Key Insights

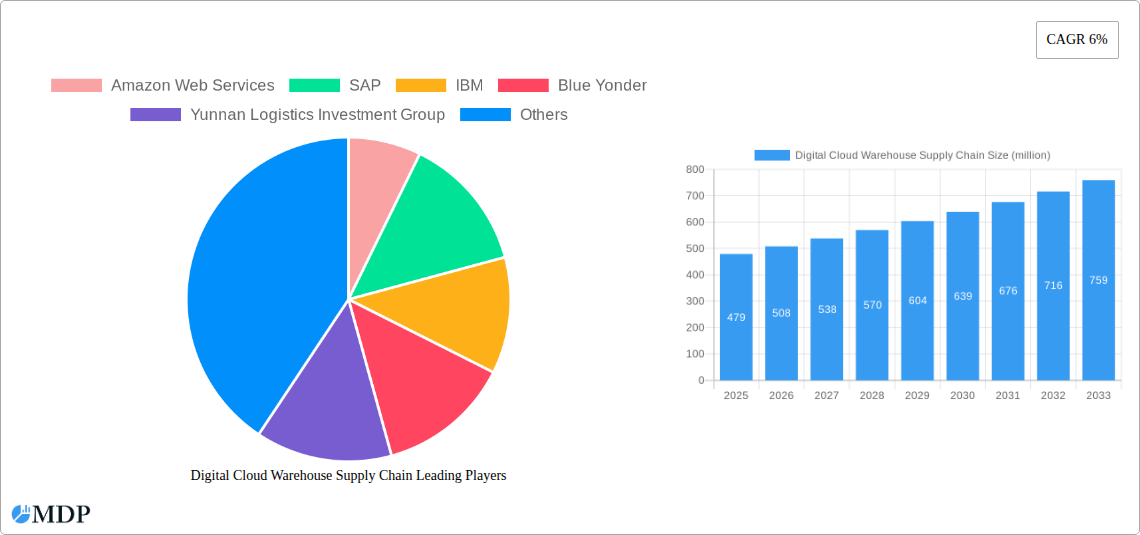

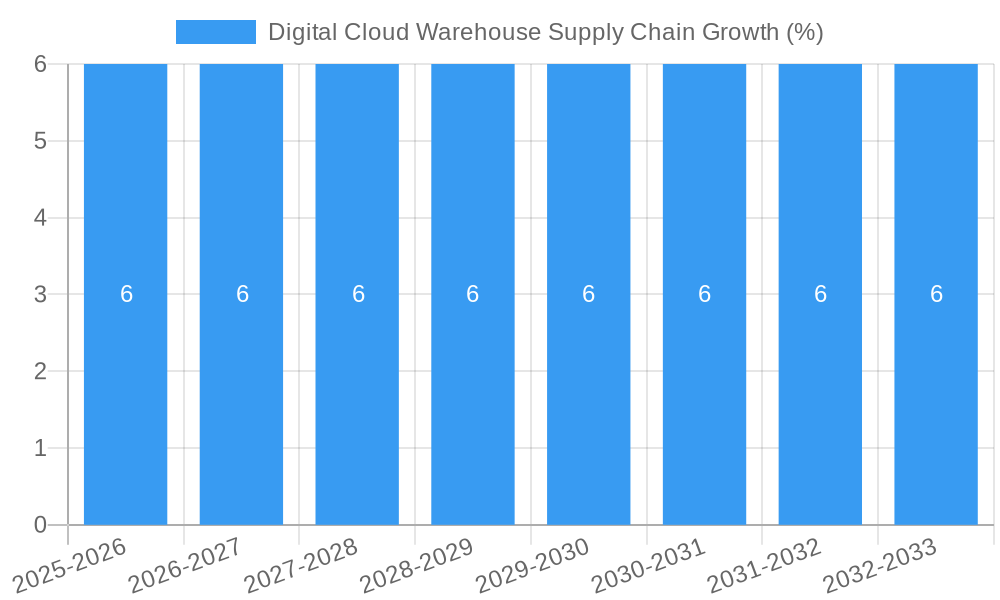

The Digital Cloud Warehouse Supply Chain market is poised for substantial growth, projected to reach $479 million by 2025 with a Compound Annual Growth Rate (CAGR) of 6% over the forecast period (2025-2033). This expansion is primarily fueled by the increasing adoption of cloud-based solutions across various industries seeking greater efficiency, scalability, and cost-effectiveness in their supply chain operations. The surge in e-commerce, leading to an exponential rise in order volumes and complexity, is a critical driver. Businesses are increasingly relying on digital cloud warehouses to manage inventory, optimize logistics, and provide real-time visibility throughout the supply chain. Furthermore, the growing demand for advanced supply chain technologies, such as AI-powered analytics and automation within cloud warehouses, is augmenting market growth. The logistics sector, in particular, is a significant beneficiary, with shared cloud warehousing models gaining traction for their flexibility and reduced operational overheads. Consumer goods and agriculture sectors are also recognizing the transformative potential of digital cloud warehouses in streamlining distribution and reducing post-harvest losses.

The market landscape is characterized by a dynamic interplay of established technology giants and specialized logistics providers. Key players like Amazon Web Services, SAP, and IBM are leveraging their extensive cloud infrastructure and software solutions to offer comprehensive digital warehousing services. Simultaneously, dedicated players such as JD Logistics, Cainiao Network, and Flexe are innovating with tailored cloud warehousing solutions for e-commerce and third-party logistics (3PL) providers. The market is segmented by platform ownership, including e-commerce platforms with their own cloud warehouses, logistics shared cloud warehouses, and internet third-party shared warehousing cloud warehouses, each catering to different business needs and scales. Despite the robust growth trajectory, the market faces certain restraints, including the initial investment costs for cloud integration, data security and privacy concerns, and the need for skilled personnel to manage complex digital supply chains. However, the overarching benefits of enhanced agility, improved inventory management, and optimized delivery times are expected to outweigh these challenges, driving sustained market expansion.

Digital Cloud Warehouse Supply Chain Market Report: Unleashing the Future of Logistics

This comprehensive report provides an in-depth analysis of the Digital Cloud Warehouse Supply Chain market, offering critical insights for industry stakeholders. Spanning the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this research covers the Historical Period: 2019–2024 to deliver a holistic market view. We delve into the transformative impact of cloud warehousing solutions on modern supply chains, examining market dynamics, technological advancements, and strategic opportunities. With projected market values reaching into the millions, this report is an indispensable guide to navigating the evolving landscape of digital logistics.

Digital Cloud Warehouse Supply Chain Market Dynamics & Concentration

The Digital Cloud Warehouse Supply Chain market exhibits a dynamic yet consolidating structure, driven by intense innovation and strategic M&A activity. Major players like Amazon Web Services, SAP, and IBM are at the forefront, leveraging their extensive cloud infrastructure and software expertise. The market concentration is moderately high, with a few dominant entities holding significant market share, estimated at over 60% combined. Innovation drivers include the escalating demand for real-time inventory visibility, predictive analytics for demand forecasting, and the integration of AI and IoT for enhanced operational efficiency. Regulatory frameworks, while evolving, are largely supportive of digital transformation, encouraging data standardization and interoperability. Product substitutes, such as traditional on-premise warehouse management systems, are gradually being phased out due to their inflexibility and higher operational costs. End-user trends are strongly skewed towards agility, cost optimization, and enhanced customer experience, leading to a rapid adoption of cloud-based solutions. M&A activities are a significant force shaping the market, with an estimated 25 deals in the historical period and projected to reach over 40 in the forecast period, as companies seek to acquire complementary technologies and expand their market reach.

- Market Concentration: Moderately high, with top 5 players estimated to hold over 60% of the market share.

- Innovation Drivers: Real-time inventory visibility, AI-powered demand forecasting, IoT integration.

- M&A Activities: Estimated 25 deals in the historical period, projected 40+ in the forecast period.

Digital Cloud Warehouse Supply Chain Industry Trends & Analysis

The Digital Cloud Warehouse Supply Chain industry is on an accelerated growth trajectory, driven by a confluence of technological advancements, evolving consumer preferences, and the relentless pursuit of operational excellence. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period, with its market penetration reaching an estimated 75% of the total warehousing solutions market by 2033. Key market growth drivers include the increasing complexity of global supply chains, the demand for greater transparency and traceability, and the imperative for businesses to reduce operational costs and enhance agility. Technological disruptions are at the core of this transformation, with Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain revolutionizing warehouse management. AI and ML are enabling predictive maintenance, optimized picking routes, and intelligent inventory allocation, significantly improving efficiency. IoT sensors provide real-time data on asset location, environmental conditions, and operational status, fostering a truly connected warehouse environment. Blockchain technology is enhancing supply chain security and trust through immutable record-keeping. Consumer preferences are increasingly dictating the pace of change, with a growing expectation for faster, more reliable deliveries, which in turn necessitates sophisticated and agile cloud-based warehousing solutions. This has led to a surge in e-commerce, further amplifying the need for scalable and efficient digital warehousing. Competitive dynamics are fierce, with established technology giants and agile startups alike vying for market share. Companies are investing heavily in R&D to develop innovative solutions that offer superior analytics, automation, and integration capabilities. The shift from traditional, on-premise warehouse management systems (WMS) to cloud-based solutions is a dominant trend, driven by the scalability, flexibility, and cost-effectiveness offered by the cloud. The increasing adoption of shared warehousing models, facilitated by cloud platforms, is another significant trend, allowing businesses to optimize space utilization and reduce capital expenditure. The integration of digital cloud warehouses with other supply chain components, such as transportation management systems (TMS) and enterprise resource planning (ERP) systems, is crucial for creating a seamless and end-to-end supply chain visibility. The report projects the global Digital Cloud Warehouse Supply Chain market to reach a valuation of over $500 million by 2025, with significant growth anticipated in emerging markets.

Leading Markets & Segments in Digital Cloud Warehouse Supply Chain

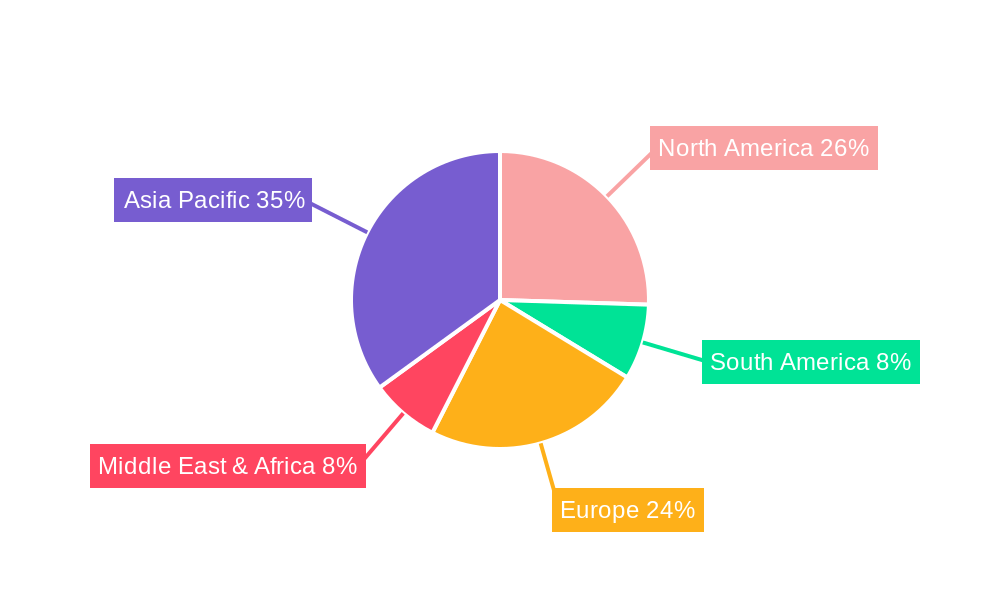

The Digital Cloud Warehouse Supply Chain market is experiencing robust growth across various regions and segments, with a notable dominance of certain applications and warehousing types. Geographically, North America and Europe are currently leading markets, driven by advanced technological infrastructure and high adoption rates of digital solutions. However, the Asia-Pacific region, particularly China, is rapidly emerging as a significant growth engine, fueled by the massive scale of its e-commerce and logistics industries, with companies like Yunnan Logistics Investment Group, Zhongtong, Cainiao Network, and JD Logistics playing pivotal roles.

Within the Application segment, Logistics is the largest and fastest-growing sector, accounting for an estimated 55% of the market share. This dominance is attributed to the inherent need for efficient inventory management, order fulfillment, and last-mile delivery in the logistics industry. The Consumer Goods segment follows, with an estimated 30% market share, driven by the increasing demand for fast and reliable delivery of retail products. The Agriculture segment, while smaller, is showing promising growth, with an estimated 15% market share, as digital warehousing solutions are increasingly being adopted for the storage and distribution of agricultural produce, ensuring quality and minimizing spoilage.

In terms of Type, E-Commerce Platform Owns Cloud Warehouse is a dominant category, holding an estimated 40% of the market share. E-commerce giants are investing heavily in proprietary cloud warehouses to control their entire fulfillment process, ensuring speed and customer satisfaction. Logistics Shared Cloud Warehouse is another significant segment, accounting for approximately 35% of the market. This model offers flexibility and cost-efficiency for businesses of all sizes. Internet Third-Party Shared Warehousing Cloud Warehouse represents the remaining 25%, providing specialized warehousing services through digital platforms.

- Dominant Regions: North America, Europe, and rapidly emerging Asia-Pacific (especially China).

- Leading Application Segments:

- Logistics (55% market share): Driven by demand for efficient inventory, fulfillment, and delivery.

- Consumer Goods (30% market share): Fueled by fast and reliable delivery expectations.

- Agriculture (15% market share): Growing adoption for produce storage and distribution.

- Leading Warehousing Types:

- E-Commerce Platform Owns Cloud Warehouse (40% market share): For end-to-end control over fulfillment.

- Logistics Shared Cloud Warehouse (35% market share): Offering flexibility and cost-efficiency.

- Internet Third-Party Shared Warehousing Cloud Warehouse (25% market share): Specialized digital warehousing services.

Digital Cloud Warehouse Supply Chain Product Developments

Product developments in the Digital Cloud Warehouse Supply Chain sector are heavily focused on enhancing automation, intelligence, and interoperability. Companies are launching advanced Warehouse Management Systems (WMS) with AI-powered capabilities for predictive analytics, optimized slotting, and automated task management. Innovations in robotics and automated guided vehicles (AGVs) are integrating seamlessly with cloud platforms to streamline picking, packing, and moving operations. Furthermore, the development of IoT-enabled sensors is providing real-time visibility into inventory levels, environmental conditions, and equipment health. Blockchain integration is enhancing supply chain transparency and security. These developments aim to reduce labor costs, minimize errors, improve throughput, and provide end-to-end visibility, offering significant competitive advantages in a rapidly evolving market.

Key Drivers of Digital Cloud Warehouse Supply Chain Growth

The growth of the Digital Cloud Warehouse Supply Chain market is propelled by several key factors. Technological Advancements in AI, ML, IoT, and automation are creating more efficient and intelligent warehousing solutions. The Explosion of E-Commerce necessitates scalable and agile fulfillment capabilities. Globalization and Complex Supply Chains demand greater visibility and control. Cost Optimization Pressures drive businesses towards the flexibility and efficiency of cloud-based models. Finally, Increasing Customer Expectations for faster and more reliable deliveries are pushing for digital transformation in warehousing.

Challenges in the Digital Cloud Warehouse Supply Chain Market

Despite the rapid growth, the Digital Cloud Warehouse Supply Chain market faces several challenges. High initial investment costs for implementing new cloud infrastructure and integrating with existing systems can be a barrier for some businesses. Cybersecurity threats and data privacy concerns are paramount, requiring robust security measures. The shortage of skilled labor to manage and operate advanced digital warehouse technologies poses a significant challenge. Interoperability issues between different systems and platforms can hinder seamless integration. Furthermore, resistance to change within established organizations can slow down adoption rates.

Emerging Opportunities in Digital Cloud Warehouse Supply Chain

Emerging opportunities in the Digital Cloud Warehouse Supply Chain market are abundant. The expansion of Industry 4.0 principles into warehousing, emphasizing connectivity and data-driven decision-making, presents significant potential. The development of autonomous mobile robots (AMRs) and advanced automation technologies will further revolutionize warehouse operations. Strategic partnerships between technology providers, logistics companies, and e-commerce platforms will unlock new service models and market reach. The growing demand for sustainable warehousing solutions, incorporating energy efficiency and waste reduction, is another promising avenue. Furthermore, the application of digital cloud warehousing in emerging industries like pharmaceuticals and temperature-sensitive goods offers significant growth prospects.

Leading Players in the Digital Cloud Warehouse Supply Chain Sector

- Amazon Web Services

- SAP

- IBM

- Blue Yonder

- Yunnan Logistics Investment Group

- Zhongtong

- Cainiao Network

- JD Logistics

- Flexe

- SF Express

- EDA

Key Milestones in Digital Cloud Warehouse Supply Chain Industry

- 2019: Increased adoption of AI-powered WMS solutions for predictive analytics.

- 2020: Surge in demand for cloud warehousing due to e-commerce boom during the pandemic.

- 2021: Major cloud providers launch specialized logistics and supply chain solutions.

- 2022: Significant investments in robotics and automation within digital warehouses.

- 2023: Growing emphasis on sustainability in cloud warehouse design and operations.

- 2024: Increased integration of blockchain for enhanced supply chain transparency.

Strategic Outlook for Digital Cloud Warehouse Supply Chain Market

The strategic outlook for the Digital Cloud Warehouse Supply Chain market is overwhelmingly positive, with a sustained period of innovation and expansion anticipated. Growth accelerators will include the continued maturation of AI and ML capabilities for hyper-personalized logistics, the widespread adoption of IoT for real-time, end-to-end supply chain visibility, and the increasing integration of advanced robotics for highly automated operations. Strategic partnerships and ecosystem development will be crucial for unlocking new business models and market segments. The market will also witness a greater focus on data analytics for predictive insights and proactive risk management. Companies that prioritize agility, scalability, and sustainability in their cloud warehouse strategies will be best positioned to capitalize on the immense future potential of this transformative sector.

Digital Cloud Warehouse Supply Chain Segmentation

-

1. Application

- 1.1. Agriculture

- 1.2. Logistics

- 1.3. Consumer Goods

-

2. Type

- 2.1. E-Commerce Platform Owns Cloud Warehouse

- 2.2. Logistics Shared Cloud Warehouse

- 2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

Digital Cloud Warehouse Supply Chain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Cloud Warehouse Supply Chain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Agriculture

- 5.1.2. Logistics

- 5.1.3. Consumer Goods

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-Commerce Platform Owns Cloud Warehouse

- 5.2.2. Logistics Shared Cloud Warehouse

- 5.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Agriculture

- 6.1.2. Logistics

- 6.1.3. Consumer Goods

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. E-Commerce Platform Owns Cloud Warehouse

- 6.2.2. Logistics Shared Cloud Warehouse

- 6.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Agriculture

- 7.1.2. Logistics

- 7.1.3. Consumer Goods

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. E-Commerce Platform Owns Cloud Warehouse

- 7.2.2. Logistics Shared Cloud Warehouse

- 7.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Agriculture

- 8.1.2. Logistics

- 8.1.3. Consumer Goods

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. E-Commerce Platform Owns Cloud Warehouse

- 8.2.2. Logistics Shared Cloud Warehouse

- 8.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Agriculture

- 9.1.2. Logistics

- 9.1.3. Consumer Goods

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. E-Commerce Platform Owns Cloud Warehouse

- 9.2.2. Logistics Shared Cloud Warehouse

- 9.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Cloud Warehouse Supply Chain Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Agriculture

- 10.1.2. Logistics

- 10.1.3. Consumer Goods

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. E-Commerce Platform Owns Cloud Warehouse

- 10.2.2. Logistics Shared Cloud Warehouse

- 10.2.3. Internet Third-Party Shared Warehousing Cloud Warehouse

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon Web Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SAP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blue Yonder

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yunnan Logistics Investment Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zhongtong

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cainiao Network

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JD Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Flexe

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SF Express

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EDA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Amazon Web Services

List of Figures

- Figure 1: Global Digital Cloud Warehouse Supply Chain Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Cloud Warehouse Supply Chain Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Cloud Warehouse Supply Chain Revenue (million), by Type 2024 & 2032

- Figure 5: North America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Digital Cloud Warehouse Supply Chain Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Cloud Warehouse Supply Chain Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Cloud Warehouse Supply Chain Revenue (million), by Type 2024 & 2032

- Figure 11: South America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Digital Cloud Warehouse Supply Chain Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Cloud Warehouse Supply Chain Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Cloud Warehouse Supply Chain Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Cloud Warehouse Supply Chain Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Cloud Warehouse Supply Chain Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Digital Cloud Warehouse Supply Chain Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Digital Cloud Warehouse Supply Chain Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Cloud Warehouse Supply Chain Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Cloud Warehouse Supply Chain Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Digital Cloud Warehouse Supply Chain Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Cloud Warehouse Supply Chain Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Cloud Warehouse Supply Chain?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Digital Cloud Warehouse Supply Chain?

Key companies in the market include Amazon Web Services, SAP, IBM, Blue Yonder, Yunnan Logistics Investment Group, Zhongtong, Cainiao Network, JD Logistics, Flexe, SF Express, EDA.

3. What are the main segments of the Digital Cloud Warehouse Supply Chain?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 479 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Cloud Warehouse Supply Chain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Cloud Warehouse Supply Chain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Cloud Warehouse Supply Chain?

To stay informed about further developments, trends, and reports in the Digital Cloud Warehouse Supply Chain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence