Key Insights

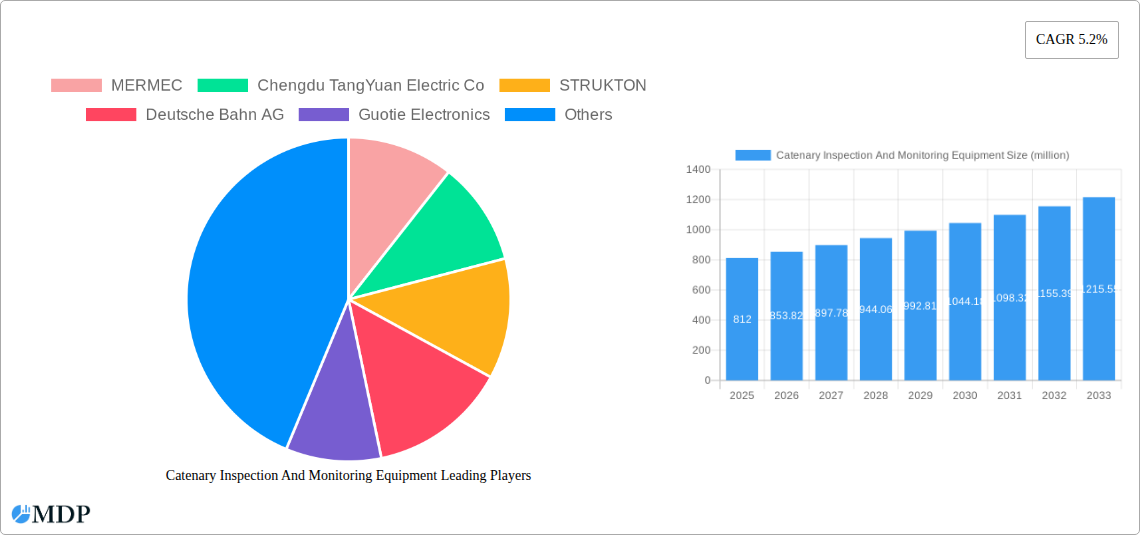

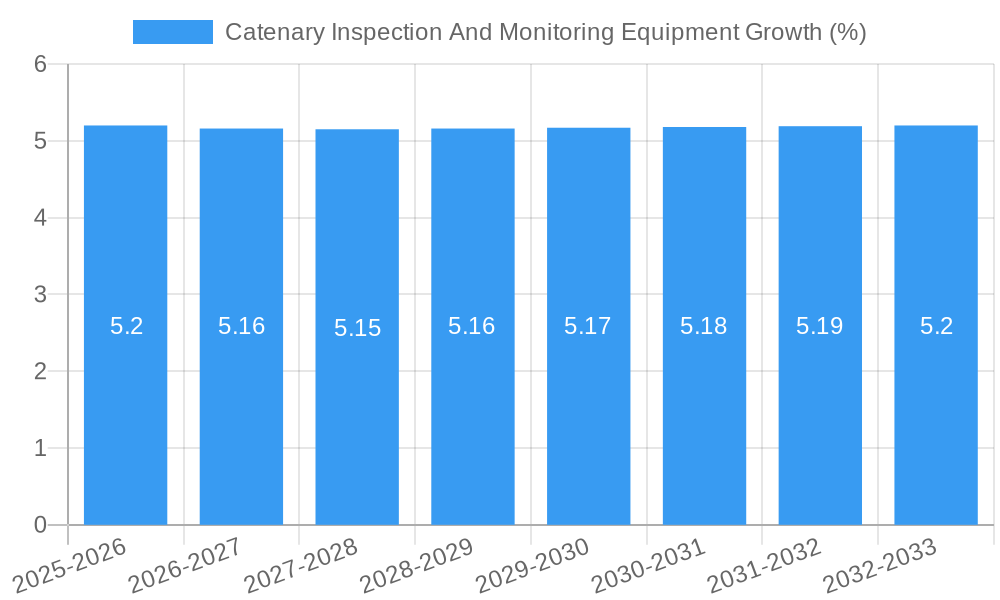

The global Catenary Inspection and Monitoring Equipment market is poised for substantial growth, projected to reach an estimated USD 812 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period of 2025-2033. This robust expansion is driven by the increasing emphasis on rail safety, operational efficiency, and the aging infrastructure of traditional railway networks worldwide. The continuous modernization and expansion of high-speed rail lines, coupled with the burgeoning urban rail transit systems, particularly in emerging economies, are significant catalysts. These advanced rail networks demand sophisticated inspection and monitoring solutions to ensure the uninterrupted and safe flow of electricity to trains, thereby preventing costly disruptions and potential accidents. The market's growth trajectory is further bolstered by regulatory mandates and the proactive adoption of advanced technologies by railway operators seeking to optimize maintenance schedules and extend the lifespan of their catenary systems.

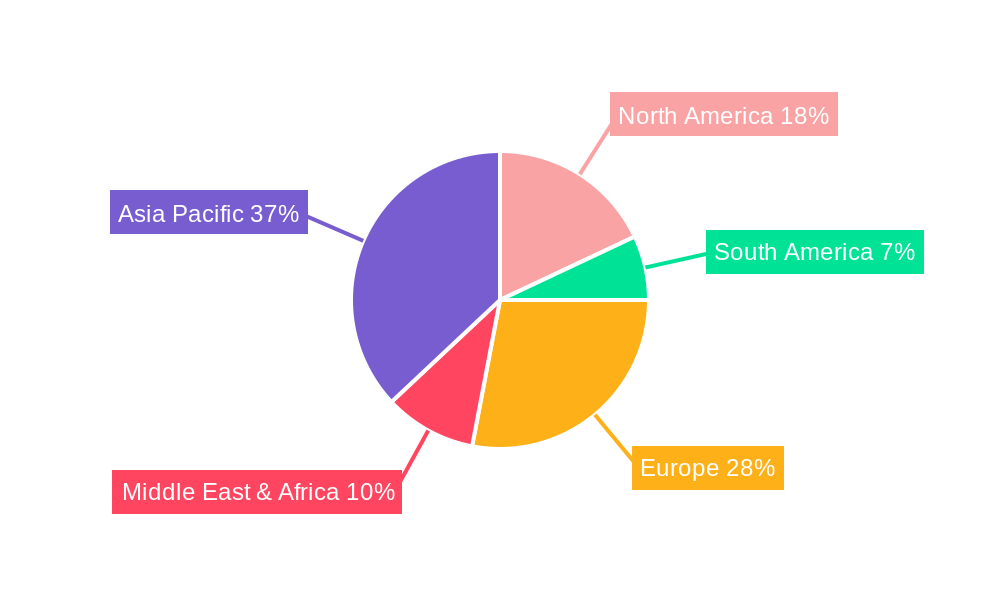

The market is segmented into two primary categories: by Type, encompassing Catenary Monitoring Devices and Catenary Detection Devices, and by Application, covering Traditional Railways, High-speed Railways, and Urban Rail Transit. The Catenary Monitoring Device segment is expected to witness strong demand due to its role in real-time, continuous oversight of catenary health, offering predictive maintenance capabilities. The High-speed Railways and Urban Rail Transit applications are anticipated to be the leading growth segments, owing to their critical need for reliable and advanced monitoring systems to support their high operational speeds and passenger volumes. Geographically, Asia Pacific, led by China and India, is projected to emerge as a dominant force, driven by massive investments in rail infrastructure and rapid urbanization. Europe and North America, with their well-established and modernizing rail networks, will also represent significant markets, characterized by the adoption of cutting-edge technologies and a strong focus on safety standards. Key industry players are actively engaged in research and development to introduce innovative solutions that enhance accuracy, efficiency, and data analytics for catenary inspection and monitoring.

Catenary Inspection And Monitoring Equipment Market Analysis: Driving Infrastructure Safety and Efficiency (2019–2033)

This comprehensive report delves into the burgeoning global market for Catenary Inspection and Monitoring Equipment. Analyzing the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study provides in-depth insights into market dynamics, technological advancements, key players, and future trends. With a focus on enhancing the safety and operational efficiency of railway networks, this report is an indispensable resource for industry stakeholders, including manufacturers, infrastructure operators, and technology providers. The market is poised for significant growth, driven by increasing investments in railway modernization, the expansion of high-speed rail networks, and the growing adoption of advanced monitoring technologies.

Catenary Inspection And Monitoring Equipment Market Dynamics & Concentration

The Catenary Inspection and Monitoring Equipment market exhibits moderate to high concentration, with a few key players holding significant market share. Leading entities such as MERMEC, Chengdu TangYuan Electric Co, STRUKTON, Deutsche Bahn AG, Guotie Electronics, CHSR, Meidensha Corporation, Geismar, TVEMA, ELAG Elektronik AG, ENSCO, European Trans Energy GmbH, Harbin VEIC Technology Co, HHGK, CRRC, Luster Lighttech Co, Patil Group(ApnaTech), BvSys Bildverarbeitungssysteme GmbH, Jiangxi Everbright Measurement and Control Technology Co, Selvistec Srl, Guangzhou Keii, ISVision(Hangzhou) Technology Co, and Chengdu Jiaoda Guangmang Technology Co are actively engaged in innovation and market expansion. Innovation drivers include the demand for real-time data, predictive maintenance capabilities, and enhanced automation in inspection processes. Regulatory frameworks, such as stringent safety standards for railway infrastructure, are also a significant factor shaping product development and market entry. Product substitutes, such as manual inspection methods, are gradually being phased out due to their inherent inefficiencies and safety risks. End-user trends indicate a growing preference for integrated, intelligent monitoring systems that can provide comprehensive data analysis and early fault detection. Merger and acquisition (M&A) activities, with an estimated xx M&A deal counts, are strategically aimed at consolidating market presence, acquiring advanced technologies, and expanding product portfolios to meet the evolving needs of the railway sector.

Catenary Inspection And Monitoring Equipment Industry Trends & Analysis

The Catenary Inspection and Monitoring Equipment industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period. This expansion is primarily fueled by the global imperative to upgrade aging railway infrastructure and the rapid development of new high-speed and urban rail transit systems. Technological disruptions are at the forefront of this growth, with advancements in sensor technology, artificial intelligence (AI), machine learning (ML), and drone-based inspection solutions revolutionizing how catenary systems are monitored. Consumers, primarily railway operators and infrastructure managers, are increasingly demanding solutions that offer higher accuracy, reduced downtime, and predictive maintenance capabilities. This shift is moving away from reactive repair strategies towards proactive asset management. The competitive landscape is characterized by intense innovation, with companies investing heavily in R&D to develop more sophisticated and cost-effective monitoring devices and detection systems. Market penetration of advanced inspection technologies is steadily increasing, as operators recognize the long-term economic benefits of improved safety and reduced maintenance costs. The integration of IoT (Internet of Things) platforms further enhances the value proposition by enabling seamless data flow and centralized monitoring of vast railway networks. The increasing complexity of modern catenary systems, coupled with higher operating speeds, necessitates more advanced and reliable inspection and monitoring solutions. The focus on operational efficiency and the prevention of costly disruptions are key drivers for the adoption of these cutting-edge technologies. The industry is also witnessing a trend towards more comprehensive diagnostic tools that can assess not only the physical condition of the catenary wires and supporting structures but also their electrical performance and environmental impact.

Leading Markets & Segments in Catenary Inspection And Monitoring Equipment

The global market for Catenary Inspection and Monitoring Equipment is dominated by the High-speed Railways segment, driven by the significant investments in high-speed rail networks worldwide. Countries like China, Japan, Germany, and France are at the forefront of this expansion, necessitating advanced monitoring solutions to ensure the safety and reliability of these high-speed lines.

Key Drivers of Dominance in High-speed Railways:

- Infrastructure Development: Massive government and private sector investments in building new high-speed rail corridors.

- Operational Demands: The necessity for extremely high levels of safety and uninterrupted operations at speeds exceeding 300 km/h.

- Technological Advancement: The adoption of state-of-the-art catenary systems that require specialized monitoring equipment.

- Regulatory Mandates: Stringent safety regulations specifically targeting high-speed rail operations.

Within the Type segmentation, Catenary Monitoring Devices are experiencing the highest demand, encompassing a broad range of technologies from static sensors to mobile data acquisition systems. These devices are crucial for continuous or periodic assessment of catenary condition, identifying wear, damage, and potential faults before they escalate into critical issues.

Key Drivers of Dominance in Catenary Monitoring Devices:

- Preventative Maintenance: Enabling proactive maintenance strategies, reducing costly emergency repairs and service disruptions.

- Data-Driven Insights: Providing real-time and historical data for trend analysis, performance optimization, and asset management.

- Automation: Facilitating automated inspection processes, reducing human error and increasing inspection efficiency.

- Cost-Effectiveness: Offering a superior return on investment through the prevention of major failures and extended equipment lifespan.

The Traditional Railways segment also represents a substantial market, driven by the need to maintain and upgrade existing infrastructure, particularly in developing economies and regions with extensive legacy rail networks. Urban Rail Transit is another rapidly growing segment, fueled by increasing urbanization and the demand for efficient public transportation systems in metropolitan areas. The development and expansion of metro and light rail networks necessitate reliable and cost-effective catenary inspection and monitoring solutions.

Catenary Inspection And Monitoring Equipment Product Developments

Product developments in the Catenary Inspection and Monitoring Equipment market are characterized by a strong emphasis on enhancing accuracy, automation, and data analytics. Innovations include the integration of AI and machine learning algorithms for automated fault detection and predictive maintenance, the development of drone-based inspection systems capable of real-time data capture, and the creation of robust, non-contact sensors for continuous monitoring. These advancements offer significant competitive advantages by reducing inspection time, improving safety for maintenance personnel, and providing more granular insights into the condition of the catenary infrastructure. The market is witnessing a trend towards integrated solutions that combine various inspection technologies into a single platform, offering comprehensive diagnostic capabilities and seamless data management.

Key Drivers of Catenary Inspection And Monitoring Equipment Growth

The growth of the Catenary Inspection and Monitoring Equipment market is propelled by several key factors. Technologically, the increasing sophistication of sensors, AI, and drone technology enables more efficient and accurate inspections. Economically, significant global investments in railway infrastructure development and modernization, particularly in high-speed and urban rail transit, directly fuel demand for these specialized equipment. Regulatory frameworks worldwide are increasingly prioritizing railway safety, mandating advanced inspection and monitoring practices to prevent accidents and operational disruptions. Furthermore, the growing emphasis on predictive maintenance strategies by railway operators to reduce operational costs and improve asset longevity is a major catalyst for market expansion.

Challenges in the Catenary Inspection And Monitoring Equipment Market

Despite robust growth, the Catenary Inspection and Monitoring Equipment market faces several challenges. High initial investment costs for advanced monitoring systems can be a barrier for some operators, particularly smaller railway companies or those in developing regions. Regulatory hurdles and the need for standardization across different railway networks can also slow down the adoption of new technologies. Supply chain complexities, especially for specialized components, can lead to delays and increased costs. Moreover, the competitive pressure among manufacturers drives down margins, requiring continuous innovation to maintain profitability. Resistance to adopting new technologies and the need for extensive training for personnel also present challenges.

Emerging Opportunities in Catenary Inspection And Monitoring Equipment

Emerging opportunities in the Catenary Inspection and Monitoring Equipment market lie in the continued expansion of high-speed and urban rail transit networks, particularly in emerging economies. Technological breakthroughs in areas such as IoT integration, digital twins, and advanced AI for anomaly detection present significant growth catalysts. Strategic partnerships between equipment manufacturers, software providers, and railway operators can lead to the development of tailored, integrated solutions. The growing demand for predictive maintenance as a service (MaaS) also offers a lucrative opportunity for service-oriented business models. Furthermore, the increasing focus on sustainability and the need to minimize the environmental impact of railway operations will drive the demand for efficient and reliable monitoring systems.

Leading Players in the Catenary Inspection And Monitoring Equipment Sector

- MERMEC

- Chengdu TangYuan Electric Co

- STRUKTON

- Deutsche Bahn AG

- Guotie Electronics

- CHSR

- Meidensha Corporation

- Geismar

- TVEMA

- ELAG Elektronik AG

- ENSCO

- European Trans Energy GmbH

- Harbin VEIC Technology Co

- HHGK

- CRRC

- Luster Lighttech Co

- Patil Group(ApnaTech)

- BvSys Bildverarbeitungssysteme GmbH

- Jiangxi Everbright Measurement and Control Technology Co

- Selvistec Srl

- Guangzhou Keii

- ISVision(Hangzhou) Technology Co

- Chengdu Jiaoda Guangmang Technology Co

Key Milestones in Catenary Inspection And Monitoring Equipment Industry

- 2019: Increased adoption of drone-based visual inspection for routine catenary checks.

- 2020: Significant advancements in AI-powered image analysis for automated defect identification.

- 2021: Launch of integrated monitoring systems combining static and dynamic data acquisition.

- 2022: Growing interest in IoT platforms for real-time, network-wide catenary health monitoring.

- 2023: Introduction of advanced non-contact sensors for more precise measurement of contact wire wear.

- 2024: Strategic partnerships formed to develop comprehensive predictive maintenance solutions.

- 2025 (Estimated): Expected widespread deployment of digital twin technology for catenary asset management.

- 2026-2033 (Forecast): Anticipated integration of advanced robotics for automated repairs guided by monitoring data.

Strategic Outlook for Catenary Inspection And Monitoring Equipment Market

The strategic outlook for the Catenary Inspection and Monitoring Equipment market is overwhelmingly positive, driven by the continuous evolution of railway infrastructure and the indispensable need for safety and operational efficiency. Future growth will be propelled by the increasing adoption of smart technologies, including AI, ML, and IoT, which enable predictive maintenance and real-time performance monitoring. The expansion of high-speed rail networks globally, coupled with the ongoing urbanization leading to increased demand for urban rail transit, will further amplify market opportunities. Strategic investments in R&D, focus on integrated solutions, and the formation of robust partnerships will be crucial for key players to maintain a competitive edge and capitalize on the evolving demands of the railway industry. The market is poised for sustained expansion as infrastructure operators prioritize advanced technologies to ensure the longevity and reliability of their critical assets.

Catenary Inspection And Monitoring Equipment Segmentation

-

1. Application

- 1.1. Traditional Railways

- 1.2. High-speed Railways

- 1.3. Urban Rail Transit

-

2. Type

- 2.1. Catenary Monitoring Device

- 2.2. Catenary Detection Device

Catenary Inspection And Monitoring Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Catenary Inspection And Monitoring Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Traditional Railways

- 5.1.2. High-speed Railways

- 5.1.3. Urban Rail Transit

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Catenary Monitoring Device

- 5.2.2. Catenary Detection Device

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Traditional Railways

- 6.1.2. High-speed Railways

- 6.1.3. Urban Rail Transit

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Catenary Monitoring Device

- 6.2.2. Catenary Detection Device

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Traditional Railways

- 7.1.2. High-speed Railways

- 7.1.3. Urban Rail Transit

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Catenary Monitoring Device

- 7.2.2. Catenary Detection Device

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Traditional Railways

- 8.1.2. High-speed Railways

- 8.1.3. Urban Rail Transit

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Catenary Monitoring Device

- 8.2.2. Catenary Detection Device

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Traditional Railways

- 9.1.2. High-speed Railways

- 9.1.3. Urban Rail Transit

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Catenary Monitoring Device

- 9.2.2. Catenary Detection Device

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Catenary Inspection And Monitoring Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Traditional Railways

- 10.1.2. High-speed Railways

- 10.1.3. Urban Rail Transit

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Catenary Monitoring Device

- 10.2.2. Catenary Detection Device

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MERMEC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chengdu TangYuan Electric Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STRUKTON

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deutsche Bahn AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Guotie Electronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHSR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meidensha Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Geismar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TVEMA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ELAG Elektronik AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ENSCO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 European Trans Energy GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Harbin VEIC Technology Co

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HHGK

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CRRC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Luster Lighttech Co

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Patil Group(ApnaTech)

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BvSys Bildverarbeitungssysteme GmbH

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Jiangxi Everbright Measurement and Control Technology Co

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Selvistec Srl

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Guangzhou Keii

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 ISVision(Hangzhou) Technology Co

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Chengdu Jiaoda Guangmang Technology Co

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 MERMEC

List of Figures

- Figure 1: Global Catenary Inspection And Monitoring Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Catenary Inspection And Monitoring Equipment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Catenary Inspection And Monitoring Equipment Revenue (million), by Type 2024 & 2032

- Figure 5: North America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Catenary Inspection And Monitoring Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Catenary Inspection And Monitoring Equipment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Catenary Inspection And Monitoring Equipment Revenue (million), by Type 2024 & 2032

- Figure 11: South America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Catenary Inspection And Monitoring Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Catenary Inspection And Monitoring Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Catenary Inspection And Monitoring Equipment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Catenary Inspection And Monitoring Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Catenary Inspection And Monitoring Equipment Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Catenary Inspection And Monitoring Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Catenary Inspection And Monitoring Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Catenary Inspection And Monitoring Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Catenary Inspection And Monitoring Equipment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Catenary Inspection And Monitoring Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Catenary Inspection And Monitoring Equipment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Catenary Inspection And Monitoring Equipment?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Catenary Inspection And Monitoring Equipment?

Key companies in the market include MERMEC, Chengdu TangYuan Electric Co, STRUKTON, Deutsche Bahn AG, Guotie Electronics, CHSR, Meidensha Corporation, Geismar, TVEMA, ELAG Elektronik AG, ENSCO, European Trans Energy GmbH, Harbin VEIC Technology Co, HHGK, CRRC, Luster Lighttech Co, Patil Group(ApnaTech), BvSys Bildverarbeitungssysteme GmbH, Jiangxi Everbright Measurement and Control Technology Co, Selvistec Srl, Guangzhou Keii, ISVision(Hangzhou) Technology Co, Chengdu Jiaoda Guangmang Technology Co.

3. What are the main segments of the Catenary Inspection And Monitoring Equipment?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 812 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Catenary Inspection And Monitoring Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Catenary Inspection And Monitoring Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Catenary Inspection And Monitoring Equipment?

To stay informed about further developments, trends, and reports in the Catenary Inspection And Monitoring Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence