Key Insights

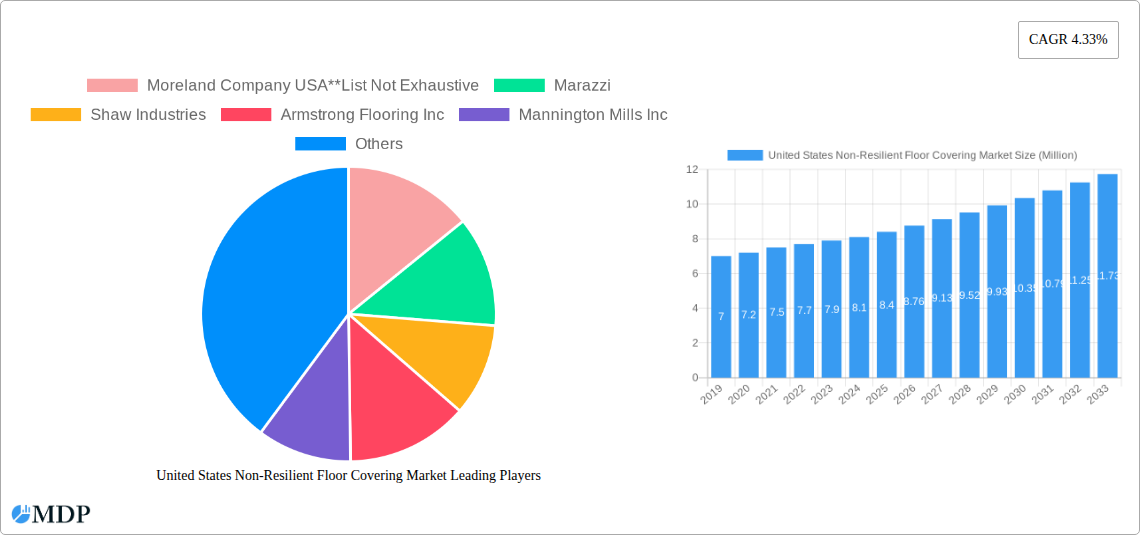

The United States Non-Resilient Floor Covering Market is poised for steady expansion, with an estimated market size of $8.40 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.33% through 2033. This robust growth is fueled by a confluence of factors, including the enduring popularity of aesthetically versatile and durable materials like ceramic and stone tiles, alongside the increasing adoption of wood and laminate tiles for their natural appeal and performance benefits in both residential and commercial settings. The shift towards visually appealing, low-maintenance, and sustainable flooring solutions is a significant driver, especially as consumers and businesses increasingly prioritize longevity and ease of upkeep. Furthermore, the evolving interior design landscape, which favors textured surfaces and natural-looking materials, directly benefits the non-resilient segment. The market is also witnessing a growing emphasis on innovative product features such as enhanced scratch resistance, water repellency, and eco-friendly compositions.

United States Non-Resilient Floor Covering Market Market Size (In Million)

While the market exhibits strong growth potential, certain challenges temper its trajectory. The inherent cost associated with some premium non-resilient options, such as high-end natural stone or intricately designed ceramic tiles, can present a barrier to entry for budget-conscious consumers. Additionally, fluctuating raw material prices and the complexities of global supply chains can impact manufacturing costs and availability, leading to price volatility. However, the expanding distribution channels, particularly the burgeoning online segment, are actively addressing these restraints by offering greater accessibility, competitive pricing, and a wider selection of products. The increasing availability of installation tutorials and customer reviews online also empowers consumers, thereby mitigating concerns related to installation complexity and product suitability. The market's ability to innovate and offer value-driven solutions across its diverse product segments will be crucial in navigating these challenges and capitalizing on its inherent growth momentum.

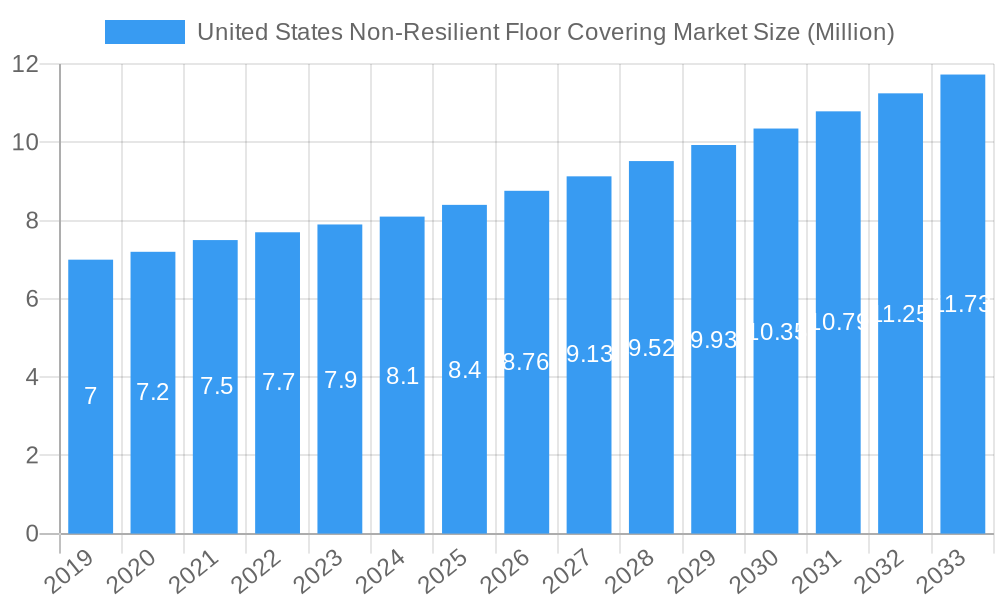

United States Non-Resilient Floor Covering Market Company Market Share

United States Non-Resilient Floor Covering Market: In-Depth Analysis & Forecast (2019-2033)

Unlock critical insights into the dynamic United States non-resilient floor covering market. This comprehensive report delves into market trends, growth drivers, competitive landscapes, and future opportunities, providing actionable intelligence for manufacturers, distributors, investors, and industry stakeholders. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers detailed analysis and precise forecasts to guide your strategic decisions.

United States Non-Resilient Floor Covering Market Market Dynamics & Concentration

The United States non-resilient floor covering market is characterized by a moderate to high concentration, with a few key players dominating significant market share. This concentration is driven by substantial capital investment requirements for manufacturing, extensive distribution networks, and brand recognition. Innovation remains a crucial driver, particularly in developing sustainable materials, enhanced durability, and aesthetically pleasing designs that mimic natural materials. Regulatory frameworks, such as building codes, environmental standards (e.g., VOC emissions), and material safety regulations, play a significant role in shaping product development and market access. Product substitutes, including resilient flooring options and even alternative wall coverings, pose a constant competitive challenge, pushing manufacturers to continuously improve their offerings. End-user trends are shifting towards preferences for eco-friendly products, ease of maintenance, and designs that enhance both residential comfort and commercial aesthetics. Mergers and acquisitions (M&A) activities are notable, indicating consolidation within the industry as companies seek to expand their product portfolios, market reach, and technological capabilities. For instance, the strategic partnership between Encina Development Group and Shaw Industries signifies a growing trend towards circular economy principles.

- Market Share: Major players like Mohawk Industries Inc., Armstrong Flooring Inc., and Shaw Industries Group, Inc. collectively hold a substantial portion of the market.

- M&A Deal Counts: While specific deal counts fluctuate, the historical trend shows consistent activity aimed at market consolidation and strategic expansion.

- Innovation Drivers: Sustainability, performance enhancements (e.g., scratch resistance, water repellency), and design versatility are paramount.

United States Non-Resilient Floor Covering Market Industry Trends & Analysis

The United States non-resilient floor covering market is experiencing robust growth, fueled by a confluence of factors including expanding residential construction, a recovering commercial sector, and increasing consumer demand for durable and aesthetically appealing flooring solutions. The Compound Annual Growth Rate (CAGR) is projected to be healthy throughout the forecast period, driven by sustained investment in home renovations and new construction projects. Technological disruptions are significantly influencing the market, with advancements in manufacturing processes leading to more cost-effective production and enhanced product quality. The development of advanced composite materials and innovative printing technologies allows for the creation of non-resilient floor coverings that closely replicate the look and feel of natural materials like wood and stone, at a more accessible price point.

Consumer preferences are evolving, with a heightened emphasis on sustainability and environmental responsibility. This trend is driving demand for flooring made from recycled materials, low-VOC emitting products, and those with a reduced carbon footprint. Furthermore, consumers are seeking flooring solutions that offer ease of installation, low maintenance, and high durability, especially in high-traffic areas of both residential and commercial spaces. The market penetration of advanced non-resilient flooring options is steadily increasing as consumers become more aware of their benefits.

The competitive dynamics within the market are intense, with both established giants and emerging players vying for market share. Companies are differentiating themselves through product innovation, strategic marketing campaigns, and the development of comprehensive distribution networks. The rise of e-commerce has also opened new avenues for sales and customer engagement, impacting traditional retail models. The increasing adoption of luxury vinyl tile (LVT) and engineered wood flooring, which fall under the broader non-resilient category, highlights a significant shift in consumer choices driven by a desire for both performance and aesthetic appeal. The demand for waterproof and scratch-resistant options further underscores the industry's responsiveness to evolving consumer needs.

Leading Markets & Segments in United States Non-Resilient Floor Covering Market

The United States non-resilient floor covering market is segmented by product type, end-user, and distribution channel, with distinct growth trajectories for each.

Dominant Product Type: Ceramic Tiles Flooring and Wood Tiles Flooring continue to hold significant market share due to their timeless appeal, durability, and versatility in design. Ceramic tiles are favored for their water resistance and ease of maintenance, making them ideal for kitchens and bathrooms. Wood tiles, encompassing both solid and engineered wood, are highly sought after for their aesthetic warmth and ability to enhance property value in residential settings. However, Laminate Tiles Flooring is rapidly gaining traction due to its cost-effectiveness, durability, and increasingly realistic wood and stone-look designs, making it a strong contender in the market.

- Key Drivers for Ceramic Tiles Flooring:

- High durability and moisture resistance.

- Wide range of design options, including realistic stone and wood imitations.

- Growing demand in both residential and commercial sectors for aesthetically pleasing and low-maintenance solutions.

- Key Drivers for Wood Tiles Flooring:

- Perceived luxury and aesthetic appeal in residential markets.

- Increasing adoption of engineered wood for enhanced stability and durability.

- Growing renovation market prioritizing home improvement.

- Key Drivers for Laminate Tiles Flooring:

- Cost-effectiveness compared to natural wood and stone.

- Improved scratch and stain resistance.

- Ease of installation, appealing to DIY consumers.

Dominant End-User: The Residential sector remains the primary driver of demand for non-resilient floor coverings, fueled by new home construction, renovation projects, and an increasing focus on interior design. Homeowners are investing in flooring that offers both durability and aesthetic appeal, driving the popularity of products that mimic natural materials. The Commercial sector, encompassing offices, retail spaces, healthcare facilities, and hospitality, also represents a substantial market, with demand influenced by factors such as foot traffic, hygiene requirements, and brand image.

- Key Drivers for Residential Sector:

- High volume of home renovation and remodeling projects.

- Increased consumer spending on home aesthetics and comfort.

- Growing demand for durable and low-maintenance flooring solutions.

- Key Drivers for Commercial Sector:

- Expansion of retail and hospitality industries.

- Need for durable and easily maintainable flooring in high-traffic areas.

- Emphasis on creating inviting and branded environments.

Dominant Distribution Channel: The Offline distribution channel, including traditional flooring retailers, home improvement stores, and specialized flooring showrooms, continues to dominate sales. These channels offer customers the opportunity to see, touch, and experience the flooring products firsthand, which is crucial for purchasing decisions. However, the Online channel is experiencing rapid growth, driven by e-commerce platforms and direct-to-consumer sales models. Online channels offer convenience, wider product selection, and competitive pricing, attracting a growing segment of tech-savvy consumers.

- Key Drivers for Offline Channel:

- Tangible product experience and expert advice from sales associates.

- Convenience for immediate purchase and installation planning.

- Established relationships with contractors and builders.

- Key Drivers for Online Channel:

- Growing preference for e-commerce for home goods.

- Competitive pricing and promotional offers.

- Accessibility to a wider range of brands and product specifications.

United States Non-Resilient Floor Covering Market Product Developments

Product development in the United States non-resilient floor covering market is largely focused on enhancing sustainability and performance. Innovations in material science have led to the creation of flooring solutions with improved scratch resistance, water repellency, and impact absorption, catering to the demands of high-traffic residential and commercial environments. Technological advancements in digital printing are enabling the production of incredibly realistic wood, stone, and abstract patterns, offering a vast aesthetic palette. Furthermore, the industry is witnessing a surge in eco-friendly product lines, utilizing recycled content and low-VOC emitting materials, aligning with growing consumer and regulatory preferences for sustainable building products. These developments not only address functional needs but also significantly enhance the visual appeal and market fit of non-resilient flooring options.

Key Drivers of United States Non-Resilient Floor Covering Market Growth

The growth of the United States non-resilient floor covering market is propelled by several key drivers. Robust residential construction and a thriving home renovation market are paramount, as consumers invest in upgrading their living spaces with aesthetically pleasing and durable flooring. Technological advancements in manufacturing are enabling the production of cost-effective and high-performance flooring solutions that closely mimic natural materials, thereby expanding their appeal. Increasing consumer awareness regarding the benefits of non-resilient flooring, such as its durability, water resistance, and ease of maintenance, further fuels demand. Moreover, the growing emphasis on sustainable and eco-friendly building materials is driving innovation and market adoption of products made from recycled content and with lower environmental impact.

Challenges in the United States Non-Resilient Floor Covering Market Market

Despite its growth, the United States non-resilient floor covering market faces several challenges. Intense price competition among manufacturers and the availability of lower-cost substitutes can put pressure on profit margins. Volatile raw material prices, particularly for polymers and resins used in production, can impact manufacturing costs and pricing strategies. Supply chain disruptions, as experienced in recent years, can lead to delays in production and delivery, affecting inventory management and customer satisfaction. Furthermore, evolving environmental regulations and stringent VOC emission standards require continuous investment in research and development to ensure product compliance. The perceived inferiority compared to natural materials in some consumer segments also presents an ongoing marketing challenge.

Emerging Opportunities in United States Non-Resilient Floor Covering Market

Emerging opportunities in the United States non-resilient floor covering market are substantial and varied. The growing demand for luxury vinyl tile (LVT) and other high-end waterproof flooring solutions presents a significant growth avenue, driven by their durability and aesthetic appeal in both residential and commercial applications. The increasing focus on sustainability and the circular economy is creating opportunities for manufacturers to develop and market innovative products made from recycled materials and with reduced environmental footprints. Technological advancements in digital printing and material science are enabling the creation of highly customizable and performance-enhanced flooring, opening new niche markets. Furthermore, strategic partnerships and collaborations, such as the one between Encina Development Group and Shaw Industries, highlight the potential for innovation in material sourcing and recycling. The expansion of e-commerce and direct-to-consumer sales channels also offers new avenues for market reach and customer engagement.

Leading Players in the United States Non-Resilient Floor Covering Market Sector

- Moreland Company USA

- Marazzi

- Shaw Industries

- Armstrong Flooring Inc

- Mannington Mills Inc

- FloorMuffler

- Kronotex USA

- Florida Tile Inc

- Mohawk Industries Inc

- Bruce flooring

Key Milestones in United States Non-Resilient Floor Covering Market Industry

- April 2023: Encina Development Group, a producer of ISCC+ circular chemicals from end-of-life plastics, announced a new recycling partnership with Shaw Industries Group, Inc., a global flooring manufacturer. Under the agreement, Shaw will provide Encina with more than USD 2.72 million of waste materials from its carpet manufacturing processes annually. This partnership underscores a growing commitment to sustainability and circular economy principles within the industry.

- August 2022: AHF sold factories and warehouses in Arkansas, Kentucky, Missouri, and Tennessee to Broadstone Net Lease, based in Rochester, New York. The leaseback deal is for 25 years, with options to extend the lease twice for 10-year intervals. AHF's payment is about USD 5 million annually. This transaction signifies strategic financial management and potential operational restructuring among key industry players, impacting supply chain dynamics and production capacities.

Strategic Outlook for United States Non-Resilient Floor Covering Market Market

The strategic outlook for the United States non-resilient floor covering market is overwhelmingly positive, driven by sustained demand for aesthetically pleasing, durable, and cost-effective flooring solutions. Key growth accelerators include continued innovation in material science and manufacturing technologies, leading to products that offer superior performance and mimic natural materials with greater authenticity. The increasing consumer and regulatory emphasis on sustainability will continue to drive the development and adoption of eco-friendly flooring options, creating significant market opportunities for companies investing in circular economy principles and recycled content. Furthermore, the expansion of e-commerce platforms and direct-to-consumer sales models presents strategic avenues for enhanced market reach and customer engagement, while a focus on product diversification to cater to specific end-user needs in both residential and commercial sectors will be crucial for long-term success. Strategic partnerships and potential consolidation through M&A activities are also anticipated to shape the competitive landscape, allowing companies to leverage synergies and expand their market presence.

United States Non-Resilient Floor Covering Market Segmentation

-

1. Product Type

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Other Product Types

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

United States Non-Resilient Floor Covering Market Segmentation By Geography

- 1. United States

United States Non-Resilient Floor Covering Market Regional Market Share

Geographic Coverage of United States Non-Resilient Floor Covering Market

United States Non-Resilient Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth of Construction Sector is Driving the United States Non-Resilient Flooring Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Moreland Company USA**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marazzi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shaw Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Armstrong Flooring Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mannington Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FloorMuffler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kronotex USA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Florida Tile Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mohawk Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bruce flooring

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Moreland Company USA**List Not Exhaustive

List of Figures

- Figure 1: United States Non-Resilient Floor Covering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Non-Resilient Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 7: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Non-Resilient Floor Covering Market?

The projected CAGR is approximately 4.33%.

2. Which companies are prominent players in the United States Non-Resilient Floor Covering Market?

Key companies in the market include Moreland Company USA**List Not Exhaustive, Marazzi, Shaw Industries, Armstrong Flooring Inc, Mannington Mills Inc, FloorMuffler, Kronotex USA, Florida Tile Inc, Mohawk Industries Inc, Bruce flooring.

3. What are the main segments of the United States Non-Resilient Floor Covering Market?

The market segments include Product Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Growth of Construction Sector is Driving the United States Non-Resilient Flooring Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices.

8. Can you provide examples of recent developments in the market?

April 2023: Encina Development Group, a producer of ISCC+ circular chemicals from end-of-life plastics, announced a new recycling partnership with Shaw Industries Group, Inc., a global flooring manufacturer. Under the agreement, Shaw will provide Encina with more than USD 2.72 million of waste materials from its carpet manufacturing processes annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Non-Resilient Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Non-Resilient Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Non-Resilient Floor Covering Market?

To stay informed about further developments, trends, and reports in the United States Non-Resilient Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence