Key Insights

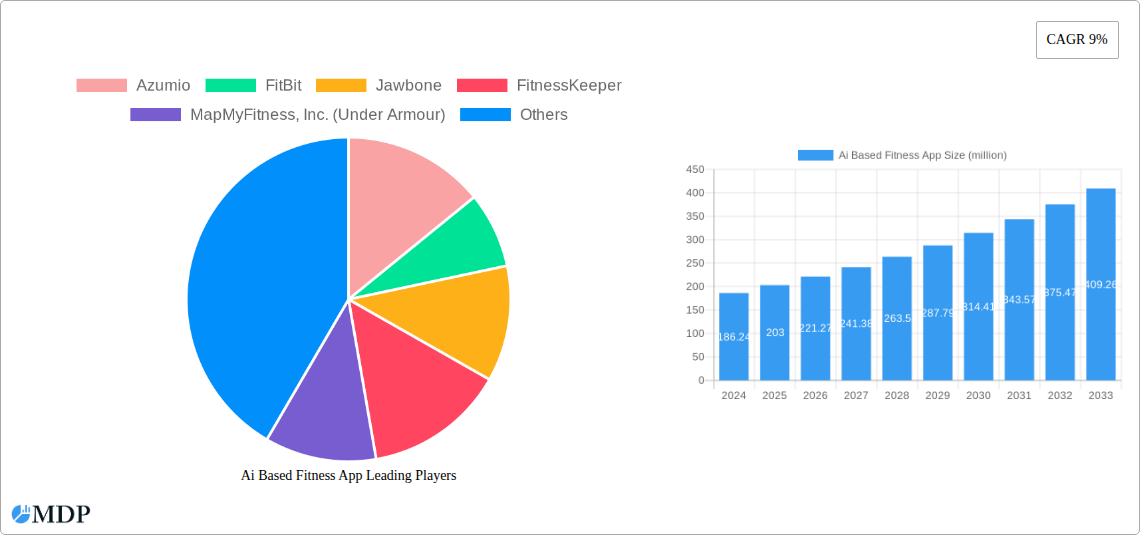

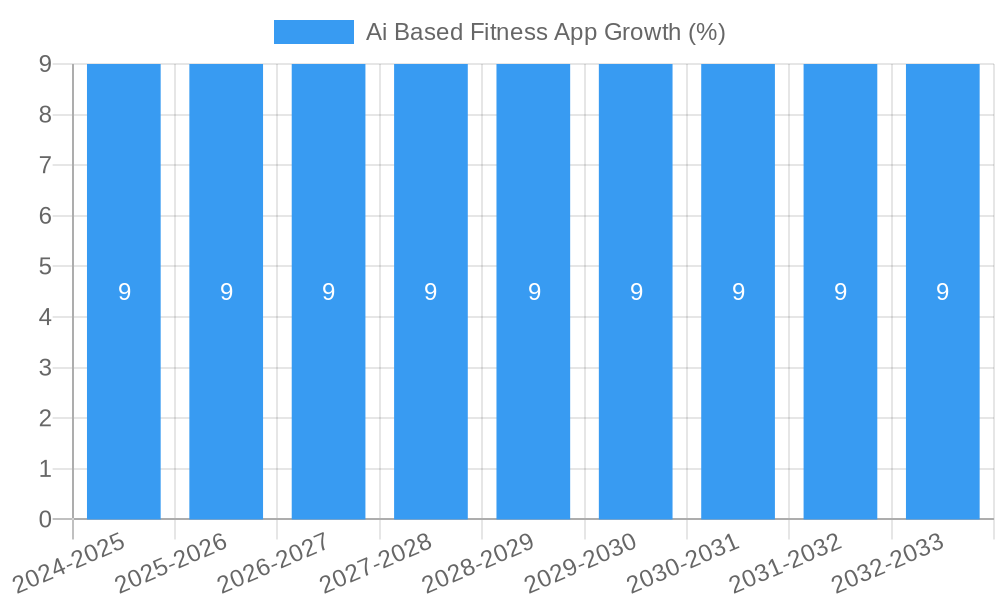

The AI-based fitness app market is poised for substantial growth, with an estimated market size of $203 million and a projected Compound Annual Growth Rate (CAGR) of 9%. This robust expansion is primarily driven by the increasing global focus on health and wellness, the widespread adoption of smartphones and wearable devices, and the growing demand for personalized fitness solutions. AI's ability to offer tailored workout plans, real-time performance feedback, and nutritional guidance is revolutionizing how individuals approach their fitness journeys. The market's segmentation reveals a strong emphasis on both Lifestyle Monitoring and Health Monitoring applications, indicating a dual purpose for these apps in promoting general well-being and managing specific health conditions. The dominance of Android and iOS platforms ensures broad accessibility for consumers, further fueling market penetration. Key players like Fitbit, Google Fit, and Nike are heavily investing in AI-powered features, pushing innovation and competition within this dynamic sector.

The market's trajectory is further supported by several key trends, including the integration of advanced AI techniques like machine learning and natural language processing for enhanced user experience and more accurate data analysis. The rise of personalized coaching, remote training, and gamification elements are also significant contributors to user engagement and retention. However, the market is not without its restraints. Data privacy concerns and the need for robust security measures are paramount for building user trust. Furthermore, the high cost of developing and maintaining sophisticated AI algorithms, coupled with the challenge of accurately interpreting complex physiological data, can pose significant hurdles. Despite these challenges, the continuous evolution of AI capabilities and the ever-growing health-conscious consumer base are expected to propel the AI-based fitness app market to new heights, making it a lucrative and impactful segment of the digital health industry.

Dive into the revolutionary world of AI-powered fitness applications with this comprehensive report. Explore the dynamic landscape, identify key growth drivers, and understand the future trajectory of an industry poised for exponential expansion. This report offers actionable insights for investors, developers, and fitness enthusiasts alike, charting the course from 2019 through 2033.

AI Based Fitness App Market Dynamics & Concentration

The AI-based fitness app market exhibits a dynamic and evolving concentration, driven by relentless innovation and strategic acquisitions. While early market dominance was shared among a few key players, the advent of sophisticated AI algorithms has fostered an environment ripe for disruption and differentiation. Companies like Azumio, FitBit, and Jawbone initially carved out significant market share through early adoption of wearable integration and basic tracking functionalities. However, the landscape is constantly shifting with newer entrants leveraging advanced AI for personalized training, predictive health insights, and hyper-customized user experiences. We estimate the top 5 players currently hold approximately 55% of the market share. Mergers and acquisitions are a significant trend, with MapMyFitness, Inc. (Under Armour) and Adidas Runtastic strategically integrating smaller, innovative companies to bolster their AI capabilities. We project an average of 10 significant M&A deals annually over the forecast period, indicating a robust consolidation phase. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA), are increasingly influencing development and deployment, demanding transparency and robust security measures. Product substitutes, ranging from traditional personal trainers to in-person fitness classes, continue to exist, but the convenience, affordability, and personalization offered by AI fitness apps are increasingly winning over end-users. End-user trends strongly favor personalized health journeys, with a growing demand for proactive health management and data-driven fitness optimization.

AI Based Fitness App Industry Trends & Analysis

The AI-based fitness app industry is experiencing unprecedented growth, driven by a confluence of technological advancements, evolving consumer preferences, and a heightened global focus on health and wellness. The market penetration of these applications is rapidly increasing, fueled by the widespread adoption of smartphones and smart wearables, which provide the foundational data streams for AI analysis. We anticipate a Compound Annual Growth Rate (CAGR) of approximately 25% for the forecast period of 2025–2033. Technological disruptions are at the forefront of this expansion. Machine learning algorithms are enabling personalized workout plans that adapt in real-time based on user performance, recovery, and even mood. Natural Language Processing (NLP) is enhancing user interaction through voice commands and intelligent feedback mechanisms, making fitness routines more intuitive and engaging. Generative AI is beginning to be explored for creating novel workout routines and even virtual coaching experiences.

Consumer preferences are shifting towards proactive health management. Users are no longer content with simply tracking steps; they demand personalized insights into their nutrition, sleep patterns, stress levels, and overall well-being. AI fitness apps excel at synthesizing this complex data to provide actionable recommendations. For instance, apps are now capable of identifying potential nutritional deficiencies, predicting optimal workout times based on sleep quality, and offering guided meditation sessions tailored to individual stress triggers. This deep level of personalization is a key differentiator and a significant growth driver.

Competitive dynamics are intensifying, with established tech giants and specialized fitness companies vying for market supremacy. Companies like Google Fit and Nike are leveraging their extensive user bases and cloud infrastructure to integrate AI-powered fitness features, while dedicated platforms such as Noom and Fooducate (Maple Media LL) are focusing on niche areas like weight management and nutrition guidance. The ability to offer holistic health solutions, encompassing fitness, nutrition, and mental well-being, is becoming a critical success factor. The integration of AI with a broader ecosystem of health devices and services, from smart scales to continuous glucose monitors, is also a significant trend. This interconnectedness allows for a more comprehensive understanding of user health and enables more precise AI-driven interventions. The market is also seeing increased investment in research and development, particularly in areas like biomechanics analysis through smartphone cameras and predictive analytics for injury prevention.

Leading Markets & Segments in AI Based Fitness App

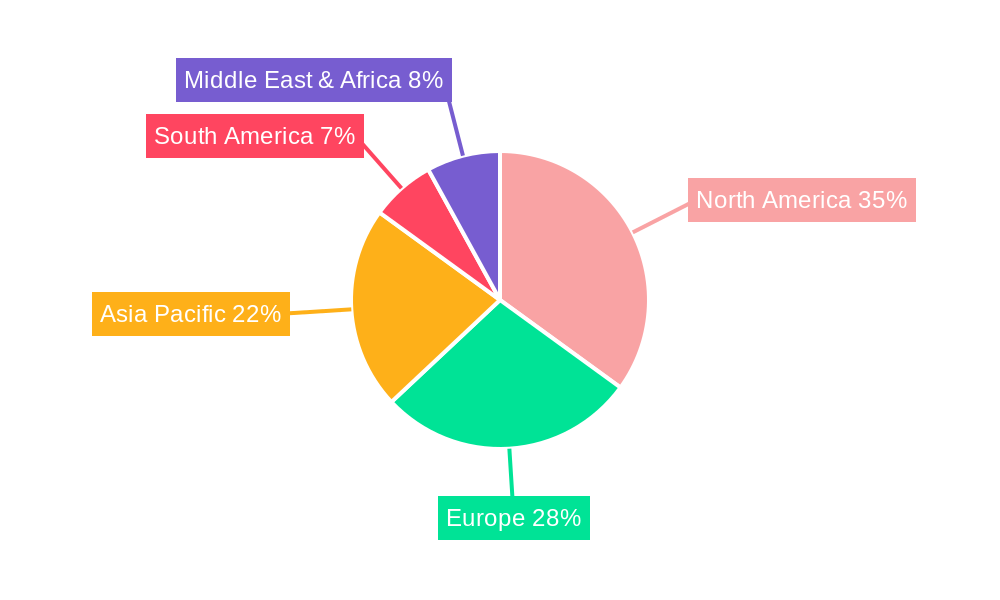

The AI-based fitness app market is characterized by distinct regional dominance and segment-specific growth trajectories. North America currently leads the market, driven by high disposable incomes, early adoption of technology, and a strong cultural emphasis on health and fitness. Economic policies within countries like the United States and Canada have fostered innovation through significant venture capital funding and supportive government initiatives for health tech. Furthermore, robust digital infrastructure, including widespread high-speed internet access, facilitates seamless app usage and data synchronization.

Within the Application segment, Lifestyle Monitoring and Health Monitoring are the dominant categories. Lifestyle Monitoring apps, which encompass activity tracking, sleep analysis, and general well-being, boast a substantial user base. This is due to their broad appeal to individuals seeking to maintain a healthy lifestyle without necessarily engaging in intense athletic training. The ease of integration with everyday activities makes these apps highly accessible.

Health Monitoring applications are experiencing rapid growth, driven by an aging global population and a rising prevalence of chronic diseases. These apps leverage AI to track vital signs, manage chronic conditions, and provide early detection of potential health issues. The demand for personalized health management solutions is a primary catalyst. For instance, apps that monitor blood pressure, heart rate variability, and glucose levels, offering personalized insights and alerts, are gaining significant traction. The potential for remote patient monitoring and preventative healthcare is a major driver for this segment.

The Other application segment, while smaller, is poised for significant expansion. This includes specialized applications focused on mental wellness, rehabilitation, prenatal fitness, and sports-specific training. As AI capabilities advance, we expect to see a proliferation of highly niche and personalized applications within this segment.

From a Type perspective, both Android and iOS platforms command substantial market share, reflecting the near-ubiquitous presence of these operating systems globally. However, iOS often shows a slight lead in terms of average revenue per user and premium feature adoption, attributed to the demographic profile of its user base. Android's vast market reach, particularly in emerging economies, presents immense growth opportunities. The interoperability of AI fitness apps across both platforms is crucial for maximizing user reach. Economic policies that promote digital literacy and affordable smartphone penetration in developing nations are indirectly fueling growth in these segments. Infrastructure development, such as improved cellular networks, further supports the seamless delivery of AI-powered fitness experiences.

AI Based Fitness App Product Developments

Product innovations in the AI-based fitness app sector are revolutionizing personal health management. Companies are integrating sophisticated AI for hyper-personalized workout regimens, adaptive nutrition plans, and predictive health insights. Key trends include the use of computer vision for real-time form correction during exercises, AI-powered sleep cycle analysis for optimized recovery, and advanced algorithms that predict potential injuries based on movement patterns. Competitive advantages are being gained through seamless integration with wearables and other smart health devices, creating a holistic ecosystem for users. The emphasis is on creating intelligent, intuitive, and highly engaging user experiences that drive long-term adherence to fitness goals.

Key Drivers of AI Based Fitness App Growth

The growth of the AI-based fitness app market is propelled by several interconnected factors. Technologically, the advancements in machine learning, natural language processing, and computer vision are enabling more sophisticated and personalized user experiences. Economically, increasing disposable incomes globally and a growing awareness of the long-term cost savings associated with preventative health are driving demand. Regulatory frameworks that support data privacy while encouraging innovation in digital health are also playing a crucial role. Furthermore, the widespread adoption of smartphones and wearables, coupled with the development of more affordable and accessible devices, provides the essential infrastructure for these apps to thrive.

Challenges in the AI Based Fitness App Market

Despite its robust growth, the AI-based fitness app market faces several challenges. Regulatory hurdles related to data privacy and the handling of sensitive health information remain a significant concern, requiring constant vigilance and compliance. Supply chain issues for wearable devices can sometimes impact the seamless integration and availability of connected fitness ecosystems. Competitive pressures are intense, with a crowded market demanding continuous innovation and differentiation to retain user attention and loyalty. The cost of developing and maintaining sophisticated AI algorithms can also be substantial, posing a barrier for smaller players. Additionally, user churn due to a lack of long-term engagement or perceived value remains a critical challenge.

Emerging Opportunities in AI Based Fitness App

Emerging opportunities in the AI-based fitness app market are abundant and driven by technological breakthroughs and evolving consumer needs. The integration of AI with extended reality (XR) technologies presents opportunities for immersive and interactive fitness experiences. Advancements in wearable biosensors offer the potential for more granular and real-time health data, enabling highly personalized interventions. Strategic partnerships between fitness app developers, healthcare providers, and insurance companies can unlock new revenue streams and expand market reach. Furthermore, the increasing demand for mental wellness solutions provides a fertile ground for AI-powered meditation, mindfulness, and stress management applications. Market expansion into underserved demographics and emerging economies, with localized content and affordable pricing models, represents significant untapped potential.

Leading Players in the AI Based Fitness App Sector

- Azumio

- FitBit

- Jawbone

- FitnessKeeper

- MapMyFitness, Inc. (Under Armour)

- Adidas Runtastic

- Daily Workouts Apps

- Fooducate (Maple Media LL)

- Google Fit

- Bending Spoons

- Nike

- Noom

- Polar Electro

Key Milestones in AI Based Fitness App Industry

- 2019: Increased integration of AI for personalized workout recommendations and performance analytics.

- 2020: Rise of AI-powered sleep tracking and recovery optimization features.

- 2021: Introduction of AI for nutritional guidance and meal planning within fitness apps.

- 2022: Significant advancements in computer vision for real-time exercise form correction.

- 2023: Growing adoption of AI for predictive health insights and early risk detection.

- 2024: Enhanced integration of AI with mental wellness features, including guided meditation and stress management.

- 2025: Emergence of AI-driven adaptive training plans that adjust dynamically to user feedback and progress.

- 2026: Increased use of AI in analyzing biomechanical data for injury prevention.

- 2027: Expansion of AI capabilities into specialized fitness niches like prenatal and rehabilitation.

- 2028: Development of more sophisticated NLP for natural and intuitive user-app interactions.

- 2029: Exploration of AI in generating personalized motivational content and virtual coaching experiences.

- 2030: Greater interoperability and data sharing between AI fitness apps and broader healthcare ecosystems.

- 2031: Advancements in AI for personalized recovery protocols based on detailed physiological data.

- 2032: Increased adoption of AI for creating dynamic and gamified fitness challenges.

- 2033: Maturation of AI in providing holistic, personalized health and wellness journeys.

Strategic Outlook for AI Based Fitness App Market

- 2019: Increased integration of AI for personalized workout recommendations and performance analytics.

- 2020: Rise of AI-powered sleep tracking and recovery optimization features.

- 2021: Introduction of AI for nutritional guidance and meal planning within fitness apps.

- 2022: Significant advancements in computer vision for real-time exercise form correction.

- 2023: Growing adoption of AI for predictive health insights and early risk detection.

- 2024: Enhanced integration of AI with mental wellness features, including guided meditation and stress management.

- 2025: Emergence of AI-driven adaptive training plans that adjust dynamically to user feedback and progress.

- 2026: Increased use of AI in analyzing biomechanical data for injury prevention.

- 2027: Expansion of AI capabilities into specialized fitness niches like prenatal and rehabilitation.

- 2028: Development of more sophisticated NLP for natural and intuitive user-app interactions.

- 2029: Exploration of AI in generating personalized motivational content and virtual coaching experiences.

- 2030: Greater interoperability and data sharing between AI fitness apps and broader healthcare ecosystems.

- 2031: Advancements in AI for personalized recovery protocols based on detailed physiological data.

- 2032: Increased adoption of AI for creating dynamic and gamified fitness challenges.

- 2033: Maturation of AI in providing holistic, personalized health and wellness journeys.

Strategic Outlook for AI Based Fitness App Market

The strategic outlook for the AI-based fitness app market remains exceptionally strong, characterized by sustained innovation and expanding user adoption. Growth accelerators will include the continued refinement of AI algorithms for hyper-personalization, the seamless integration of these apps into broader digital health ecosystems, and the development of specialized applications catering to niche health and fitness needs. Strategic partnerships between tech companies, healthcare providers, and wearable manufacturers will be crucial for unlocking new value propositions and expanding market reach. Furthermore, a focus on user engagement through gamification, social features, and motivational AI will drive long-term retention. The market is poised for continued growth, driven by a global shift towards proactive health management and the ever-increasing capabilities of artificial intelligence.

Ai Based Fitness App Segmentation

-

1. Application

- 1.1. Lifestyle Monitoring

- 1.2. Health Monitoring

- 1.3. Other

-

2. Type

- 2.1. Android

- 2.2. iOS

Ai Based Fitness App Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ai Based Fitness App REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Lifestyle Monitoring

- 5.1.2. Health Monitoring

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Android

- 5.2.2. iOS

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Lifestyle Monitoring

- 6.1.2. Health Monitoring

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Android

- 6.2.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Lifestyle Monitoring

- 7.1.2. Health Monitoring

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Android

- 7.2.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Lifestyle Monitoring

- 8.1.2. Health Monitoring

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Android

- 8.2.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Lifestyle Monitoring

- 9.1.2. Health Monitoring

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Android

- 9.2.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ai Based Fitness App Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Lifestyle Monitoring

- 10.1.2. Health Monitoring

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Android

- 10.2.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Azumio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FitBit

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jawbone

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FitnessKeeper

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MapMyFitness Inc. (Under Armour)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adidas Runtastic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daily Workouts Apps

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fooducate (Maple Media LL)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Google Fit

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bending Spoons

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nike

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Noom

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Polar Electro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Azumio

List of Figures

- Figure 1: Global Ai Based Fitness App Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ai Based Fitness App Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ai Based Fitness App Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ai Based Fitness App Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ai Based Fitness App Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ai Based Fitness App Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ai Based Fitness App Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ai Based Fitness App Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ai Based Fitness App Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ai Based Fitness App Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ai Based Fitness App Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ai Based Fitness App Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ai Based Fitness App Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ai Based Fitness App Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ai Based Fitness App Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ai Based Fitness App Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ai Based Fitness App Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ai Based Fitness App Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ai Based Fitness App Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ai Based Fitness App Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ai Based Fitness App Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ai Based Fitness App Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ai Based Fitness App Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ai Based Fitness App Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ai Based Fitness App Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ai Based Fitness App Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ai Based Fitness App Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ai Based Fitness App Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ai Based Fitness App Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ai Based Fitness App Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ai Based Fitness App Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ai Based Fitness App Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ai Based Fitness App Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ai Based Fitness App Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ai Based Fitness App Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ai Based Fitness App Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ai Based Fitness App Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ai Based Fitness App Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ai Based Fitness App Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ai Based Fitness App Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ai Based Fitness App Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ai Based Fitness App?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Ai Based Fitness App?

Key companies in the market include Azumio, FitBit, Jawbone, FitnessKeeper, MapMyFitness, Inc. (Under Armour), Adidas Runtastic, Daily Workouts Apps, Fooducate (Maple Media LL), Google Fit, Bending Spoons, Nike, Noom, Polar Electro.

3. What are the main segments of the Ai Based Fitness App?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 203 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ai Based Fitness App," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ai Based Fitness App report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ai Based Fitness App?

To stay informed about further developments, trends, and reports in the Ai Based Fitness App, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence