Key Insights

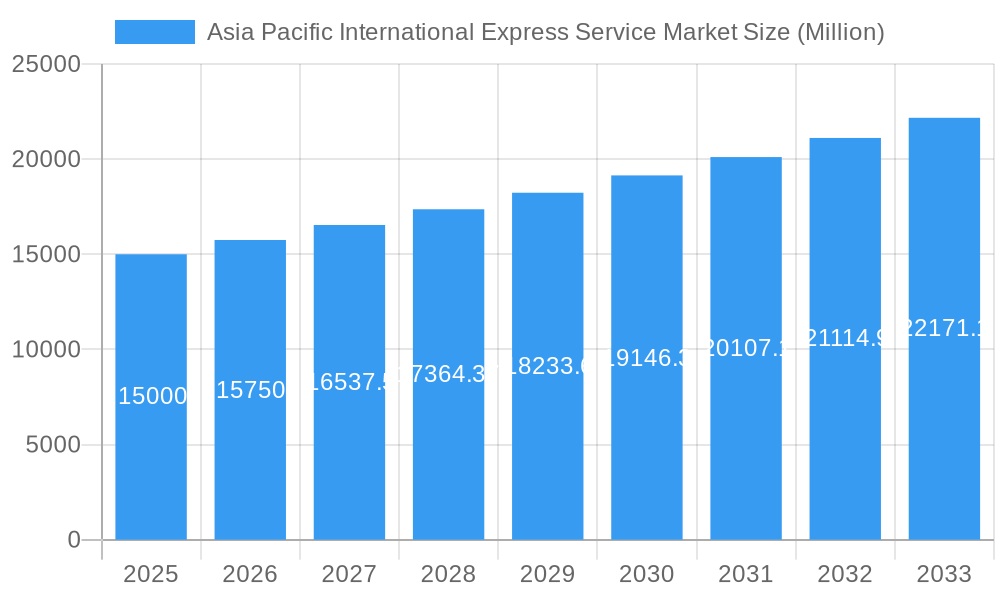

The Asia Pacific International Express Service market is experiencing robust growth, driven by the region's expanding e-commerce sector, increasing cross-border trade, and the rise of global supply chains. With a Compound Annual Growth Rate (CAGR) exceeding 5%, the market size, estimated at $XX million in 2025, is projected to reach substantial heights by 2033. Key growth drivers include the rapid digitalization of businesses across the region, a burgeoning middle class with increased disposable income fueling online shopping, and the continuous improvement of logistics infrastructure, including improved airport and port facilities and advanced tracking technologies. While challenges exist, such as geopolitical uncertainties and fluctuations in fuel prices, the long-term outlook remains positive. The market segmentation by shipment weight (heavy, medium, and light) reflects diverse customer needs and operational complexities, each segment exhibiting different growth trajectories. Major players such as China Post, DHL, FedEx, UPS, and others are actively investing in technological advancements and strategic partnerships to enhance their market share and cater to the evolving demands of shippers and consumers. The dominance of certain companies in specific regional markets within Asia Pacific, such as China Post in China or SF Express in several Asian countries, further shapes the competitive landscape.

Asia Pacific International Express Service Market Market Size (In Billion)

The Asia Pacific region's diverse economies and varying levels of infrastructure development create opportunities and challenges. While countries like China, Japan, South Korea, and India represent significant market segments, other nations within the Asia-Pacific region also contribute to the market's overall growth. The market's growth will be influenced by factors like government regulations affecting international trade, the adoption of e-commerce platforms, and the effectiveness of last-mile delivery solutions. Continued expansion in e-commerce, particularly cross-border B2C transactions, is expected to fuel demand for reliable and efficient international express services. The increased focus on supply chain resilience and the optimization of logistics networks will also play a crucial role in shaping the future landscape of this dynamic market. The competitive dynamics will continue to be shaped by mergers, acquisitions, and technological innovations.

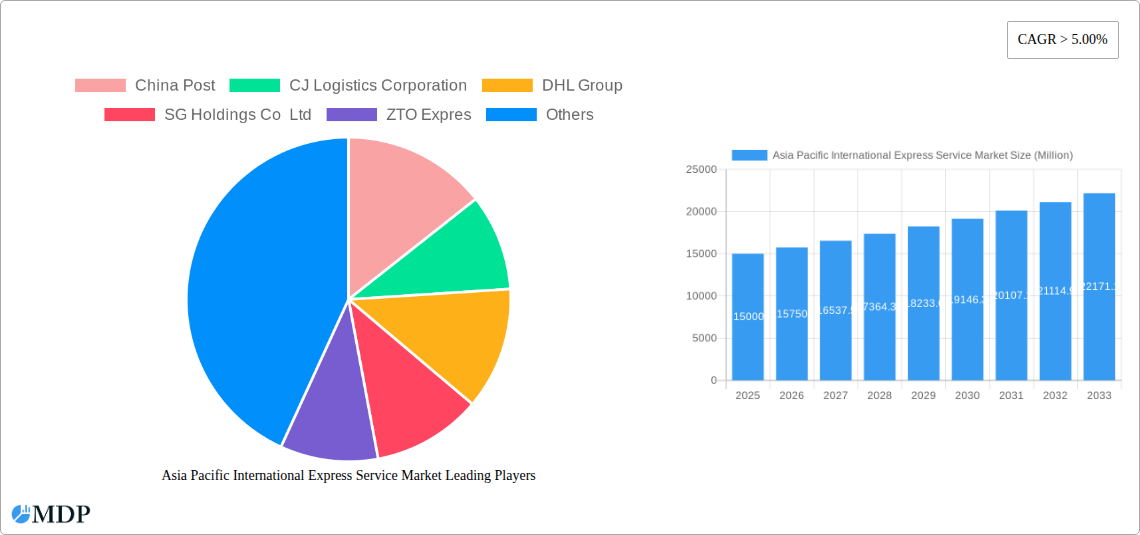

Asia Pacific International Express Service Market Company Market Share

Asia Pacific International Express Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific International Express Service Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, leading players, emerging trends, and future growth opportunities, equipping stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The report is based on extensive research and data analysis, providing actionable intelligence for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific International Express Service Market Market Dynamics & Concentration

The Asia Pacific International Express Service Market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is moderately high, with several major players holding significant market share. However, the emergence of smaller, agile companies and technological advancements are fostering competition.

The market exhibits a complex regulatory landscape varying across countries, influencing operational costs and strategies. While established players benefit from economies of scale, innovative startups are disrupting the market through technological advancements, particularly in automation and data analytics.

Several key dynamics shape the market:

- Market Share: DHL Group, FedEx, and UPS hold substantial market share, exceeding xx% collectively in 2024. However, regional players like SF Express (KEX-SF) and CJ Logistics Corporation are increasing their presence.

- M&A Activity: The past five years have seen xx M&A deals, reflecting strategic consolidation and expansion efforts within the market. These deals are primarily driven by the need to expand geographical reach, enhance technological capabilities, and access new customer segments.

- Innovation Drivers: Automation, AI-powered logistics, and improved tracking systems are key innovation drivers. Companies are investing heavily in these technologies to optimize delivery times, reduce costs, and enhance customer experience.

- Regulatory Frameworks: Varying regulations across different countries in Asia-Pacific influence operational costs, compliance requirements, and market access. This complexity necessitates strategic adaptation by market players.

- Product Substitutes: While traditional express delivery remains dominant, alternative solutions like e-commerce fulfillment networks and specialized niche players are emerging, posing a competitive threat.

- End-User Trends: The rise of e-commerce, increasing consumer expectations for faster delivery, and the growth of cross-border trade drive substantial market demand.

Asia Pacific International Express Service Market Industry Trends & Analysis

The Asia Pacific International Express Service Market is experiencing robust growth fueled by several factors. The increasing prevalence of e-commerce, particularly in rapidly developing economies, fuels the demand for efficient and reliable express delivery services. Furthermore, rising disposable incomes across the region are empowering consumers to purchase more goods online, boosting demand further. Technological advancements are transforming the industry, enabling faster and more efficient delivery through automation, AI, and data analytics.

Companies are investing heavily in improving their logistics networks, incorporating sophisticated tracking systems, and expanding their delivery reach to remote areas. This investment is driven by both consumer expectations for increased transparency and efficiency in delivery, and the competitive pressure to provide superior service. The increasing integration of technology into all aspects of the supply chain, from order placement to final delivery, is streamlining operations and reducing costs.

These technological advancements are not only enhancing efficiency but also improving the overall customer experience. Real-time tracking capabilities, automated notifications, and improved customer service response times are becoming the norm, shaping consumer preferences. The growing adoption of mobile apps and digital platforms for booking and tracking shipments further contributes to this trend.

Competitive dynamics are fierce, with both established multinational corporations and regional players vying for market share. Companies are employing various strategies to maintain a competitive edge, including strategic partnerships, acquisitions, and investments in technological innovation. Price competitiveness, while important, is increasingly being balanced against factors such as service quality, delivery speed, and reliability.

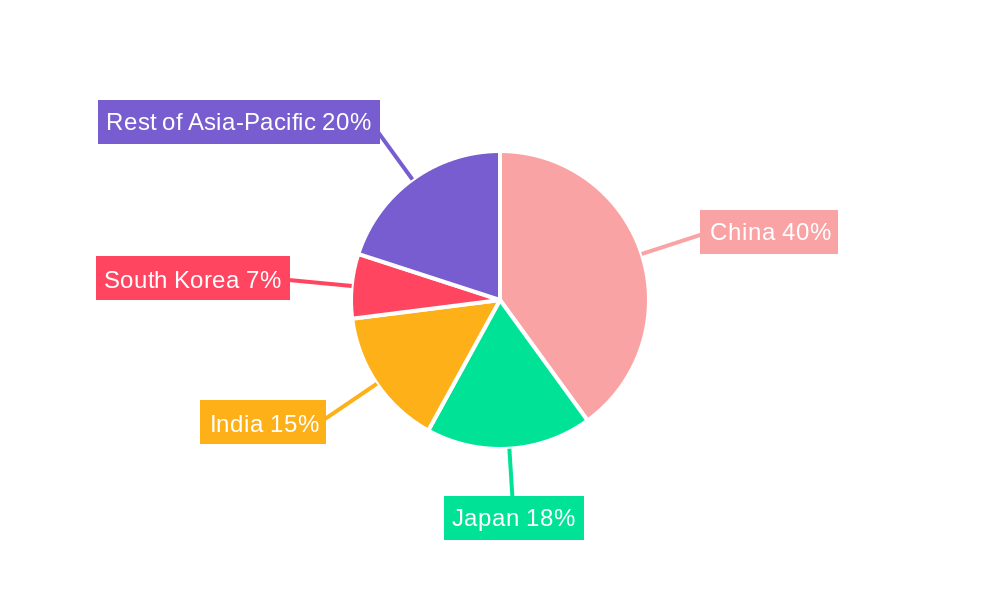

Leading Markets & Segments in Asia Pacific International Express Service Market

China remains the dominant market in the Asia Pacific region, accounting for approximately xx% of the total market value in 2024. This dominance is driven by several factors:

- Strong E-commerce Growth: China boasts a massive and rapidly expanding e-commerce sector, consistently contributing to significant demand for express delivery services.

- Robust Infrastructure: Significant investments in infrastructure, including transportation networks and logistics facilities, have enhanced the efficiency and capacity of the express delivery system in China.

- Government Support: Supportive government policies and initiatives aimed at promoting the growth of e-commerce and logistics further facilitate the sector's expansion.

Segment Dominance:

- Light Weight Shipments: This segment dominates the market owing to the surge in e-commerce, with a xx% market share in 2024. The growing popularity of online retail and the prevalence of smaller packages contribute to its substantial volume.

- Medium Weight Shipments: This segment displays steady growth propelled by the rising demand for business-to-business and business-to-consumer deliveries. It holds an estimated xx% market share in 2024.

- Heavy Weight Shipments: This segment demonstrates slower growth compared to others, mainly due to its dependence on specific industries and logistical challenges associated with handling large shipments. It comprises approximately xx% of the market share in 2024.

Other leading markets include Japan, India, South Korea, and Australia, each exhibiting robust growth driven by unique economic factors and infrastructure developments.

Asia Pacific International Express Service Market Product Developments

Recent product developments focus heavily on technological integration to improve efficiency and customer experience. This includes the adoption of AI-powered routing optimization, autonomous delivery vehicles, advanced tracking systems, and automated sorting facilities. These innovations enhance delivery speed, reduce operational costs, and improve the overall reliability of express delivery services. The market sees a strong trend towards customized solutions tailored to specific industry needs, reflecting the increasing demand for specialized logistics services across various sectors.

Key Drivers of Asia Pacific International Express Service Market Growth

Several key factors contribute to the market's robust growth:

- E-commerce Expansion: The explosive growth of e-commerce across the Asia-Pacific region is the primary driver, creating substantial demand for efficient and reliable delivery services.

- Rising Disposable Incomes: Increased disposable incomes in several Asian countries lead to higher consumer spending, boosting demand for online purchases and subsequently, express delivery.

- Technological Advancements: Innovations in automation, AI, and data analytics are streamlining operations, improving efficiency, and reducing costs, further propelling market expansion.

- Government Initiatives: Government support in several countries through infrastructure development and policy changes create a favorable environment for market growth.

Challenges in the Asia Pacific International Express Service Market Market

Several challenges hinder market growth:

- Infrastructure Gaps: Uneven infrastructure development across the region presents logistical challenges, particularly in reaching remote areas. This leads to increased delivery times and costs in certain regions.

- Regulatory Hurdles: Inconsistent regulatory frameworks across different countries create complexity and compliance issues for operators.

- Intense Competition: The market is highly competitive, with established players and new entrants vying for market share, increasing pricing pressure. This competitiveness necessitates continuous innovation and strategic adaptation for survival and growth.

Emerging Opportunities in Asia Pacific International Express Service Market

Significant opportunities exist for long-term growth:

- Technological Breakthroughs: Continued investment in AI, automation, and drone technology will drive efficiency gains and open up new possibilities for last-mile delivery.

- Strategic Partnerships: Collaboration between express delivery companies and e-commerce platforms will enhance logistics efficiency and improve service offerings.

- Market Expansion: Expanding into underserved markets within the Asia Pacific region will unlock significant growth potential.

Leading Players in the Asia Pacific International Express Service Market Sector

- China Post

- CJ Logistics Corporation

- DHL Group

- SG Holdings Co Ltd

- ZTO Express

- FedEx

- United Parcel Service of America Inc (UPS)

- YTO Express

- Yamato Holdings

- SF Express (KEX-SF)

- Blue Dart Express

- DTDC Express Limited

- Toll Group

- JWD Group

Key Milestones in Asia Pacific International Express Service Market Industry

- June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China, signifying a significant advancement in last-mile delivery technology.

- April 2023: China Post and Ping An Bank launched an intelligent archives service center, integrating auto finance and express logistics, illustrating growing industry convergence.

- March 2023: Colowide MD Co. Ltd and Yamato Transport Co. Ltd entered an agreement to optimize supply chains, highlighting the increasing importance of supply chain visualization and efficiency.

Strategic Outlook for Asia Pacific International Express Service Market Market

The Asia Pacific International Express Service Market exhibits significant growth potential over the next decade. Continued expansion of e-commerce, coupled with technological advancements, presents substantial opportunities for market players. Strategic partnerships, investments in advanced logistics technologies, and expansion into underserved markets will be crucial for companies to capitalize on this growth. Companies focused on improving customer experience, enhancing supply chain visibility, and offering customized solutions are well-positioned to succeed in this competitive and dynamic market.

Asia Pacific International Express Service Market Segmentation

-

1. Shipment Weight

- 1.1. Heavy Weight Shipments

- 1.2. Light Weight Shipments

- 1.3. Medium Weight Shipments

-

2. End User Industry

- 2.1. E-Commerce

- 2.2. Financial Services (BFSI)

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Primary Industry

- 2.6. Wholesale and Retail Trade (Offline)

- 2.7. Others

Asia Pacific International Express Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific International Express Service Market Regional Market Share

Geographic Coverage of Asia Pacific International Express Service Market

Asia Pacific International Express Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific International Express Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.1.1. Heavy Weight Shipments

- 5.1.2. Light Weight Shipments

- 5.1.3. Medium Weight Shipments

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. E-Commerce

- 5.2.2. Financial Services (BFSI)

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Primary Industry

- 5.2.6. Wholesale and Retail Trade (Offline)

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CJ Logistics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SG Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZTO Expres

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamato Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SF Express (KEX-SF)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Blue Dart Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC Express Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toll Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JWD Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 China Post

List of Figures

- Figure 1: Asia Pacific International Express Service Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific International Express Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific International Express Service Market Revenue undefined Forecast, by Shipment Weight 2020 & 2033

- Table 2: Asia Pacific International Express Service Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 3: Asia Pacific International Express Service Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific International Express Service Market Revenue undefined Forecast, by Shipment Weight 2020 & 2033

- Table 5: Asia Pacific International Express Service Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 6: Asia Pacific International Express Service Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific International Express Service Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific International Express Service Market?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the Asia Pacific International Express Service Market?

Key companies in the market include China Post, CJ Logistics Corporation, DHL Group, SG Holdings Co Ltd, ZTO Expres, FedEx, United Parcel Service of America Inc (UPS), YTO Express, Yamato Holdings, SF Express (KEX-SF), Blue Dart Express, DTDC Express Limited, Toll Group, JWD Group.

3. What are the main segments of the Asia Pacific International Express Service Market?

The market segments include Shipment Weight, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China. The intelligent delivery solution relies on a combination of unmanned vehicles outdoors and robots indoors, constructing an integrated indoor and outdoor unmanned distribution mode and developing a last-mile logistics network with AI transport capacity sharing.April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong to promote the service integration of auto finance and express and logistics businesses.March 2023: Colowide MD Co. Ltd, which oversees merchandising for the Colowide Group, and Yamato Transport Co. Ltd entered an agreement. The two companies will promote the visualization and optimization of the entire supply chain of Colowide Group, which operates multiple brands such as Gyu-Kaku, Kappa Sushi, and OOTOYA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific International Express Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific International Express Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific International Express Service Market?

To stay informed about further developments, trends, and reports in the Asia Pacific International Express Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence