Key Insights

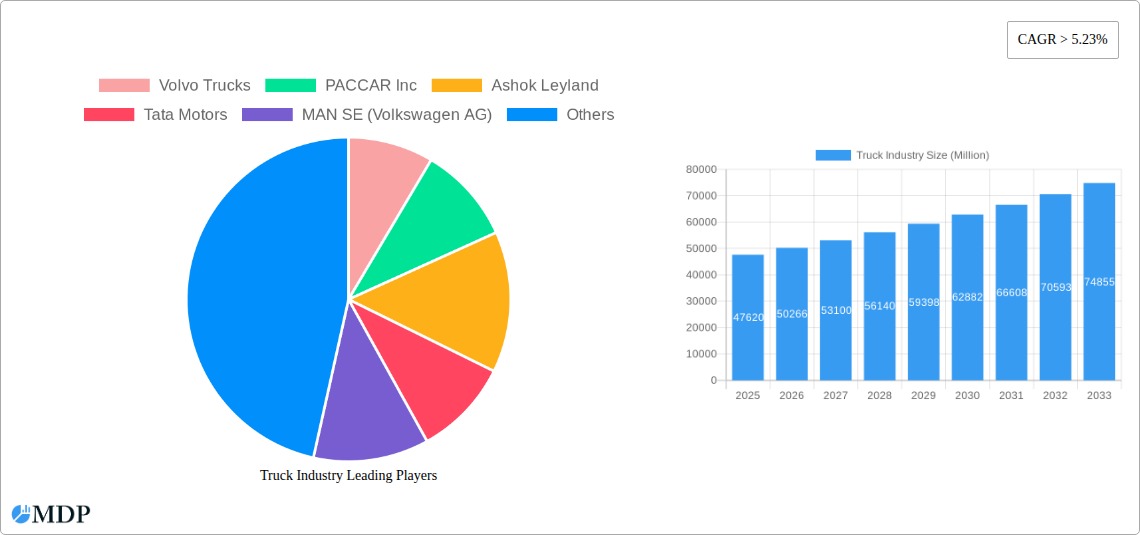

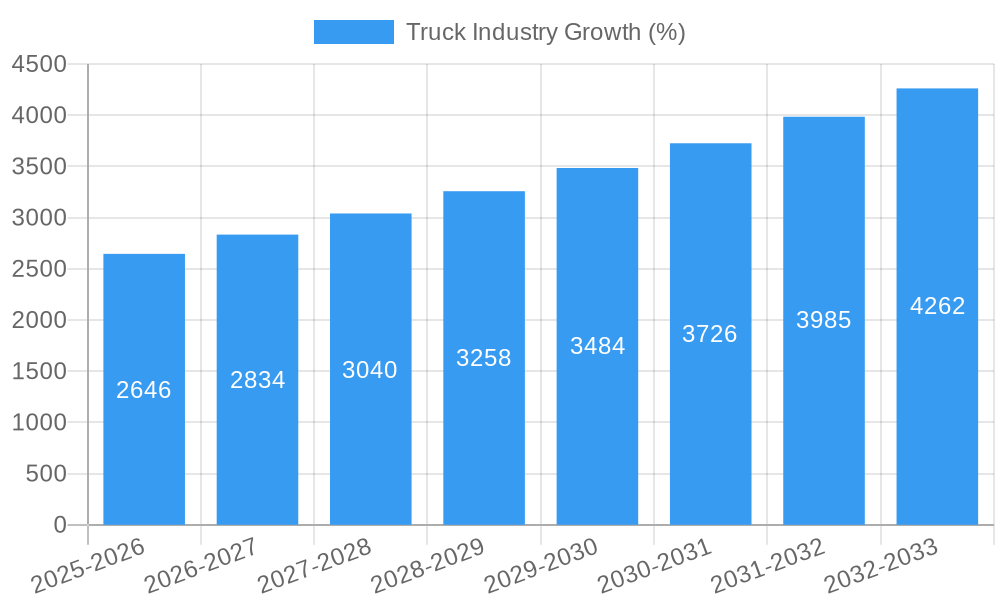

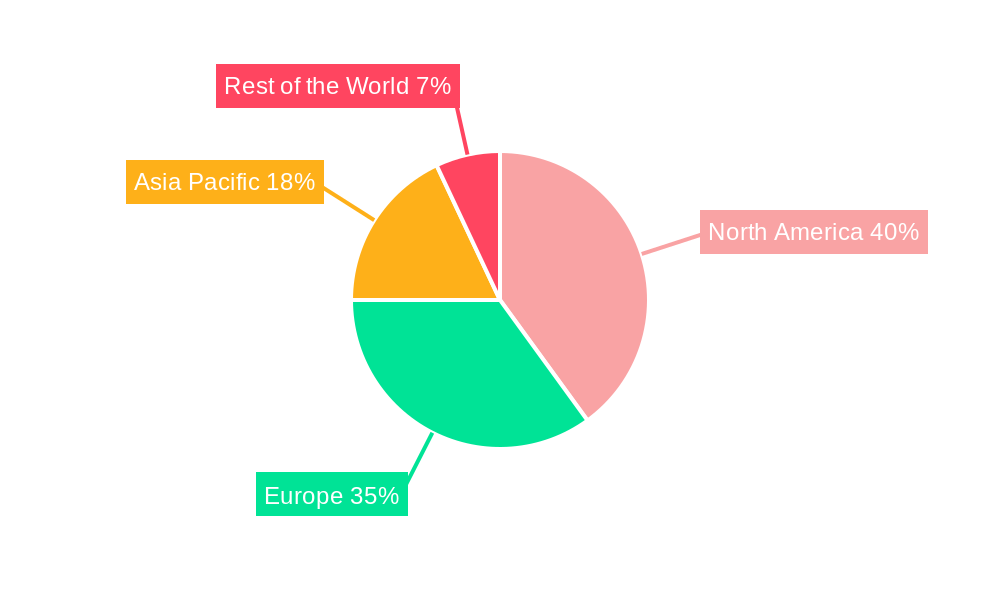

The global used truck market, valued at $47.62 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5.23% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for efficient and cost-effective transportation solutions, particularly within the logistics and e-commerce sectors, fuels the market. Furthermore, the rising replacement cycle of aging truck fleets, coupled with technological advancements in used truck refurbishment and remarketing, contributes significantly to market growth. The preference for pre-owned trucks over new ones, owing to their lower purchase price and operational costs, further strengthens market demand. Regional variations exist, with North America and Europe currently holding significant market shares, though the Asia-Pacific region is anticipated to witness accelerated growth in the coming years due to burgeoning economies and infrastructure development. Segment-wise, the heavy-duty truck segment commands a substantial share, reflecting the high demand for heavy-duty transportation in various industries. Franchised dealers currently dominate sales channels, but independent dealers and peer-to-peer platforms are gradually gaining traction, driven by increased online presence and convenience.

The competitive landscape is characterized by a mix of established global players like Volvo Trucks, PACCAR Inc., and Daimler AG, alongside regional manufacturers such as Ashok Leyland and Tata Motors. These companies are employing various strategies to maintain their market positions, including expanding their product portfolios, enhancing after-sales services, and adopting innovative digital marketing techniques. However, challenges remain, including fluctuating fuel prices, stringent emission regulations, and supply chain disruptions that may influence overall market growth. The future of the used truck market will likely involve increased adoption of telematics, data-driven maintenance, and sustainable practices to meet evolving environmental concerns and enhance operational efficiency. The market's trajectory indicates a promising outlook, with continued growth anticipated over the forecast period, fueled by ongoing technological advancements and the ever-increasing demand for efficient freight transportation.

Truck Industry Market Report: 2019-2033 Forecast

Uncover the dynamics of a $xx Million market poised for explosive growth. This comprehensive report provides an in-depth analysis of the global truck industry, offering invaluable insights for investors, manufacturers, and industry stakeholders. From market size and segmentation to leading players and emerging trends, this report illuminates the path to success in this dynamic sector. The study period covers 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033.

Keywords: Truck Industry, Market Analysis, Heavy-duty Trucks, Medium-duty Trucks, Light Trucks, Volvo Trucks, PACCAR Inc, Ashok Leyland, Tata Motors, MAN SE, Scania AB, Navistar, Eicher, Renault, Mascus, Daimler AG, Truck Sales, Used Trucks, E-commerce, Truck Market Forecast, Commercial Vehicles, Industry Trends, Market Segmentation, CAGR, Market Share

Truck Industry Market Dynamics & Concentration

The global truck industry, valued at $xx Million in 2024, is characterized by moderate market concentration with a few dominant players commanding significant market share. Volvo Trucks, PACCAR Inc., and Daimler AG (including its SelecTrucks division) consistently rank among the top players, exhibiting strong global presence and diversified product portfolios. However, regional variations exist, with companies like Ashok Leyland and Tata Motors holding substantial market share in specific geographic areas.

Market share fluctuations are influenced by several factors, including:

- Innovation Drivers: The ongoing push for electric and autonomous trucks, along with advancements in fuel efficiency and safety technologies, drives significant innovation and shapes the competitive landscape. Companies investing heavily in R&D are better positioned to capture market share.

- Regulatory Frameworks: Stringent emission standards and safety regulations impact vehicle design and manufacturing costs, thus creating a competitive advantage for companies complying efficiently. Changes in import/export regulations also significantly affect the market dynamics.

- Product Substitutes: While the truck industry has limited direct substitutes for its core functionalities, the rise of alternative transportation modes like railways and enhanced intermodal transport systems is impacting the overall demand.

- End-User Trends: The evolving demands of end-users in logistics and transportation (e.g., preference for fuel-efficient, technologically advanced, and cost-effective trucks) are shaping the truck specifications and features.

- M&A Activities: Consolidation within the truck industry through mergers and acquisitions is a recurring theme. Over the historical period (2019-2024), we observed approximately xx M&A deals. This activity reshapes the market landscape, impacting market shares and competitive dynamics.

Truck Industry Industry Trends & Analysis

The global truck industry demonstrates a robust growth trajectory, projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key market drivers include:

- Infrastructure Development: Expansion of road networks in developing economies fuels demand for trucks to support transportation needs.

- E-commerce Boom: The rapid expansion of e-commerce is significantly increasing the demand for efficient logistics solutions, driving truck sales.

- Technological Disruptions: The adoption of advanced technologies such as telematics, connected services, and autonomous driving capabilities is enhancing operational efficiency and driving demand for technologically superior vehicles.

- Consumer Preferences: The focus on improved fuel efficiency, safety features, and driver comfort influences vehicle designs and consumer purchase decisions. This trend is driving premiumization in certain segments.

- Competitive Dynamics: Intense competition among manufacturers pushes innovation, improves product quality, and creates a buyer's market, resulting in better pricing and customer service.

Market penetration of electric trucks remains relatively low currently, but it's projected to increase significantly with growing environmental awareness and government regulations.

Leading Markets & Segments in Truck Industry

The North American and European regions currently dominate the global truck market, driven by strong economic activity, robust infrastructure, and mature logistics sectors. Within vehicle types, the heavy-duty truck segment holds the largest market share, primarily due to the high demand for long-haul transportation.

Key Drivers for Leading Regions & Segments:

- North America: Strong economic growth, robust infrastructure, and well-established logistics networks.

- Europe: High adoption of advanced technologies, stringent emission regulations, and a focus on sustainability.

- Heavy-duty Trucks: Essential for long-haul transportation, construction, and mining activities.

- Franchised Dealers: Offer established distribution networks, after-sales services, and brand support, maintaining a significant market share in sales channels.

The peer-to-peer sales channel is showing potential for future growth, though it currently represents a relatively small segment compared to traditional dealer networks.

Truck Industry Product Developments

Recent product innovations focus on improving fuel efficiency, safety, and connectivity. Electric and autonomous truck technologies are rapidly advancing, although widespread adoption faces challenges related to infrastructure and cost. Manufacturers are also incorporating advanced driver-assistance systems (ADAS) and telematics solutions to enhance fleet management and reduce operational costs. These developments aim to enhance the overall customer experience and strengthen the competitive positioning of manufacturers.

Key Drivers of Truck Industry Growth

Technological advancements, particularly in electric and autonomous driving technologies, are significantly impacting industry growth. Furthermore, robust economic growth in key markets and supportive government policies drive infrastructure development and enhance logistics needs. Stringent emission regulations also necessitate the adoption of cleaner technologies, stimulating innovation and market expansion.

Challenges in the Truck Industry Market

The truck industry faces challenges including stringent emission regulations, potentially increasing manufacturing costs and impacting profitability. Supply chain disruptions, particularly related to semiconductor shortages, are causing production delays and impacting vehicle availability. Intense competition among established and emerging manufacturers puts pricing pressure on the market, affecting profit margins for individual companies.

Emerging Opportunities in Truck Industry

The integration of autonomous driving and artificial intelligence technologies presents significant opportunities for improving efficiency and safety in the trucking industry. Strategic partnerships between truck manufacturers, technology companies, and logistics providers can unlock new market segments and revenue streams. Expanding into emerging markets and developing economies can provide access to new customer bases and market growth potential.

Leading Players in the Truck Industry Sector

- Volvo Trucks

- PACCAR Inc

- Ashok Leyland

- Tata Motors

- MAN SE (Volkswagen AG)

- Scania AB (Traton SE)

- Navistar International Corporation

- Eicher

- Renault SA

- Mascus

- Daimler AG (SelecTrucks)

- Enterprise Truck Rental

- AmeriQuest Used Truck

Key Milestones in Truck Industry Industry

- August 2023: Ashok Leyland launched its e-marketplace 'Re-AL' for used trucks, enhancing customer access and facilitating vehicle exchange. This initiative is expected to boost used truck sales and increase market penetration.

- June 2023: Daimler launched the "Bharat Benz Certified" platform for pre-owned trucks, focusing on quality assurance and enhanced customer trust. This move strengthens the used truck market and promotes sustainability.

Strategic Outlook for Truck Industry Market

The truck industry is poised for substantial growth driven by technological advancements, infrastructure investments, and expanding e-commerce activities. Strategic partnerships and mergers and acquisitions will further reshape the market landscape. Companies that effectively adapt to evolving consumer preferences, embrace technological innovation, and effectively manage supply chain challenges will capture significant market share in the years to come. The long-term outlook is highly positive, indicating substantial market expansion across segments and geographic regions.

Truck Industry Segmentation

-

1. Vehicle Type

- 1.1. Light Trucks

- 1.2. Medium-duty Trucks

- 1.3. Heavy-duty Trucks

-

2. Sales Channel

- 2.1. Independent Dealer

- 2.2. Franchised Dealer

- 2.3. Peer-to-peer

Truck Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Truck Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Infrastructure and Growing Construction Activities are Driving the Demand for Used Trucks; Cost Effectiveness and Affordability are Fueling the Demand for Used Trucks

- 3.3. Market Restrains

- 3.3.1. Stringent Emission and Safety Standards Present Challenges for the Market

- 3.4. Market Trends

- 3.4.1. Heavy-duty Trucks Will be the Leading Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Truck Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light Trucks

- 5.1.2. Medium-duty Trucks

- 5.1.3. Heavy-duty Trucks

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Independent Dealer

- 5.2.2. Franchised Dealer

- 5.2.3. Peer-to-peer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Truck Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light Trucks

- 6.1.2. Medium-duty Trucks

- 6.1.3. Heavy-duty Trucks

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Independent Dealer

- 6.2.2. Franchised Dealer

- 6.2.3. Peer-to-peer

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Truck Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light Trucks

- 7.1.2. Medium-duty Trucks

- 7.1.3. Heavy-duty Trucks

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Independent Dealer

- 7.2.2. Franchised Dealer

- 7.2.3. Peer-to-peer

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Truck Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light Trucks

- 8.1.2. Medium-duty Trucks

- 8.1.3. Heavy-duty Trucks

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Independent Dealer

- 8.2.2. Franchised Dealer

- 8.2.3. Peer-to-peer

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Truck Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Light Trucks

- 9.1.2. Medium-duty Trucks

- 9.1.3. Heavy-duty Trucks

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Independent Dealer

- 9.2.2. Franchised Dealer

- 9.2.3. Peer-to-peer

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Truck Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Truck Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Italy

- 11.1.6 Rest of Europe

- 12. Asia Pacific Truck Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Truck Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 South Africa

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Volvo Trucks

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 PACCAR Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Ashok Leyland

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Tata Motors

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 MAN SE (Volkswagen AG)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Scania AB ( Traton SE)

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Navistar International Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Eicher

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Renault SA

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mascus

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Daimler AG (SelecTrucks)

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Enterprise Truck Rental

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 AmeriQuest Used Truck

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 Volvo Trucks

List of Figures

- Figure 1: Global Truck Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Truck Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Truck Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Truck Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 13: North America Truck Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: North America Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Truck Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 17: Europe Truck Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 18: Europe Truck Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 19: Europe Truck Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 20: Europe Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Truck Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Asia Pacific Truck Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Asia Pacific Truck Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 25: Asia Pacific Truck Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 26: Asia Pacific Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Truck Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Truck Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Rest of the World Truck Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Rest of the World Truck Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Rest of the World Truck Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Rest of the World Truck Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Truck Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Truck Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Truck Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Truck Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Global Truck Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Africa Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Other Countries Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Truck Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global Truck Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Truck Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 33: Global Truck Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 34: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Russia Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Italy Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Truck Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 42: Global Truck Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 43: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Truck Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Truck Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 51: Global Truck Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Africa Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Other Countries Truck Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Truck Industry?

The projected CAGR is approximately > 5.23%.

2. Which companies are prominent players in the Truck Industry?

Key companies in the market include Volvo Trucks, PACCAR Inc, Ashok Leyland, Tata Motors, MAN SE (Volkswagen AG), Scania AB ( Traton SE), Navistar International Corporation, Eicher, Renault SA, Mascus, Daimler AG (SelecTrucks), Enterprise Truck Rental, AmeriQuest Used Truck.

3. What are the main segments of the Truck Industry?

The market segments include Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Infrastructure and Growing Construction Activities are Driving the Demand for Used Trucks; Cost Effectiveness and Affordability are Fueling the Demand for Used Trucks.

6. What are the notable trends driving market growth?

Heavy-duty Trucks Will be the Leading Segment.

7. Are there any restraints impacting market growth?

Stringent Emission and Safety Standards Present Challenges for the Market.

8. Can you provide examples of recent developments in the market?

August 2023: Ashok Leyland introduced its e-marketplace 'Re-AL', dedicated to the sale of used trucks. The platform enables customers to exchange their existing commercial vehicles and upgrade to new Ashok Leyland trucks and buses. The e-marketplace provides customers with various features to help them easily locate vehicles of their choice, including verified images of the vehicles, validated documents, and evaluation reports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Truck Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Truck Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Truck Industry?

To stay informed about further developments, trends, and reports in the Truck Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence