Key Insights

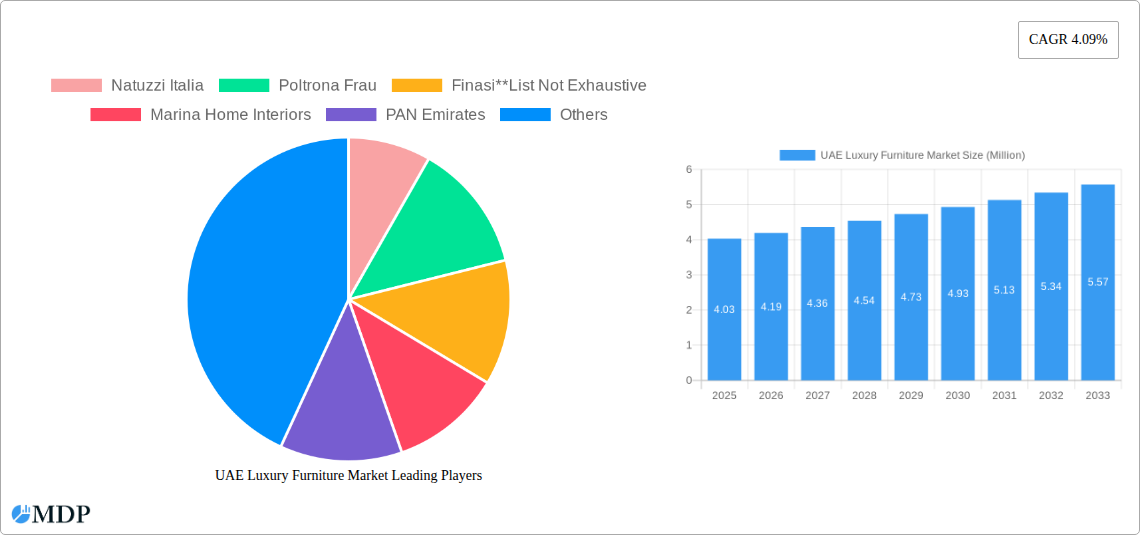

The UAE Luxury Furniture Market is poised for robust growth, projected to expand from an estimated value of $4.03 million in 2025 with a Compound Annual Growth Rate (CAGR) of 4.09% through 2033. This upward trajectory is primarily fueled by a confluence of factors, including the nation's burgeoning real estate sector, a rising disposable income among its affluent population, and a sustained demand for high-end, aesthetically pleasing interior designs. The market's dynamism is further amplified by government initiatives promoting tourism and attracting foreign investment, which in turn stimulate the demand for premium hospitality and residential furniture. Key drivers such as the increasing urbanization and a growing preference for bespoke and custom-designed furniture pieces that reflect individual lifestyles and social status are expected to propel market expansion. Furthermore, the continuous introduction of innovative designs and the integration of smart technologies into furniture offerings are contributing to its appeal among discerning consumers.

UAE Luxury Furniture Market Market Size (In Million)

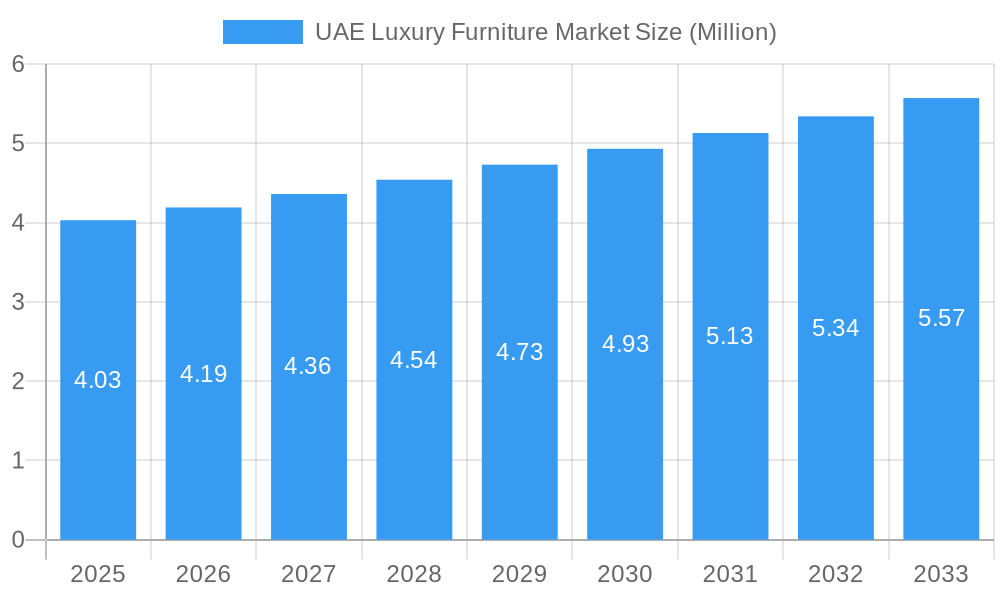

The market segmentation reveals a diverse landscape, with 'Home Furniture' and 'Office Furniture' applications representing significant revenue streams, catering to both residential and corporate clients. The 'Material' segment is expected to see strong performance from 'Wood' and 'Metal' furniture, valued for their durability and aesthetic appeal, while 'Glass' and 'Plastic' offer modern and versatile options. Distribution channels are also evolving, with 'Online' platforms experiencing rapid adoption due to convenience and wider reach, complementing traditional 'Home Centers,' 'Flagship Stores,' and 'Specialty Stores.' Companies like Natuzzi Italia, Poltrona Frau, and Marina Home Interiors are at the forefront, continuously innovating to capture market share. The GCC region, particularly the UAE, is a focal point for luxury furniture consumption, driven by its status as a global hub for luxury goods and its commitment to developing world-class infrastructure and residential developments.

UAE Luxury Furniture Market Company Market Share

Unveiling the UAE Luxury Furniture Market: A Comprehensive Report

Report Description:

Dive deep into the thriving UAE luxury furniture market with this in-depth analysis, designed to equip industry stakeholders with actionable insights and strategic foresight. This report meticulously examines market dynamics, industry trends, key segments, product innovations, growth drivers, challenges, and emerging opportunities within the UAE's opulent furniture landscape. Featuring comprehensive data from 2019 to 2033, with a base year of 2025, this study offers unparalleled visibility into market concentration, competitive landscapes, and future trajectories. Discover the pivotal role of key players like Natuzzi Italia, Poltrona Frau, Finasi, Marina Home Interiors, PAN Emirates, Danube, Minotti, Durabella Furniture, B&B Italia, and Royal Furniture as we explore the market's evolution through segments such as Wood, Metal, Glass, Plastic, and Other Materials, and applications spanning Home Furniture, Office Furniture, Hospitality Furniture, and Other Furniture. Understand the impact of distribution channels like Home Centers, Flagship Stores, Specialty Stores, and Online, and gain clarity on significant industry developments. This report is your definitive guide to navigating and capitalizing on the booming UAE luxury furniture sector.

UAE Luxury Furniture Market Market Dynamics & Concentration

The UAE luxury furniture market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration, while present with established international and regional brands, is also fostered by the presence of discerning consumers seeking unique and high-quality pieces. Innovation drivers are paramount, with a constant push for bespoke designs, sustainable materials, and smart furniture solutions that cater to the evolving preferences of affluent clientele. Regulatory frameworks, while generally supportive of business growth, often focus on import regulations and product standards, ensuring quality and safety. Product substitutes, primarily from mass-market brands or artisanal local crafts, exist but rarely compete directly with the perceived value, craftsmanship, and brand prestige associated with luxury furniture. End-user trends lean heavily towards personalization, experiential retail, and a desire for furniture that reflects status and sophisticated taste. Mergers and acquisition (M&A) activities, while not overtly high in volume, are strategically focused on expanding market reach, acquiring niche brands, or integrating supply chains for enhanced efficiency. For instance, a hypothetical M&A targeting a premium bespoke wood furniture manufacturer could significantly enhance a larger retailer's product portfolio. The market, though competitive, offers significant opportunities for brands that can consistently deliver on quality, design, and customer experience.

UAE Luxury Furniture Market Industry Trends & Analysis

The UAE luxury furniture market is experiencing robust growth, driven by a confluence of economic prosperity, a burgeoning expatriate population, and an increasing demand for sophisticated living and working spaces. The projected Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is estimated at a healthy XX%, indicating sustained expansion. Market penetration is steadily increasing as luxury brands become more accessible through diverse distribution channels, including prominent home centers and sophisticated online platforms. A significant trend is the growing emphasis on sustainability and ethical sourcing, with consumers increasingly favoring furniture made from eco-friendly materials and produced with minimal environmental impact. This shift is compelling manufacturers to invest in innovative materials and production processes. Technological disruptions are also reshaping the industry, with the integration of smart home technologies into furniture, offering enhanced functionality and convenience. Virtual reality (VR) and augmented reality (AR) are being leveraged for immersive customer experiences, allowing shoppers to visualize furniture in their own spaces before making a purchase. Consumer preferences are increasingly leaning towards personalized and customizable furniture, reflecting individual tastes and lifestyle needs. This demand for bespoke solutions is pushing brands to offer a wider range of design options, materials, and finishes. The competitive landscape is intensifying, with both established international luxury brands and ambitious regional players vying for market share. Strategic partnerships and collaborations are becoming crucial for brands to expand their reach and offer comprehensive design solutions. The hospitality sector, in particular, continues to be a significant market for luxury furniture, with the UAE’s continuous development of world-class hotels and resorts fueling demand for high-end furnishings.

Leading Markets & Segments in UAE Luxury Furniture Market

The UAE luxury furniture market exhibits dominance across several key segments, reflecting the diverse needs and preferences of its affluent consumer base.

Dominant Application Segment: Home Furniture stands as the most significant segment, driven by the high disposable incomes and strong propensity for home improvement among residents and expatriates. The ongoing development of residential properties, including luxury apartments and villas, further fuels this demand.

Dominant Material Segment: Wood remains the cornerstone of luxury furniture, prized for its natural beauty, durability, and versatility. High-quality hardwoods like walnut, oak, and mahogany are extensively used, often in conjunction with intricate carving and artisanal finishes. The enduring appeal of classic and contemporary wooden designs ensures its continued market leadership.

Dominant Distribution Channel: Flagship Stores and Specialty Stores collectively represent the primary distribution channel for luxury furniture. These exclusive environments provide an immersive brand experience, allowing customers to interact with high-end products, receive personalized consultations, and appreciate the craftsmanship firsthand. The emphasis on curated collections and a premium shopping journey makes these channels indispensable for luxury brands.

Emerging Segment Influence: While Home Furniture dominates, Hospitality Furniture is a rapidly growing segment. The UAE's continuous development of world-class hotels, resorts, and high-end restaurants necessitates a constant influx of sophisticated and durable furniture. This sector benefits from large-scale projects and a focus on creating luxurious and memorable guest experiences.

Material Nuances: Beyond wood, Metal furniture, particularly in polished brass, stainless steel, and wrought iron, is gaining traction for its modern aesthetic and structural integrity. Glass, often tempered or artistic, is incorporated for tabletops, accents, and partitions, adding a touch of elegance. Plastic, while less prevalent in traditional luxury, is finding its niche in innovative, designer pieces that prioritize form and cutting-edge aesthetics.

Distribution Channel Evolution: The Online distribution channel is experiencing significant growth, driven by convenience and the increasing sophistication of e-commerce platforms. Luxury brands are investing in high-quality online catalogs, virtual consultations, and efficient delivery and installation services to capture this segment. However, it often complements, rather than replaces, the in-store experience for high-value purchases.

UAE Luxury Furniture Market Product Developments

Product innovations in the UAE luxury furniture market are largely focused on enhancing aesthetics, functionality, and sustainability. Designers are increasingly incorporating smart technology, such as integrated charging ports and adjustable lighting, into pieces like bespoke desks and ergonomic chairs. The trend towards customization allows consumers to select from a wide array of premium materials, including ethically sourced woods, recycled metals, and innovative composite materials, to create unique pieces tailored to their specific tastes and living spaces. Competitive advantages are being built on the fusion of artisanal craftsmanship with modern design principles, resulting in furniture that is both visually stunning and highly functional, offering enhanced durability and a distinct market appeal.

Key Drivers of UAE Luxury Furniture Market Growth

The sustained growth of the UAE luxury furniture market is propelled by several key factors. Economically, the nation's stable GDP and high per capita income, coupled with a robust tourism and hospitality sector, create a fertile ground for luxury spending. Regulatory frameworks that encourage foreign investment and business setup, alongside a proactive government focus on developing world-class infrastructure, contribute to a conducive business environment. Technologically, the increasing adoption of e-commerce and advanced digital tools for design visualization and customer engagement are expanding market reach. Furthermore, a growing expatriate population with diverse cultural tastes and a desire for premium living experiences significantly fuels demand for high-quality, designer furniture.

Challenges in the UAE Luxury Furniture Market Market

Despite its promising growth, the UAE luxury furniture market faces several challenges. Intense competition from both international and local brands, coupled with the high cost of premium materials and craftsmanship, can impact profit margins. Fluctuations in raw material prices and global supply chain disruptions can lead to increased production costs and extended lead times, affecting product availability. Stringent import regulations and customs duties on certain furniture components can also add to operational complexities and costs. Furthermore, maintaining consistent quality and delivering exceptional customer service across all touchpoints is crucial but can be resource-intensive, particularly as the market expands.

Emerging Opportunities in UAE Luxury Furniture Market

The UAE luxury furniture market presents several compelling opportunities for growth and innovation. The increasing demand for sustainable and eco-friendly furniture is creating a niche for brands that prioritize environmentally conscious materials and production methods. The rise of e-commerce and digital technologies offers avenues for expanding market reach through online sales, virtual showrooms, and personalized digital marketing campaigns. Strategic partnerships with interior designers, architects, and property developers can unlock access to large-scale residential and commercial projects, further driving sales. Moreover, the ongoing development of new residential and commercial spaces across the UAE presents a continuous demand for high-end, bespoke furniture solutions, offering significant potential for market expansion.

Leading Players in the UAE Luxury Furniture Market Sector

- Natuzzi Italia

- Poltrona Frau

- Finasi

- Marina Home Interiors

- PAN Emirates

- Danube

- Minotti

- Durabella Furniture

- B&B Italia

- Royal Furniture

Key Milestones in UAE Luxury Furniture Market Industry

- January 2022: Royal Furniture opened a new store in the UAE in City Center Al Zahia, a new haven for mall-goers by Majid Al Futtaim, situated in the heart of Sharjah.

- 2021: Pan Emirates released a product catalog consisting of more than 100 new designs for living room, dining room, bedroom, kitchen, and home decoration and lighting accessories.

Strategic Outlook for UAE Luxury Furniture Market Market

The strategic outlook for the UAE luxury furniture market is exceptionally bright, driven by continuous economic diversification and a sustained focus on enhancing living standards. The market is poised for significant growth, fueled by ongoing real estate development, a rising affluent population, and a burgeoning tourism sector that demands world-class hospitality furnishings. Brands that can adeptly blend traditional craftsmanship with modern innovation, prioritize sustainability, and leverage digital channels for enhanced customer engagement and sales will be best positioned for success. Strategic collaborations with interior design professionals and a focus on offering highly personalized, bespoke furniture solutions will be key accelerators for market penetration and long-term dominance in this opulent and evolving sector.

UAE Luxury Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Glass

- 1.4. Plastic

- 1.5. Other Materials

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

- 2.4. Other Furniture

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

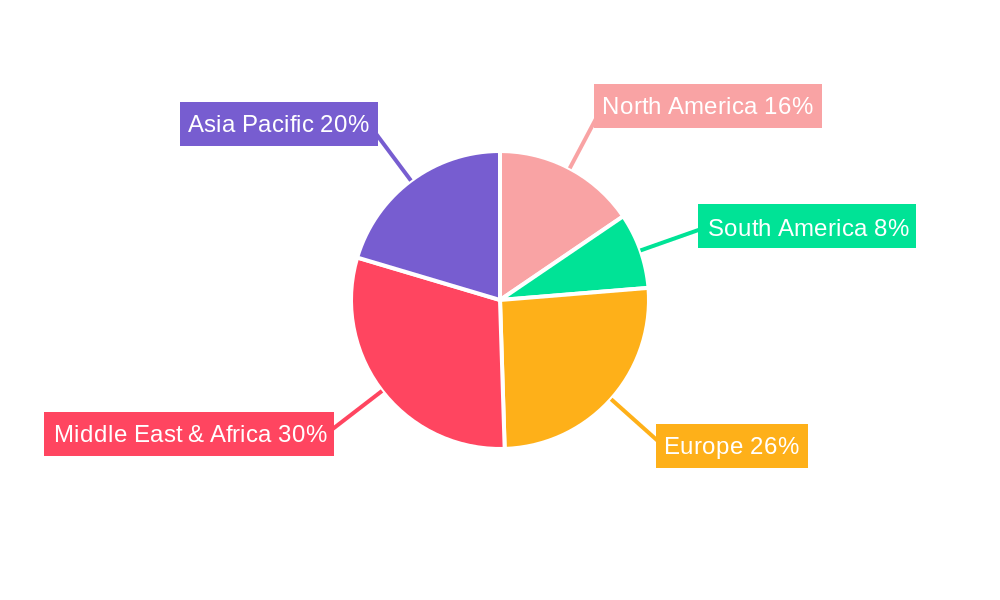

UAE Luxury Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Luxury Furniture Market Regional Market Share

Geographic Coverage of UAE Luxury Furniture Market

UAE Luxury Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend for Luxury Furniture; Real Estate Development

- 3.3. Market Restrains

- 3.3.1. High Import Taxes and Duties; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growth of Real Estate Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Plastic

- 5.1.5. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.2.4. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Plastic

- 6.1.5. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Furniture

- 6.2.2. Office Furniture

- 6.2.3. Hospitality Furniture

- 6.2.4. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Plastic

- 7.1.5. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Furniture

- 7.2.2. Office Furniture

- 7.2.3. Hospitality Furniture

- 7.2.4. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Wood

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Plastic

- 8.1.5. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home Furniture

- 8.2.2. Office Furniture

- 8.2.3. Hospitality Furniture

- 8.2.4. Other Furniture

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Wood

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Plastic

- 9.1.5. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home Furniture

- 9.2.2. Office Furniture

- 9.2.3. Hospitality Furniture

- 9.2.4. Other Furniture

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific UAE Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Wood

- 10.1.2. Metal

- 10.1.3. Glass

- 10.1.4. Plastic

- 10.1.5. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home Furniture

- 10.2.2. Office Furniture

- 10.2.3. Hospitality Furniture

- 10.2.4. Other Furniture

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Natuzzi Italia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Poltrona Frau

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Finasi**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marina Home Interiors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PAN Emirates

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danube

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Minotti

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Durabella Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B&B Italia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Natuzzi Italia

List of Figures

- Figure 1: Global UAE Luxury Furniture Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Luxury Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America UAE Luxury Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America UAE Luxury Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America UAE Luxury Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UAE Luxury Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America UAE Luxury Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America UAE Luxury Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UAE Luxury Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Luxury Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 11: South America UAE Luxury Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America UAE Luxury Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 13: South America UAE Luxury Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America UAE Luxury Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America UAE Luxury Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America UAE Luxury Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UAE Luxury Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Luxury Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe UAE Luxury Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe UAE Luxury Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe UAE Luxury Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe UAE Luxury Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe UAE Luxury Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe UAE Luxury Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UAE Luxury Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Luxury Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa UAE Luxury Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa UAE Luxury Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa UAE Luxury Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa UAE Luxury Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa UAE Luxury Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa UAE Luxury Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Luxury Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Luxury Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific UAE Luxury Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific UAE Luxury Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific UAE Luxury Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific UAE Luxury Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific UAE Luxury Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific UAE Luxury Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Luxury Furniture Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UAE Luxury Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global UAE Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global UAE Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global UAE Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global UAE Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Luxury Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global UAE Luxury Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global UAE Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global UAE Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Luxury Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Luxury Furniture Market?

The projected CAGR is approximately 4.09%.

2. Which companies are prominent players in the UAE Luxury Furniture Market?

Key companies in the market include Natuzzi Italia, Poltrona Frau, Finasi**List Not Exhaustive, Marina Home Interiors, PAN Emirates, Danube, Minotti, Durabella Furniture, B&B Italia, Royal Furniture.

3. What are the main segments of the UAE Luxury Furniture Market?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend for Luxury Furniture; Real Estate Development.

6. What are the notable trends driving market growth?

Growth of Real Estate Sector.

7. Are there any restraints impacting market growth?

High Import Taxes and Duties; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

On January 26, 2022, Royal Furniture opened a new store in the UAE in City Center Al Zahia, a new haven for mall-goers by Majid Al Futtaim, situated in the heart of Sharjah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Luxury Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Luxury Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Luxury Furniture Market?

To stay informed about further developments, trends, and reports in the UAE Luxury Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence