Key Insights

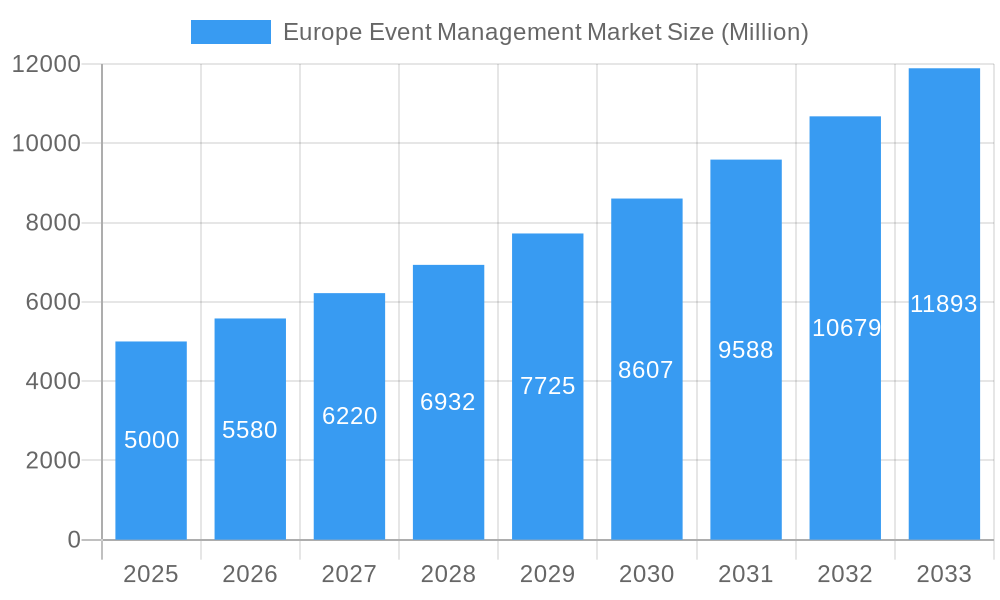

The European event management market is poised for significant expansion, driven by a robust Compound Annual Growth Rate (CAGR) of 7.1%. The market size is projected to reach 2502.1 million by 2025. Growth is fueled by the increasing demand for corporate events, conferences, and festivals, supported by economic recovery and a rebound in business travel. Technological advancements, including virtual and hybrid event platforms, are enhancing accessibility and engagement. Key trends such as sustainable practices, data-driven planning, and personalized attendee experiences are shaping the industry's future. Economic uncertainties and potential disruptions represent market restraints. The market is segmented by event type, size, and services offered. Leading players are actively pursuing market share through strategic initiatives.

Europe Event Management Market Market Size (In Billion)

The future of the European event management market depends on navigating challenges and leveraging emerging opportunities. Continuous innovation, strategic alliances, and a focus on exceptional customer experiences will be vital. The market's growth is expected to remain strong through 2033, with a diverse range of events catering to specific niches. Adaptability to evolving consumer preferences and technological advancements will be critical for market leadership. While precise segmentation and regional data are not available, market size and distribution can be estimated through industry analysis.

Europe Event Management Market Company Market Share

Europe Event Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Event Management Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. Unlock actionable intelligence to navigate the complexities of this dynamic sector.

Europe Event Management Market Dynamics & Concentration

The Europe Event Management Market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape. Market share is primarily held by a mix of established players and emerging niche specialists. Innovation in event technology, including virtual and hybrid event platforms, is a major driver, alongside evolving regulatory frameworks impacting event permits and safety standards. Product substitutes, such as virtual conferences and webinars, exert competitive pressure, while end-user trends lean towards experiential and personalized events. The market has witnessed xx M&A deals in the historical period (2019-2024), reflecting consolidation and strategic expansion efforts.

- Market Concentration: The top 5 players hold an estimated xx% market share.

- Innovation Drivers: Virtual event technology, sustainable event practices, personalized event experiences.

- Regulatory Frameworks: Vary across European nations, impacting event licensing and safety regulations.

- Product Substitutes: Virtual conferences, webinars, online engagement platforms.

- End-User Trends: Demand for experiential events, personalized engagement, and data-driven event ROI.

- M&A Activity: xx deals between 2019 and 2024, indicating consolidation and strategic expansion.

Europe Event Management Market Industry Trends & Analysis

The Europe Event Management Market exhibits a projected CAGR of xx% during the forecast period (2025-2033). Growth is fueled by increasing corporate spending on events for marketing, training, and team building, coupled with a resurgence in in-person events post-pandemic. Technological disruptions, such as AI-powered event planning tools and immersive VR/AR experiences, are reshaping the market. Consumer preferences are shifting toward sustainable and ethical event practices, while competitive dynamics are characterized by innovation, service differentiation, and strategic partnerships. Market penetration of hybrid event formats is expected to reach xx% by 2033.

Leading Markets & Segments in Europe Event Management Market

The UK currently holds the largest market share within Europe, driven by a robust economy, well-developed infrastructure, and a thriving business events sector. Germany and France follow as significant markets, influenced by factors including strong tourism sectors and a high concentration of multinational corporations. Key growth drivers include:

- UK: Strong economy, developed infrastructure, high corporate event spending.

- Germany: Large industrial base, robust business travel sector, numerous trade shows.

- France: Significant tourism industry, strong presence of international organizations.

Other significant segments include corporate events, conferences, festivals, and exhibitions, each exhibiting unique growth trajectories and competitive landscapes.

Europe Event Management Market Product Developments

Recent product innovations are revolutionizing the Europe Event Management market by prioritizing attendee engagement, data-driven decision-making, and environmental stewardship. Interactive technologies, such as gamification platforms and augmented reality experiences, are becoming integral to creating memorable and engaging events. Advanced data analytics are empowering organizers to measure and optimize event ROI with unprecedented precision, allowing for personalized attendee journeys and targeted marketing efforts. Furthermore, a strong emphasis is being placed on sustainable event solutions, with innovations in waste reduction, carbon footprint management, and ethical sourcing gaining traction. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is streamlining event planning processes, from venue selection and budgeting to personalized content delivery and real-time attendee support. These advancements are directly addressing the market's growing demand for efficient, captivating, and environmentally responsible event experiences.

Key Drivers of Europe Event Management Market Growth

The Europe Event Management Market is experiencing robust growth fueled by a confluence of powerful economic and societal factors. Rising disposable incomes across the continent are directly contributing to an increased demand for both leisure and corporate events. Businesses are recognizing the invaluable role of events in brand building, client relations, and employee engagement, leading to a significant uptick in corporate event spending. Technological advancements continue to play a pivotal role, not only enhancing the operational efficiency of event management but also elevating the attendee experience through innovative digital tools and platforms. Supportive government policies, particularly those aimed at bolstering the tourism and events sectors, are creating a more favorable operating environment. The post-pandemic recovery has also ignited a resurgence in the desire for in-person networking and collaborative experiences, serving as a significant catalyst for market expansion.

Challenges in the Europe Event Management Market

Challenges include economic uncertainties impacting event budgets, rising operational costs (venue rental, staffing, technology), and intense competition among event management companies. Furthermore, potential regulatory changes and supply chain disruptions present ongoing obstacles. These factors are estimated to have reduced market growth by xx% in 2022.

Emerging Opportunities in Europe Event Management Market

The landscape of the Europe Event Management Market is ripe with emerging opportunities, particularly in adapting to evolving event formats and catering to specialized audience needs. The widespread adoption of virtual and hybrid event solutions, accelerated by recent global events, continues to present innovative ways to reach wider audiences and offer flexible participation options. The growth of niche event segments is particularly noteworthy; this includes a surge in demand for sustainability-focused events, highly personalized experiential marketing activations, and specialized industry-specific gatherings. Strategic partnerships between agile event management companies and cutting-edge technology providers are opening doors to integrated solutions and enhanced service offerings. Furthermore, exploring and expanding into less saturated event sectors within emerging European markets offers substantial untapped potential for growth and market penetration.

Leading Players in the Europe Event Management Market Sector

- Forum Europe

- Smartworks Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- List Not Exhaustive

Key Milestones in Europe Event Management Market Industry

- May 2022: Forum Europe's successful hosting of events focused on the EU-US Trade and Technology Dialogue, in collaboration with esteemed institutions like CEPS, EUI, IAI, and The Providence Group, underscores the growing significance of high-level policy discussions and international cooperation within the event management domain.

- October 2021: The strategic partnership between Smart Events and HQ for fundraising initiatives demonstrates the sector's increasing commitment to and involvement in meaningful social impact and charitable causes, showcasing a broader societal role for event organizers.

Strategic Outlook for Europe Event Management Market Market

The Europe Event Management Market presents significant long-term growth potential driven by technological innovation, evolving consumer preferences, and a recovering economy. Strategic opportunities exist in developing innovative event formats, leveraging data analytics for improved ROI, and focusing on sustainable and ethical event practices. Expanding into emerging markets and forging strategic partnerships will be crucial for success in this dynamic sector.

Europe Event Management Market Segmentation

-

1. Type

- 1.1. Corporate Events

- 1.2. Association Events

- 1.3. Non-Profit Events

-

2. Application

- 2.1. Individual User

- 2.2. Corporate Organization

- 2.3. Public Organization

- 2.4. Others

Europe Event Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Event Management Market Regional Market Share

Geographic Coverage of Europe Event Management Market

Europe Event Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in Disposable Income Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Event Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Events

- 5.1.2. Association Events

- 5.1.3. Non-Profit Events

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Individual User

- 5.2.2. Corporate Organization

- 5.2.3. Public Organization

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Forum Europe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smartworks Events

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Absolute Event Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DFA Productions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eclipse Leisure

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Felix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hughes Productions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Irwin Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JP Events Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Off Limits

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Owl Live**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Forum Europe

List of Figures

- Figure 1: Europe Event Management Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Event Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Event Management Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Event Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Event Management Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Europe Event Management Market?

Key companies in the market include Forum Europe, Smartworks Events, Absolute Event Services, DFA Productions, Eclipse Leisure, Felix, Hughes Productions, Irwin Video, JP Events Ltd, Off Limits, Owl Live**List Not Exhaustive.

3. What are the main segments of the Europe Event Management Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2502.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in Disposable Income Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 2022, In coordination with CEPS, the European University Institute (EUI), the Istituto Affari Internazionali (IAI), and The Providence Group, Forum Europe will host several events on the EU-US Trade and Technology Dialogue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Event Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Event Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Event Management Market?

To stay informed about further developments, trends, and reports in the Europe Event Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence