Key Insights

The Czech Republic's third-party logistics (3PL) market is projected for substantial expansion, fueled by escalating e-commerce penetration, robust manufacturing output, and a heightened demand for optimized supply chain solutions. The market, valued at approximately $1.41 billion in the base year 2024, is anticipated to achieve a compound annual growth rate (CAGR) of 8.5% through 2033. Key growth drivers include the imperative for advanced warehousing and distribution to support e-commerce expansion, the intricate supply chain needs of the automotive and manufacturing sectors, and the increasing volume of cross-border trade facilitated by the Czech Republic's strategic European location.

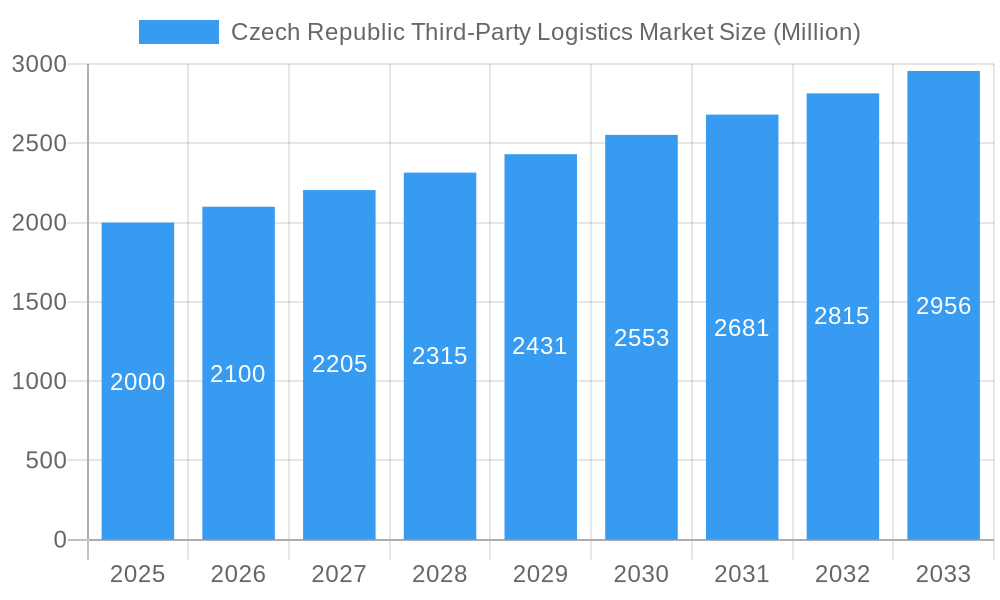

Czech Republic Third-Party Logistics Market Market Size (In Billion)

Within this dynamic market, domestic and international transportation management segments are poised for considerable growth. The strategic positioning of the Czech Republic as a central European logistics hub will further bolster international transportation services. Value-added warehousing and distribution services, crucial for inventory management, order fulfillment, and specialized packaging, are experiencing heightened adoption as businesses prioritize supply chain efficiency. Major end-user industries, including manufacturing, automotive, oil & gas, chemicals, and distributive trade (with a particular emphasis on e-commerce), will continue to propel market growth. Prominent market participants such as DHL Supply Chain, DSV Logistics, and Rhenus Logistics are actively expanding their operations, complemented by regional players like PST CLC, Yusen Logistics, and Gefco, all contributing to the competitive landscape.

Czech Republic Third-Party Logistics Market Company Market Share

Czech Republic Third-Party Logistics (3PL) Market Report: 2019-2033

Unlocking Growth Opportunities in the Dynamic Czech 3PL Sector

This comprehensive report provides an in-depth analysis of the Czech Republic's thriving third-party logistics market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key players, and forecasts future trends, enabling informed strategic planning and investment decisions. The Czech Republic's strategic location and robust economy make its 3PL sector a compelling investment opportunity, and this report illuminates its full potential. The market is estimated to be worth xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

Czech Republic Third-Party Logistics Market Market Dynamics & Concentration

The Czech Republic's third-party logistics (3PL) market is characterized by a moderately concentrated structure, featuring a dynamic interplay between prominent multinational logistics providers and well-established domestic players actively competing for significant market share. While precise figures fluctuate, the market share held by the top 5 players is estimated to represent a substantial portion, approximately [Insert Percentage]% of the total market value in 2025. Key catalysts for market evolution include continuous technological advancements, particularly in areas such as advanced warehouse automation (including robotics and AI-driven solutions), sophisticated data analytics for predictive insights, and integrated transportation management systems (TMS) for optimized route planning and execution. The regulatory landscape, while generally conducive to business operations, introduces certain administrative requirements and compliance demands that necessitate ongoing attention from market participants as regulations evolve. Direct substitutes for comprehensive 3PL services are relatively limited, primarily revolving around in-house logistics capabilities, which often prove less cost-effective and resource-intensive for many businesses. The mergers and acquisitions (M&A) arena has witnessed considerable activity, with an estimated [Insert Number] M&A deals recorded between 2019 and 2024, largely driven by strategic consolidation and the pursuit of enhanced economies of scale. End-user trends highlight a discernible and growing preference for outsourced logistics solutions, primarily motivated by the pursuit of significant cost optimization, operational efficiency gains, and the ability to focus on core business competencies.

- Market Concentration: Top 5 players are projected to collectively hold approximately [Insert Percentage]% of the market share in 2025, indicating a competitive yet consolidated environment.

- M&A Activity: The period between 2019 and 2024 saw approximately [Insert Number] M&A deals, signaling ongoing industry consolidation and strategic realignment.

- Innovation Drivers: The market's technological advancement is primarily fueled by the adoption of automation, sophisticated data analytics, and integrated Transportation Management Systems (TMS).

- Regulatory Framework: The existing regulatory environment is largely supportive of business growth, though it presents some administrative complexities requiring diligent compliance efforts.

Czech Republic Third-Party Logistics Market Industry Trends & Analysis

The Czech Republic's 3PL market is currently experiencing a period of robust and sustained growth, driven by a multifaceted array of influential factors. The exponential expansion of e-commerce has become a primary engine, significantly escalating the demand for integrated warehousing, efficient distribution networks, and agile last-mile delivery services. Simultaneously, rapid technological advancements, encompassing the transformative potential of the Internet of Things (IoT) for real-time asset tracking and Artificial Intelligence (AI) for predictive analytics and process optimization, are profoundly enhancing supply chain efficiency, transparency, and overall traceability. Consumer expectations are increasingly shifting towards faster delivery timelines and greater product customization, compelling 3PL providers to proactively adapt their service offerings and deliver more bespoke logistics solutions. The competitive landscape is defined by intense price competition, a strong emphasis on service differentiation, and the continuous trend of market consolidation as larger players acquire smaller ones or merge to expand their capabilities and reach.

- Market Growth Drivers: Key drivers fueling market expansion include the booming e-commerce sector, continuous technological advancements, and an escalating demand for highly customized logistics solutions.

- Technological Disruptions: Emerging technologies like IoT, AI, and advanced automation are fundamentally reshaping warehouse operations, inventory management, and transportation logistics.

- Competitive Dynamics: The market is characterized by aggressive price competition, a focus on innovative service offerings, and ongoing consolidation among industry players.

Leading Markets & Segments in Czech Republic Third-Party Logistics Market

The Manufacturing & Automotive sector dominates the Czech Republic's 3PL market, driven by the country's strong automotive industry and extensive manufacturing base. Value-added warehousing and distribution services constitute the largest segment by service type. International transportation management is also experiencing significant growth, fueled by increased cross-border trade.

Key Drivers by Segment:

- Manufacturing & Automotive: Large industrial base, foreign investment, and automotive industry clusters.

- Distributive Trade: E-commerce growth and expansion of retail networks.

- Value-added Warehousing & Distribution: Growing demand for customized services and supply chain optimization.

- International Transportation Management: Increased cross-border trade and globalization.

Dominance Analysis:

The Prague region is the dominant market due to its proximity to major transportation hubs and concentration of industrial activity. This is further strengthened by supportive government policies and efficient infrastructure.

Czech Republic Third-Party Logistics Market Product Developments

Recent product innovations focus on enhancing visibility, efficiency, and security within supply chains. This includes the implementation of real-time tracking, improved warehouse management systems (WMS), and the adoption of advanced analytics to optimize logistics processes. These solutions deliver competitive advantages by enhancing efficiency, lowering costs, and providing customers with greater transparency and control over their supply chains. The market is increasingly moving towards integrated solutions that seamlessly link different aspects of logistics operations.

Key Drivers of Czech Republic Third-Party Logistics Market Growth

The accelerated growth trajectory of the Czech Republic's 3PL market is underpinned by a powerful synergy of contributing factors. Broad economic expansion within the nation directly translates into heightened demand for comprehensive logistics services across various industries. Significant investments in technological innovation, particularly in the adoption of automation for improved operational efficiency and real-time tracking systems for enhanced visibility and reduced transit times, are actively lowering operational costs. Proactive government support, manifested through strategic infrastructure development projects and the implementation of favorable regulatory policies, cultivates a positive and conducive business environment for logistics providers. Furthermore, the persistent and expanding growth of the e-commerce sector continues to be a major impetus, driving substantial demand for specialized last-mile delivery capabilities and flexible warehousing solutions.

Challenges in the Czech Republic Third-Party Logistics Market Market

The Czech 3PL market encounters several significant challenges that impact its operational efficiency and profitability. A persistent issue is the shortage of skilled labor, particularly in specialized roles within logistics operations and technological implementation. Fluctuations in global fuel prices and prevailing geopolitical uncertainties introduce volatility and increase transportation costs, directly affecting operational budgets. The intensifying competition from both established domestic and aggressive international players necessitates a constant commitment to innovation and ongoing improvements in operational efficiency to maintain a competitive edge. Additionally, the imperative of maintaining strict compliance with an evolving regulatory framework adds a layer of administrative complexity and cost. Collectively, these factors exert pressure on profit margins and overall operational effectiveness, thereby influencing the broader market dynamics.

Emerging Opportunities in Czech Republic Third-Party Logistics Market

The Czech 3PL market presents compelling opportunities. The growing adoption of automation and advanced technologies offers significant potential for efficiency gains and cost reduction. Strategic partnerships between 3PL providers and technology companies unlock innovative solutions. Expansion into new market segments, such as the growing healthcare and pharmaceuticals sectors, offers untapped potential. Finally, investing in sustainable logistics practices, such as green transportation and eco-friendly warehousing, enhances brand image and appeals to environmentally conscious clients.

Leading Players in the Czech Republic Third-Party Logistics Market Sector

- PST CLC

- Yusen Logistics

- Gefco

- MD Logistika

- DHL Supply Chain

- HAVI Logistics

- DSV Logistics

- Rhenus Logistics

- CEE Logistics

- CD Cargo

Key Milestones in Czech Republic Third-Party Logistics Market Industry

- 2020: A marked increase in the adoption of Warehouse Management Systems (WMS) was observed, driven by the urgent need for enhanced operational efficiency and inventory control.

- 2021: The industry witnessed a notable surge in merger and acquisition (M&A) activities, leading to significant consolidation among key market players and restructuring of market share.

- 2022: Substantial investments were made in cutting-edge technologies such as Automated Guided Vehicles (AGVs) and Robotic Process Automation (RPA) to revolutionize warehouse operations and boost productivity.

- 2023: The government initiated several strategic programs aimed at improving national logistics infrastructure and accelerating the digitalization of supply chain processes.

- 2024: A growing commitment towards sustainable logistics practices became evident among 3PL providers, reflecting an increasing focus on environmental responsibility and greener supply chains.

Strategic Outlook for Czech Republic Third-Party Logistics Market Market

The Czech Republic's 3PL market is poised for continued growth, driven by e-commerce expansion, technological advancements, and government support for infrastructure development. Strategic opportunities lie in investing in automation, leveraging data analytics for supply chain optimization, and offering specialized logistics solutions for niche sectors. Companies that adapt to changing consumer preferences, adopt sustainable practices, and embrace technological innovation will be well-positioned to capture significant market share and achieve sustained growth in the years to come.

Czech Republic Third-Party Logistics Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End-Users

Czech Republic Third-Party Logistics Market Segmentation By Geography

- 1. Czech Republic

Czech Republic Third-Party Logistics Market Regional Market Share

Geographic Coverage of Czech Republic Third-Party Logistics Market

Czech Republic Third-Party Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. Electricity Crisis

- 3.4. Market Trends

- 3.4.1. Development in the Czech Republic's Transportation Network

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic Third-Party Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PST CLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yusen Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gefco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MD Logistika**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Supply Chain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HAVI Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DSV Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rhenus Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEE Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CD Cargo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PST CLC

List of Figures

- Figure 1: Czech Republic Third-Party Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Czech Republic Third-Party Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Czech Republic Third-Party Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic Third-Party Logistics Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Czech Republic Third-Party Logistics Market?

Key companies in the market include PST CLC, Yusen Logistics, Gefco, MD Logistika**List Not Exhaustive, DHL Supply Chain, HAVI Logistics, DSV Logistics, Rhenus Logistics, CEE Logistics, CD Cargo.

3. What are the main segments of the Czech Republic Third-Party Logistics Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Fruit Exports.

6. What are the notable trends driving market growth?

Development in the Czech Republic's Transportation Network.

7. Are there any restraints impacting market growth?

Electricity Crisis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic Third-Party Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic Third-Party Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic Third-Party Logistics Market?

To stay informed about further developments, trends, and reports in the Czech Republic Third-Party Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence