Key Insights

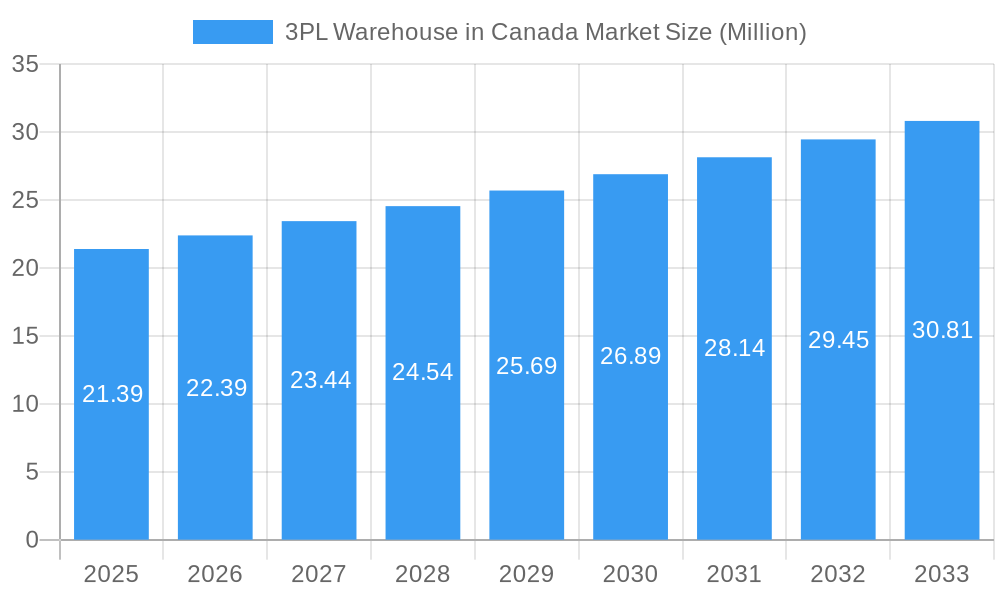

The Canadian 3PL warehouse market, valued at $21.39 million in 2025, is poised for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.58% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector in Canada fuels the demand for efficient warehousing and distribution solutions, pushing businesses to outsource logistics operations to specialized 3PL providers. Furthermore, increasing complexities in supply chains, a desire to optimize operational costs, and the need for enhanced inventory management are all contributing to the market's upward trajectory. The growth is particularly pronounced within the segments focusing on domestic transportation management and value-added warehousing and distribution services. The automotive, consumer & retail, and healthcare sectors are major end-users driving this demand, reflecting the need for timely and reliable delivery of goods across various industries. Regional variations exist, with Eastern and Western Canada potentially showing higher growth rates due to population density and industrial activity. While challenges such as labor shortages and fluctuating fuel prices might act as restraints, the overall market outlook remains positive, indicating a substantial expansion in the coming years.

3PL Warehouse in Canada Market Market Size (In Million)

The competitive landscape is marked by a blend of established international players like DHL Supply Chain, Kuehne + Nagel, and DB Schenker, alongside regional and specialized 3PL providers. These companies are strategically investing in advanced technologies like automation and data analytics to enhance their service offerings and gain a competitive edge. The presence of these large players, coupled with the market's inherent growth potential, is attracting new entrants, fostering innovation and further enhancing the range of available solutions. The Canadian government's initiatives to improve infrastructure and streamline logistics processes are further expected to boost the market's performance over the forecast period. This combination of supportive regulatory environments, technological advancements, and strong end-user demand indicates a robust and expansive future for the Canadian 3PL warehouse market.

3PL Warehouse in Canada Market Company Market Share

Unlock Growth Potential: The Definitive 3PL Warehouse in Canada Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canadian 3PL warehouse market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. The Canadian 3PL warehouse market is projected to reach xx Million by 2033, presenting significant investment potential.

3PL Warehouse in Canada Market Market Dynamics & Concentration

The Canadian 3PL warehouse market is characterized by a dynamic yet moderately concentrated landscape, with a robust mix of global powerhouses and agile domestic specialists actively shaping its trajectory. Key industry leaders such as DB Schenker, Ryder Supply Chain Solutions, Polaris Worldwide Logistics, CEVA Logistics, Kuehne + Nagel, Mactrans Logistics, TSI Group, DHL Supply Chain, and DSV are strategically positioned to capture significant market share. The intricate dynamics influencing this market are multifaceted:

- Market Concentration: While the top five players are anticipated to command an estimated [XX]% market share in 2025, this structure presents fertile ground for both organic expansion by existing entities and strategic mergers and acquisitions (M&A) by ambitious market entrants or consolidators.

- Innovation Drivers: The relentless pursuit of operational excellence is propelled by transformative technological advancements. The integration of warehouse automation, the strategic deployment of AI-powered logistics solutions, and the sophisticated utilization of data analytics are not merely enhancing efficiency but also fostering a culture of innovation, attracting substantial investment and intensifying competitive pressures.

- Regulatory Frameworks: Navigating the complex web of Canadian regulations, encompassing transportation, warehousing standards, and stringent data privacy laws, is paramount. These frameworks directly influence operational expenditures and necessitate meticulously crafted compliance strategies for all 3PL providers operating within the country.

- Product Substitutes: The burgeoning landscape of alternative logistics solutions, particularly the rise of on-demand delivery platforms and gig economy logistics, is presenting a tangible challenge to traditional 3PL models. This competitive pressure compels established providers to continuously adapt, diversify their service offerings, and enhance their value proposition.

- End-User Trends: The accelerating adoption of e-commerce and the strategic imperative for omnichannel distribution across a diverse spectrum of end-user industries – including Automotive, Consumer & Retail, Energy, Healthcare, Industrial & Aerospace, and Technology – is significantly amplifying the demand for flexible, scalable, and highly responsive 3PL services.

- M&A Activities: A review of the past five years (2019-2024) reveals approximately [XX] notable M&A transactions within the Canadian 3PL sector. This activity underscores a discernible trend towards consolidation, strategic market positioning, and the pursuit of synergistic growth opportunities among established and emerging players.

3PL Warehouse in Canada Market Industry Trends & Analysis

The Canadian 3PL warehouse market is on a robust growth trajectory, propelled by a confluence of powerful industry trends that are reshaping the logistics landscape. The market is projected to witness a compelling Compound Annual Growth Rate (CAGR) of [XX]% during the forecast period spanning from 2025 to 2033. This expansion is significantly fueled by the continuous growth of e-commerce, which inherently drives an insatiable demand for efficient warehousing, sophisticated inventory management, and streamlined distribution solutions. Furthermore, disruptive technological advancements, epitomized by the increasing integration of robotics and advanced automation, are revolutionizing operational efficiencies, leading to substantial cost reductions and enhanced service levels. Shifting consumer preferences, marked by an escalating demand for faster, more convenient, and transparent delivery experiences, are compelling 3PL providers to make substantial investments in cutting-edge technologies and to meticulously optimize their end-to-end supply chain networks. The competitive intensity among 3PL providers is a potent catalyst for innovation and aggressive price optimization, benefiting end-users. The market penetration of automated warehousing solutions, estimated at [XX]% in 2025, is poised for a significant ascent, expected to reach substantially higher levels by 2033 as the benefits of automation become more widely recognized and adopted.

Leading Markets & Segments in 3PL Warehouse in Canada Market

Geographically, the Canadian 3PL warehouse market is largely dominated by the economic powerhouses of Ontario and British Columbia, with their leadership attributable to a synergistic combination of factors:

- Ontario: Boasting a high population density, strategic proximity to major North American transportation arteries, and a well-established network of industrial clusters, Ontario serves as a critical logistics hub.

- British Columbia: Its strategic West Coast location offers crucial access to Asia-Pacific markets, coupled with a robust and rapidly expanding e-commerce sector and continuous development in its logistics infrastructure.

Segmentation by Services:

- Value-added warehousing and distribution: This segment is experiencing the most dynamic growth, driven by the escalating demand for specialized, bespoke services such as product kitting, customized packaging, intricate labeling, and assembly operations that go beyond basic storage.

- Domestic Transportation Management: This segment remains a cornerstone of the market, underpinned by the consistent and substantial volume of interprovincial and cross-border trade within Canada.

- International Transportation Management: While the growth in cross-border trade with global partners presents significant opportunities, the inherent complexities of international logistics, including customs, tariffs, and varied regulatory environments, continue to shape this segment.

Segmentation by End-User:

- Consumer & Retail: This sector unequivocally represents the largest and most influential end-user segment, propelled by the unprecedented surge in online shopping and the evolving demands of the modern consumer.

- Automotive: The presence of major global automotive manufacturers and their intricate, just-in-time supply chains ensures a sustained and significant demand for sophisticated 3PL services.

- Industrial & Aerospace: This segment demonstrates stable and consistent demand for comprehensive logistics support throughout the entire industrial value chain, from raw material handling to finished product distribution.

3PL Warehouse in Canada Market Product Developments

Recent product innovations focus on automation, AI-driven optimization, and enhanced visibility solutions. The adoption of robotics, automated guided vehicles (AGVs), and warehouse management systems (WMS) is enhancing operational efficiency and minimizing human error. Integration of advanced analytics and blockchain technologies is improving transparency and traceability across the supply chain, providing competitive advantages for 3PL providers. These advancements align with the market's increasing demand for speed, efficiency, and cost-effectiveness.

Key Drivers of 3PL Warehouse in Canada Market Growth

The expansion of the 3PL warehouse market in Canada is being propelled by a potent combination of forward-looking factors:

- Technological Advancements: The pervasive adoption of automation, the strategic integration of artificial intelligence (AI) in logistics planning and execution, and the sophisticated use of data analytics are collectively driving unprecedented gains in operational efficiency, reducing costs, and enhancing service quality.

- E-commerce Boom: The exponential growth of online retail continues to be a primary engine of demand, creating an urgent need for specialized warehousing solutions that can efficiently manage inventory, process orders, and facilitate rapid fulfillment.

- Government Initiatives: Proactive government investments in critical infrastructure development, coupled with supportive policies aimed at enhancing the efficiency and competitiveness of the logistics sector, are creating a favorable environment for market expansion and innovation.

Challenges in the 3PL Warehouse in Canada Market Market

Despite its robust growth, the Canadian 3PL warehouse market is not without its significant hurdles:

- Labor Shortages: A persistent challenge lies in the ability to attract, train, and retain a skilled and reliable workforce, particularly for operational roles within warehouses.

- Infrastructure Limitations: Congestion at key transportation hubs and within urban logistics corridors can impede the efficiency of supply chain operations, leading to delays and increased costs.

- Supply Chain Disruptions: The globalized nature of modern supply chains makes them vulnerable to unforeseen events, such as geopolitical instability, natural disasters, or pandemics. These disruptions have had a tangible impact, estimated to have caused approximately [XX] Million in losses to the sector in 2024 alone, underscoring the need for enhanced resilience and contingency planning.

Emerging Opportunities in 3PL Warehouse in Canada Market

The long-term outlook is positive, with several opportunities:

- Sustainable Logistics: Growing demand for environmentally friendly solutions presents opportunities for green initiatives.

- Strategic Partnerships: Collaboration with technology providers can drive innovation and expansion.

- Expansion into Underserved Markets: Targeting smaller businesses and specific niche markets can drive revenue growth.

Leading Players in the 3PL Warehouse in Canada Market Sector

- DB Schenker

- Ryder Supply Chain Solutions

- Polaris Worldwide Logistics

- CEVA Logistics

- Kuehne + Nagel

- Mactrans Logistics

- TSI Group

- DHL Supply Chain

- DSV

Key Milestones in 3PL Warehouse in Canada Market Industry

- 2020: Increased adoption of contactless delivery solutions due to the pandemic.

- 2022: Significant investments in automation technologies by major 3PL providers.

- 2023: Implementation of new regulations impacting data privacy and security.

Strategic Outlook for 3PL Warehouse in Canada Market Market

The Canadian 3PL warehouse market holds significant long-term growth potential, driven by continued e-commerce growth, technological advancements, and government support. Strategic opportunities include investments in automation, sustainable logistics solutions, and expansion into new markets. By capitalizing on these opportunities, 3PL providers can solidify their market positions and benefit from the market’s upward trajectory.

3PL Warehouse in Canada Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer & Retail

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Industrial & Aerospace

- 2.6. Technology

- 2.7. Other End Users

3PL Warehouse in Canada Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

3PL Warehouse in Canada Market Regional Market Share

Geographic Coverage of 3PL Warehouse in Canada Market

3PL Warehouse in Canada Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. Effects of USMCA on Automobile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer & Retail

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Industrial & Aerospace

- 5.2.6. Technology

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Domestic Transportation Management

- 6.1.2. International Transportation Management

- 6.1.3. Value-added Warehousing and Distribution

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Automotive

- 6.2.2. Consumer & Retail

- 6.2.3. Energy

- 6.2.4. Healthcare

- 6.2.5. Industrial & Aerospace

- 6.2.6. Technology

- 6.2.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Domestic Transportation Management

- 7.1.2. International Transportation Management

- 7.1.3. Value-added Warehousing and Distribution

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Automotive

- 7.2.2. Consumer & Retail

- 7.2.3. Energy

- 7.2.4. Healthcare

- 7.2.5. Industrial & Aerospace

- 7.2.6. Technology

- 7.2.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Domestic Transportation Management

- 8.1.2. International Transportation Management

- 8.1.3. Value-added Warehousing and Distribution

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Automotive

- 8.2.2. Consumer & Retail

- 8.2.3. Energy

- 8.2.4. Healthcare

- 8.2.5. Industrial & Aerospace

- 8.2.6. Technology

- 8.2.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Domestic Transportation Management

- 9.1.2. International Transportation Management

- 9.1.3. Value-added Warehousing and Distribution

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Automotive

- 9.2.2. Consumer & Retail

- 9.2.3. Energy

- 9.2.4. Healthcare

- 9.2.5. Industrial & Aerospace

- 9.2.6. Technology

- 9.2.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific 3PL Warehouse in Canada Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Domestic Transportation Management

- 10.1.2. International Transportation Management

- 10.1.3. Value-added Warehousing and Distribution

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Automotive

- 10.2.2. Consumer & Retail

- 10.2.3. Energy

- 10.2.4. Healthcare

- 10.2.5. Industrial & Aerospace

- 10.2.6. Technology

- 10.2.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ryder Supply Chain Solutions**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Polaris Worldwide Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CEVA Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kuehne + Nagel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mactrans Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TSI Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DHL Supply Chain

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global 3PL Warehouse in Canada Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 3PL Warehouse in Canada Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America 3PL Warehouse in Canada Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America 3PL Warehouse in Canada Market Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America 3PL Warehouse in Canada Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America 3PL Warehouse in Canada Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America 3PL Warehouse in Canada Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America 3PL Warehouse in Canada Market Revenue (Million), by Services 2025 & 2033

- Figure 9: South America 3PL Warehouse in Canada Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: South America 3PL Warehouse in Canada Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: South America 3PL Warehouse in Canada Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: South America 3PL Warehouse in Canada Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America 3PL Warehouse in Canada Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe 3PL Warehouse in Canada Market Revenue (Million), by Services 2025 & 2033

- Figure 15: Europe 3PL Warehouse in Canada Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Europe 3PL Warehouse in Canada Market Revenue (Million), by End-User 2025 & 2033

- Figure 17: Europe 3PL Warehouse in Canada Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe 3PL Warehouse in Canada Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe 3PL Warehouse in Canada Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa 3PL Warehouse in Canada Market Revenue (Million), by Services 2025 & 2033

- Figure 21: Middle East & Africa 3PL Warehouse in Canada Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Middle East & Africa 3PL Warehouse in Canada Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Middle East & Africa 3PL Warehouse in Canada Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East & Africa 3PL Warehouse in Canada Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa 3PL Warehouse in Canada Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific 3PL Warehouse in Canada Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Asia Pacific 3PL Warehouse in Canada Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Asia Pacific 3PL Warehouse in Canada Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific 3PL Warehouse in Canada Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific 3PL Warehouse in Canada Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific 3PL Warehouse in Canada Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 11: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 29: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Services 2020 & 2033

- Table 38: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 39: Global 3PL Warehouse in Canada Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific 3PL Warehouse in Canada Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3PL Warehouse in Canada Market?

The projected CAGR is approximately 4.58%.

2. Which companies are prominent players in the 3PL Warehouse in Canada Market?

Key companies in the market include DB Schenker, Ryder Supply Chain Solutions**List Not Exhaustive, Polaris Worldwide Logistics, CEVA Logistics, Kuehne + Nagel, Mactrans Logistics, TSI Group, DHL Supply Chain, DSV.

3. What are the main segments of the 3PL Warehouse in Canada Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.39 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

Effects of USMCA on Automobile Industry.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3PL Warehouse in Canada Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3PL Warehouse in Canada Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3PL Warehouse in Canada Market?

To stay informed about further developments, trends, and reports in the 3PL Warehouse in Canada Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence