Key Insights

The Asia-Pacific postal services market is poised for substantial growth, projected at a CAGR of 7.7%. This expansion is primarily driven by the booming e-commerce sector and escalating cross-border trade within the region. Express postal services are leading this surge, catering to the increasing demand for rapid parcel delivery. Technological advancements, including sophisticated logistics and tracking systems, alongside the integration of digital services, are further accelerating market development. Despite challenges from private courier competition and fluctuating fuel costs, the market's robust growth is sustained. Parcel delivery, both domestically and internationally, represents a significant revenue driver, with China, India, and Japan spearheading market performance due to their large populations and extensive e-commerce activities. Opportunities also exist in specialized delivery segments, such as fragile and temperature-sensitive goods. Government-led digitalization and infrastructure development initiatives across Asia are expected to further boost future market growth.

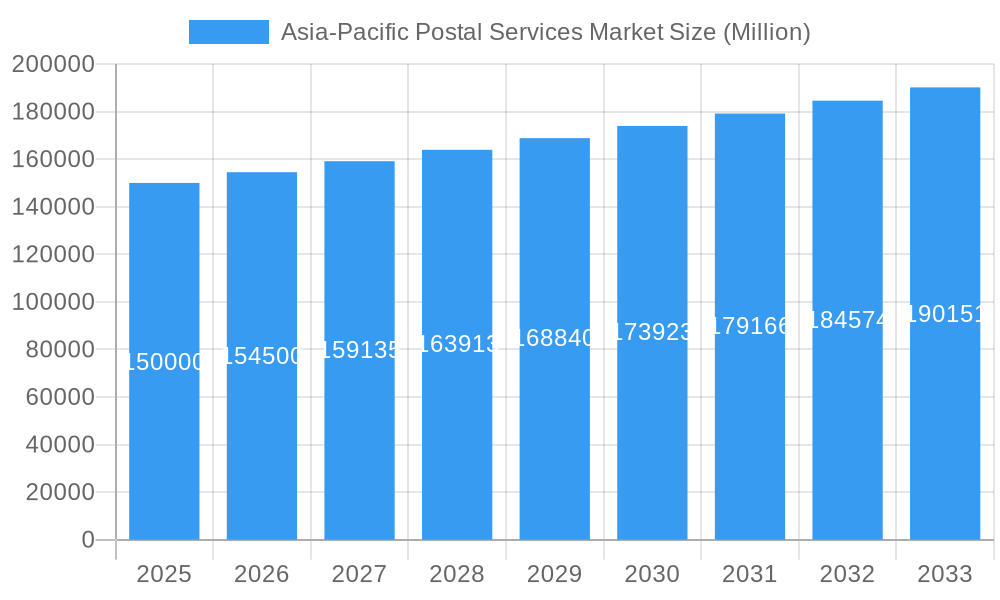

Asia-Pacific Postal Services Market Market Size (In Billion)

Navigating the diverse Asia-Pacific landscape requires postal service providers to prioritize speed and reliability in parcel delivery, necessitating ongoing investment in infrastructure and technology. Adapting to these demands involves offering diverse express delivery options and advanced tracking. Strategic management of operational costs, competitive pricing, and efficient handling of increasing parcel volumes are paramount for sustained success. Cross-border collaborations will be vital for seamless international shipping. The expansion of e-commerce into rural areas presents a significant, albeit challenging, growth avenue, requiring investment in logistics and last-mile delivery solutions. The market is expected to see increased consolidation through mergers and acquisitions, as companies aim to scale and expand their reach to meet this growing demand. The market size is estimated at $172.37 billion in the base year 2025.

Asia-Pacific Postal Services Market Company Market Share

Asia-Pacific Postal Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Postal Services Market, offering invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a meticulous examination of market dynamics, trends, and future projections. The report leverages extensive data analysis to forecast robust market growth, identifying key opportunities and challenges impacting the industry's trajectory. This research is crucial for informed decision-making and strategic planning in this competitive landscape.

Asia-Pacific Postal Services Market Market Dynamics & Concentration

The Asia-Pacific postal services market is characterized by a dynamic interplay of factors driving its expansion and influencing its competitive landscape. Market share is distributed across a broad spectrum, encompassing established national postal operators and agile private courier companies. Leading national postal services such as China Post Group Corporation, India Post, and Japan Post Co Ltd maintain significant domestic market presence. Concurrently, global logistics giants like DHL, FedEx, and UPS are key players in the international express segment, fostering intense competition. Smaller, yet vital, regional operators like Pos Malaysia Berhad and Pos Indonesia also contribute significantly to the diverse market dynamics.

- Market Concentration: The market displays moderate concentration. While a few dominant players, particularly China Post Group Corporation leveraging the vast Chinese market, hold substantial shares, numerous smaller entities contribute to a competitive environment. The overall market concentration ratio, estimated to be [Insert Specific CR value here], points towards a moderately fragmented yet competitive market.

- Innovation Drivers: Key catalysts for innovation include rapid technological advancements, specifically in the realms of automation for sorting and delivery, sophisticated logistics optimization algorithms, and the comprehensive digitalization of services. This includes enhanced online tracking, digital payment options, and streamlined customer interfaces.

- Regulatory Frameworks: The diverse and often varying regulatory environments across the Asia-Pacific region present significant impacts on operational costs, market accessibility, and service standards for both domestic and international postal operators. Efforts towards regulatory harmonization remain an ongoing and crucial endeavor.

- Product Substitutes: The increasing prevalence of digital communication channels and the ubiquity of e-commerce platforms introduce a degree of substitution for traditional letter-based postal services. However, the fundamental requirement for the physical delivery of goods, amplified by e-commerce growth, continues to underscore the essential role of parcel and package delivery services.

- End-User Trends: The exponential growth of e-commerce is the primary fuel for the surging demand in parcel delivery services. This trend is profoundly reshaping market segmentation, driving growth in express postal services, and influencing the types of logistics solutions required.

- M&A Activities: Mergers and acquisitions (M&A) within the Asia-Pacific postal services sector have historically been relatively selective. Recent activity, with an estimated [Insert Number of M&A Deals here] deals, has primarily been driven by strategic regional expansion initiatives and consolidation efforts among smaller, niche operators seeking economies of scale or enhanced service portfolios.

Asia-Pacific Postal Services Market Industry Trends & Analysis

The Asia-Pacific postal services market is experiencing robust growth, driven by several key factors. The burgeoning e-commerce sector fuels an escalating demand for parcel delivery, particularly in countries like China, India, and Singapore. Furthermore, increased cross-border trade, coupled with rising disposable incomes in many Asian economies, contributes significantly to market expansion. Technological advancements like automated sorting systems and improved tracking capabilities enhance operational efficiency and customer satisfaction. However, competitive pressures from private courier companies and the need for sustained investment in infrastructure represent significant challenges. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is highest in urban areas but is progressively increasing in rural regions due to infrastructure developments and increased internet access. The shift toward sustainable practices, as evident in China's initiatives to reduce carbon emissions, also shapes industry trends.

Leading Markets & Segments in Asia-Pacific Postal Services Market

China stands as the undisputed leader in the Asia-Pacific postal services market, propelled by its immense population and the unparalleled expansion of its e-commerce sector. India and Japan are also prominent national markets, each with distinct structural characteristics and growth trajectories that contribute significantly to the regional landscape.

- Dominant Regions/Countries:

- China: The confluence of exceptionally high e-commerce penetration, a continuously developing and robust logistics infrastructure, and an enormous consumer base fuels unprecedented growth in its postal services sector.

- India: Rapid economic expansion, a burgeoning middle class with increasing disposable income, and proactive government initiatives aimed at enhancing logistics and infrastructure are pivotal growth drivers for the Indian postal market.

- Japan: A mature and highly efficient postal system, characterized by a strong emphasis on timely delivery, exceptional customer service standards, and technological integration, defines the Japanese market.

- Dominant Segments:

- Type: Express Postal Services are experiencing significantly higher growth rates compared to Standard Postal Services. This surge is directly attributable to the demands of the booming e-commerce sector, which prioritizes speed and reliability.

- Item: Parcel delivery has emerged as the dominant segment, outperforming the traditional letter segment due to the pervasive influence of e-commerce activities and the increasing volume of online retail transactions.

- Destination: The International segment is witnessing remarkable growth, driven by the substantial increase in cross-border e-commerce trade as consumers and businesses engage more readily in global online marketplaces.

Key Drivers for Dominant Markets:

- China: Sustained robust economic growth, significant government investment in advanced logistics infrastructure, and a vast and active consumer base are the primary forces propelling the market forward.

- India: A rapidly expanding e-commerce ecosystem, a growing and aspirational middle class, and strategic government-led initiatives focused on infrastructure development and digital connectivity are key enablers.

- Japan: High levels of consumer spending, a sophisticated and well-established logistics network, and a consistent focus on technological innovation and service enhancement contribute to market stability and growth.

Asia-Pacific Postal Services Market Product Developments

Recent product and service developments within the Asia-Pacific postal services market are strategically focused on elevating operational efficiency, enhancing real-time tracking capabilities, and significantly improving the overall customer experience. This includes the widespread adoption of advanced automation systems in sorting facilities, the seamless integration of mobile applications for intuitive tracking and delivery scheduling, and the introduction of specialized, tailored services designed specifically for the unique demands of e-commerce businesses. Furthermore, there is a pronounced and growing emphasis on sustainable logistics, manifested through the increasing utilization of electric vehicles for last-mile delivery and the adoption of eco-friendly packaging materials. These progressive advancements collectively bolster the competitive advantages of service providers by concurrently improving the speed, reliability, and environmental sustainability of their postal operations.

Key Drivers of Asia-Pacific Postal Services Market Growth

The growth of the Asia-Pacific postal services market is fuelled by several key factors:

- E-commerce Boom: The exponential rise of online shopping is driving significant demand for efficient and reliable delivery services.

- Economic Growth: Rising disposable incomes across many Asian economies are enhancing purchasing power and fueling demand for goods and services delivered through postal channels.

- Technological Advancements: Automation, improved tracking technologies, and digitalization are enhancing operational efficiencies and customer experience.

- Government Initiatives: Government investments in infrastructure and supportive policies foster market expansion.

Challenges in the Asia-Pacific Postal Services Market Market

The Asia-Pacific postal services market grapples with several significant challenges that impact its operational efficiency and growth potential:

- Infrastructure Gaps: Unevenly distributed and often inadequate infrastructure development across various regions, particularly in rural and remote areas, continues to impede efficient and cost-effective delivery. This directly translates to higher operational costs and extended delivery timelines, affecting customer satisfaction.

- Competitive Pressures: The market faces intense competition from a multitude of private courier companies and logistics providers. This heightened competition exerts considerable pressure on pricing strategies and profit margins, necessitating continuous efforts to optimize costs and differentiate services.

- Regulatory Hurdles: The presence of inconsistent and often complex regulatory frameworks across different countries within the Asia-Pacific region creates significant operational complexities. Navigating these diverse regulations increases compliance costs and can act as a barrier to seamless cross-border operations.

- Supply Chain Disruptions: The market remains vulnerable to unforeseen global events, including pandemics, geopolitical instability, and natural disasters. Such disruptions can severely impact supply chains, disrupt operational continuity, and lead to substantial revenue losses, highlighting the need for enhanced resilience.

Emerging Opportunities in Asia-Pacific Postal Services Market

The Asia-Pacific postal services market presents several lucrative opportunities:

- Last-Mile Delivery Solutions: Improving last-mile delivery efficiency and scalability remains a crucial area for innovation and growth.

- Cross-Border E-commerce: Expansion into cross-border e-commerce logistics offers significant market expansion potential.

- Strategic Partnerships: Collaborations between postal operators and technology companies can unlock innovations in service delivery and automation.

- Sustainable Practices: Adopting eco-friendly practices, such as utilizing electric vehicles and recyclable packaging, can attract environmentally conscious customers and enhance brand image.

Leading Players in the Asia-Pacific Postal Services Market Sector

- Korea Post

- China Post Group Corporation

- NZ Post

- DHL

- Thailand Post

- Australian Postal Corporation

- Hongkong Post

- FedEx

- India Post

- Singapore Post Limited

- Japan Post Co Ltd

- DTDC EXPRESS LTD

- Pos Malaysia Berhad

- Pos Indonesia

Key Milestones in Asia-Pacific Postal Services Market Industry

- September 2022: The Australian Government and Australia Post launched the Pacific Postal Development Partnership, receiving a USD 450,000 contribution to improve Pacific Island postal services. This demonstrates a commitment to enhancing regional connectivity and supporting businesses.

- July 2022: China's postal sector announced its commitment to a green transformation, aiming to recycle 700 Million corrugated boxes and utilize 10 Million boxes with recyclable packaging. This highlights the growing importance of sustainability within the industry.

Strategic Outlook for Asia-Pacific Postal Services Market Market

The Asia-Pacific postal services market is strategically positioned for sustained and robust growth, underpinned by the relentless expansion of e-commerce, continuous technological advancements, and increasingly supportive government policies across the region. Key strategic opportunities lie in aggressively embracing and integrating innovative technological solutions, forging mutually beneficial strategic partnerships to expand service offerings and market reach, and strategically expanding operations into high-growth emerging markets. Companies that demonstrate agility in adapting to evolving consumer preferences, proactively invest in modernizing their infrastructure, and prioritize sustainability initiatives will be exceptionally well-positioned to capitalize on the market's significant long-term potential. The overarching focus on sustainability and the implementation of green logistics will undoubtedly shape future market strategies and define competitive advantages.

Asia-Pacific Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Asia-Pacific Postal Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Postal Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Postal Services Market

Asia-Pacific Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Liberalization Affecting the Market Share of Designated Operators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NZ Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thailand Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Australian Postal Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 India Post

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Post Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Japan Post Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC EXPRESS LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pos Malaysia Berhad

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pos Indonesia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Korea Post

List of Figures

- Figure 1: Asia-Pacific Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia-Pacific Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Asia-Pacific Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Postal Services Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Postal Services Market?

Key companies in the market include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post**List Not Exhaustive, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, Pos Indonesia.

3. What are the main segments of the Asia-Pacific Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Liberalization Affecting the Market Share of Designated Operators.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Australian Government and Australia Post announced a new Pacific Postal Development Partnership to strengthen postal services in the Pacific by signing a joint declaration with the Universal Postal Union (UPU) and Asian-Pacific Postal Union (APPU) to improve the efficiency and security of postal services between Australia and Pacific island countries, benefiting consumers and businesses. To support the three-year partnership, the government has provided Australia Post with a USD 450,000 contribution to target improvements to postal systems, processes, technology, and training in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Postal Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence