Key Insights

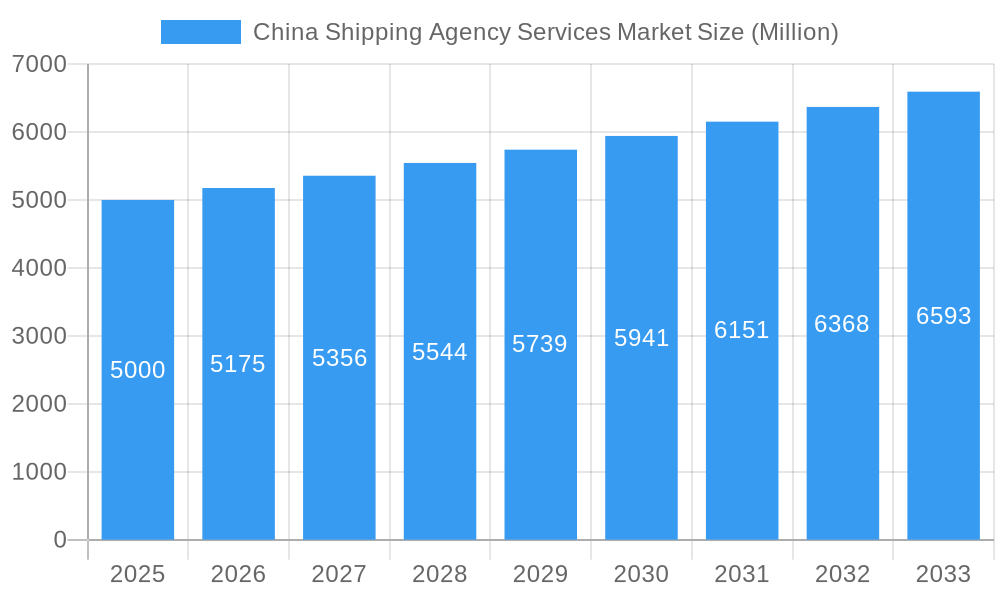

The China shipping agency services market is poised for significant expansion, driven by robust international trade and its pivotal role as a global manufacturing hub. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.05% from 2024 to 2033. The market size is estimated at 8.32 billion in 2024, with substantial growth anticipated by 2033. Key growth catalysts include the increasing complexity of global supply chains, necessitating expert customs clearance, logistical support, and cargo handling services provided by shipping agencies. Technological advancements, such as digital platforms for documentation and tracking, are further enhancing operational efficiency and fueling market growth.

China Shipping Agency Services Market Market Size (In Billion)

Market segmentation highlights diverse opportunities within port, cargo, and charter agencies, as well as specialized services like packaging, shipping, customs clearance, and logistical support. Leading entities including Greaten Shipping Agency Limited, Sinotrans Limited, and COSCO SHIPPING Development Co Ltd are strategically positioned to capitalize on this growth, though the competitive landscape is expected to remain dynamic. Despite potential headwinds from global economic fluctuations and trade policy shifts, the outlook for the China shipping agency services market is highly positive, offering considerable growth and investment potential. Increased e-commerce activity, the proliferation of specialized logistics, and ongoing port infrastructure development are anticipated to propel this growth trajectory.

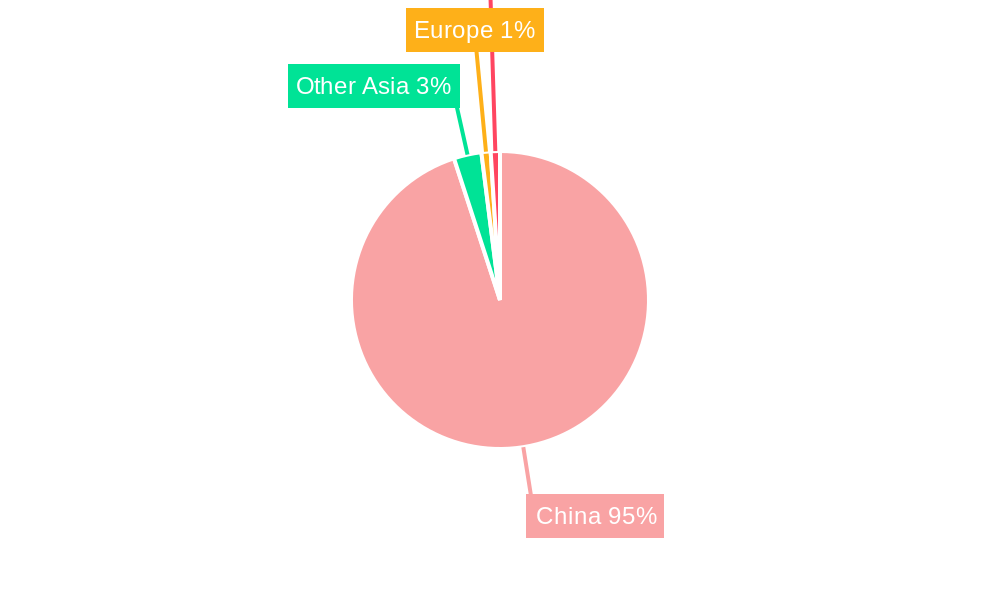

China Shipping Agency Services Market Company Market Share

China Shipping Agency Services Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the China Shipping Agency Services market, providing invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future growth potential. The report leverages extensive data analysis and incorporates key industry developments to deliver actionable intelligence. The market size is predicted to reach xx Million by 2033.

China Shipping Agency Services Market Market Dynamics & Concentration

The China Shipping Agency Services market is characterized by a dynamic interplay of robust growth drivers and a moderately concentrated competitive landscape. While established global and national players command significant market share, the sector also benefits from a vibrant ecosystem of smaller, specialized agencies, fostering a competitive environment. Innovation is primarily driven by the rapid adoption of advanced logistics management systems, the integration of sophisticated digital platforms, and a pervasive demand for highly efficient and transparent shipping operations. The regulatory framework, encompassing stringent national maritime laws and international conventions, plays a pivotal role in shaping operational standards and compliance. The market also faces evolving challenges from substitute services, including direct-to-consumer fulfillment models and the increasing viability of alternative transport modes. End-user preferences are increasingly leaning towards holistic, integrated logistics solutions and a heightened demand for end-to-end supply chain visibility. Mergers and acquisitions (M&A) continue to be a notable feature, with an estimated xx M&A deals recorded within the historical period (2019-2024), indicative of strategic consolidation and expansion efforts.

- Market Share: Leading entities such as COSCO SHIPPING Development Co Ltd and Sinotrans Limited collectively hold a substantial market share, estimated at xx%.

- M&A Activity: The period between 2019 and 2024 saw an average of approximately xx M&A deals annually, reflecting active industry consolidation.

- Innovation Drivers: Key catalysts for innovation include comprehensive digitalization initiatives, the implementation of automation technologies, and the development of unified logistics platforms.

- Regulatory Impacts: Stringent environmental protection regulations and rigorous safety standards are significant influencing factors for market operations.

China Shipping Agency Services Market Industry Trends & Analysis

The China Shipping Agency Services market is on a trajectory of significant expansion, propelled by the sustained growth of China's international trade, its ongoing industrialization, and the explosive growth of e-commerce. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, with projections indicating a robust growth to xx% during the forecast period (2025-2033). Technological advancements are profoundly reshaping industry operations, particularly the integration of blockchain technology to bolster supply chain transparency and the deployment of AI-driven solutions for optimizing logistics. Consumer expectations are evolving towards a preference for seamless, end-to-end logistics services that emphasize both efficiency and enhanced visibility. Competitive dynamics are marked by intense price competition, strategic service differentiation, and the formation of strategic alliances, with major players reinforcing their market positions through targeted acquisitions and substantial investments in technology. The market penetration of digital logistics platforms is experiencing steady growth, with an estimated rate of xx% in 2024, projected to ascend to xx% by 2033.

Leading Markets & Segments in China Shipping Agency Services Market

Geographically, China's coastal regions, home to pivotal ports such as Shanghai, Shenzhen, and Ningbo, emerge as the dominant hubs within the market. In terms of service types, Port Agency services command the largest market share, followed by Cargo Agency and Charter Agency services. The primary application segment is Ship Owners, accounting for an estimated xx% of the overall market.

- Key Drivers for Port Agency Dominance: High volumes of port activities, the strategic geographical positioning of major ports, and substantial government investments in port infrastructure significantly contribute to the dominance of Port Agency services.

- Key Drivers for Ship Owner Application: The extensive scale of shipping operations and the demand for comprehensive agency support services from ship owners fuel this segment's prominence.

- Regional Dominance: Coastal provinces and municipalities boasting well-developed port infrastructure are leading the market.

Type Segmentation:

- Port Agency: Remains the largest segment, driven by the sheer volume of port activities and vessel traffic.

- Cargo Agency: Exhibits significant growth, propelled by increasing import and export volumes.

- Charter Agency: Shows moderate growth, influenced by the rising utilization of chartered vessels.

- Others: Encompasses niche segments offering specialized, high-value services.

Application Segmentation:

- Ship Owner: Continues to be the largest segment due to the persistent high demand for all-encompassing shipping solutions.

- Lessee: Represents a growing segment, correlating with the increasing adoption and use of chartered vessels.

Service Segmentation:

- Shipping Services: The foundational service, acting as a core driver for overall market growth.

- Custom Clearance Services: An indispensable service holding a substantial market share due to its critical role in international trade.

- Logistical Support Services: A rapidly expanding segment, reflecting the increasing complexity and integration requirements of modern supply chains.

China Shipping Agency Services Market Product Developments

Recent product developments are heavily focused on the creation of integrated digital platforms that incorporate real-time cargo tracking, automated documentation processing, and advanced predictive analytics. These innovations are instrumental in enhancing operational efficiency, bolstering transparency, and driving cost-effectiveness for clients. The market is also witnessing a growing trend towards the development and adoption of specialized services tailored to meet the unique demands of niche industries, such as cold chain logistics and the handling of hazardous materials. These specialized offerings provide significant competitive advantages by delivering highly customized solutions and elevating the overall customer service experience.

Key Drivers of China Shipping Agency Services Market Growth

The China Shipping Agency Services market's growth is propelled by several key factors. Firstly, the robust expansion of China's international trade fuels the demand for efficient shipping and logistics services. Secondly, government initiatives promoting infrastructure development and trade liberalization further stimulate market expansion. Finally, technological advancements, such as automation and digitalization in logistics management, contribute significantly to market growth.

Challenges in the China Shipping Agency Services Market Market

The market faces challenges like increasing regulatory scrutiny, which necessitates compliance with strict environmental and safety standards. Supply chain disruptions and geopolitical uncertainties also pose significant risks. Furthermore, intense price competition among numerous providers creates pressure on profit margins. These factors collectively impact market growth and profitability.

Emerging Opportunities in China Shipping Agency Services Market

The market presents several promising opportunities. The increasing adoption of innovative technologies, such as AI-powered logistics optimization, offers significant potential for efficiency gains and cost reduction. Strategic partnerships between shipping agencies and technology providers will further drive market growth. Expansion into new markets and service offerings, particularly specialized logistics services and cross-border e-commerce solutions, holds substantial growth potential.

Leading Players in the China Shipping Agency Services Market Sector

- Greaten Shipping Agency Limited

- Sinotrans Limited

- ADP Supply Chain Management

- JiuFang Ecommerce Logistics

- Shenzhen Marine Shipping Agency Co Ltd

- Sun Jet Logistics Xiamen Co Ltd

- YuanYong International Forwarding Co Ltd

- China Marine Shipping Agency Co Ltd

- SINO Shipping

- COSCO SHIPPING Development Co Ltd

Key Milestones in China Shipping Agency Services Market Industry

- May 2022: The successful maiden voyage of the world's first LNG dual-fuel ultra-large crude oil tanker marked a significant stride towards sustainable maritime transport, consequently influencing the demand for specialized agency services catering to eco-friendly vessels.

- July 2022: The commissioning of China's first indigenously developed offshore oil and gas extraction facility represented a pivotal moment for domestic energy production, creating new avenues and opportunities for shipping agencies involved in supporting these critical offshore operations.

Strategic Outlook for China Shipping Agency Services Market Market

The China Shipping Agency Services market is poised for sustained growth, driven by increasing trade volumes, technological advancements, and government support. Strategic partnerships, investments in technology, and expansion into new market segments will be crucial for maintaining a competitive advantage. The focus on sustainable and efficient logistics solutions will be a key determinant of future market success.

China Shipping Agency Services Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Ship Owner

- 2.2. Lessee

-

3. Service

- 3.1. Packaging Services

- 3.2. Shipping Services

- 3.3. Custom Clearance Services

- 3.4. Logistical Support Services

- 3.5. Other Services

China Shipping Agency Services Market Segmentation By Geography

- 1. China

China Shipping Agency Services Market Regional Market Share

Geographic Coverage of China Shipping Agency Services Market

China Shipping Agency Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of efficient transportation infrastructure4.; High cost of white glove services

- 3.4. Market Trends

- 3.4.1. China’s Global Investment in Shipping Ports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ship Owner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Packaging Services

- 5.3.2. Shipping Services

- 5.3.3. Custom Clearance Services

- 5.3.4. Logistical Support Services

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greaten Shipping Agency Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sinotrans Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADP Supply Chain Management**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JiuFang Ecommerce Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shenzhen Marine Shipping Agency Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sun Jet Logistics Xiamen Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 YuanYong International Forwarding Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Marine Shipping Agency Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SINO Shipping

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 COSCO SHIPPING Development Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greaten Shipping Agency Limited

List of Figures

- Figure 1: China Shipping Agency Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Shipping Agency Services Market Share (%) by Company 2025

List of Tables

- Table 1: China Shipping Agency Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Shipping Agency Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Shipping Agency Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 4: China Shipping Agency Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Shipping Agency Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: China Shipping Agency Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: China Shipping Agency Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: China Shipping Agency Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Shipping Agency Services Market?

The projected CAGR is approximately 5.05%.

2. Which companies are prominent players in the China Shipping Agency Services Market?

Key companies in the market include Greaten Shipping Agency Limited, Sinotrans Limited, ADP Supply Chain Management**List Not Exhaustive, JiuFang Ecommerce Logistics, Shenzhen Marine Shipping Agency Co Ltd, Sun Jet Logistics Xiamen Co Ltd, YuanYong International Forwarding Co Ltd, China Marine Shipping Agency Co Ltd, SINO Shipping, COSCO SHIPPING Development Co Ltd.

3. What are the main segments of the China Shipping Agency Services Market?

The market segments include Type, Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.32 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency.

6. What are the notable trends driving market growth?

China’s Global Investment in Shipping Ports.

7. Are there any restraints impacting market growth?

4.; Lack of efficient transportation infrastructure4.; High cost of white glove services.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Shipping Agency Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Shipping Agency Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Shipping Agency Services Market?

To stay informed about further developments, trends, and reports in the China Shipping Agency Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence