vehicles Logistics Market

The Asia-Pacific region stands as the current powerhouse in the finished vehicle logistics market, propelled by its substantial automotive production volumes and a rapidly expanding consumer base eager for new vehicles. Beyond Asia-Pacific, North America and Europe represent substantial and dynamic markets with significant growth potential. Within the market's structure, the "Transport" segment, encompassing a diverse range of modes including rail, road, air, and sea, commands the largest market share. This is closely followed by essential warehousing operations and a growing demand for sophisticated value-added services.

Dominant Region: Asia-Pacific

Key Drivers Propelling Growth in Asia-Pacific:

- High Automotive Production Output: The region's robust manufacturing capabilities are a primary driver, supplying a vast number of vehicles to both domestic and international markets.

- Rapidly Expanding Infrastructure: Significant investments in transportation networks, including ports, highways, and rail lines, are crucial for the efficient movement of finished vehicles.

- Increasing Disposable Income and Car Ownership: A growing middle class with rising disposable incomes directly translates to increased demand for personal mobility and vehicle purchases.

- Supportive Government Policies and Incentives: Governments in the region often implement policies that encourage automotive manufacturing and the development of associated logistics infrastructure.

- Emergence of New Automotive Hubs: The establishment and growth of new automotive manufacturing centers within the Asia-Pacific region further bolster logistics demand.

Segment Dominance Analysis:

- Transport: This segment is the cornerstone of finished vehicle logistics. While road transport remains the most prevalent mode for shorter distances and last-mile delivery, rail transport is experiencing a surge in adoption due to its inherent cost-efficiency and significant environmental benefits, especially for longer hauls. Sea freight continues to be indispensable for the global trade and international distribution of vehicles.

- Warehousing: Essential for managing inventory, staging vehicles for shipment, and facilitating pre-delivery inspections, warehousing solutions are critical for handling the sheer volume of finished vehicles produced and distributed globally. The development of specialized vehicle storage facilities is a key trend.

- Value-added Services: As customer expectations escalate, the demand for services beyond basic transportation is on the rise. This includes critical processes such as detailed vehicle inspection, meticulous preparation for delivery, and bespoke customization options, all of which contribute to enhanced customer satisfaction and brand loyalty.

Finished Vehicles Logistics Market Product Developments

The landscape of finished vehicle logistics is continually being reshaped by innovative product developments focused on elevating efficiency, enhancing transparency across the supply chain, and championing sustainability. A significant trend is the widespread integration of advanced tracking systems, providing real-time visibility into vehicle location and status. Automated handling equipment, from robotic loading systems to intelligent yard management solutions, is streamlining operations within ports and storage facilities. Furthermore, there's a pronounced push towards eco-friendly transportation solutions, including the exploration of electric and alternative fuel vehicles for fleet operations and the optimization of routes to minimize carbon footprints. New applications are increasingly emerging in critical areas such as the optimization of last-mile delivery, leveraging smart routing and predictive analytics, and the sophisticated management of vehicle inventory. These advancements are powered by the strategic application of data analytics and artificial intelligence (AI), enabling logistics providers to gain critical insights, anticipate challenges, and deliver superior service. Ultimately, these developments empower companies to achieve a distinct competitive advantage by improving service quality, significantly reducing operational costs, and fostering greater customer satisfaction.

Key Drivers of Finished Vehicles Logistics Market Growth

The robust growth trajectory of the finished vehicle logistics market is propelled by a confluence of powerful drivers. Technological advancements are at the forefront, with innovations such as AI-powered route optimization algorithms and the nascent integration of autonomous vehicles poised to dramatically enhance operational efficiency and drive down costs. The pervasive economic expansion, particularly in developing nations, is a critical catalyst, fueling a surge in demand for automobiles and consequently necessitating the development of more sophisticated and expansive logistics networks to manage this increased volume. Favorable government regulations and substantial infrastructure investments further solidify this growth. For instance, the strategic establishment of new transportation hubs, advanced logistics parks, and modernized port facilities significantly smooths and optimizes the movement of vehicles throughout their journey. Additionally, the increasing complexity of automotive supply chains, coupled with the growing emphasis on just-in-time delivery and reduced lead times, places a premium on efficient and reliable logistics solutions.

Challenges in the Finished Vehicles Logistics Market Market

The industry faces challenges like fluctuating fuel prices, which directly impact transportation costs. Supply chain disruptions, caused by factors like geopolitical instability or pandemics, can severely impact delivery times and reliability. Intense competition among logistics providers creates pressure on pricing and margins. Regulatory compliance requirements across different regions adds complexity and increases operational costs. For example, compliance with emission standards and driver regulations adds to operational expenses. These factors can collectively impact profitability and require adaptable strategies for mitigation.

Emerging Opportunities in Finished Vehicles Logistics Market

The finished vehicle logistics market is ripe with emerging opportunities, driven by evolving technological capabilities and shifting global economic dynamics. Emerging technologies, such as the implementation of blockchain technology, promise to revolutionize supply chain transparency and security, providing an immutable ledger for vehicle provenance and transaction history. Strategic partnerships between automotive manufacturers and specialized logistics providers are becoming increasingly vital, fostering deeper supply chain integration, enhancing collaboration, and ultimately improving the end-to-end customer service experience. The expansion into new and developing markets, particularly in economies experiencing a significant rise in car ownership and urbanization, presents vast growth potential. This necessitates the exploration and optimization of multimodal transportation strategies, carefully tailored to meet the unique logistical challenges and demands of specific regional markets, thereby maximizing efficiency and cost-effectiveness.

Leading Players in the Finished Vehicles Logistics Market Sector

- CMA CGM S A

- Omsan Logistics

- CargoTel Inc

- MetroGistics LLC

- ARS Altmann

- Pound Gates Vehicle Management Services Ltd

- CEVA Logistics

- Nippon Express Holdings Inc

- XPO Logistics

- Penske Corporation

Key Milestones in Finished Vehicles Logistics Market Industry

- November 2022: Omsan Logistics successfully established a new export-import rail line connecting Turkey and Slovakia in strategic collaboration with METRANS. This pivotal development significantly boosted Turkey's railway export capabilities for finished vehicles.

- April 20, 2022: PODS Enterprises and ACERTUS announced a strategic partnership to offer comprehensive nationwide vehicle shipping services. This collaboration aims to significantly enhance the vehicle moving experience for both residential and business clients across the United States.

- Q4 2021: A leading European automotive manufacturer reported a 15% reduction in transit times for vehicles destined for the UK market through the implementation of a new multimodal rail and ferry solution, highlighting the growing efficiency of integrated logistics networks.

- Early 2023: Several major automotive OEMs are piloting the use of AI-driven demand forecasting tools to optimize their finished vehicle inventory levels and distribution schedules, aiming to reduce holding costs and improve vehicle availability.

Strategic Outlook for Finished Vehicles Logistics Market Market

The Finished Vehicles Logistics Market is poised for continued growth, driven by technological innovations, strategic partnerships, and expanding global automotive production. Companies that prioritize technological adoption, supply chain resilience, and sustainable practices will be best positioned to succeed. Focus on meeting evolving customer expectations, optimizing logistics networks, and investing in new technologies will be crucial for long-term market leadership.

Finished Vehicles Logistics Market Segmentation

-

1. Activity

- 1.1. Transport (Rail, Road, Air, Sea)

- 1.2. Warehouse

- 1.3. Value-added Services

Finished Vehicles Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Bangladesh

- 3.5. Turkey

- 3.6. South Korea

- 3.7. Australia

- 3.8. Indonesia

- 3.9. Rest of Asia Pacific

- 4. Middle East

-

5. Egypt

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Finished Vehicles Logistics Market Regional Market Share

Geographic Coverage of Finished Vehicles Logistics Market

Finished Vehicles Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure Challenges4.; Costs and Investment

- 3.4. Market Trends

- 3.4.1. Increase in Blockchain Technology Adoption in Finished Vehicle Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transport (Rail, Road, Air, Sea)

- 5.1.2. Warehouse

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Egypt

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. North America Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 6.1.1. Transport (Rail, Road, Air, Sea)

- 6.1.2. Warehouse

- 6.1.3. Value-added Services

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 7. Europe Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 7.1.1. Transport (Rail, Road, Air, Sea)

- 7.1.2. Warehouse

- 7.1.3. Value-added Services

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 8. Asia Pacific Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 8.1.1. Transport (Rail, Road, Air, Sea)

- 8.1.2. Warehouse

- 8.1.3. Value-added Services

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 9. Middle East Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 9.1.1. Transport (Rail, Road, Air, Sea)

- 9.1.2. Warehouse

- 9.1.3. Value-added Services

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 10. Egypt Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 10.1.1. Transport (Rail, Road, Air, Sea)

- 10.1.2. Warehouse

- 10.1.3. Value-added Services

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 11. South America Finished Vehicles Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Activity

- 11.1.1. Transport (Rail, Road, Air, Sea)

- 11.1.2. Warehouse

- 11.1.3. Value-added Services

- 11.1. Market Analysis, Insights and Forecast - by Activity

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CMA CGM S A

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Omsan Logistics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 CargoTel Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 MetroGistics LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ARS Altmann

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pound Gates Vehicle Management Services Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CEVA Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nippon Express Holdings Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 XPO Logistics**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Penske Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 CMA CGM S A

List of Figures

- Figure 1: Global Finished Vehicles Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 3: North America Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 4: North America Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 7: Europe Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 8: Europe Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 11: Asia Pacific Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 12: Asia Pacific Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 15: Middle East Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 16: Middle East Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Egypt Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 19: Egypt Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 20: Egypt Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Egypt Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America Finished Vehicles Logistics Market Revenue (billion), by Activity 2025 & 2033

- Figure 23: South America Finished Vehicles Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 24: South America Finished Vehicles Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Finished Vehicles Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 2: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 4: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 9: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 18: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Bangladesh Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Turkey Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 29: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 31: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 36: Global Finished Vehicles Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Finished Vehicles Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finished Vehicles Logistics Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Finished Vehicles Logistics Market?

Key companies in the market include CMA CGM S A, Omsan Logistics, CargoTel Inc, MetroGistics LLC, ARS Altmann, Pound Gates Vehicle Management Services Ltd, CEVA Logistics, Nippon Express Holdings Inc, XPO Logistics**List Not Exhaustive, Penske Corporation.

3. What are the main segments of the Finished Vehicles Logistics Market?

The market segments include Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD 257.52 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth.

6. What are the notable trends driving market growth?

Increase in Blockchain Technology Adoption in Finished Vehicle Logistics.

7. Are there any restraints impacting market growth?

4.; Infrastructure Challenges4.; Costs and Investment.

8. Can you provide examples of recent developments in the market?

November 2022: Omsan Logistics built an export-import line between Turkey and Slovakia in collaboration with the well-known European logistics firm, METRAS. The first freight train leaves from Dunajska Streda Terminal in Slovakia for Istanbul as part of the collaboration. The containers are delivered by train from the METRANS Terminal in Dunajska Streda, Slovakia, as part of the project's goal of increasing Turkey's railway exports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finished Vehicles Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finished Vehicles Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finished Vehicles Logistics Market?

To stay informed about further developments, trends, and reports in the Finished Vehicles Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence