Key Insights

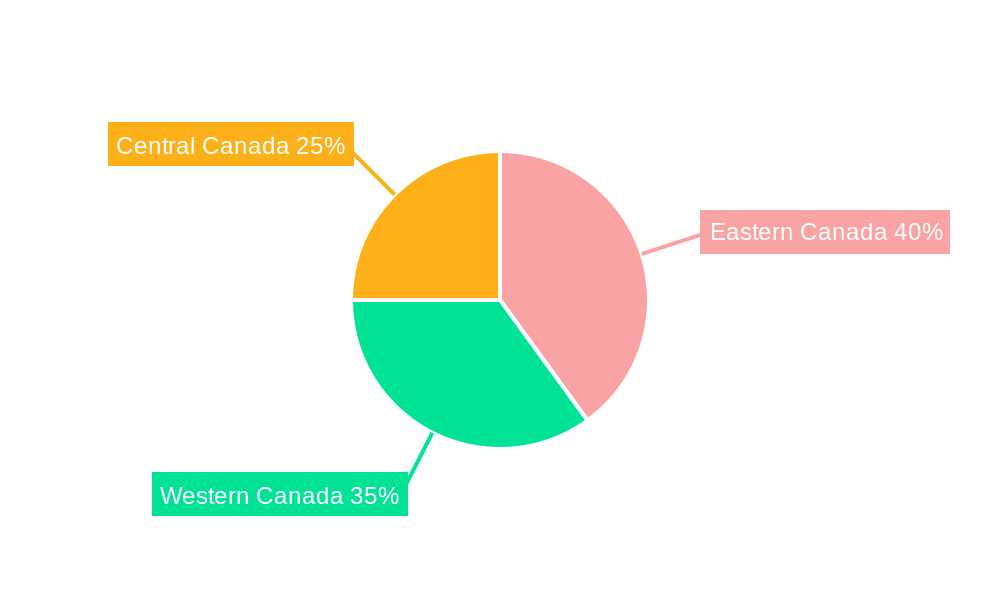

The Canadian cold chain logistics market is poised for significant expansion, fueled by escalating demand for perishable goods, enhanced consumer purchasing power driving a preference for fresh produce and processed foods, and a heightened emphasis on food safety and quality standards. The market is projected to achieve a robust Compound Annual Growth Rate (CAGR) of 12.4%, with an estimated market size of $6.9 billion by 2024, reflecting a strong growth trajectory through the forecast period. Key market drivers include the transportation and storage of chilled and frozen products across vital sectors such as horticulture, dairy, and meat. The increasing adoption of value-added services, including blast freezing, specialized labeling, and advanced inventory management solutions, is critical for optimizing supply chain efficiency. Furthermore, the burgeoning e-commerce sector and the widespread adoption of online grocery shopping are significantly accelerating market growth. While regional markets in Eastern and Western Canada are expected to lead due to concentrated populations and extensive agricultural activities, the overall outlook for the Canadian cold chain logistics market is highly positive, presenting substantial opportunities for innovation and expansion.

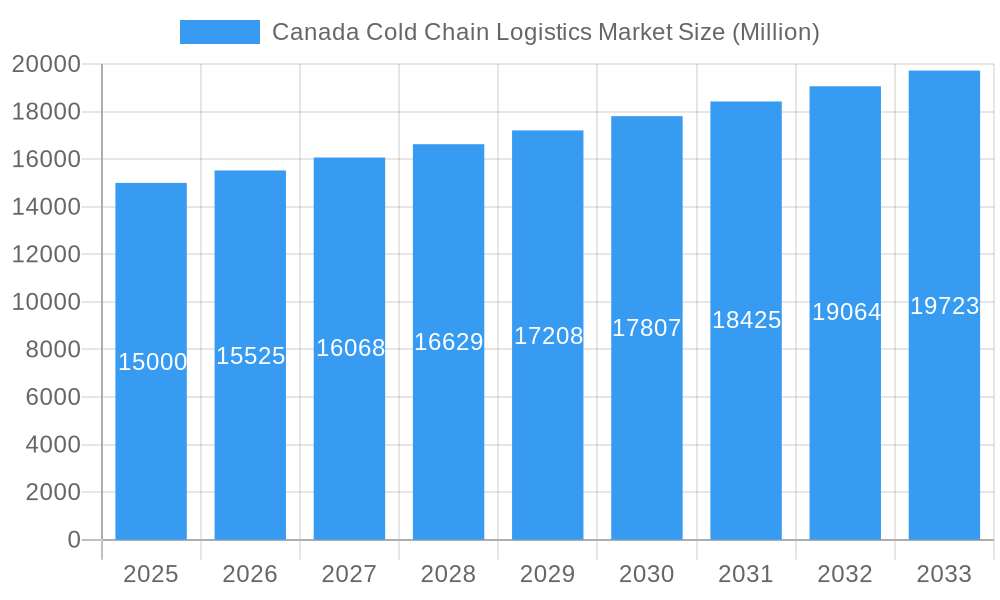

Canada Cold Chain Logistics Market Market Size (In Billion)

The competitive arena features a dynamic interplay between established global enterprises and agile regional specialists. Foremost companies such as Lineage Logistics, Americold Logistics, and Groupe Robert are proactively investing in infrastructure upgrades, technological innovations like advanced temperature monitoring and transportation management systems, and broadening their service capabilities to secure market leadership. Smaller, specialized providers are concentrating on niche market segments and specific geographic areas. Anticipate increased market consolidation through mergers and acquisitions as players strive to augment their market presence and service portfolios. The integration of sustainable logistics practices, including the adoption of alternative energy sources and route optimization strategies, will shape the market, promoting environmentally conscious operations. Canada's considerable agricultural output and a growing populace underscore the substantial growth potential within this sector.

Canada Cold Chain Logistics Market Company Market Share

Canada Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Cold Chain Logistics market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report presents a holistic view of market trends, competitive dynamics, and future growth prospects. The report uses Million as the unit for all values.

Keywords: Canada Cold Chain Logistics, Cold Chain, Logistics, Transportation, Storage, Value-added Services, Chilled, Frozen, Ambient, Horticulture, Dairy, Meats, Fish, Poultry, Processed Food, Pharma, Life Sciences, Chemicals, Market Analysis, Market Size, Market Growth, Market Share, CAGR, Competitive Landscape, Industry Trends, M&A, Confederation Freezers, Groupe Robert, Landtran Logistics, Americold Logistics, Congebec Logistics, Conestoga Cold Storage, MTE Logistix, Trenton Cold Storage, Lineage Logistics, Yusen Logistics.

Canada Cold Chain Logistics Market Market Dynamics & Concentration

The Canadian cold chain logistics market is experiencing robust expansion, propelled by escalating consumer appetite for fresh and processed foods, the pervasive growth of e-commerce, and an increasingly stringent regulatory landscape governing temperature-sensitive goods. Market concentration is observed as moderately fragmented, featuring a constellation of prominent large-scale operators alongside a multitude of agile, smaller regional enterprises. The collective market share of the top five industry leaders is projected to be approximately [Insert specific percentage]% in 2025, indicating a dynamic competitive environment.

- Innovation Drivers: Rapid technological advancements in precise temperature control systems, sophisticated tracking solutions, and advanced automation are pivotal in augmenting operational efficiency and substantially minimizing product spoilage. The integration of the Internet of Things (IoT) and blockchain technology is progressively gaining momentum, promising enhanced transparency and security within the supply chain.

- Regulatory Frameworks: Stringent and evolving regulations pertaining to food safety, product traceability, and the integrity of temperature-controlled shipments are fundamentally reshaping market practices. This necessitates continuous investment in advanced compliance solutions and infrastructure to meet and exceed industry standards.

- Product Substitutes: While direct substitutes for essential cold chain services are inherently limited, the emphasis on developing and implementing highly efficient, cost-effective transportation and storage methodologies remains a cornerstone of competitive differentiation.

- End-User Trends: A pronounced shift in consumer preferences towards healthier, convenience-oriented food options is a significant catalyst, driving elevated demand for specialized cold chain logistics services across an expanding array of product categories.

- M&A Activities: The market has been characterized by a moderate yet consistent pattern of Mergers & Acquisitions (M&A) over the past several years, with an estimated [Insert specific number] deals occurring between 2019 and 2024. These activities are predominantly fueled by strategic consolidation objectives and ambitious expansion plans undertaken by key industry players seeking to broaden their geographical reach and service portfolios.

Canada Cold Chain Logistics Market Industry Trends & Analysis

The Canadian cold chain logistics market is poised for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) of [Insert specific percentage]% during the forecast period spanning 2025-2033. This projected expansion is underpinned by a confluence of influential factors:

- Growing E-commerce Sector: The accelerating proliferation of online grocery platforms and food delivery services is a major contributor, creating an unprecedented surge in the demand for agile and reliable cold chain logistics solutions capable of handling rapid, temperature-controlled deliveries.

- Infrastructure Development: Substantial and ongoing investments in state-of-the-art cold storage facilities and the enhancement of transportation infrastructure are critically improving the overall efficiency, capacity, and resilience of the national cold chain network.

- Technological Disruptions: The proactive adoption of cutting-edge technologies such as Artificial Intelligence (AI), Machine Learning (ML), and sophisticated automation systems is revolutionizing operational workflows. These advancements are optimizing logistics, enhancing real-time traceability, and significantly reducing product waste throughout the supply chain.

- Consumer Preference Shift: An heightened consumer awareness and demand for superior food safety and quality standards are directly translating into a greater need for robust and dependable cold chain solutions, particularly for highly perishable goods.

- Competitive Dynamics: The market is defined by a dynamic interplay between large, established multinational corporations and specialized regional providers, fostering an intensely competitive environment. This competition primarily manifests in pricing strategies and the breadth and depth of service offerings. Market penetration for value-added services is projected to reach approximately [Insert specific percentage]% by 2033.

Leading Markets & Segments in Canada Cold Chain Logistics Market

The Canadian cold chain logistics market exhibits significant geographical diversity, with pronounced operational activity concentrated across its major provinces. The Frozen segment currently commands the largest market share, largely attributable to the persistent high demand for frozen food products across the nation.

By Service:

- Storage: This segment represents a substantial portion of the market's value, characterized by the operation of large-scale, sophisticated cold storage facilities designed to cater to the diverse requirements of various industries.

- Transportation: Refrigerated trucking and advanced rail transportation networks are indispensable for the seamless and efficient delivery of temperature-sensitive goods throughout Canada's vast geographical expanse.

- Value-Added Services: The demand for specialized value-added services, including blast freezing, custom labeling, and sophisticated inventory management solutions, is on a steady rise as businesses increasingly seek to optimize operational efficiency and enhance final product quality.

By Temperature:

- Frozen: This segment remains the dominant force in the market, driven by the substantial and consistent demand for a wide array of frozen food products.

- Chilled: The chilled segment also holds significant market importance, effectively serving the logistical needs of the fresh produce, dairy, and other temperature-sensitive perishable goods industries.

- Ambient: The ambient segment, while smaller in comparison, plays a supporting role for products requiring controlled, but not necessarily refrigerated, temperatures.

By End User:

- Food & Beverage: This sector, encompassing horticulture (fresh fruits & vegetables), dairy, meats, fish, poultry, and processed food products, stands as the undisputed dominant end-user segment for cold chain logistics.

- Pharma & Life Sciences: The burgeoning pharmaceutical and life sciences industry is a significant and growing driver of demand for highly specialized and rigorously controlled cold chain solutions essential for the safe transport of pharmaceuticals, biologics, and vaccines.

- Other End Users: A range of other end-users contribute a smaller but steadily increasing share to the overall market demand.

Key Drivers:

- The sustained robust economic growth experienced across Canada serves as a primary engine for market expansion.

- Government initiatives aimed at bolstering food safety standards and promoting higher quality benchmarks are positively influencing market dynamics and investment in cold chain infrastructure.

- Ongoing investments in the development and modernization of logistical infrastructure are significantly enhancing the overall capacity, efficiency, and reliability of the cold chain ecosystem.

Canada Cold Chain Logistics Market Product Developments

Recent advancements in cold chain logistics products and solutions are primarily focused on refining temperature control accuracy, enhancing real-time monitoring capabilities, and improving end-to-end traceability. The widespread adoption of IoT-enabled sensors and advanced real-time tracking systems is dramatically increasing visibility and optimizing efficiency throughout the cold chain. These innovations are directly addressing critical market demands for preserving product integrity and minimizing waste, offering significant competitive advantages to early adopters. Furthermore, the development of advanced automation technologies and sophisticated software solutions for inventory management is continually reshaping the operational landscape of the market.

Key Drivers of Canada Cold Chain Logistics Market Growth

The Canadian cold chain logistics market is fundamentally propelled by the unprecedented rise of e-commerce, a continually increasing consumer demand for fresh and processed food items, rapid technological advancements including the integration of IoT, AI, and blockchain, and stringent government regulations that prioritize food safety and product quality. The rigorous quality and safety standards mandated for pharmaceutical products also represent a significant contributing factor to the ongoing market expansion.

Challenges in the Canada Cold Chain Logistics Market Market

The industry faces challenges including high infrastructure costs, fluctuating fuel prices, and the need for skilled labor. Maintaining consistent temperature control during transportation presents operational hurdles, while ensuring regulatory compliance adds to operational complexity. Intense competition amongst providers and maintaining profitability in a price-sensitive market remain significant challenges. Estimates suggest that these factors contribute to a xx% increase in operating costs annually.

Emerging Opportunities in Canada Cold Chain Logistics Market

The market offers significant opportunities in expanding into specialized segments like pharmaceuticals and life sciences, where stringent requirements drive demand for advanced cold chain solutions. The incorporation of emerging technologies like AI and blockchain for improved tracking, traceability, and predictive maintenance creates substantial opportunities for growth. Strategic partnerships and expansion into underserved regions are also key opportunities for market players.

Leading Players in the Canada Cold Chain Logistics Market Sector

- Confederation Freezers (Premium Brands Holdings Corporation)

- Groupe Robert

- Landtran Logistics Inc

- Americold Logistics

- Congebec Logistics Inc

- Conestoga Cold Storage

- MTE Logistix

- Trenton Cold Storage Inc

- Lineage Logistics Ltd

- Yusen Logistics (Canada) Inc

- List Not Exhaustive

Key Milestones in Canada Cold Chain Logistics Market Industry

- 2020: Increased adoption of temperature monitoring technologies.

- 2021: Implementation of stricter food safety regulations.

- 2022: Several mergers and acquisitions among key players.

- 2023: Significant investment in cold storage facility expansions.

- 2024: Growing adoption of sustainable cold chain practices.

Strategic Outlook for Canada Cold Chain Logistics Market Market

The Canadian cold chain logistics market presents a promising outlook for long-term growth. Continued investment in technology, infrastructure development, and strategic partnerships will be vital in driving market expansion. Focus on enhancing efficiency, improving traceability, and meeting stringent regulatory requirements will define success in this competitive landscape. The potential for market expansion into new segments and leveraging the benefits of technological advancements offer considerable opportunities for substantial growth in the coming years.

Canada Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Canada Cold Chain Logistics Market Segmentation By Geography

- 1. Canada

Canada Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Canada Cold Chain Logistics Market

Canada Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Rise in Exports of Perishable Goods Driving the Demand for Cold Chain Logistics Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Confederation Freezers(Premium Brands Holdings Corporation)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe Robert

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Landtran Logistics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Americold Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Congebec Logistics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Conestoga Cold Storage

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MTE Logistix

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trenton Cold Storage Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lineage Logistics Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yusen Logistics(Canada) Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Confederation Freezers(Premium Brands Holdings Corporation)

List of Figures

- Figure 1: Canada Cold Chain Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Canada Cold Chain Logistics Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 3: Canada Cold Chain Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Canada Cold Chain Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Canada Cold Chain Logistics Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 7: Canada Cold Chain Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Canada Cold Chain Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Cold Chain Logistics Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Canada Cold Chain Logistics Market?

Key companies in the market include Confederation Freezers(Premium Brands Holdings Corporation), Groupe Robert, Landtran Logistics Inc, Americold Logistics, Congebec Logistics Inc, Conestoga Cold Storage, MTE Logistix, Trenton Cold Storage Inc, Lineage Logistics Ltd, Yusen Logistics(Canada) Inc **List Not Exhaustive.

3. What are the main segments of the Canada Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Rise in Exports of Perishable Goods Driving the Demand for Cold Chain Logistics Services.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Canada Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence