Key Insights

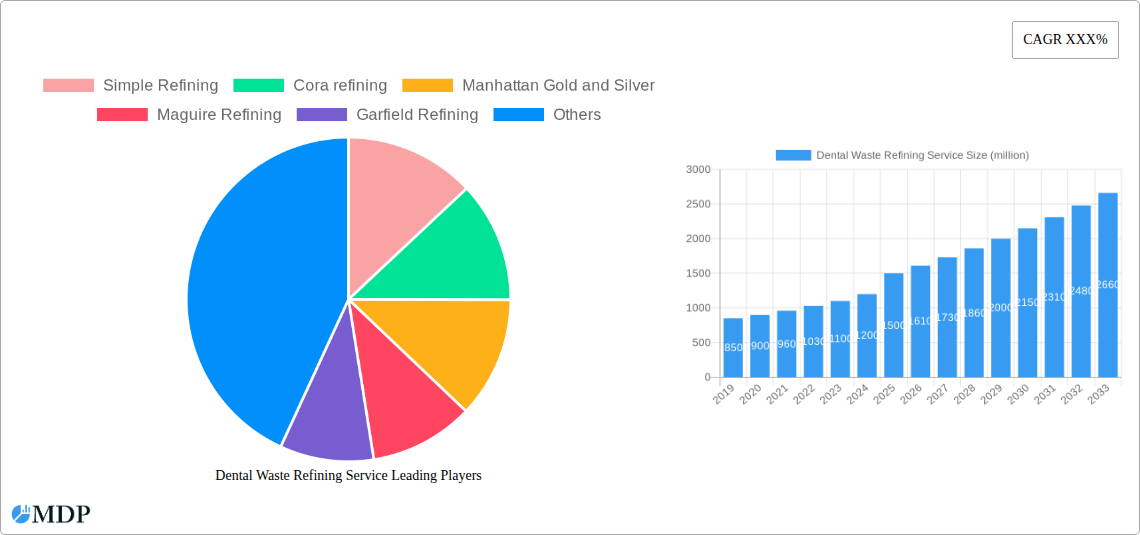

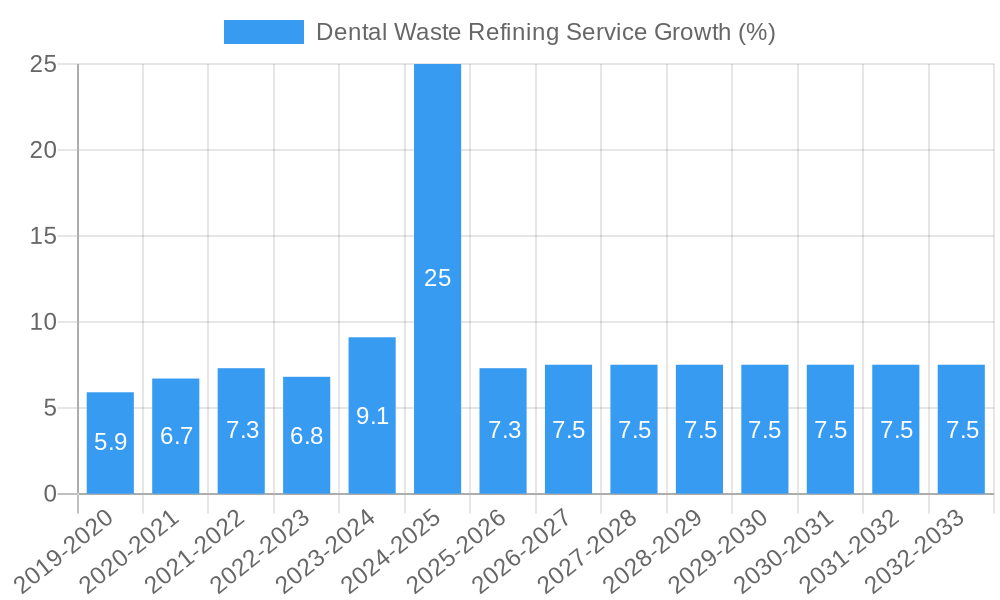

The global Dental Waste Refining Service market is experiencing robust growth, projected to reach approximately $1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% expected throughout the forecast period of 2025-2033. This expansion is primarily fueled by the increasing volume of dental procedures worldwide, which in turn generates a significant amount of precious metal-containing waste, such as gold, platinum, and palladium, from dental restorations like crowns, inlays, and bridges. Growing environmental awareness and stricter regulations regarding the disposal of hazardous and valuable materials are also significant drivers, compelling dental practices and laboratories to seek professional refining services. Furthermore, the rising cost of precious metals globally incentivizes the recovery of these materials from dental scrap, making refining a financially attractive option for dental facilities. The market is segmented by application into Dental Hospitals, Dental Clinics, and Dental Laboratories, with Dental Clinics and Laboratories being the dominant contributors due to their higher volume of restorative procedures and direct handling of dental prosthetics.

The market's trajectory is further shaped by several key trends. Technological advancements in refining processes are leading to higher recovery rates and improved efficiency, attracting more service providers and customers. The emergence of specialized companies offering comprehensive dental waste management solutions, including collection, transportation, and refining, is streamlining the process for end-users. While the market demonstrates strong growth potential, certain restraints exist. Fluctuations in the global prices of precious metals can impact the profitability of refining operations and the perceived value for dental practices. Additionally, the initial investment required for sophisticated refining equipment can be a barrier for smaller entities looking to establish their own refining capabilities, thus favoring specialized third-party services. The competitive landscape features a mix of established players and emerging companies, all vying for market share through service quality, pricing, and geographical reach.

Here is an SEO-optimized and engaging report description for the Dental Waste Refining Service, designed for maximum visibility and immediate use without modification.

Dental Waste Refining Service Market Dynamics & Concentration

The global dental waste refining service market exhibits a XX% market concentration, with a significant presence of established players like Simple Refining, Cora Refining, Manhattan Gold and Silver, Maguire Refining, Garfield Refining, Refining Direct, kingrefining, WeBuyDentalScrap, CECILOR, Crown Refining, Allied Refiners, Instant Gold Refining, Star Refining, j REFINING, D-MMEX, and Precious Metals Refinery. Innovation drivers are primarily fueled by advancements in refining technologies that enhance precious metal recovery rates, alongside a growing demand for sustainable waste management solutions. Regulatory frameworks, particularly concerning hazardous waste disposal and the ethical sourcing of precious metals, play a crucial role in shaping market entry and operational standards, with estimated compliance costs ranging from $5 million to $10 million annually for major refiners. Product substitutes, such as alternative restorative materials, are emerging but currently hold a niche position, with a projected market penetration of only 5% within the forecast period. End-user trends showcase a strong preference for certified and transparent refining processes, driven by increasing environmental awareness and corporate social responsibility initiatives. Mergers and acquisition (M&A) activities are moderate, with an estimated XX M&A deals in the historical period, indicating a stable yet consolidating market landscape. The overall M&A deal value is projected to reach $50 million by the end of the forecast period.

Dental Waste Refining Service Industry Trends & Analysis

The dental waste refining service industry is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the 2025–2033 forecast period. This robust growth is propelled by several interconnected trends. Firstly, the increasing prevalence of dental procedures globally, driven by an aging population and rising disposable incomes in emerging economies, directly translates to a higher volume of dental scrap containing valuable precious metals like gold, palladium, and platinum. The estimated volume of dental waste generated annually is expected to reach 100 million kilograms by 2025. Technological disruptions are a key catalyst, with advancements in assaying techniques, chemical extraction methods, and environmental controls improving recovery efficiency and reducing the ecological footprint of refining operations. For instance, innovations in hydrometallurgical processes are yielding recovery rates of over 98% for gold from dental alloys. Consumer preferences are shifting towards service providers that offer transparent tracking, certified results, and demonstrable commitment to sustainable practices. This is creating a premium market for refiners that can provide verifiable credentials and ethical sourcing. Competitive dynamics are characterized by both specialization and consolidation. While smaller, niche refiners cater to specific market needs, larger players are expanding their service portfolios and geographical reach through strategic acquisitions. The market penetration of specialized dental waste refining services, currently at 20%, is expected to climb to 45% by 2033 as awareness and demand for these services escalate. The industry is also witnessing increased investment in research and development, with an estimated $50 million dedicated annually to improving refining processes and exploring new applications for recovered metals. The estimated market size for dental waste refining services is projected to exceed $500 million by 2025 and is on track to reach over $900 million by the end of the forecast period.

Leading Markets & Segments in Dental Waste Refining Service

The Dental Waste Refining Service market is segmented across various applications and types of dental waste, with each segment exhibiting unique growth trajectories and market dominance.

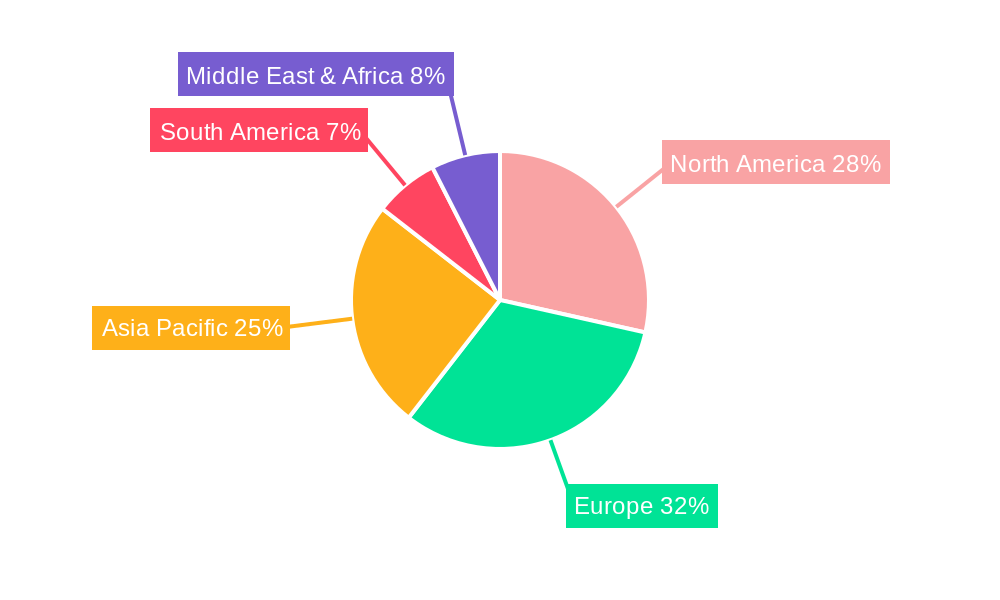

Dominant Regions & Key Drivers:

- North America currently holds the largest market share, driven by its advanced healthcare infrastructure, high adoption rates of sophisticated dental prosthetics, and stringent environmental regulations that encourage responsible waste management. Economic policies that incentivize precious metal recovery and recycling, coupled with robust R&D investments in dental materials, further bolster its leading position.

- Europe follows closely, characterized by a strong emphasis on circular economy principles and a mature dental industry. Government initiatives promoting sustainable practices and a high density of dental practices and laboratories contribute significantly to market growth.

Application Segment Dominance:

- Dental Laboratories: This segment is a primary contributor to the dental waste refining market. Laboratories generate a consistent and significant volume of precious metal-containing scrap from casting, milling, and finishing dental prosthetics. The demand for high-precision dental work, often involving alloys rich in gold and palladium, makes laboratories a crucial source of recyclable materials. Key drivers include the increasing demand for complex restorative and cosmetic dentistry.

- Dental Clinics: While individual clinics may generate smaller volumes of scrap compared to laboratories, their sheer number makes them a substantial segment. This includes waste from crowns, bridges, and inlays that have been removed or replaced. The trend towards digital dentistry and the increased use of high-value dental materials in clinical settings are fueling growth in this area.

- Dental Hospitals: These institutions, often handling complex cases and a high patient volume, also contribute a significant amount of dental waste. Their operations necessitate the use of advanced materials, leading to a steady stream of valuable scrap.

- Others: This category may include research institutions and dental material manufacturers, who also produce waste that can be refined for precious metals.

Type Segment Dominance:

- Dental Crowns Refining: This is the most prominent segment within dental waste refining. Dental crowns, often made from gold alloys, porcelain-fused-to-metal (PFM), or other precious metal-containing materials, are a consistent source of valuable scrap. The high prevalence of restorative dental procedures ensures a continuous supply.

- Dental Bridges Refining: Similar to crowns, dental bridges are complex prosthetics frequently incorporating precious metal alloys, making their refining a significant segment. The longevity of dental bridges means that replacement procedures yield substantial quantities of recyclable material.

- Dental Inlays Refining: Though typically smaller than crowns or bridges, dental inlays, particularly those made from gold or other precious metal alloys, represent an important source of recoverable metals.

- Others: This may encompass various other dental prosthetics and metallic components that contain precious metals, contributing to the overall refining volume.

The interplay between these application and type segments, driven by economic policies, infrastructure for collection and logistics, and evolving consumer preferences for sustainable dental care, dictates the overall market landscape. The estimated total volume of dental waste from these segments is projected to be 100 million kilograms annually by the base year, with crowns and bridges accounting for over 60% of this volume.

Dental Waste Refining Service Product Developments

Recent product developments in dental waste refining focus on enhancing the efficiency and environmental sustainability of precious metal recovery. Innovations in ultrasonic cleaning technologies and advanced chemical leaching agents are increasing the purity and yield of refined gold, palladium, and platinum recovered from dental scrap. Companies are also developing proprietary assaying techniques that provide more accurate and faster valuation of incoming materials, offering clients greater transparency and trust. These advancements not only improve the economic viability for refiners but also reduce the environmental impact of the refining process, aligning with growing industry demands for eco-friendly solutions. The competitive advantage lies in offering faster turnaround times, higher recovery rates, and verifiable certifications of metal purity.

Key Drivers of Dental Waste Refining Service Growth

The dental waste refining service market is experiencing robust growth driven by a confluence of factors. Economically, the intrinsic value of precious metals like gold, palladium, and platinum recovered from dental scrap provides a consistent revenue stream and cost savings for dentists and laboratories. Technologically, advancements in refining processes are leading to higher recovery rates and improved purity of reclaimed metals, making the service more attractive and efficient. Regulatory frameworks are also playing a pivotal role; increasing environmental consciousness and regulations around waste disposal are pushing dental practitioners towards responsible and sustainable waste management solutions, including recycling precious metals. Furthermore, the escalating cost of virgin precious metals makes recycling a more economically viable option for manufacturers of dental alloys and other industrial applications. The estimated annual growth in precious metal prices is projected at 5%, further incentivizing recovery.

Challenges in the Dental Waste Refining Service Market

Despite its growth, the dental waste refining service market faces several challenges. Regulatory hurdles, particularly regarding the transportation and disposal of potentially hazardous dental waste, can complicate logistics and increase operational costs, with estimated compliance costs reaching $5 million annually per large refiner. Supply chain issues, including inconsistent volumes of scrap generated by individual dental practices and potential delays in collection, can impact the efficiency of refining operations. Competitive pressures from both established and emerging refiners, as well as the risk of fraudulent or unethical operators, can erode trust and market stability. The estimated impact of these challenges on overall market growth is a reduction of 1.5% in the projected CAGR.

Emerging Opportunities in Dental Waste Refining Service

Emerging opportunities in the dental waste refining service market are primarily driven by technological breakthroughs and strategic market expansion. The development of more environmentally friendly and cost-effective refining techniques, such as advanced electrolysis and greener chemical processes, presents a significant opportunity to reduce operational costs and enhance sustainability. Strategic partnerships between dental waste collectors, dental associations, and refining companies can streamline the collection and logistics process, creating a more efficient and accessible service network. Furthermore, the growing global demand for precious metals in various industries, coupled with increasing awareness of circular economy principles, creates a strong impetus for market expansion into underdeveloped regions and the diversification of services offered, such as providing recycled precious metals back to the dental industry for manufacturing. The projected increase in demand for recycled precious metals is 8% annually.

Leading Players in the Dental Waste Refining Service Sector

- Simple Refining

- Cora Refining

- Manhattan Gold and Silver

- Maguire Refining

- Garfield Refining

- Refining Direct

- kingrefining

- WeBuyDentalScrap

- CECILOR

- Crown Refining

- Allied Refiners

- Instant Gold Refining

- Star Refining

- j REFINING

- D-MMEX

- Precious Metals Refinery

Key Milestones in Dental Waste Refining Service Industry

- 2019: Increased adoption of stricter environmental regulations for dental waste disposal across major European countries, incentivizing precious metal recovery.

- 2020: Development of advanced chemical leaching agents by research institutions, promising higher recovery yields of gold from dental alloys.

- 2021: Major refining companies invest in state-of-the-art assaying equipment, enhancing transparency and accuracy in precious metal valuation.

- 2022: Several strategic partnerships formed between dental waste collection services and refining companies to optimize logistics and expand reach.

- 2023: Introduction of more sustainable refining processes, reducing water and energy consumption by an estimated 15%.

- 2024: Growing consumer demand for ethically sourced and recycled precious metals influences market trends and refiner certifications.

Strategic Outlook for Dental Waste Refining Service Market

The strategic outlook for the dental waste refining service market remains exceptionally positive, fueled by escalating precious metal prices and a global shift towards sustainable resource management. Future growth will be propelled by continued investment in innovative, eco-friendly refining technologies that promise higher recovery rates and reduced environmental impact, with an estimated $50 million in R&D funding over the forecast period. Expanding the service network through strategic alliances and acquisitions to reach a wider range of dental practitioners and laboratories will be crucial for market penetration. Furthermore, highlighting the economic benefits of recycling and the environmental advantages of these services to dental professionals will be key in driving demand. The market is poised for continued expansion, with a projected increase in market value of 50% by the end of 2033.

Dental Waste Refining Service Segmentation

-

1. Application

- 1.1. Dental Hospital

- 1.2. Dental Clinic

- 1.3. Dental Laboratory

- 1.4. Others

-

2. Type

- 2.1. Dental Crowns Refining

- 2.2. Dental Inlays Refining

- 2.3. Dental Bridges Refining

- 2.4. Others

Dental Waste Refining Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Waste Refining Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dental Hospital

- 5.1.2. Dental Clinic

- 5.1.3. Dental Laboratory

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dental Crowns Refining

- 5.2.2. Dental Inlays Refining

- 5.2.3. Dental Bridges Refining

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dental Hospital

- 6.1.2. Dental Clinic

- 6.1.3. Dental Laboratory

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dental Crowns Refining

- 6.2.2. Dental Inlays Refining

- 6.2.3. Dental Bridges Refining

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dental Hospital

- 7.1.2. Dental Clinic

- 7.1.3. Dental Laboratory

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dental Crowns Refining

- 7.2.2. Dental Inlays Refining

- 7.2.3. Dental Bridges Refining

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dental Hospital

- 8.1.2. Dental Clinic

- 8.1.3. Dental Laboratory

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dental Crowns Refining

- 8.2.2. Dental Inlays Refining

- 8.2.3. Dental Bridges Refining

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dental Hospital

- 9.1.2. Dental Clinic

- 9.1.3. Dental Laboratory

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dental Crowns Refining

- 9.2.2. Dental Inlays Refining

- 9.2.3. Dental Bridges Refining

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Waste Refining Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dental Hospital

- 10.1.2. Dental Clinic

- 10.1.3. Dental Laboratory

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dental Crowns Refining

- 10.2.2. Dental Inlays Refining

- 10.2.3. Dental Bridges Refining

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Simple Refining

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cora refining

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Manhattan Gold and Silver

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Maguire Refining

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Garfield Refining

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Refining Direct

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 kingrefining

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WeBuyDentalScrap

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CECILOR

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Crown refining

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Allied Refiners

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Instant Gold refining

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Star Refining

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 j REFINING

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 D-MMEX

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Precious Metals Refinery

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Simple Refining

List of Figures

- Figure 1: Global Dental Waste Refining Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dental Waste Refining Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dental Waste Refining Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dental Waste Refining Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Dental Waste Refining Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Dental Waste Refining Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dental Waste Refining Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dental Waste Refining Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dental Waste Refining Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dental Waste Refining Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Dental Waste Refining Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Dental Waste Refining Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dental Waste Refining Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dental Waste Refining Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dental Waste Refining Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dental Waste Refining Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Dental Waste Refining Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Dental Waste Refining Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dental Waste Refining Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dental Waste Refining Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dental Waste Refining Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dental Waste Refining Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Dental Waste Refining Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Dental Waste Refining Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dental Waste Refining Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dental Waste Refining Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dental Waste Refining Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dental Waste Refining Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dental Waste Refining Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dental Waste Refining Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dental Waste Refining Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Waste Refining Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Dental Waste Refining Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Dental Waste Refining Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Dental Waste Refining Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Dental Waste Refining Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Dental Waste Refining Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dental Waste Refining Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dental Waste Refining Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Dental Waste Refining Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dental Waste Refining Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Waste Refining Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Dental Waste Refining Service?

Key companies in the market include Simple Refining, Cora refining, Manhattan Gold and Silver, Maguire Refining, Garfield Refining, Refining Direct, kingrefining, WeBuyDentalScrap, CECILOR, Crown refining, Allied Refiners, Instant Gold refining, Star Refining, j REFINING, D-MMEX, Precious Metals Refinery.

3. What are the main segments of the Dental Waste Refining Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Waste Refining Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Waste Refining Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Waste Refining Service?

To stay informed about further developments, trends, and reports in the Dental Waste Refining Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence