Key Insights

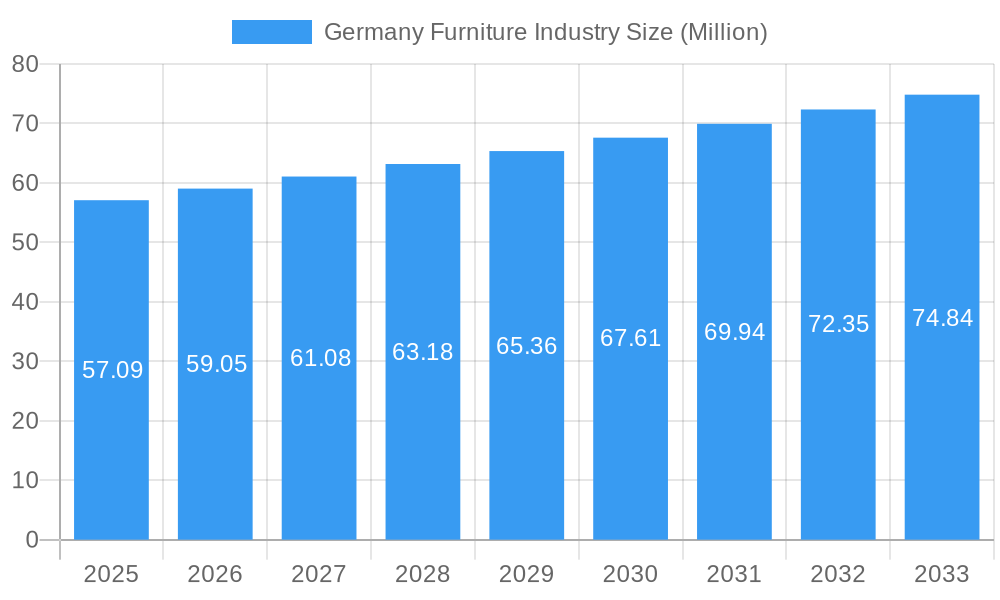

The German furniture industry is poised for steady growth, driven by a robust domestic market and evolving consumer preferences. With a market size estimated at €57.09 million and a projected Compound Annual Growth Rate (CAGR) of 3.43% between 2025 and 2033, the sector demonstrates sustained resilience and expansion. Key growth drivers include an increasing demand for home furnishings, fueled by a strong emphasis on interior design and comfort within households, alongside a consistent need for office furniture as businesses invest in modern workspaces. The hospitality sector also contributes significantly, with ongoing renovations and new establishments creating a steady demand for quality furniture. The distribution channels are increasingly shifting towards online platforms, offering convenience and wider selection, though traditional specialty stores and larger retail formats like supermarkets and hypermarkets retain their importance. The material landscape is diverse, with wood and metal dominating due to their durability and aesthetic appeal, while plastic and other innovative materials are gaining traction for their versatility and sustainability.

Germany Furniture Industry Market Size (In Million)

Emerging trends within the German furniture market point towards a heightened focus on sustainability, customization, and smart furniture solutions. Consumers are actively seeking eco-friendly materials and production processes, influencing manufacturers to adopt greener practices. The desire for personalized living spaces is driving demand for bespoke and modular furniture that can adapt to various room layouts and individual needs. Furthermore, the integration of technology into furniture, such as smart storage solutions and integrated charging ports, is becoming a significant differentiator. However, challenges such as rising raw material costs and logistical complexities can impact profit margins. Despite these restraints, the market's adaptability and the continuous innovation from established players like IKEA and Otto, alongside premium brands such as Thonet and Rolf Benz, are expected to ensure continued positive market trajectory, making the German furniture sector an attractive and dynamic market for both domestic and international stakeholders.

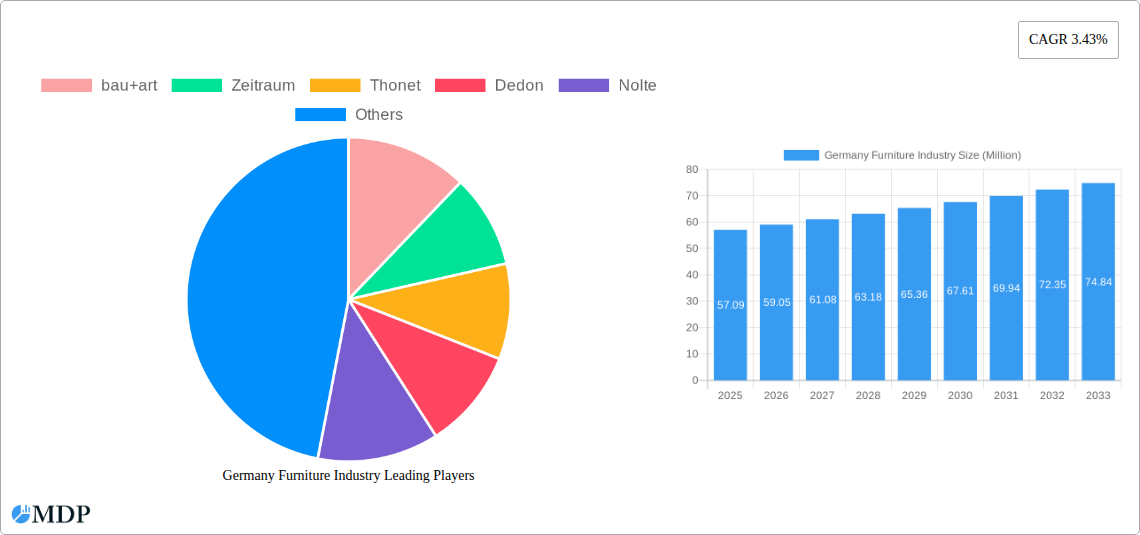

Germany Furniture Industry Company Market Share

Germany Furniture Industry Market Report: Dynamics, Trends, and Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the German furniture industry, a crucial sector contributing significantly to the nation's economy. Covering the historical period of 2019–2024 and projecting growth through 2033, this study delves into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. With a base year of 2025 and an estimated market value in the billions of Euros, this report is an indispensable resource for industry stakeholders, investors, and policymakers seeking to understand and capitalize on the evolving German furniture landscape.

Germany Furniture Industry Market Dynamics & Concentration

The German furniture industry exhibits a moderate to high market concentration, with a mix of large, established players and a significant number of small to medium-sized enterprises (SMEs). Innovation is a primary driver, fueled by consumer demand for sustainable, technologically integrated, and design-forward furniture. Regulatory frameworks, particularly concerning environmental standards and product safety, play a crucial role in shaping market operations. While direct product substitutes are limited, the broader home furnishings and interior design sectors represent indirect competition. End-user trends are increasingly leaning towards personalization, smart home integration, and eco-friendly materials. Merger and acquisition (M&A) activities are present, driven by the desire for market consolidation, access to new technologies, and expansion of distribution networks. M&A deal counts are estimated to be in the double digits annually, with significant value in strategic acquisitions by larger entities. Market share is distributed, with key players holding substantial portions in specific niches.

Germany Furniture Industry Industry Trends & Analysis

The German furniture industry is poised for robust growth, driven by several key factors. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at XX%, indicating a healthy expansion. Market penetration is expected to deepen, particularly in online channels and for specialized furniture segments like smart home solutions and ergonomic office furniture. Technological disruptions are reshaping manufacturing processes, with increased adoption of automation, 3D printing, and digital design tools leading to greater efficiency and customization capabilities. Consumer preferences are increasingly shaped by sustainability concerns, with a growing demand for furniture made from recycled materials, responsibly sourced wood, and low-VOC finishes. The rise of e-commerce has significantly altered distribution channels, offering greater accessibility and convenience to consumers. Competitive dynamics are characterized by a blend of global brands and strong domestic players, all vying for market share through product differentiation, brand building, and strategic pricing. The industry is also witnessing a growing emphasis on circular economy principles, promoting repair, refurbishment, and recycling of furniture to minimize environmental impact and create new business models. The economic stability of Germany and its strong manufacturing base provide a solid foundation for continued growth, while an aging population also presents opportunities for specialized furniture catering to comfort and accessibility needs.

Leading Markets & Segments in Germany Furniture Industry

The German furniture industry's dominance is evident across various segments, with Home Furniture holding the largest market share due to consistent consumer demand for residential upgrades and renovations. Within the Material segment, Wood remains the dominant choice, favored for its aesthetic appeal, durability, and sustainable sourcing potential, followed by Metal which is crucial for contemporary and industrial designs.

- Home Furniture: This segment benefits from strong consumer spending, an increasing focus on interior design, and the ongoing trend of home office setups. Key drivers include rising disposable incomes, low interest rates supporting housing markets, and a cultural appreciation for well-furnished living spaces.

- Office Furniture: With the resurgence of hybrid work models and a growing emphasis on ergonomic and well-being-focused workspaces, this segment is experiencing significant growth. Technological integration and modular designs are key trends driving demand.

- Hospitality Furniture: The recovery and growth of the tourism and hospitality sectors are directly impacting this segment. Demand for stylish, durable, and comfortable furniture for hotels, restaurants, and cafes is on the rise.

In terms of Distribution Channels, the Online segment is witnessing the most rapid expansion, driven by convenience, wider product selection, and competitive pricing.

- Online: This channel's growth is fueled by a young, tech-savvy population, efficient logistics networks, and direct-to-consumer (DTC) models adopted by manufacturers and retailers.

- Specialty Stores: These remain important for consumers seeking curated selections, expert advice, and high-end or niche products.

- Supermarkets & Hypermarkets: While these channels offer basic furniture items, their overall market share in the furniture industry is relatively smaller compared to specialized channels.

The Plastic & Other Furniture segment is also gaining traction due to its versatility, affordability, and suitability for outdoor and contract furniture applications. Economic policies supporting domestic manufacturing and infrastructure development further bolster the overall performance of these leading segments.

Germany Furniture Industry Product Developments

Recent product developments highlight a strong focus on sustainability, smart technology integration, and ergonomic design. Innovations are aimed at enhancing user experience and reducing environmental impact. Companies are actively incorporating recycled materials and developing modular furniture that can adapt to changing living and working spaces. The competitive advantage lies in offering unique design aesthetics, superior functionality, and a commitment to eco-friendly production.

Key Drivers of Germany Furniture Industry Growth

Several factors are propelling the growth of the German furniture industry. Economic stability and rising disposable incomes are paramount, enabling consumers to invest more in home furnishings. Technological advancements, including automation in manufacturing and the integration of smart features in furniture, are creating new product categories and improving production efficiency. Government initiatives promoting sustainable practices and energy efficiency are also influencing product development and consumer choices. Furthermore, a growing appreciation for design and quality craftsmanship within Germany and across international markets drives demand for premium furniture. The increasing adoption of e-commerce platforms also significantly expands market reach.

Challenges in the Germany Furniture Industry Market

The German furniture industry faces several challenges. Rising raw material costs and supply chain disruptions continue to exert pressure on profit margins. Intense competition from both domestic and international manufacturers, particularly from lower-cost economies, necessitates continuous innovation and cost optimization. Stringent environmental regulations, while beneficial for sustainability, can increase production costs and compliance burdens. Furthermore, adapting to rapidly changing consumer preferences and the increasing demand for fast-fashion furniture requires agile manufacturing and marketing strategies. The labor shortage in skilled manufacturing roles also poses a significant challenge to production capacity.

Emerging Opportunities in Germany Furniture Industry

Emerging opportunities in the German furniture industry are primarily driven by sustainability initiatives and digitalization. The growing consumer demand for eco-friendly and ethically sourced furniture presents a significant market for companies adopting circular economy principles, upcycling, and using sustainable materials. The expansion of smart home technology integration into furniture offers lucrative avenues for product development and market differentiation. Strategic partnerships with technology providers and designers can unlock new product functionalities. Furthermore, exploring untapped international markets and expanding direct-to-consumer (DTC) e-commerce capabilities present substantial growth potential. The increasing emphasis on well-being also opens opportunities for furniture designed for specific health and comfort needs.

Key Milestones in Germany Furniture Industry Industry

- May 2023: Brunner Group introduced its new upholstered furniture range, "Oval," focusing on modern office trends that combine style and well-being.

- April 2023: Rolf Benz unveiled its "Jackout" collection, featuring a distinctive design with powder-coated stainless steel frame struts showcasing delicate cross-connection and stabilization.

Strategic Outlook for Germany Furniture Industry Market

The strategic outlook for the German furniture industry is positive, driven by innovation and a commitment to sustainability. The market is expected to witness continued growth fueled by evolving consumer lifestyles and technological advancements. Key growth accelerators include the expansion of e-commerce, the development of smart and connected furniture, and the increasing demand for customizable and eco-friendly products. Strategic opportunities lie in leveraging digital platforms for wider market reach, forging partnerships for technological integration, and focusing on niche markets with high growth potential, such as ergonomic home office solutions and sustainable luxury furniture. The industry's resilience and adaptability will be crucial in navigating future market dynamics.

Germany Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic & Other Furniture

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

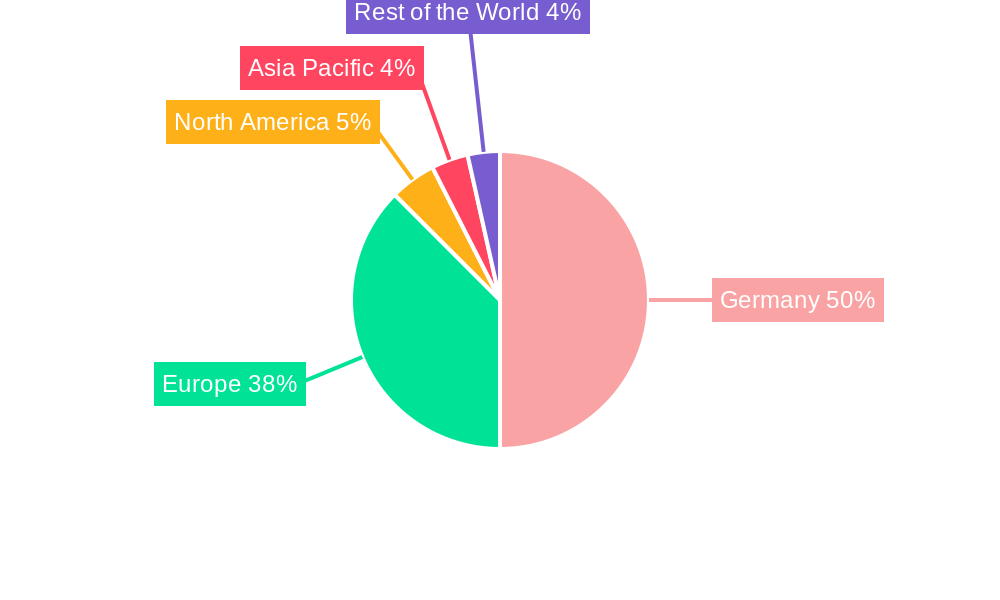

Germany Furniture Industry Segmentation By Geography

- 1. Germany

Germany Furniture Industry Regional Market Share

Geographic Coverage of Germany Furniture Industry

Germany Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market

- 3.3. Market Restrains

- 3.3.1. High Competition Among Players in the Market; High Price of Supply Chain and Logistics

- 3.4. Market Trends

- 3.4.1. Increasing Construction and Renovation Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic & Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 bau+art

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zeitraum

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thonet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dedon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nolte

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rolf Benz

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Otto

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Brunner

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 noah-living**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 bau+art

List of Figures

- Figure 1: Germany Furniture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Germany Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Germany Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Germany Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Germany Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Germany Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Germany Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Furniture Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Germany Furniture Industry?

Key companies in the market include bau+art, Zeitraum, Thonet, Dedon, Nolte, Rolf Benz, IKEA, Otto, Brunner, noah-living**List Not Exhaustive.

3. What are the main segments of the Germany Furniture Industry?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market.

6. What are the notable trends driving market growth?

Increasing Construction and Renovation Activities.

7. Are there any restraints impacting market growth?

High Competition Among Players in the Market; High Price of Supply Chain and Logistics.

8. Can you provide examples of recent developments in the market?

May 2023: Brunner Group has recently introduced a new upholstered furniture range named "Oval." With this launch, Brunner is at the forefront of modern office trends, offering furniture that combines style and a sense of well-being.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Furniture Industry?

To stay informed about further developments, trends, and reports in the Germany Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence