Key Insights

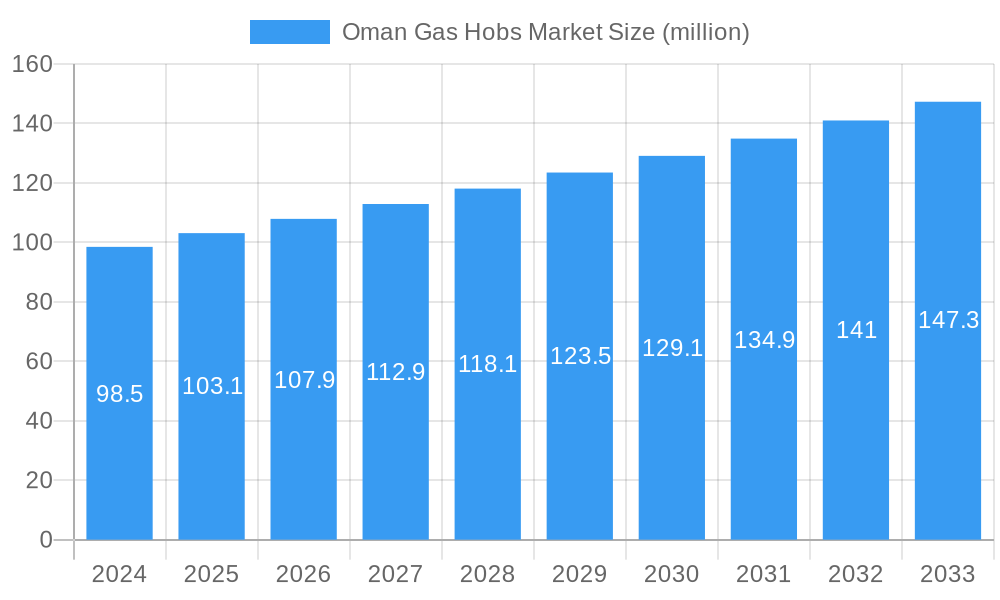

The Oman Gas Hobs market is poised for robust growth, with an estimated market size of USD 98.5 million in 2024. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.7% over the forecast period from 2025 to 2033. This expansion is primarily driven by an increasing disposable income among Omani households, leading to a greater demand for modern kitchen appliances. The rising trend of home renovation and the construction of new residential properties further bolster the market. Furthermore, the growing awareness of the efficiency and cost-effectiveness of gas hobs compared to electric alternatives, especially in regions where natural gas infrastructure is well-established, contributes significantly to market momentum.

Oman Gas Hobs Market Market Size (In Million)

The market is segmented into Desktop Gas Hobs and Embedded Gas Hobs, with the latter likely experiencing faster adoption due to its aesthetic appeal and space-saving benefits in contemporary kitchens. Both Household and Commercial end-users represent significant revenue streams, with the commercial sector driven by the hospitality industry's expansion. Distribution channels are diversifying, with both Online and Offline platforms playing crucial roles in reaching a wider consumer base. Leading companies such as Siemens, Rinnai, and Electrolux are actively participating in the market, introducing innovative products and expanding their reach. Despite the promising outlook, factors such as fluctuating natural gas prices and the increasing popularity of induction hobs may present some market restraints, necessitating continuous product innovation and competitive pricing strategies.

Oman Gas Hobs Market Company Market Share

Unlock the full potential of the Oman gas hobs market with this in-depth report. Covering a study period of 2019–2033, with a base year and estimated year of 2025, and a detailed forecast period of 2025–2033, this analysis provides critical insights into the dynamics, trends, and opportunities within Oman's burgeoning kitchen appliance sector. Whether you are a manufacturer, distributor, investor, or industry analyst, this report equips you with the strategic intelligence needed to navigate and capitalize on the evolving Oman gas hob industry. Discover market segmentation by product type (desktop gas hobs, embedded gas hobs), end user (household, commercial), and distribution channel (online, offline). Examine key players such as Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, and Candy Home Appliances.

Oman Gas Hobs Market Market Dynamics & Concentration

The Oman gas hobs market exhibits a moderate to high concentration, driven by a mix of established international brands and a growing presence of local distributors. Innovation in embedded gas hobs and energy-efficient designs are key drivers, responding to increasing consumer demand for modern and sustainable kitchen solutions. Regulatory frameworks, while evolving, are largely supportive of appliance imports and sales, fostering a competitive environment. Product substitutes, primarily electric induction hobs, present a growing challenge, necessitating continuous product development and marketing by gas hob manufacturers. End-user trends highlight a strong preference for convenience, durability, and aesthetic appeal, particularly within the household segment. Commercial kitchens are increasingly adopting advanced gas hob technologies for efficiency and precision. Mergers and acquisitions (M&A) activities, while not dominant, are strategically shaping the market landscape as companies seek to expand their portfolios and market reach. For instance, the establishment of new distributors like Muscat Kitchen Appliances signifies strategic expansion and consolidation of brands, impacting overall market share.

- Market Concentration: Moderate to High, with a significant share held by leading international brands.

- Innovation Drivers: Energy efficiency, smart features in embedded gas hobs, enhanced safety mechanisms.

- Regulatory Frameworks: Supportive of imports and sales, with ongoing focus on safety standards.

- Product Substitutes: Electric induction hobs, with growing adoption in modern kitchens.

- End-User Trends: Growing demand for sleek designs, durability, and user-friendly interfaces in both household and commercial segments.

- M&A Activities: Limited but strategic, focused on market expansion and brand acquisition.

Oman Gas Hobs Market Industry Trends & Analysis

The Oman gas hobs market is poised for robust growth, fueled by a combination of rising disposable incomes, increasing urbanization, and a growing emphasis on home improvement among Omani consumers. The household segment continues to be the primary revenue generator, driven by new home constructions and renovations. The commercial segment, encompassing hotels, restaurants, and catering services, also presents significant growth opportunities as Oman's tourism and hospitality sectors expand. Technological advancements are a key trend, with a shift towards more sophisticated embedded gas hobs that offer enhanced features like flame control, auto-ignition, and safety shut-off mechanisms. The online distribution channel is witnessing rapid expansion, driven by the convenience it offers to consumers and the reach it provides to manufacturers and retailers alike. Conversely, offline channels, particularly large format retail stores and specialized kitchen appliance showrooms, remain crucial for product demonstration and customer engagement. The CAGR for the Oman gas hobs market is projected to be approximately 5.5% from 2025 to 2033. Market penetration is expected to deepen as awareness of advanced gas hob technologies increases. The competitive landscape is characterized by intense rivalry, with brands differentiating themselves through product innovation, pricing strategies, and after-sales service. The increasing availability of a wide range of gas hob models, from basic desktop gas hobs to high-end built-in units, caters to a diverse consumer base with varying budget constraints and preferences.

Leading Markets & Segments in Oman Gas Hobs Market

The household segment is the dominant force within the Oman gas hobs market, accounting for an estimated 70% of total sales. This dominance is primarily driven by a growing population, increasing household formation, and a strong cultural inclination towards home cooking and family gatherings. Within product types, embedded gas hobs are gaining significant traction, reflecting a broader trend towards modern, integrated kitchen designs in contemporary Omani homes. Their sleek aesthetics and space-saving features make them highly desirable. The online distribution channel is rapidly emerging as a leading segment, spurred by the increasing digital literacy and internet penetration in Oman. E-commerce platforms offer a wide selection, competitive pricing, and convenient delivery, appealing to a younger, tech-savvy demographic. However, offline channels, including hypermarkets, department stores, and dedicated kitchen appliance showrooms, continue to hold substantial market share due to their ability to facilitate product inspection and immediate purchase.

- Dominant End User Segment: Household (approx. 70% market share)

- Key Drivers: Increasing population, rising disposable incomes, preference for home cooking, new residential constructions.

- Growing Product Type Segment: Embedded Gas Hobs

- Key Drivers: Modern kitchen aesthetics, space-saving designs, integration with modular kitchens, advanced features.

- Emerging Distribution Channel: Online

- Key Drivers: Convenience, wider product selection, competitive pricing, efficient delivery networks, growing e-commerce adoption.

- Sustained Distribution Channel: Offline

- Key Drivers: Product tangibility, in-person consultation, immediate availability, brand trust associated with physical retail.

Oman Gas Hobs Market Product Developments

Product innovation in the Oman gas hobs market is increasingly focused on enhancing user experience, safety, and energy efficiency. Manufacturers are introducing advanced features such as precise flame control for optimal cooking, auto-ignition systems for convenience, and robust flame failure safety devices for enhanced security. The aesthetics of embedded gas hobs are also a significant area of development, with a move towards premium finishes like tempered glass and stainless steel that complement modern kitchen décor. Furthermore, there is a growing emphasis on durable materials and easy-to-clean surfaces, addressing consumer demand for low-maintenance appliances. Competitive advantages are being built through the integration of smart technologies, though this is still a nascent area for gas hobs in Oman. The development of more compact and efficient desktop gas hobs also caters to smaller living spaces and the budget-conscious consumer.

Key Drivers of Oman Gas Hobs Market Growth

Several factors are propelling the Oman gas hobs market forward. Economic growth and rising disposable incomes are enabling more households to invest in modern kitchen appliances. A burgeoning population and increasing numbers of new home constructions directly translate to higher demand for cooking appliances. Growing consumer awareness of the benefits of gas cooking, such as superior temperature control and faster heating, is a significant driver. Furthermore, government initiatives promoting domestic infrastructure development and improving living standards indirectly support the appliance market. The expansion of the commercial sector, particularly in hospitality and food services, is also a substantial growth catalyst, increasing demand for durable and efficient gas hobs.

- Economic Growth & Disposable Income: Increased consumer spending power on home appliances.

- Population Growth & Urbanization: Higher demand from new households and residential developments.

- Consumer Preferences for Gas Cooking: Appreciation for precise temperature control and speed.

- Infrastructure Development: Government focus on enhancing living standards and modernizing homes.

- Growth of Hospitality & Food Service Sector: Increased demand from commercial establishments.

Challenges in the Oman Gas Hobs Market Market

Despite its growth trajectory, the Oman gas hobs market faces certain challenges. The primary restraint is the increasing competition from electric induction hobs, which are perceived as more modern and energy-efficient by some consumers. Fluctuations in the cost of imported components and logistics can impact pricing and profitability for manufacturers and retailers. Stringent import regulations and customs procedures, though aimed at ensuring quality, can sometimes lead to delays and increased costs. Additionally, ensuring widespread availability of skilled technicians for installation and after-sales service, particularly in more remote areas, remains a challenge. Brand awareness and consumer education about the specific benefits of modern gas hobs over their predecessors and substitutes are also crucial for sustained market penetration.

- Competition from Induction Hobs: Perceived modernity and energy efficiency.

- Import Costs & Logistics: Volatility in component prices and shipping expenses.

- Regulatory Hurdles: Customs procedures and import compliance.

- After-Sales Service & Technical Expertise: Availability of skilled technicians.

- Consumer Education: Raising awareness about advanced gas hob features.

Emerging Opportunities in Oman Gas Hobs Market

The Oman gas hobs market is ripe with emerging opportunities. The growing demand for integrated and smart kitchens presents a significant avenue for manufacturers to introduce gas hobs with Wi-Fi connectivity, app control, and advanced safety features. The expansion of the online distribution channel offers a cost-effective way to reach a wider customer base across Oman. Strategic partnerships between gas hob manufacturers and real estate developers can lead to bundled offerings and increased adoption in new housing projects. There's also an opportunity to focus on the development and marketing of energy-efficient gas hob models, aligning with global sustainability trends and potentially attracting environmentally conscious consumers. Furthermore, exploring niche markets within the commercial segment, such as specialized catering equipment, can unlock new revenue streams.

Leading Players in the Oman Gas Hobs Market Sector

- Siemens

- Nikai

- Prestige

- Rinnai

- Electrolux

- Haier

- Sonashi

- Bosch

- Simfer

- Candy Home Appliances

Key Milestones in Oman Gas Hobs Market Industry

- 2022: Jashanmal, carrying its 100-year legacy of trust and quality, announced the opening of its first department store in Oman, bringing some of the world's best brands under one roof. Jashanmal is retailing many leading, bestselling brands like De Longhi, Kenwood, Nespresso, Blendtec, Jura, Hoover, and Bertazzoni. This expansion of retail presence for high-end home appliances, including kitchenware, signifies a growing market for quality products and potentially increased competition and consumer choice in the broader kitchen appliance sector, which includes gas hobs.

- 2020: Muscat Kitchen Appliances was established in 2020 and has grown to become one of the market leaders in kitchen appliances across Oman. Muscat Kitchen Appliances is the sole distributor of several leading European brands from Slovenia, Italy, India & Turkey such as Gorenje, Carysil, Fiesta & Nsk in the Sultanate of Oman. The establishment and rapid growth of Muscat Kitchen Appliances as a key distributor highlights the dynamic nature of the Omani market and the increasing strategic importance of distribution networks for bringing diverse brands and product offerings to consumers. This development has likely influenced the availability and market share of various gas hob brands they represent.

Strategic Outlook for Oman Gas Hobs Market Market

The strategic outlook for the Oman gas hobs market remains positive, with continued growth anticipated over the forecast period. Key growth accelerators will include a sustained focus on product innovation, particularly in the embedded gas hob category, emphasizing both functionality and aesthetics. Expanding the reach of online distribution channels will be crucial for capturing market share and offering convenience to a wider consumer base. Manufacturers should also explore opportunities to enhance the energy efficiency of their gas hobs to align with evolving environmental consciousness and potential future regulations. Building strong relationships with distributors and focusing on robust after-sales service will be vital for brand loyalty and market penetration. The commercial segment, driven by Oman's thriving tourism and hospitality industry, presents significant potential for specialized product offerings and volume sales.

Oman Gas Hobs Market Segmentation

-

1. Product Type

- 1.1. Desktop Gas Hobs

- 1.2. Embedded Gas Hobs

-

2. End User

- 2.1. Household

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Oman Gas Hobs Market Segmentation By Geography

- 1. Oman

Oman Gas Hobs Market Regional Market Share

Geographic Coverage of Oman Gas Hobs Market

Oman Gas Hobs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Gas Hobs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Desktop Gas Hobs

- 5.1.2. Embedded Gas Hobs

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikai

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prestige

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rinnai

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonashi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Simfer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Candy Home Appliances

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens

List of Figures

- Figure 1: Oman Gas Hobs Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Oman Gas Hobs Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Gas Hobs Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Oman Gas Hobs Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Oman Gas Hobs Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Oman Gas Hobs Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Oman Gas Hobs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Oman Gas Hobs Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Oman Gas Hobs Market Revenue million Forecast, by End User 2020 & 2033

- Table 12: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Oman Gas Hobs Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Oman Gas Hobs Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Oman Gas Hobs Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Gas Hobs Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Oman Gas Hobs Market?

Key companies in the market include Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, Candy Home Appliances.

3. What are the main segments of the Oman Gas Hobs Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Rising Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges.

8. Can you provide examples of recent developments in the market?

2022 - Jashanmal, carrying its 100-year legacy of trust and quality, announced the opening of its first department store in Oman, bringing some of the world's best brands under one roof. Jashanmal is retailing many leading, bestselling brands like De Longhi, Kenwood, Nespresso, Blendtec, Jura, Hoover, and Bertazzoni.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Gas Hobs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Gas Hobs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Gas Hobs Market?

To stay informed about further developments, trends, and reports in the Oman Gas Hobs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence