Key Insights

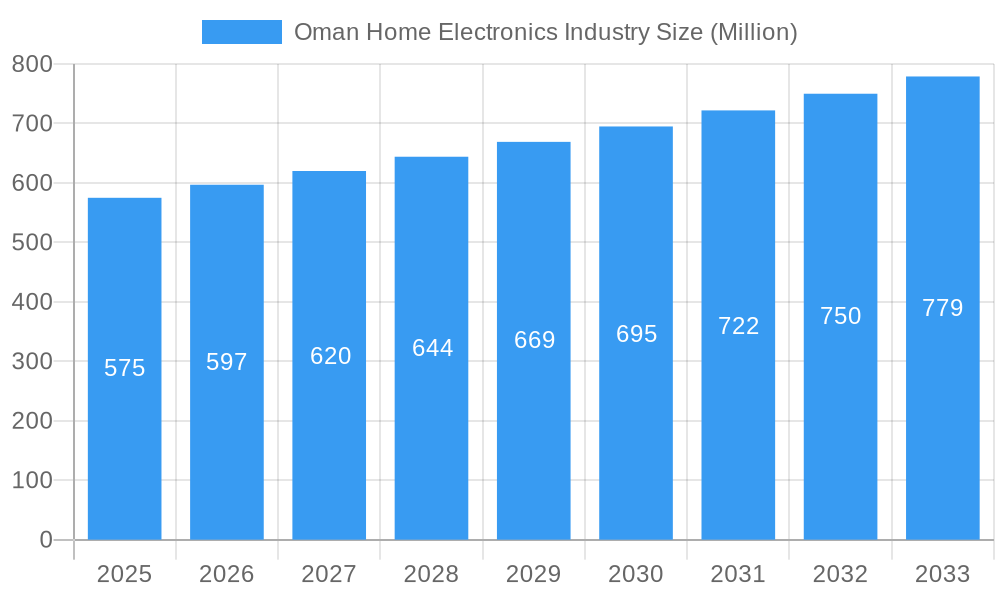

The Oman Home Electronics Market is projected for substantial growth, expanding from a base of 500 million in 2024, with a Compound Annual Growth Rate (CAGR) of 8%. This expansion is fueled by Oman's growing population, rising disposable incomes, and increasing consumer demand for modern living solutions. Key growth factors include ongoing urbanization driving demand for new housing and essential home appliances, alongside a growing adoption of energy-efficient and smart home technologies. Government initiatives for economic diversification and infrastructure development also create a favorable environment for consumer spending. Enhanced retail penetration and the rapid growth of e-commerce channels are further boosting product accessibility across the Sultanate.

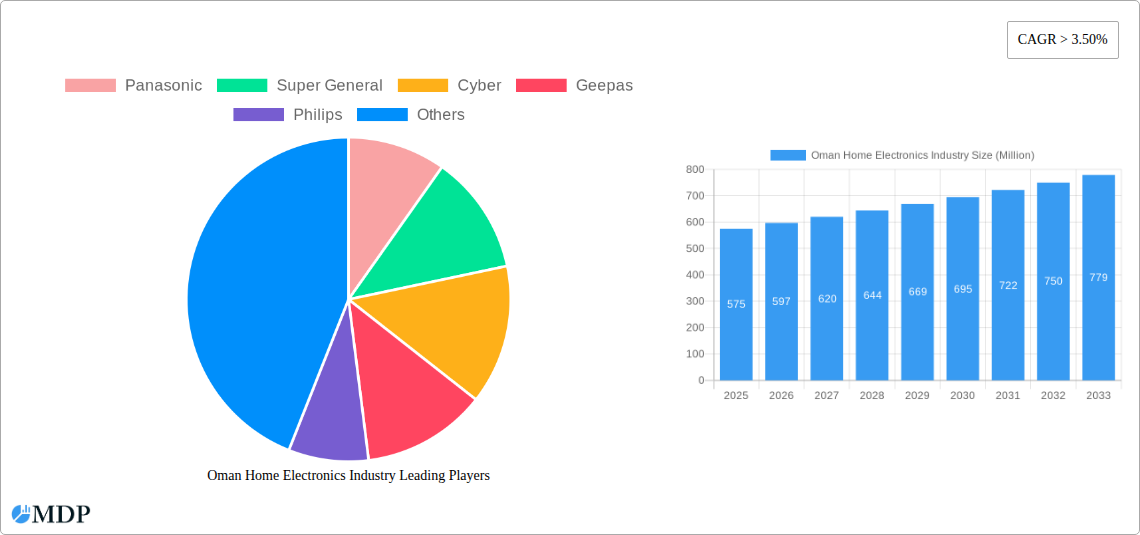

Oman Home Electronics Industry Market Size (In Million)

Product segmentation highlights steady demand for essential appliances such as refrigerators and washing machines. Air conditioners are experiencing accelerated growth due to Oman's climate and rising comfort expectations. The "Others" category, including small kitchen appliances and entertainment systems, shows significant potential as consumers invest in enhancing their living spaces. Distribution channels are evolving, with multi-branded and specialty stores remaining important, while online sales are rapidly gaining prominence for their convenience and broader product selection. Leading international and regional players like LG Electronics, Samsung, and Bosch are engaged in intense competition, introducing innovative products and strategic marketing campaigns to capture market share. The market's competitive landscape is expected to remain dynamic, characterized by technological advancements and customer-focused strategies, further stimulating market expansion.

Oman Home Electronics Industry Company Market Share

Oman Home Electronics Industry Market Dynamics & Concentration

The Oman home electronics industry is characterized by a moderate market concentration, with a few key players like Panasonic, Samsung, and LG Electronics holding significant market share. The market share distribution indicates that these leading brands collectively command approximately 60% of the market value. Innovation drivers are primarily fueled by increasing consumer demand for smart home technology and energy-efficient appliances. Regulatory frameworks, largely driven by government initiatives to promote energy conservation and product safety standards, are increasingly shaping product development and market entry. The availability of product substitutes from both domestic and international markets presents a constant competitive pressure, influencing pricing strategies and product differentiation. End-user trends are strongly leaning towards connectivity, convenience, and premium features, with a growing segment of consumers seeking integrated smart home ecosystems. Merger and acquisition (M&A) activities have been limited in recent years, with only a few minor strategic partnerships observed, reflecting a stable competitive landscape for now. The estimated number of M&A deals in the past five years is around 5, indicating a cautious approach to consolidation.

Oman Home Electronics Industry Industry Trends & Analysis

The Oman home electronics industry is experiencing robust growth, propelled by a confluence of escalating disposable incomes, a burgeoning expatriate population, and a rising preference for modern and technologically advanced home appliances. The Compound Annual Growth Rate (CAGR) for the home electronics market in Oman is projected at a healthy 7.5% over the forecast period of 2025–2033. This expansion is significantly driven by increasing consumer awareness and adoption of smart home devices, a trend amplified by global technological advancements. The market penetration of essential home appliances like refrigerators and washing machines is already high, nearing 90%, but the growth in these categories is now shifting towards higher-end, feature-rich models. Air conditioners represent a significant segment due to Oman’s climatic conditions, with continuous innovation in energy efficiency and cooling technology being a key market differentiator. The rise of e-commerce and digital platforms has also dramatically reshaped distribution channels, offering consumers greater convenience and wider product selection. This shift is fostering intense competition among manufacturers and retailers to enhance their online presence and digital customer engagement strategies. Furthermore, government initiatives promoting digitalization and smart city development are expected to further stimulate the demand for interconnected home electronics. The ongoing evolution of consumer preferences, with a growing emphasis on aesthetics, durability, and after-sales service, necessitates that industry players continually innovate and adapt their product portfolios and marketing approaches to maintain a competitive edge in this dynamic market.

Leading Markets & Segments in Oman Home Electronics Industry

The Air Conditioners segment stands out as a dominant force within the Oman home electronics industry, driven by the nation’s hot and arid climate. This segment consistently accounts for a significant portion of market revenue, estimated at 35% of the total home electronics market value in the base year of 2025.

- Product Segment Dominance:

- Refrigerators: While a mature market, demand for larger capacity and energy-efficient models continues to fuel steady growth. Economic policies encouraging energy-saving appliances have positively impacted this segment.

- Washing Machines: High household penetration rates, coupled with a growing demand for smart and inverter technology, solidify its position.

- Air Conditioners: This is the undisputed leader, with consistent demand throughout the year. Factors like increasing infrastructure development and a growing expatriate population, particularly in urban centers like Muscat and Salalah, significantly contribute to its dominance. Government initiatives promoting energy efficiency standards for AC units have also spurred innovation and consumer adoption of premium models.

- Distribution Channel Dominance:

- Multi-Branded Stores: These outlets remain the primary distribution channel, offering consumers a wide array of brands and product choices under one roof. Their extensive reach across major cities and towns provides unparalleled accessibility.

- Online: The online distribution channel is rapidly gaining traction, exhibiting a CAGR of 15% during the forecast period. The convenience of home delivery, competitive pricing, and wider product availability are key drivers. Government efforts to boost e-commerce infrastructure and a growing tech-savvy population are accelerating this trend.

- Specialty Stores: While a smaller segment, they cater to niche markets and high-end products, offering expert advice and personalized service.

Oman Home Electronics Industry Product Developments

Product innovation in the Oman home electronics industry is primarily focused on smart home integration and energy efficiency. Manufacturers are increasingly embedding AI and IoT capabilities into appliances, allowing for remote control, automated operation, and enhanced user experiences. For instance, new refrigerator models offer advanced cooling technologies and inventory management features, while washing machines incorporate intelligent fabric care and reduced water consumption. The competitive advantage lies in the seamless integration of these devices into a connected home ecosystem, alongside robust after-sales support and warranty services, catering to the discerning Omani consumer’s demand for convenience and technological sophistication.

Key Drivers of Oman Home Electronics Industry Growth

Several key drivers are propelling the Oman home electronics industry forward. Rising disposable incomes among Omani households and a significant expatriate population with a penchant for modern living significantly boost purchasing power. The government's push towards digitalization and smart city initiatives is creating a fertile ground for smart home devices and connected appliances. Furthermore, favorable demographics, including a young and tech-savvy population, are readily adopting new technologies. Ongoing urbanization also necessitates greater demand for home appliances in new residential developments.

Challenges in the Oman Home Electronics Industry Market

Despite strong growth, the Oman home electronics industry faces certain challenges. Intense price competition among domestic and international brands can compress profit margins for manufacturers and retailers. Supply chain disruptions, exacerbated by global events, can lead to stockouts and delivery delays, impacting consumer satisfaction. Stringent import regulations and customs duties on certain electronic components can also increase operational costs. Furthermore, the high initial cost of advanced smart home devices can be a deterrent for a segment of the price-sensitive consumer base, limiting market penetration for premium products.

Emerging Opportunities in Oman Home Electronics Industry

Emerging opportunities in the Oman home electronics industry are largely centered around the expansion of the smart home ecosystem and the growing demand for sustainable products. As consumers become more aware of energy consumption, there is an increasing appetite for energy-efficient appliances and renewable energy-integrated solutions. Strategic partnerships between electronics manufacturers and smart home technology providers can unlock new revenue streams. Furthermore, the development of localized customer support and after-sales services tailored to the Omani market can create a significant competitive advantage and foster customer loyalty.

Leading Players in the Oman Home Electronics Industry Sector

- Panasonic

- Super General

- Cyber

- Geepas

- Philips

- Braun

- Bosch

- Krypton

- Garmin

- Samsung

- LG Electronics

- Hitachi

Key Milestones in Oman Home Electronics Industry Industry

- Aug 2021: LG Electronics (LG) Home Appliance & Air Solution Company opened a new online showroom, LG HVAC Virtual Experience, responding to consumers' and businesses' increasing reliance on online resources to influence purchase decisions and capitalizing on the trend of virtual experiences.

- June 2021: BSH, a manufacturer of connected home appliances, announced a cooperation with Embedded Voice Recognition Solutions to integrate voice automation into its factories, aiming to boost production operator efficiency and enhance ergonomics through its BSH Startup Kitchen venture client branch.

Strategic Outlook for Oman Home Electronics Industry Market

The strategic outlook for the Oman home electronics industry is optimistic, driven by a sustained demand for advanced and energy-efficient appliances. The focus will be on leveraging technological advancements like AI and IoT to create truly connected and intuitive home environments. Expanding the reach of online sales channels and enhancing digital customer engagement will be crucial. Furthermore, strategic collaborations with real estate developers to integrate smart home solutions into new constructions will unlock significant growth potential. The industry's future success hinges on its ability to adapt to evolving consumer preferences for convenience, sustainability, and sophisticated home technology.

Oman Home Electronics Industry Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashers

- 1.4. Washing Machines

- 1.5. Air Conditioners

- 1.6. Microwave Ovens

- 1.7. Others

-

2. Distribution Channel

- 2.1. Multi Branded Store

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Oman Home Electronics Industry Segmentation By Geography

- 1. Oman

Oman Home Electronics Industry Regional Market Share

Geographic Coverage of Oman Home Electronics Industry

Oman Home Electronics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Smart Homes are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Home Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashers

- 5.1.4. Washing Machines

- 5.1.5. Air Conditioners

- 5.1.6. Microwave Ovens

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi Branded Store

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Super General

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cyber

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Geepas

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Braun

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Krypton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Garmin

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LG Electronics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hitachi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Oman Home Electronics Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Oman Home Electronics Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Home Electronics Industry Revenue million Forecast, by Product 2020 & 2033

- Table 2: Oman Home Electronics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Oman Home Electronics Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Oman Home Electronics Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Oman Home Electronics Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Oman Home Electronics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Oman Home Electronics Industry Revenue million Forecast, by Product 2020 & 2033

- Table 8: Oman Home Electronics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Oman Home Electronics Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Oman Home Electronics Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Oman Home Electronics Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Oman Home Electronics Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Home Electronics Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Oman Home Electronics Industry?

Key companies in the market include Panasonic, Super General, Cyber, Geepas, Philips, Braun, Bosch, Krypton, Garmin, Samsung, LG Electronics, Hitachi.

3. What are the main segments of the Oman Home Electronics Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 500 million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Smart Homes are Driving the Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

Aug 2021: LG Electronics (LG) Home Appliance & Air Solution Company has opened a new online showroom, LG HVAC Virtual Experience, as consumers and business have looked to online recourses to help influence their purchase decision, since virtual experiences have become a trend.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Home Electronics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Home Electronics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Home Electronics Industry?

To stay informed about further developments, trends, and reports in the Oman Home Electronics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence