Key Insights

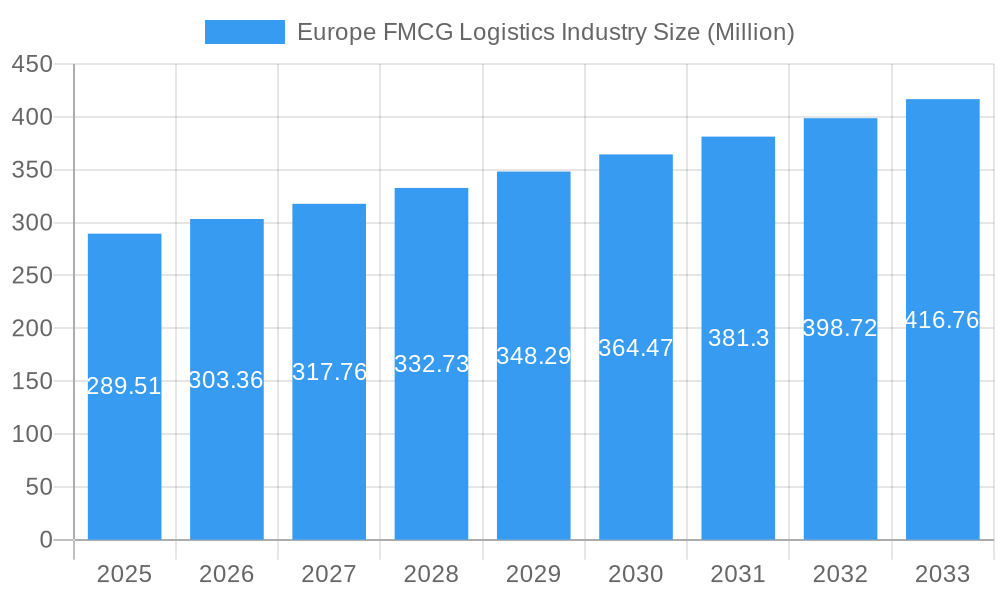

The European FMCG logistics market, valued at €289.51 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.62% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for efficient and reliable supply chains within the fast-moving consumer goods (FMCG) sector, coupled with the rising e-commerce penetration across Europe, is a major catalyst. Consumers are increasingly demanding faster delivery times and greater product variety, pushing logistics providers to innovate and optimize their operations. Furthermore, advancements in technology, such as warehouse automation, route optimization software, and real-time tracking systems, are enhancing efficiency and reducing costs, further bolstering market growth. The growth is also segmented across various services (transportation, warehousing, distribution, inventory management, and value-added services) and product categories (food and beverage, personal care, household care, and other consumables). Germany, the United Kingdom, and France are expected to remain the largest markets within Europe, driven by their robust economies and established FMCG sectors. However, growth opportunities exist across other European nations, particularly as e-commerce continues to expand its reach.

Europe FMCG Logistics Industry Market Size (In Million)

Competitive intensity in the European FMCG logistics market is high, with major players such as DB Schenker, DHL Group, FedEx, and Kuehne + Nagel vying for market share. These companies are investing heavily in infrastructure upgrades, technological advancements, and strategic partnerships to maintain their competitive edge. The market is witnessing a shift towards integrated logistics solutions, with providers offering a comprehensive suite of services to meet the diverse needs of FMCG companies. Sustainability is also emerging as a key consideration, with an increasing focus on environmentally friendly transportation and warehousing practices. This trend is likely to shape future market dynamics, favoring companies that adopt sustainable operational models. The ongoing geopolitical landscape and potential supply chain disruptions will remain crucial factors affecting the market's trajectory.

Europe FMCG Logistics Industry Company Market Share

Europe FMCG Logistics Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Europe FMCG logistics industry, covering market dynamics, key trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including logistics providers, FMCG manufacturers, and investors. Download now to gain a competitive edge.

Europe FMCG Logistics Industry Market Dynamics & Concentration

The European FMCG logistics market, valued at €XX Million in 2024, is characterized by moderate concentration, with several large players holding significant market share. Key innovation drivers include automation, digitalization, and sustainable practices. Stringent regulatory frameworks, including environmental regulations and data privacy laws, significantly influence operational strategies. Product substitutes, such as direct-to-consumer models, pose a growing challenge, while end-user trends like e-commerce and omnichannel fulfillment drive demand for flexible and efficient logistics solutions. Mergers and acquisitions (M&A) are frequent, with an estimated XX M&A deals in the last five years, reshaping the competitive landscape.

- Market Concentration: The top 5 players account for approximately XX% of the market share (2024).

- Innovation Drivers: Automation (robotics, AI), blockchain technology, sustainable packaging and transportation solutions.

- Regulatory Framework: Emphasis on carbon reduction, waste management, and data security compliance.

- M&A Activity: XX major deals in the past 5 years, indicating industry consolidation.

Europe FMCG Logistics Industry Industry Trends & Analysis

The European FMCG logistics market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of **XX%** during the forecast period of 2025-2033. This upward trajectory is underpinned by several significant factors. The relentless expansion of e-commerce continues to be a primary driver, necessitating more sophisticated and agile supply chain operations. Consumers' escalating demand for faster, more reliable, and increasingly personalized delivery experiences is compelling FMCG companies to adopt sophisticated omnichannel strategies. Technological disruptions are fundamentally reshaping the landscape; the integration of the Internet of Things (IoT) for real-time tracking and data collection, coupled with Artificial Intelligence (AI) for predictive analytics and optimized decision-making, is significantly enhancing operational efficiency, end-to-end transparency, and inventory management across supply chains. Furthermore, a growing consumer consciousness regarding sustainability and ethical sourcing is proactively driving the demand for greener logistics solutions, including the adoption of electric vehicles, optimized route planning to reduce carbon emissions, and sustainable packaging initiatives. The competitive intensity among logistics providers necessitates a culture of continuous innovation and strategic partnerships to not only maintain but expand market share. The market penetration of advanced automated warehousing solutions is estimated to reach **XX%** by 2025, signaling a significant shift towards digitalization and efficiency in storage and fulfillment operations.

Leading Markets & Segments in Europe FMCG Logistics Industry

Germany, the United Kingdom, and France collectively represent the most substantial markets within the European FMCG logistics landscape, contributing an estimated **XX%** to the total market value in 2024. The transportation segment currently holds the dominant position within the services sector, closely followed by warehousing and distribution services. Among product categories, food and beverage emerges as the largest segment, largely propelled by consistent high consumer demand and the inherent perishable nature of these goods, which necessitates specialized handling and expedited delivery.

By Country:

- Germany: Characterized by its robust manufacturing base, exceptionally well-developed and integrated infrastructure, and consistently high consumer spending power, Germany remains a pivotal market.

- United Kingdom: Boasts a substantial consumer market, a highly advanced e-commerce infrastructure that facilitates seamless online purchasing, and a pronounced strategic focus on optimizing last-mile delivery networks to meet evolving consumer expectations.

- France: Features significant FMCG production capabilities, a supportive regulatory environment and government policies that foster industry growth, and a rapidly expanding e-commerce sector, driving demand for efficient logistics.

By Service:

- Transportation: The demand for efficient, reliable, and cost-effective road, rail, and air freight solutions continues to be paramount for moving FMCG products across Europe.

- Warehousing: Growth in this segment is strongly driven by the increasing need for flexible, scalable, and technologically advanced storage capacity to accommodate fluctuating inventory levels and support omni-channel fulfillment.

By Product Category:

- Food and Beverage: This segment remains dominant due to the inherently high volume of goods and their critical need for temperature-controlled environments and rapid transit to minimize spoilage.

- Personal Care: Exhibits increasing demand for customized and personalized delivery options, including scheduled deliveries and specialized handling, reflecting evolving consumer preferences for convenience and tailored services.

Europe FMCG Logistics Industry Product Developments

Recent product and service innovations within the Europe FMCG logistics industry are primarily focused on significantly enhancing supply chain visibility through real-time tracking and data analytics, optimizing delivery routes for maximum efficiency and minimal environmental impact, and revolutionizing last-mile delivery to meet ever-increasing customer expectations. The seamless integration of cutting-edge technologies, such as IoT sensors for granular product monitoring, AI-powered route optimization software for dynamic adjustments, and sophisticated automated warehousing systems for streamlined operations, provides substantial competitive advantages. These advanced solutions are meticulously tailored to address the specific and often urgent needs of FMCG companies, prioritizing speed, cost-effectiveness, and a strong commitment to sustainability throughout the entire logistics process.

Key Drivers of Europe FMCG Logistics Industry Growth

The sustained and robust growth of the European FMCG logistics industry is propelled by several interconnected key factors. The exponential expansion of e-commerce continues to be a primary catalyst, creating an escalating need for highly efficient and agile last-mile delivery solutions. Simultaneously, the intensifying consumer demand for faster delivery times and an elevated overall customer experience further fuels market expansion. Proactive government initiatives aimed at promoting sustainable logistics practices and fostering the adoption of green technologies play a crucial role. Moreover, continuous technological advancements, particularly in automation and digitalization, are instrumental in driving efficiency, reducing costs, and enhancing the overall service offering across the supply chain.

Challenges in the Europe FMCG Logistics Industry Market

The industry faces challenges like rising fuel costs, driver shortages, and increasing regulatory compliance requirements. Fluctuations in demand and supply chain disruptions due to geopolitical events or pandemics pose considerable risks. Intense competition among logistics providers requires continuous innovation and cost optimization. These factors can impact profitability and market share. The estimated impact of supply chain disruptions on revenue in 2024 was a reduction of XX Million Euros.

Emerging Opportunities in Europe FMCG Logistics Industry

The European FMCG logistics market presents promising opportunities. The growing adoption of sustainable logistics practices, the expansion of e-commerce, and the increasing demand for omnichannel fulfillment services create significant growth potential. Strategic partnerships and technological breakthroughs in automation and AI offer lucrative prospects for businesses seeking to improve efficiency, reduce costs, and enhance customer satisfaction. Expansion into new markets and diversification of services can also unlock significant growth opportunities.

Leading Players in the Europe FMCG Logistics Industry Sector

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc

- XPO Logistics

- Kuehne + Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

Key Milestones in Europe FMCG Logistics Industry Industry

- January 2023: CEVA Logistics created a dedicated Finished Vehicle Logistics (FVL) organization following its acquisition of GEFCO, significantly expanding its automotive logistics capabilities and establishing itself as a leading player in France.

- March 2022: DHL Parcel UK partnered with ZigZag, improving its e-commerce returns service, enhancing customer experience and boosting operational efficiency through streamlined returns management.

Strategic Outlook for Europe FMCG Logistics Industry Market

The European FMCG logistics market is strategically positioned for sustained and significant growth in the coming years. This optimistic outlook is underpinned by the ongoing expansion of e-commerce, continuous technological advancements, and the growing imperative for sustainable and highly efficient supply chain operations. Companies that proactively embrace innovation, make strategic investments in cutting-edge technologies, and prioritize building robust, customer-centric relationships will be best equipped to capitalize on the substantial opportunities presented by this dynamic and evolving market. The future development of integrated, end-to-end logistics platforms and the sophisticated implementation of advanced data analytics will further enhance competitive positioning and act as key drivers of future market expansion and profitability.

Europe FMCG Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

Europe FMCG Logistics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe FMCG Logistics Industry Regional Market Share

Geographic Coverage of Europe FMCG Logistics Industry

Europe FMCG Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. E-commerce Sales to Rise at a High Pace in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe FMCG Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 APL Logistics**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 C H Robinson Worldwide Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 XPO Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel International AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agility Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hellmann Worlwide Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe FMCG Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe FMCG Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe FMCG Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Europe FMCG Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: Europe FMCG Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe FMCG Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Europe FMCG Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 6: Europe FMCG Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe FMCG Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe FMCG Logistics Industry?

The projected CAGR is approximately 4.62%.

2. Which companies are prominent players in the Europe FMCG Logistics Industry?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, Hellmann Worlwide Logistics.

3. What are the main segments of the Europe FMCG Logistics Industry?

The market segments include Service, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 289.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

E-commerce Sales to Rise at a High Pace in Europe.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

January 2023: CEVA Logistics announced the creation of a dedicated Finished Vehicle Logistics (FVL) organization as part of its integration with GEFCO. The move comes following the purchase of the French automotive logistics specialist in July 2022 by the CMA CGM Group. CEVA Logistics offers a full range of global logistics and supply chain services, including contract logistics and air, ocean, ground, and finished vehicle transport. With the GEFCO acquisition and integration, CEVA is now the largest France-based logistics company and a global leader in automotive logistics solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe FMCG Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe FMCG Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe FMCG Logistics Industry?

To stay informed about further developments, trends, and reports in the Europe FMCG Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence