Key Insights

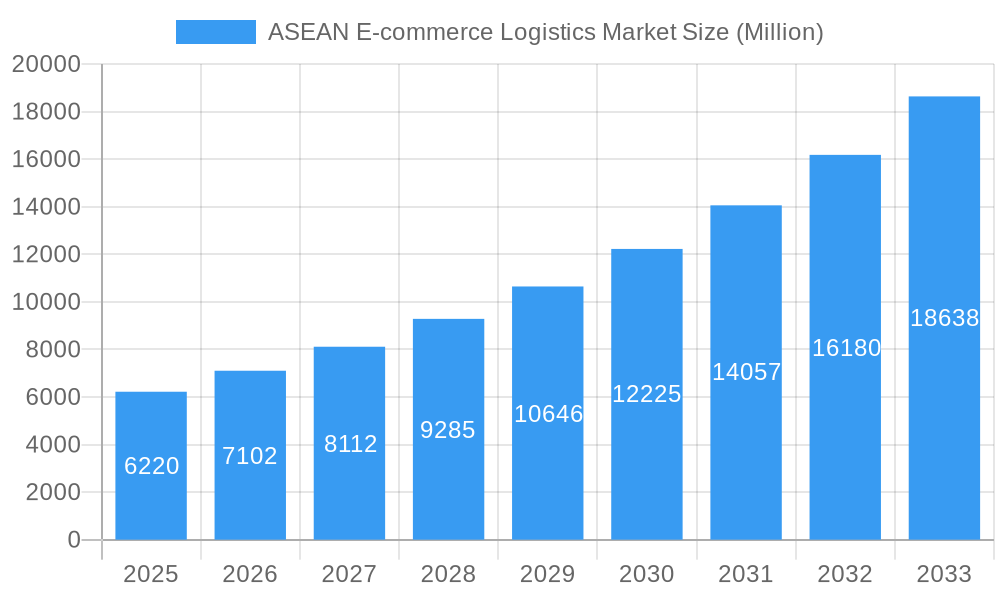

The ASEAN e-commerce logistics market is experiencing robust growth, projected to reach a market size of $6.22 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rapid rise of e-commerce across the region, driven by increasing internet and smartphone penetration, particularly amongst younger demographics, is creating a significant demand for efficient and reliable logistics solutions. Secondly, the increasing adoption of innovative technologies such as automation, AI-powered route optimization, and advanced warehousing systems are streamlining operations and improving delivery times, thus enhancing customer satisfaction and driving market growth. Furthermore, the growing preference for faster and more convenient delivery options, including same-day and next-day delivery services, is putting pressure on logistics providers to constantly upgrade their infrastructure and capabilities. Finally, the expansion of cross-border e-commerce within ASEAN, facilitated by regional trade agreements and improved connectivity, is opening new avenues for growth. Competition is fierce amongst established players like FedEx, UPS, and DHL, as well as rapidly expanding regional players like J&T Express, Ninja Van, and Kerry Express.

ASEAN E-commerce Logistics Market Market Size (In Billion)

The market segmentation reveals significant opportunities. B2C e-commerce is currently the dominant segment, but B2B logistics is showing strong growth potential as businesses increasingly leverage online platforms for procurement. Product categories like fashion and apparel, consumer electronics, and home appliances are key drivers, reflecting consumer preferences in the region. While Singapore, Malaysia, and Thailand are currently leading markets, significant untapped potential exists in countries like Vietnam, Indonesia, and the Philippines, offering significant growth opportunities for logistics providers willing to invest in infrastructure and local expertise. Challenges remain, including varying levels of infrastructure development across the region, regulatory complexities, and the need to address last-mile delivery challenges in densely populated urban areas. Addressing these challenges will be crucial for sustained growth and ensuring the seamless integration of e-commerce logistics into the ASEAN economic landscape.

ASEAN E-commerce Logistics Market Company Market Share

ASEAN E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN e-commerce logistics market, covering market dynamics, industry trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly expanding market. The market size is projected to reach xx Million by 2033.

ASEAN E-commerce Logistics Market Market Dynamics & Concentration

The ASEAN e-commerce logistics market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with several major players holding significant shares, while numerous smaller companies compete within specific niches. Innovation is a key driver, with companies constantly investing in technological advancements to enhance efficiency and scalability. The regulatory landscape varies across ASEAN countries, presenting both opportunities and challenges. The emergence of substitute services, such as drone delivery, is also impacting the market dynamics. End-user trends, such as increasing demand for faster and more reliable delivery, are shaping the market's evolution. M&A activity has been relatively high in recent years, with several large players acquiring smaller firms to expand their market reach and service offerings.

- Market Share: J&T Express and Ninja Van hold a combined xx% market share, while other major players such as DHL and FedEx maintain significant, but smaller, portions. Smaller, regional players account for the remaining xx%.

- M&A Deal Count: Over xx M&A deals were recorded between 2019 and 2024, reflecting the competitive landscape and strategic consolidation within the sector.

ASEAN E-commerce Logistics Market Industry Trends & Analysis

The ASEAN e-commerce logistics market is experiencing a period of dynamic expansion and transformation. The primary catalyst remains the exponential growth of e-commerce, fueled by a confluence of factors including widespread internet and smartphone adoption, rising disposable incomes, and a rapidly expanding middle class across the region. This surge in online retail necessitates more sophisticated and efficient logistics networks. Technological advancements are at the forefront of this evolution, with AI-powered logistics solutions, autonomous systems for warehousing and delivery, and sophisticated real-time tracking platforms revolutionizing operational efficiencies and significantly elevating the customer experience. Consumers' expectations for speed and convenience are continually rising, leading to a greater demand for same-day and next-day delivery services, compelling logistics providers to optimize their networks. The competitive landscape is fierce, prompting continuous innovation and strategic pricing adjustments, which ultimately benefit consumers. However, this intense competition also places a premium on operational excellence and strategic foresight for logistics companies. The compound annual growth rate (CAGR) for the ASEAN e-commerce logistics market is projected to be robust, estimated at **[Insert Specific CAGR Here]%** during the forecast period (2025-2033), with market penetration expected to reach **[Insert Specific Penetration % Here]%** by 2033, indicating substantial untapped potential.

Leading Markets & Segments in ASEAN E-commerce Logistics Market

Indonesia and Vietnam currently stand out as the dominant markets within the ASEAN e-commerce logistics landscape, largely attributed to their substantial populations and burgeoning e-commerce sectors. However, it is crucial to note that every country within the ASEAN region is witnessing remarkable growth in this domain, each with its unique opportunities and challenges.

-

By Service: While Transportation continues to hold the largest share, segments like Warehousing and Inventory Management are experiencing accelerated growth. This is driven by the increasing need for robust and integrated supply chain solutions that can handle the complexities of e-commerce fulfillment. Furthermore, the demand for Value-Added Services, such as customization, packaging, and returns management, is escalating as businesses seek to differentiate themselves and enhance the overall customer journey.

-

By Business: The B2C (Business-to-Consumer) segment overwhelmingly dominates the market, a direct reflection of the widespread popularity and convenience of online shopping for individual consumers. The B2B (Business-to-Business) segment is also exhibiting steady and promising growth, propelled by the increasing adoption of e-procurement platforms and online wholesale marketplaces that streamline business transactions.

-

By Destination: Domestic delivery remains the cornerstone of the ASEAN e-commerce logistics market, catering to the vast majority of intra-country transactions. However, there is a significant and accelerating trend in Cross-Border E-commerce logistics, fueled by the proliferation of global marketplaces and the growing consumer appetite for international products.

-

By Product: Key product categories driving e-commerce logistics include Fashion and Apparel, Consumer Electronics, and Beauty and Personal Care products. While these categories lead, it's important to recognize that all product categories are experiencing substantial growth, underscoring the broad appeal and expanding reach of online retail across diverse consumer goods.

-

By Country: As mentioned, Indonesia and Vietnam are leading markets due to their demographic advantages and high e-commerce adoption rates. Singapore, Malaysia, Thailand, and the Philippines are also demonstrating strong growth potential, with each country offering unique opportunities for logistics providers to tap into.

-

Key Drivers: The sustained growth of the ASEAN e-commerce logistics market is underpinned by several critical drivers. These include favorable government policies actively promoting the development of the digital economy and e-commerce ecosystems. Significant investments in infrastructure development, encompassing the enhancement of transportation networks, the establishment of modern logistics hubs, and the expansion of warehousing facilities, are vital. Furthermore, the increasing digital literacy and connectivity within the region are empowering more consumers and businesses to participate actively in the digital economy.

ASEAN E-commerce Logistics Market Product Developments

The ASEAN e-commerce logistics market is a hotbed of innovation, with a particular focus on advancements in last-mile delivery solutions designed to optimize efficiency and speed in urban and peri-urban environments. The adoption of automated warehousing systems, including robotic picking and sorting technologies, is dramatically increasing operational throughput and reducing labor costs. Furthermore, the implementation of cutting-edge tracking and delivery management technologies, such as IoT devices and blockchain-based solutions, is providing unparalleled visibility and control across the supply chain. The strategic integration of artificial intelligence (AI) and machine learning (ML) is a transformative trend. These technologies are being leveraged to optimize delivery routes, predict demand patterns with greater accuracy, enhance warehouse slotting and inventory management, and personalize delivery experiences. Logistics providers that can effectively harness and implement these advanced technologies are poised to gain significant competitive advantages, leading to improved efficiency, reduced operational expenses, and enhanced customer satisfaction.

Key Drivers of ASEAN E-commerce Logistics Market Growth

Several factors fuel the market's growth. Technological advancements, such as automated sorting facilities and real-time tracking systems, enhance efficiency. Favorable government policies supporting e-commerce development stimulate growth. The burgeoning middle class and increased internet penetration drive consumer demand. Finally, strategic partnerships among logistics providers expand reach and capabilities.

Challenges in the ASEAN E-commerce Logistics Market Market

The market faces challenges such as varying regulatory frameworks across countries, leading to complexities in cross-border shipping. Supply chain disruptions, exacerbated by geopolitical factors, impact reliability and costs. Intense competition necessitates continuous innovation and operational efficiency to maintain market share. Infrastructure limitations in certain regions hamper last-mile delivery. These factors cumulatively impact profitability and growth potential.

Emerging Opportunities in ASEAN E-commerce Logistics Market

The market presents significant growth opportunities, driven by the expanding e-commerce sector and increasing consumer demand for efficient logistics solutions. Technological breakthroughs, such as the adoption of drones and autonomous vehicles for delivery, promise efficiency gains. Strategic partnerships between logistics providers and e-commerce platforms unlock new market access. Expanding into underserved rural areas and focusing on specialized logistics services (like temperature-sensitive goods) presents significant growth avenues.

Leading Players in the ASEAN E-commerce Logistics Market Sector

- GD Express Sdn Bhd

- LBC Express

- Best Express

- FedEx Corporation

- United Parcel Service

- J&T Express

- PT Global Jet Express (J&T Express)

- Giao Hang Nhanh

- PT Citra Van Titipan Kilat (TIKI)

- PT Jalur Nugraha Ekakurir (JNE Express)

- Deutsche Post DHL Group

- Kerry Express

- Ninja Van

- Flash Express

- Pos Indonesia

Key Milestones in ASEAN E-commerce Logistics Market Industry

- 2020: In response to the escalating demands and operational shifts brought about by the COVID-19 pandemic, numerous major logistics players significantly ramped up their investments in technological upgrades aimed at enhancing operational efficiency and resilience.

- 2021: Several ASEAN governments proactively introduced new regulations and policy frameworks designed to streamline and facilitate cross-border e-commerce logistics, aiming to reduce trade barriers and boost regional trade.

- 2022: The market witnessed a series of strategic mergers and acquisitions (M&A), indicating a trend towards market consolidation as larger players sought to expand their reach and capabilities, while smaller entities were acquired for their niche expertise or market access.

- 2023: There was a marked increase in investment and focus on last-mile delivery solutions, including significant trials and development of emerging technologies such as drone delivery and autonomous delivery vehicles, aimed at overcoming urban congestion and improving delivery times.

- 2024: The strategic expansion into rural and underserved areas gained significant momentum, as logistics providers recognized the untapped market potential and the growing demand for e-commerce services beyond major urban centers. This also involved developing specialized logistics models for these regions.

Strategic Outlook for ASEAN E-commerce Logistics Market Market

The ASEAN e-commerce logistics market is poised for continued robust growth, driven by several factors. Expanding e-commerce penetration, technological innovations, and supportive government policies create a favorable environment for long-term expansion. Strategic partnerships and investments in infrastructure are crucial for unlocking the full market potential. Focus on enhancing customer experience and adapting to evolving consumer preferences is essential for success in this competitive landscape.

ASEAN E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services (Labeling, Packaging, etc.)

-

2. Business

- 2.1. B2B (Business-to-Business)

- 2.2. B2C (Business-to-Consumer)

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

ASEAN E-commerce Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN E-commerce Logistics Market Regional Market Share

Geographic Coverage of ASEAN E-commerce Logistics Market

ASEAN E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Complicated Product Returns

- 3.4. Market Trends

- 3.4.1. E-commerce growth is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services (Labeling, Packaging, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B (Business-to-Business)

- 5.2.2. B2C (Business-to-Consumer)

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Inventory Management

- 6.1.3. Value-added Services (Labeling, Packaging, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Business

- 6.2.1. B2B (Business-to-Business)

- 6.2.2. B2C (Business-to-Consumer)

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International/Cross-border

- 6.4. Market Analysis, Insights and Forecast - by Product

- 6.4.1. Fashion and Apparel

- 6.4.2. Consumer Electronics

- 6.4.3. Home Appliances

- 6.4.4. Furniture

- 6.4.5. Beauty and Personal Care Products

- 6.4.6. Other Products (Toys, Food Products, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Inventory Management

- 7.1.3. Value-added Services (Labeling, Packaging, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Business

- 7.2.1. B2B (Business-to-Business)

- 7.2.2. B2C (Business-to-Consumer)

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International/Cross-border

- 7.4. Market Analysis, Insights and Forecast - by Product

- 7.4.1. Fashion and Apparel

- 7.4.2. Consumer Electronics

- 7.4.3. Home Appliances

- 7.4.4. Furniture

- 7.4.5. Beauty and Personal Care Products

- 7.4.6. Other Products (Toys, Food Products, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Inventory Management

- 8.1.3. Value-added Services (Labeling, Packaging, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Business

- 8.2.1. B2B (Business-to-Business)

- 8.2.2. B2C (Business-to-Consumer)

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International/Cross-border

- 8.4. Market Analysis, Insights and Forecast - by Product

- 8.4.1. Fashion and Apparel

- 8.4.2. Consumer Electronics

- 8.4.3. Home Appliances

- 8.4.4. Furniture

- 8.4.5. Beauty and Personal Care Products

- 8.4.6. Other Products (Toys, Food Products, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Inventory Management

- 9.1.3. Value-added Services (Labeling, Packaging, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Business

- 9.2.1. B2B (Business-to-Business)

- 9.2.2. B2C (Business-to-Consumer)

- 9.3. Market Analysis, Insights and Forecast - by Destination

- 9.3.1. Domestic

- 9.3.2. International/Cross-border

- 9.4. Market Analysis, Insights and Forecast - by Product

- 9.4.1. Fashion and Apparel

- 9.4.2. Consumer Electronics

- 9.4.3. Home Appliances

- 9.4.4. Furniture

- 9.4.5. Beauty and Personal Care Products

- 9.4.6. Other Products (Toys, Food Products, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific ASEAN E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Inventory Management

- 10.1.3. Value-added Services (Labeling, Packaging, etc.)

- 10.2. Market Analysis, Insights and Forecast - by Business

- 10.2.1. B2B (Business-to-Business)

- 10.2.2. B2C (Business-to-Consumer)

- 10.3. Market Analysis, Insights and Forecast - by Destination

- 10.3.1. Domestic

- 10.3.2. International/Cross-border

- 10.4. Market Analysis, Insights and Forecast - by Product

- 10.4.1. Fashion and Apparel

- 10.4.2. Consumer Electronics

- 10.4.3. Home Appliances

- 10.4.4. Furniture

- 10.4.5. Beauty and Personal Care Products

- 10.4.6. Other Products (Toys, Food Products, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GD Express Sdn Bhd**List Not Exhaustive 6 3 Other Companie

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LBC Express

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Best Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FedEx Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 United Parcel Service

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 J&T Express

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PT Global Jet Express (J&T Express)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Giao Hang Nhanh

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT Citra Van Titipan Kilat (TIKI)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PT Jalur Nugraha Ekakurir (JNE Express)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deutsche Post DHL Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kerry Express

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ninja Van

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Flash Express

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pos Indonesia

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 GD Express Sdn Bhd**List Not Exhaustive 6 3 Other Companie

List of Figures

- Figure 1: Global ASEAN E-commerce Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America ASEAN E-commerce Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America ASEAN E-commerce Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America ASEAN E-commerce Logistics Market Revenue (Million), by Business 2025 & 2033

- Figure 5: North America ASEAN E-commerce Logistics Market Revenue Share (%), by Business 2025 & 2033

- Figure 6: North America ASEAN E-commerce Logistics Market Revenue (Million), by Destination 2025 & 2033

- Figure 7: North America ASEAN E-commerce Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 8: North America ASEAN E-commerce Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 9: North America ASEAN E-commerce Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America ASEAN E-commerce Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America ASEAN E-commerce Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America ASEAN E-commerce Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 13: South America ASEAN E-commerce Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America ASEAN E-commerce Logistics Market Revenue (Million), by Business 2025 & 2033

- Figure 15: South America ASEAN E-commerce Logistics Market Revenue Share (%), by Business 2025 & 2033

- Figure 16: South America ASEAN E-commerce Logistics Market Revenue (Million), by Destination 2025 & 2033

- Figure 17: South America ASEAN E-commerce Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America ASEAN E-commerce Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 19: South America ASEAN E-commerce Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: South America ASEAN E-commerce Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America ASEAN E-commerce Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe ASEAN E-commerce Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 23: Europe ASEAN E-commerce Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Europe ASEAN E-commerce Logistics Market Revenue (Million), by Business 2025 & 2033

- Figure 25: Europe ASEAN E-commerce Logistics Market Revenue Share (%), by Business 2025 & 2033

- Figure 26: Europe ASEAN E-commerce Logistics Market Revenue (Million), by Destination 2025 & 2033

- Figure 27: Europe ASEAN E-commerce Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 28: Europe ASEAN E-commerce Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 29: Europe ASEAN E-commerce Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Europe ASEAN E-commerce Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe ASEAN E-commerce Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 33: Middle East & Africa ASEAN E-commerce Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 34: Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million), by Business 2025 & 2033

- Figure 35: Middle East & Africa ASEAN E-commerce Logistics Market Revenue Share (%), by Business 2025 & 2033

- Figure 36: Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million), by Destination 2025 & 2033

- Figure 37: Middle East & Africa ASEAN E-commerce Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 39: Middle East & Africa ASEAN E-commerce Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 40: Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa ASEAN E-commerce Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 43: Asia Pacific ASEAN E-commerce Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 44: Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million), by Business 2025 & 2033

- Figure 45: Asia Pacific ASEAN E-commerce Logistics Market Revenue Share (%), by Business 2025 & 2033

- Figure 46: Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million), by Destination 2025 & 2033

- Figure 47: Asia Pacific ASEAN E-commerce Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 48: Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 49: Asia Pacific ASEAN E-commerce Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 50: Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific ASEAN E-commerce Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 16: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 17: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 23: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 24: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 25: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 37: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 38: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 39: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 48: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 49: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 50: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 51: Global ASEAN E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific ASEAN E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN E-commerce Logistics Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the ASEAN E-commerce Logistics Market?

Key companies in the market include GD Express Sdn Bhd**List Not Exhaustive 6 3 Other Companie, LBC Express, Best Express, FedEx Corporation, United Parcel Service, J&T Express, PT Global Jet Express (J&T Express), Giao Hang Nhanh, PT Citra Van Titipan Kilat (TIKI), PT Jalur Nugraha Ekakurir (JNE Express), Deutsche Post DHL Group, Kerry Express, Ninja Van, Flash Express, Pos Indonesia.

3. What are the main segments of the ASEAN E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.22 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing E-commerce Sector.

6. What are the notable trends driving market growth?

E-commerce growth is driving the market.

7. Are there any restraints impacting market growth?

4.; Complicated Product Returns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the ASEAN E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence