Key Insights

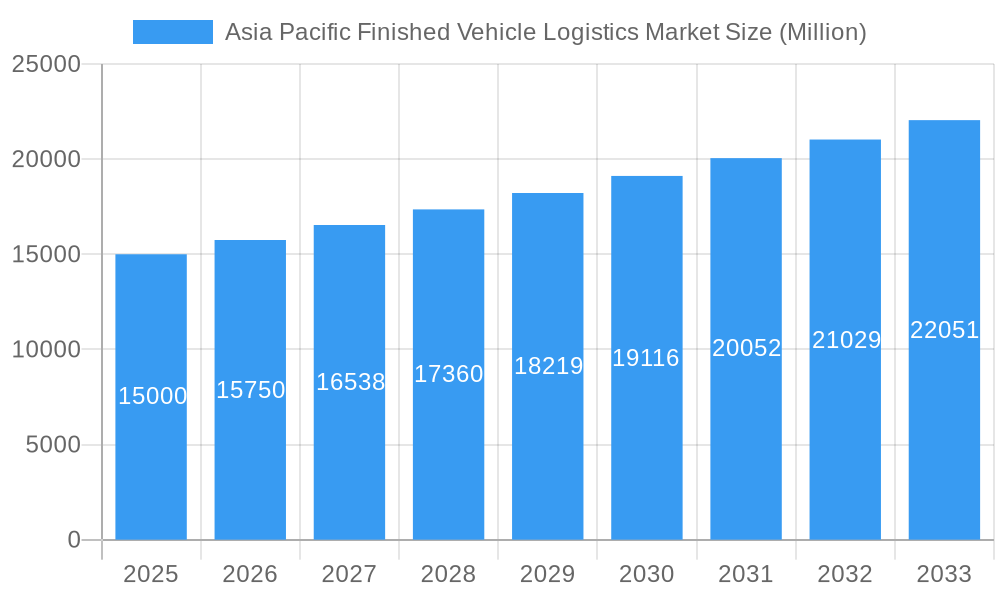

The Asia Pacific finished vehicle logistics market is poised for substantial expansion, propelled by a thriving automotive sector and escalating vehicle production across the region. The market, projected to reach $172.3 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. Key growth catalysts include rising disposable incomes driving consumer vehicle demand, expansion of automotive manufacturing hubs in China, India, and Thailand, and the growing influence of e-commerce on automotive sales, necessitating sophisticated logistics networks. Significant market trends encompass the adoption of advanced technologies such as telematics for optimized fleet management and real-time tracking, increasing investments in sustainable logistics to minimize environmental impact, and a growing preference for integrated logistics providers offering end-to-end solutions from inbound to outbound and value-added services. Challenges include regional infrastructure constraints, volatile fuel prices, and stringent environmental regulations. The market is segmented by activity (transport – rail, road, air, sea; warehousing; value-added services) and logistics service (inbound, outbound, reverse logistics, aftermarket logistics). Leading players including DHL, Kuehne + Nagel, and Yusen Logistics are actively competing, fostering innovation. China, Japan, and India dominate the market, with Indonesia, Thailand, and Australia showing strong growth potential. The forecast period (2025-2033) presents significant opportunities for both established companies and new entrants, emphasizing digitalization, sustainability, and strategic regional expansion.

Asia Pacific Finished Vehicle Logistics Market Market Size (In Billion)

The robust growth of the Asia Pacific finished vehicle logistics market is attributed to a confluence of factors. Escalating vehicle demand, fueled by expanding middle-class populations and sustained economic development, is a primary driver. The strategic positioning of many Asia Pacific nations within global supply chains further supports market expansion. Automotive manufacturers in the region are increasingly investing in advanced logistics solutions to enhance efficiency, reduce operational costs, and meet evolving customer expectations for expedited delivery. The integration of technologies like blockchain and IoT is expected to accelerate market growth by improving transparency and traceability across the supply chain. However, geopolitical uncertainties, potential trade disputes, and currency exchange rate fluctuations pose potential risks that market participants must navigate. Consequently, proactive risk assessment and mitigation strategies are imperative for ensuring sustained growth and profitability within this dynamic market landscape.

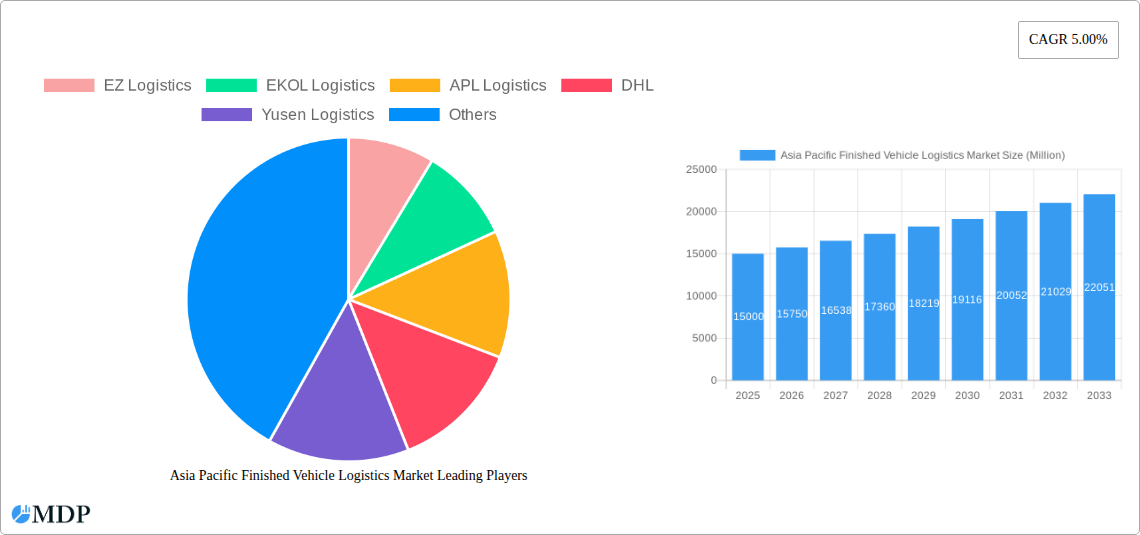

Asia Pacific Finished Vehicle Logistics Market Company Market Share

Asia Pacific Finished Vehicle Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Finished Vehicle Logistics Market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market dynamics, trends, leading players, and future opportunities. The report utilizes rigorous data analysis and expert insights to forecast market growth and identify key strategic imperatives. Download now to gain a competitive edge.

Asia Pacific Finished Vehicle Logistics Market Market Dynamics & Concentration

The Asia Pacific Finished Vehicle Logistics market is experiencing significant growth, driven by factors such as increasing vehicle production, expanding e-commerce, and robust infrastructure development. Market concentration is moderate, with several key players holding substantial market share. However, the market also displays fragmentation with numerous smaller regional operators.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This indicates a moderately consolidated market.

- Innovation Drivers: Technological advancements, including automation, AI, and IoT, are driving innovation and enhancing efficiency in logistics operations.

- Regulatory Frameworks: Varying regulations across different countries in the Asia Pacific region influence logistics costs and operational efficiency. Harmonization efforts are gradually improving the regulatory landscape.

- Product Substitutes: While limited direct substitutes exist, alternative transportation modes and technological solutions offer some degree of substitution.

- End-User Trends: The increasing demand for faster delivery times and enhanced supply chain transparency influences logistics service provider selections. The rise of direct-to-consumer models is reshaping logistics requirements.

- M&A Activities: The number of M&A deals in the market has increased in recent years, indicating a trend toward consolidation and expansion. We estimate xx M&A deals occurred between 2019 and 2024.

Asia Pacific Finished Vehicle Logistics Market Industry Trends & Analysis

The Asia Pacific Finished Vehicle Logistics market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The rapid expansion of the automotive industry, particularly in countries like China and India, is a primary driver. Technological disruptions, such as the adoption of blockchain technology and advanced analytics, are enhancing efficiency and transparency throughout the supply chain. Evolving consumer preferences, with a greater focus on speed and reliability, are impacting logistics service provider choices. The competitive landscape is dynamic, with ongoing investments in infrastructure and technological improvements. Market penetration of advanced logistics solutions is gradually increasing, with xx% penetration expected by 2033. Challenges, such as infrastructure gaps in some regions and geopolitical uncertainties, present headwinds to growth.

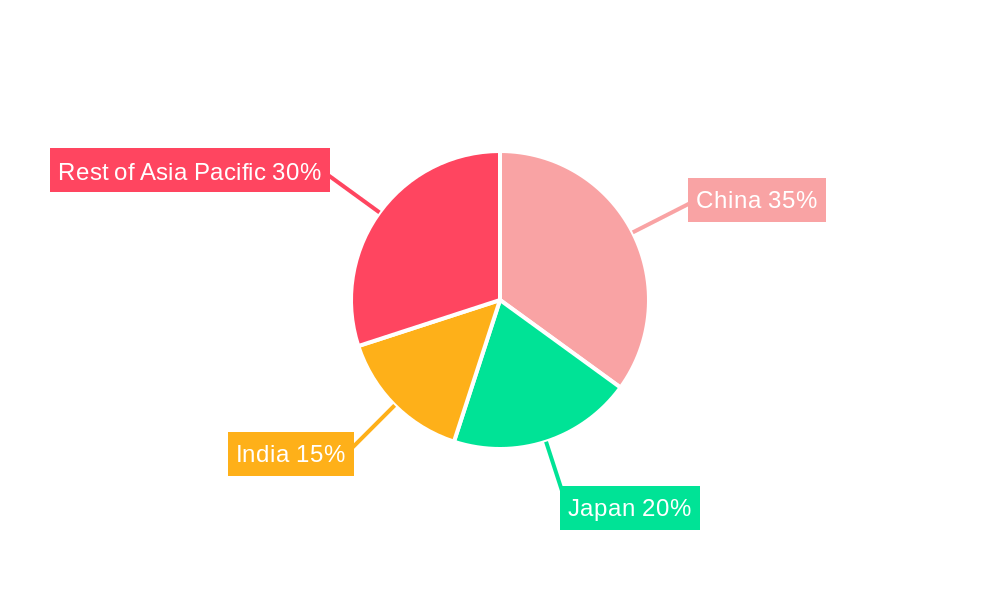

Leading Markets & Segments in Asia Pacific Finished Vehicle Logistics Market

China remains the dominant market in the Asia Pacific region, accounting for approximately xx% of the total market value in 2025. Other key markets include Japan, India, and Indonesia. The sea transport segment holds the largest share within the Activity segment, driven by the cost-effectiveness of shipping large volumes.

- Key Drivers for China:

- Robust automotive manufacturing sector.

- Extensive port infrastructure.

- Favorable government policies supporting logistics development.

- Key Drivers for India:

- Rapid growth in vehicle production and sales.

- Increasing investments in infrastructure development.

- Expanding e-commerce sector.

- Key Drivers for Japan:

- Highly developed logistics infrastructure.

- Efficient transportation networks.

- Sophisticated technology adoption.

- Dominant Segment: Sea transport, due to its cost-effectiveness for large-volume shipments, is the dominant segment within the "Activity" category, accounting for approximately xx% of the total market in 2025. Outbound logistics services constitute a significant portion of the Logistics Services segment, due to increasing vehicle exports from the region.

Asia Pacific Finished Vehicle Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, transparency, and security in vehicle logistics. This includes the development of advanced tracking systems, automated warehousing solutions, and optimized routing algorithms. The integration of IoT devices and AI-powered platforms is improving real-time visibility and predictive analytics capabilities. These innovations improve efficiency, reduce costs and meet the growing demand for faster and more reliable delivery.

Key Drivers of Asia Pacific Finished Vehicle Logistics Market Growth

Several factors are fueling market growth. Firstly, the burgeoning automotive industry in the region presents enormous demand. Secondly, the increasing adoption of e-commerce is transforming logistics needs. Thirdly, government investments in infrastructure upgrades, such as improved road and rail networks, are facilitating seamless transportation. Finally, technological advancements, especially in automation and data analytics, are significantly enhancing operational efficiency.

Challenges in the Asia Pacific Finished Vehicle Logistics Market Market

The Asia Pacific Finished Vehicle Logistics market faces several challenges. Infrastructure limitations in certain regions hinder efficient transportation and increase logistics costs. Fluctuations in fuel prices and geopolitical uncertainties disrupt supply chains and impact operational stability. Intense competition among logistics providers necessitates continuous innovation and cost optimization to maintain market share. These challenges collectively impose a xx Million impact on the market in 2025, hindering potential growth.

Emerging Opportunities in Asia Pacific Finished Vehicle Logistics Market

The market presents significant long-term opportunities. The expansion of e-commerce continues to drive demand for faster and more reliable delivery services. The increasing adoption of sustainable logistics practices presents opportunities for environmentally conscious providers. Strategic partnerships between logistics firms and technology companies can leverage technological advancements to enhance efficiency and improve services. Moreover, the growing focus on supply chain resilience in response to global disruptions provides opportunities for those offering robust and adaptable solutions.

Leading Players in the Asia Pacific Finished Vehicle Logistics Market Sector

- EZ Logistics

- EKOL Logistics

- APL Logistics

- DHL

- Yusen Logistics

- Kühne + Nagel

- VASCOR Logistics

- CEVA Logistics

- GEFCO

- DSV

Key Milestones in Asia Pacific Finished Vehicle Logistics Market Industry

- September 2022: DHL Supply Chain plans a EUR 500 Million investment in India over five years, significantly boosting its capacity and market presence.

- January 2023: DHL Supply Chain announces a EUR 10 Million investment in Northern Taiwan to expand its facilities for the LSHC and semiconductor industries, enhancing its regional footprint.

Strategic Outlook for Asia Pacific Finished Vehicle Logistics Market Market

The Asia Pacific Finished Vehicle Logistics market is poised for sustained growth, driven by robust economic expansion, technological advancements, and evolving consumer preferences. Strategic opportunities exist for companies focused on innovation, sustainability, and building resilient supply chains. Companies that can adapt quickly to changing market dynamics and leverage technological advancements will be best positioned to capture significant market share. The market's long-term potential remains substantial, offering attractive returns for strategic investors.

Asia Pacific Finished Vehicle Logistics Market Segmentation

-

1. Activity

- 1.1. Transport (Rail, Road, Air, Sea)

- 1.2. Warehouse

- 1.3. Value Added Services

-

2. Logistics Service

- 2.1. Inbound

- 2.2. Outbound

- 2.3. Others ( Reverse and Aftermarket)

Asia Pacific Finished Vehicle Logistics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Finished Vehicle Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific Finished Vehicle Logistics Market

Asia Pacific Finished Vehicle Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs

- 3.4. Market Trends

- 3.4.1. Rise in Automotive Logistics Outsourcing in the Asia Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transport (Rail, Road, Air, Sea)

- 5.1.2. Warehouse

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Logistics Service

- 5.2.1. Inbound

- 5.2.2. Outbound

- 5.2.3. Others ( Reverse and Aftermarket)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EZ Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EKOL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 APL Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuhene + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VASCOR Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEFCO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EZ Logistics

List of Figures

- Figure 1: Asia Pacific Finished Vehicle Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Finished Vehicle Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 2: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Logistics Service 2020 & 2033

- Table 3: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 5: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Logistics Service 2020 & 2033

- Table 6: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Finished Vehicle Logistics Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Asia Pacific Finished Vehicle Logistics Market?

Key companies in the market include EZ Logistics, EKOL Logistics, APL Logistics, DHL, Yusen Logistics, Kuhene + Nagel, VASCOR Logistics**List Not Exhaustive, CEVA Logistics, GEFCO, DSV.

3. What are the main segments of the Asia Pacific Finished Vehicle Logistics Market?

The market segments include Activity, Logistics Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.3 billion as of 2022.

5. What are some drivers contributing to market growth?

The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities.

6. What are the notable trends driving market growth?

Rise in Automotive Logistics Outsourcing in the Asia Pacific Region.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs.

8. Can you provide examples of recent developments in the market?

January 2023: DHL Supply Chain has disclosed its five-year plans for facility growth in Northern Taiwan. The investment of EUR 10 million (NTD 320 million) would expand DHL Supply Chain's market reach and meet the logistics needs of the LSHC and semiconductor industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Finished Vehicle Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Finished Vehicle Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Finished Vehicle Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Finished Vehicle Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence