Key Insights

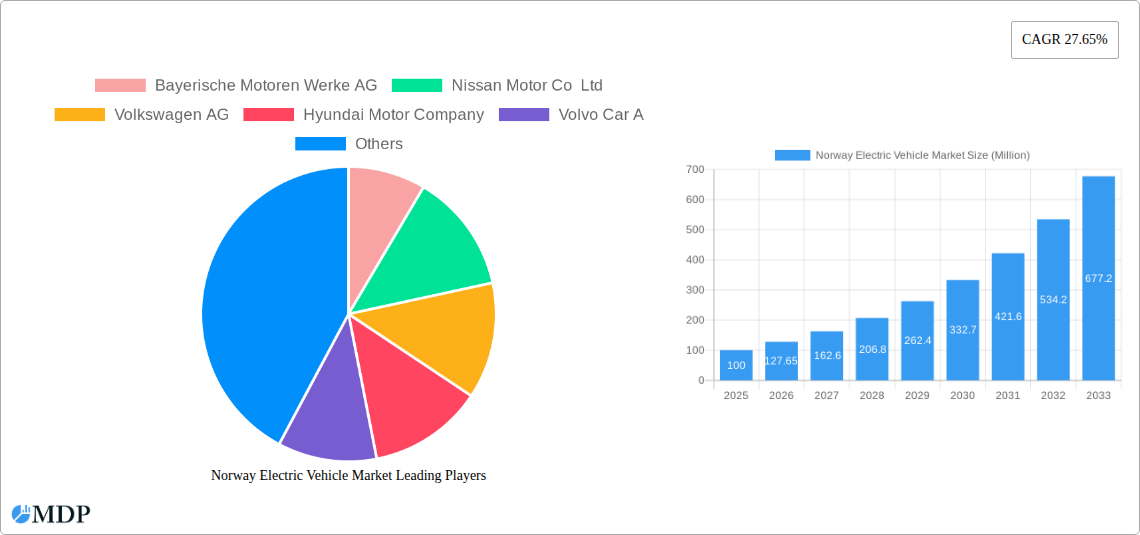

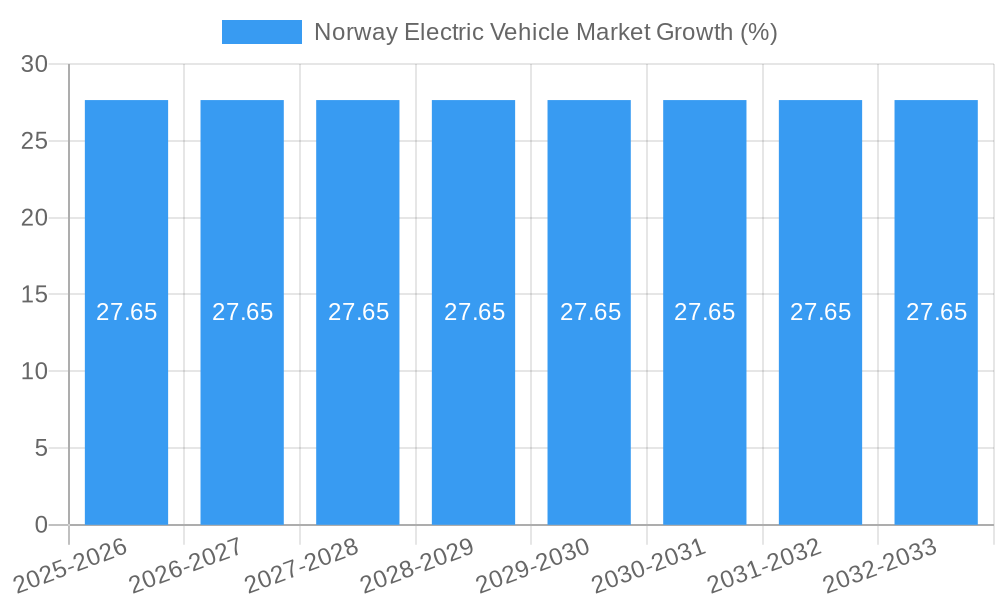

The Norway electric vehicle (EV) market is experiencing robust growth, driven by strong government incentives, a burgeoning eco-conscious consumer base, and a robust charging infrastructure. With a CAGR of 27.65% from 2019 to 2023, the market exhibits significant potential. The market's composition is diverse, encompassing Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs), across both passenger car and potentially light commercial vehicle segments (though the provided data focuses on passenger cars). Key players like Tesla, BMW, Volkswagen, and Hyundai are fiercely competing for market share, leveraging technological advancements and brand recognition to attract consumers. Norway's proactive approach to EV adoption, including substantial tax breaks and subsidies, coupled with its commitment to renewable energy sources, creates a favorable environment for continued expansion. The market's future growth will depend on factors like battery technology advancements, charging infrastructure expansion, and the overall economic climate. While potential restraints could include supply chain disruptions and rising raw material costs, Norway's commitment to sustainability and its early adoption of EVs suggest these challenges will be navigated effectively.

The forecast period of 2025-2033 presents substantial opportunities for growth. Based on the provided CAGR of 27.65% and assuming a 2025 market size of approximately 100 million (a reasonable estimation considering Norway's small but rapidly expanding EV market and a high penetration rate compared to global averages), the market is poised for exponential growth. This growth is expected to be fueled by continued government support, increasing consumer awareness of environmental concerns, and the introduction of more affordable and advanced EV models. The dominance of BEVs is likely to continue, although the presence of PHEVs and HEVs will remain significant, particularly in the transitional phase. Competition will intensify among manufacturers, leading to innovations in battery technology, charging solutions, and vehicle design. The continued success of the Norwegian EV market serves as a model for other nations aiming to achieve ambitious climate targets and reduce carbon emissions from the transportation sector.

Norway Electric Vehicle Market Report: 2019-2033 Forecast

Dive deep into the dynamic Norwegian EV market with this comprehensive report, providing invaluable insights for stakeholders and investors. This in-depth analysis covers the period 2019-2033, with a focus on the 2025-2033 forecast, offering a robust understanding of market trends, leading players, and future growth opportunities. The report uses 2025 as its base year and incorporates data from the historical period (2019-2024) to predict the market's trajectory. Expect detailed analysis across key segments – BEV, FCEV, HEV, and PHEV passenger cars – and a comprehensive overview of market leaders like Tesla Inc, Volkswagen AG, and Hyundai Motor Company. The report's value lies in its actionable insights, strategic recommendations, and precise market sizing in Millions.

Norway Electric Vehicle Market Dynamics & Concentration

This section analyzes the competitive landscape of the Norwegian electric vehicle (EV) market, considering market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The Norwegian EV market is characterized by a high degree of concentration, with a few major players holding significant market share. However, the market is also experiencing rapid innovation, driven by advancements in battery technology, charging infrastructure, and vehicle design. The government's supportive regulatory framework, including generous incentives and ambitious emission reduction targets, significantly influences market growth. The increasing availability of charging infrastructure and consumer preference for environmentally friendly vehicles are further boosting market expansion. The number of M&A deals in the sector has increased in recent years, reflecting the intense competition and consolidation within the industry. Market share data for key players (estimated for 2025):

- Tesla Inc: xx%

- Volkswagen AG: xx%

- Hyundai Motor Company: xx%

- Other Players: xx%

The total number of M&A deals within the Norwegian EV market between 2019 and 2024 is estimated at xx. These activities have significantly impacted market dynamics, leading to increased competition and innovation. The continued government support, technological advancements, and growing consumer demand are expected to drive further M&A activities in the coming years. The presence of substitutes, such as conventional internal combustion engine (ICE) vehicles, poses a challenge, but the increasing cost-competitiveness of EVs and stricter emission regulations are gradually reducing the appeal of ICE vehicles.

Norway Electric Vehicle Market Industry Trends & Analysis

The Norwegian EV market exhibits a robust growth trajectory, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the significant market expansion anticipated. Market penetration of EVs in Norway is already high compared to global averages and is expected to reach xx% by 2033. Technological disruptions, such as advancements in battery technology leading to increased range and reduced charging times, are key growth catalysts. Consumer preferences are shifting towards EVs, influenced by environmental concerns, government incentives, and the increasing availability of diverse and appealing EV models. Competitive dynamics are intense, with established automakers and new entrants vying for market share through innovation, pricing strategies, and expansion of charging infrastructure.

Leading Markets & Segments in Norway Electric Vehicle Market

The Norwegian EV market is largely dominated by the passenger car segment. Within the fuel categories, Battery Electric Vehicles (BEVs) constitute the largest segment, benefiting from the country’s well-developed charging infrastructure and government incentives. Key drivers for the dominance of BEVs and passenger cars include:

- Government Policies: Norway's robust incentives, including tax breaks and subsidies, significantly reduce the cost of EV ownership, making them highly attractive to consumers. The government’s ambitious emission reduction targets also support EV adoption.

- Charging Infrastructure: Norway boasts one of the most extensive and well-developed charging infrastructure networks in the world, addressing range anxiety concerns.

- Consumer Preferences: Norwegian consumers show a strong preference for environmentally friendly vehicles, driving the demand for EVs.

While Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) contribute to the market, their share is relatively smaller compared to BEVs. The FCEV segment remains niche due to limited infrastructure and higher cost. The geographical concentration of the market is predominantly within urban and densely populated areas where charging infrastructure is readily available. The government's commitment to expanding the charging network into rural areas could potentially unlock further growth in these regions.

Norway Electric Vehicle Market Product Developments

Recent product developments in the Norwegian EV market are focused on enhancing battery technology, improving vehicle range, and offering more sophisticated features. Automakers are competing on factors such as charging speed, battery life, safety features, and vehicle design. Innovation in battery technology, particularly solid-state batteries, promises a significant leap forward in terms of range, charging times, and safety. These advancements are crucial for sustaining the growth of the Norwegian EV market and addressing potential limitations. The market is witnessing the introduction of more affordable EVs, making them accessible to a broader range of consumers.

Key Drivers of Norway Electric Vehicle Market Growth

Several key factors drive the growth of the Norwegian EV market. These include:

- Government Support: Strong government incentives and policies designed to promote EV adoption significantly reduce purchase costs and boost consumer demand.

- Technological Advancements: Improvements in battery technology, charging infrastructure, and vehicle design enhance the overall appeal of EVs.

- Environmental Concerns: Growing public awareness of environmental issues and a desire to reduce carbon emissions contribute to a positive perception of EVs among consumers.

Challenges in the Norway Electric Vehicle Market Market

Despite the significant growth, the Norwegian EV market faces several challenges:

- High Initial Purchase Price: Despite government incentives, the initial purchase price of EVs remains higher compared to ICE vehicles for some models, potentially limiting adoption among price-sensitive consumers.

- Charging Infrastructure Gaps: While Norway’s charging infrastructure is advanced, gaps remain, particularly in less densely populated areas, potentially hindering the expansion of EV adoption.

- Battery Supply Chain Issues: Global supply chain constraints affecting battery production can impact the availability and affordability of EVs.

Emerging Opportunities in Norway Electric Vehicle Market

The long-term growth of the Norwegian EV market is fueled by significant opportunities. Advancements in battery technology promise to increase vehicle range, reduce charging times, and lower production costs, driving wider adoption. Strategic partnerships between automakers and energy companies to develop innovative charging solutions and infrastructure can further unlock the potential of the market. Expanding the charging network into rural areas can stimulate growth in those regions and further increase the accessibility of EVs.

Leading Players in the Norway Electric Vehicle Market Sector

- Bayerische Motoren Werke AG

- Nissan Motor Co Ltd

- Volkswagen AG

- Hyundai Motor Company

- Volvo Car A

- Tesla Inc

- Mercedes-Benz

- Audi AG

- Toyota Motor Corporation

Key Milestones in Norway Electric Vehicle Market Industry

- November 2023: Hyundai Motor's Genesis division opened a new showroom in New York, signaling expansion into a key US market. This has a limited impact on the Norwegian market directly, but reflects broader industry trends.

- November 2023: Tesla acquired US-based start-up SiILion battery (Battery manufacturer) to enhance its battery production capabilities in the US. This indirectly affects the Norwegian market by potentially improving global supply chains and reducing battery costs over time.

- November 2023: Tesla opened a new EV super-charging station between the Bay Area and Los Angeles in the US. Similar to the Genesis showroom opening, this primarily affects the US market, providing insights into infrastructure development trends relevant to other EV markets globally, including Norway.

Strategic Outlook for Norway Electric Vehicle Market Market

The future of the Norwegian EV market is bright, driven by continued government support, technological advancements, and increasing consumer preference. The market is expected to experience sustained growth, with BEVs continuing to dominate. Strategic opportunities exist for automakers to focus on enhancing battery technology, expanding charging infrastructure, and developing affordable EVs to reach a broader customer base. Companies that can effectively navigate the challenges related to battery supply chains and pricing will be best positioned for success in this rapidly evolving market.

Norway Electric Vehicle Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Norway Electric Vehicle Market Segmentation By Geography

- 1. Norway

Norway Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volkswagen AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Motor Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Car A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tesla Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mercedes-Benz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Audi AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Norway Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Electric Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Electric Vehicle Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Norway Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Norway Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Norway Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Norway Electric Vehicle Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 7: Norway Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 8: Norway Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Electric Vehicle Market?

The projected CAGR is approximately 27.65%.

2. Which companies are prominent players in the Norway Electric Vehicle Market?

Key companies in the market include Bayerische Motoren Werke AG, Nissan Motor Co Ltd, Volkswagen AG, Hyundai Motor Company, Volvo Car A, Tesla Inc, Mercedes-Benz, Audi AG, Toyota Motor Corporation.

3. What are the main segments of the Norway Electric Vehicle Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Motor's Genesis division has opened a new showroom in New York, the United States.November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Norway Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence