Key Insights

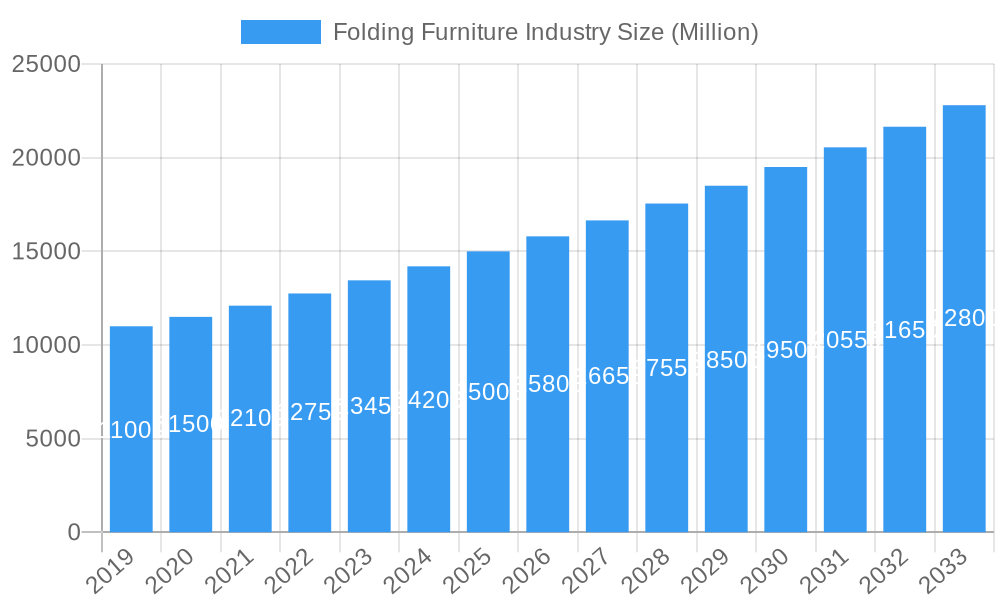

The global folding furniture market is poised for robust expansion, projected to exceed an estimated USD 15,000 million in market size by 2025, with a Compound Annual Growth Rate (CAGR) surpassing 5.00% through 2033. This sustained growth is primarily fueled by an increasing demand for space-saving solutions in urban environments, coupled with a rising trend in flexible living and working spaces. The residential sector is a significant contributor, driven by smaller dwelling sizes and the growing popularity of multi-functional furniture for apartments and studios. Simultaneously, the commercial segment is witnessing an uplift with businesses adopting agile office setups and the hospitality industry exploring adaptable event spaces and guest accommodations. Key drivers include evolving consumer lifestyles, a heightened awareness of efficient space utilization, and advancements in material science leading to lighter, more durable, and aesthetically pleasing folding furniture designs.

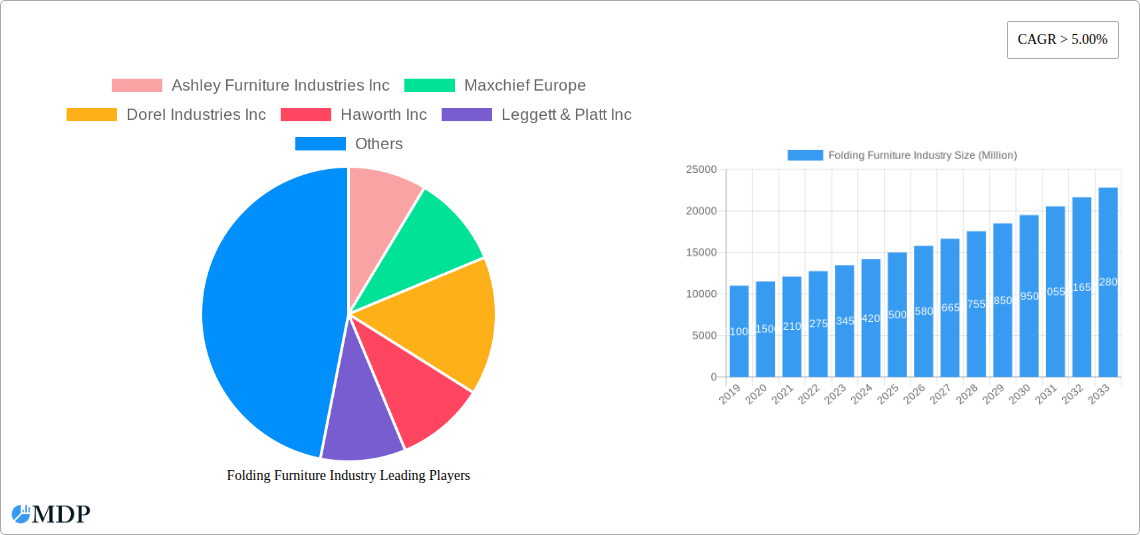

Folding Furniture Industry Market Size (In Billion)

Further stimulating the market are innovative product launches and an expanding distribution network. Online channels are emerging as a dominant force, offering convenience and a wide selection to consumers, alongside a persistent demand for specialty stores that provide curated and high-quality offerings. The trend towards sustainable and eco-friendly materials in furniture production is also gaining traction, influencing consumer purchasing decisions. While the market enjoys strong growth, potential restraints could include fluctuating raw material costs and the logistics associated with shipping bulky furniture items. However, the overall trajectory indicates a dynamic and expanding market, with regions like Asia Pacific, driven by rapid urbanization and a burgeoning middle class, expected to be a key growth engine.

Folding Furniture Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global folding furniture market, a dynamic and rapidly evolving sector driven by space optimization, portability, and evolving consumer lifestyles. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report provides invaluable insights for manufacturers, suppliers, distributors, and investors. We delve into critical market dynamics, key industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and the competitive landscape, featuring insights from prominent players like Ashley Furniture Industries Inc., Maxchief Europe, Dorel Industries Inc., Haworth Inc., Leggett & Platt Inc., Murphy Wall Beds Hardware Inc., IKEA, Expand Furniture, Hussey Seating Company, and Flexsteel Industries Inc.

Folding Furniture Industry Market Dynamics & Concentration

The folding furniture industry exhibits a moderate to high concentration, with a few key players holding significant market share, estimated to be around 60% of the total market value. Innovation is a primary driver, fueled by advancements in materials science, design aesthetics, and smart furniture technologies, leading to the development of lighter, more durable, and aesthetically pleasing folding furniture solutions. Regulatory frameworks primarily focus on product safety standards and environmental compliance, influencing material sourcing and manufacturing processes. Product substitutes, while present in the broader furniture market (e.g., modular furniture, built-in storage solutions), are less direct for specific space-saving applications where folding furniture excels. End-user trends highlight a growing demand for multi-functional furniture and solutions catering to smaller living spaces, particularly in urban environments. Merger and acquisition (M&A) activities, while not rampant, have seen strategic consolidation to enhance market reach and product portfolios. The M&A deal count in the historical period (2019-2024) was approximately 7 deals, indicating a steady but selective approach to growth.

- Market Share Distribution: Top 5 companies collectively hold an estimated 40% of the global market value.

- Innovation Drivers:

- Lightweight and durable material development (e.g., advanced polymers, lightweight alloys).

- Ergonomic design for enhanced user comfort.

- Integration of smart technologies (e.g., charging ports, lighting).

- Regulatory Landscape: Focus on EN 12520 (furniture strength, durability, and safety) and REACH compliance.

- End-User Preferences: Increasing demand for space-saving solutions, multi-functional pieces, and sustainable materials.

- M&A Activity: Strategic acquisitions to expand product lines and market penetration, with a notable trend towards companies specializing in innovative designs and sustainable materials.

Folding Furniture Industry Industry Trends & Analysis

The folding furniture industry is poised for significant growth, driven by an annual growth rate (CAGR) projected at a robust 6.5% during the forecast period. This expansion is underpinned by several interconnected trends. The increasing urbanization globally, leading to smaller average dwelling sizes, is a primary catalyst for the adoption of space-saving furniture. Consumers are actively seeking solutions that maximize utility in limited areas, making folding chairs, folding tables, and folding sofas highly desirable. Technological disruptions are playing a crucial role, with advancements in materials like high-strength aluminum alloys and reinforced polymers contributing to the creation of lighter, more durable, and aesthetically appealing folding furniture. Smart integration, such as built-in charging ports and lighting in folding desks and tables, is also gaining traction. Consumer preferences are shifting towards sustainability, with a growing demand for furniture made from recycled materials and responsibly sourced wood. Furthermore, the rise of e-commerce and online channels has democratized access to folding furniture, allowing smaller brands to reach a wider audience and fostering a more competitive market. The penetration of folding furniture in commercial applications, such as event spaces, cafes, and flexible office environments, is also expanding due to its adaptability and ease of storage. The market penetration for folding furniture is estimated to reach 35% of the total furniture market by 2033.

Leading Markets & Segments in Folding Furniture Industry

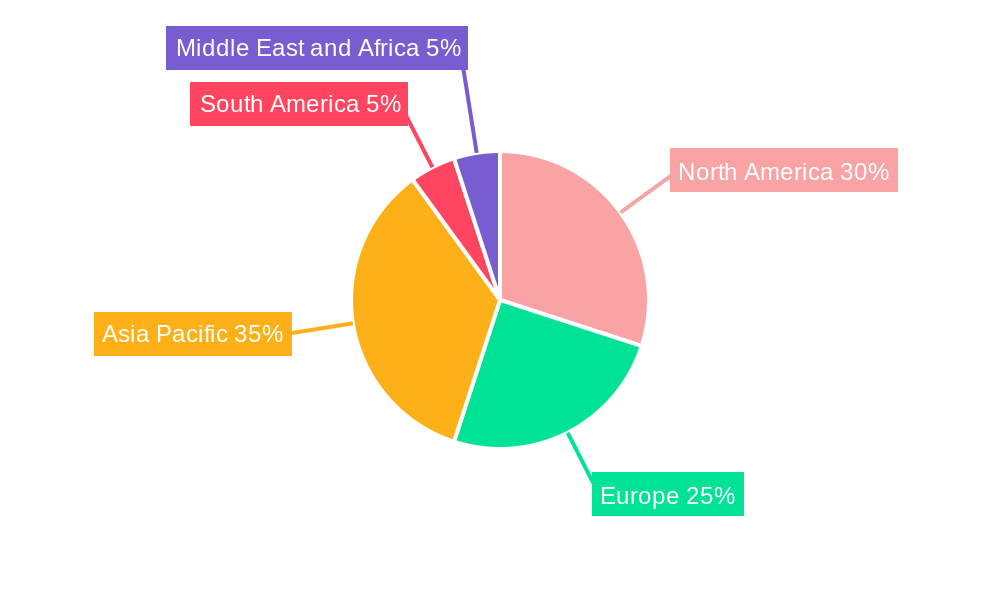

The residential application segment is the dominant force in the global folding furniture market, driven by the ever-increasing need for space optimization in homes, apartments, and smaller living spaces. Within this segment, folding chairs and folding tables represent the highest volume products, catering to diverse needs from dining to outdoor activities and temporary workspace setups. The online channels distribution segment is experiencing exponential growth, surpassing traditional retail channels due to its convenience, wider product selection, and competitive pricing. This trend is particularly evident in developed economies and rapidly growing emerging markets. Geographically, Asia-Pacific is emerging as a leading market due to rapid urbanization, a burgeoning middle class with increasing disposable income, and a growing preference for modern, space-efficient living solutions. Countries like China and India are significant contributors to this growth.

- Dominant Application:

- Residential: Accounts for an estimated 70% of the market share.

- Key Drivers: Urbanization, smaller living spaces, DIY culture, demand for multi-functional furniture.

- Residential: Accounts for an estimated 70% of the market share.

- Dominant Type:

- Chairs: Expected to hold approximately 30% of the market share.

- Key Drivers: Portability, versatility for indoor and outdoor use, affordability.

- Tables: Projected to capture around 25% of the market share.

- Key Drivers: Compact storage, suitability for small dining areas, portable workstations.

- Chairs: Expected to hold approximately 30% of the market share.

- Dominant Distribution Channel:

- Online Channels: Experiencing a CAGR of 9.8%.

- Key Drivers: E-commerce growth, accessibility, wider product variety, direct-to-consumer models.

- Online Channels: Experiencing a CAGR of 9.8%.

- Leading Region:

- Asia-Pacific: Driven by strong economic growth, population density, and evolving consumer lifestyles.

- Key Drivers: Government initiatives promoting affordable housing, increasing disposable incomes, rising trend of compact living.

- Asia-Pacific: Driven by strong economic growth, population density, and evolving consumer lifestyles.

Folding Furniture Industry Product Developments

Recent product developments in the folding furniture industry are characterized by a strong emphasis on enhancing user experience through innovative materials and intelligent design. Manufacturers are increasingly integrating lightweight yet durable alloys and reinforced polymers to reduce weight without compromising on structural integrity. The focus is on creating furniture that is not only easy to store and transport but also aesthetically pleasing and comfortable for prolonged use. Smart functionalities are also being incorporated, such as built-in USB charging ports in folding desks and tables, and adjustable lighting features. These innovations are designed to meet the evolving demands of consumers seeking multi-functional and space-saving solutions for both residential and commercial applications, providing a competitive edge in a crowded market.

Key Drivers of Folding Furniture Industry Growth

The folding furniture industry's growth is propelled by several powerful drivers. Technological advancements in material science have led to the development of lighter, stronger, and more sustainable materials, enhancing product durability and appeal. The escalating trend of urbanization worldwide, resulting in smaller living spaces, directly fuels the demand for space-saving furniture solutions. Economic factors, including rising disposable incomes in emerging economies, empower consumers to invest in practical and versatile furniture options. Furthermore, evolving consumer lifestyles, characterized by a preference for flexible living arrangements and a growing popularity of home offices and multi-functional rooms, create a sustained demand for adaptable furniture. Regulatory support for sustainable manufacturing practices also influences product development and consumer choices.

Challenges in the Folding Furniture Industry Market

Despite its growth potential, the folding furniture industry faces several challenges. Intense competition from both established brands and new entrants can lead to price wars and reduced profit margins. Supply chain disruptions, amplified by global events, can impact raw material availability and manufacturing timelines, leading to increased costs and delivery delays. Consumer perception of folding furniture sometimes leans towards less durable or aesthetically compromised options, necessitating continuous efforts in product quality and design innovation. Regulatory hurdles, particularly concerning safety standards and environmental certifications in different regions, can add complexity and cost to product development and market entry. The increasing cost of raw materials also poses a significant challenge, impacting the overall affordability of finished products.

Emerging Opportunities in Folding Furniture Industry

Emerging opportunities in the folding furniture industry lie in several key areas. The integration of smart technology, such as embedded sensors and connectivity features, presents a significant avenue for product differentiation and value addition. The growing global emphasis on sustainability and eco-friendly living creates a strong demand for folding furniture made from recycled materials and through environmentally conscious manufacturing processes. Strategic partnerships with interior designers and architects can help promote folding furniture as a desirable solution for modern living and workspace design. Furthermore, expanding into niche markets, such as compact furniture for RVs, boats, and outdoor recreational activities, offers untapped potential for growth. The development of customizable and modular folding furniture systems that cater to specific consumer needs and space constraints also presents a promising opportunity.

Leading Players in the Folding Furniture Industry Sector

- Ashley Furniture Industries Inc.

- Maxchief Europe

- Dorel Industries Inc.

- Haworth Inc.

- Leggett & Platt Inc.

- Murphy Wall Beds Hardware Inc.

- IKEA

- Expand Furniture

- Hussey Seating Company

- Flexsteel Industries Inc.

Key Milestones in Folding Furniture Industry Industry

- Apr 2022: Dorel Home, a segment of Dorel Industries Inc., reopened its 9th-floor C&D Building showroom at the High Point Market to showcase both new products and its growing portfolio of high-profile licensed brands. This strategic move aimed to enhance brand visibility and attract buyers by presenting a comprehensive range of innovative home furnishings.

- Feb 2022: Ashley Furniture HomeStore in Guadalajara, Mexico, opened a new 15,000 sq. ft. showroom located on Avenida Patria #120, in Guadalajara, Jalisco, Mexico. This significant expansion in Mexico underscores Ashley Furniture's commitment to growing its presence in key international markets and catering to the increasing demand for its products in the region.

Strategic Outlook for Folding Furniture Industry Market

The strategic outlook for the folding furniture industry is exceptionally positive, driven by sustained demand for space-saving solutions and continuous product innovation. Key growth accelerators include further integration of smart technologies, a strong push towards sustainable and eco-friendly materials, and expansion into burgeoning e-commerce channels. Companies are expected to focus on developing multi-functional, adaptable, and aesthetically appealing furniture that caters to the evolving needs of urban dwellers and flexible workspace environments. Strategic partnerships and market penetration in emerging economies will be crucial for long-term success, enabling companies to tap into new customer bases and diversify their product offerings. The future of the folding furniture market promises continued growth and innovation, solidifying its importance in modern living.

Folding Furniture Industry Segmentation

-

1. Type

- 1.1. Chairs

- 1.2. Tables

- 1.3. Sofas

- 1.4. Beds

- 1.5. Other Furniture

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Online Channels

- 3.4. Other Distribution Channels

Folding Furniture Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Folding Furniture Industry Regional Market Share

Geographic Coverage of Folding Furniture Industry

Folding Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment

- 3.3. Market Restrains

- 3.3.1. Changes in Consumer Preferences and Behavior

- 3.4. Market Trends

- 3.4.1. The Residential Application Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chairs

- 5.1.2. Tables

- 5.1.3. Sofas

- 5.1.4. Beds

- 5.1.5. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Online Channels

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chairs

- 6.1.2. Tables

- 6.1.3. Sofas

- 6.1.4. Beds

- 6.1.5. Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialty Stores

- 6.3.2. Supermarkets/Hypermarkets

- 6.3.3. Online Channels

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chairs

- 7.1.2. Tables

- 7.1.3. Sofas

- 7.1.4. Beds

- 7.1.5. Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialty Stores

- 7.3.2. Supermarkets/Hypermarkets

- 7.3.3. Online Channels

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chairs

- 8.1.2. Tables

- 8.1.3. Sofas

- 8.1.4. Beds

- 8.1.5. Other Furniture

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialty Stores

- 8.3.2. Supermarkets/Hypermarkets

- 8.3.3. Online Channels

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chairs

- 9.1.2. Tables

- 9.1.3. Sofas

- 9.1.4. Beds

- 9.1.5. Other Furniture

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialty Stores

- 9.3.2. Supermarkets/Hypermarkets

- 9.3.3. Online Channels

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Folding Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chairs

- 10.1.2. Tables

- 10.1.3. Sofas

- 10.1.4. Beds

- 10.1.5. Other Furniture

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialty Stores

- 10.3.2. Supermarkets/Hypermarkets

- 10.3.3. Online Channels

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashley Furniture Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maxchief Europe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dorel Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haworth Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leggett & Platt Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Murphy Wall Beds Hardware Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IKEA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Expand Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hussey Seating Company**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flexsteel Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ashley Furniture Industries Inc

List of Figures

- Figure 1: Global Folding Furniture Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Folding Furniture Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Folding Furniture Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Folding Furniture Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Folding Furniture Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Folding Furniture Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Folding Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Folding Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Folding Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Folding Furniture Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Folding Furniture Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Folding Furniture Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Folding Furniture Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Folding Furniture Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Folding Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Folding Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Folding Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Folding Furniture Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Folding Furniture Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Folding Furniture Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Folding Furniture Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Folding Furniture Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Folding Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Folding Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Folding Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Folding Furniture Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Folding Furniture Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Folding Furniture Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Folding Furniture Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Folding Furniture Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Folding Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Folding Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Folding Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Folding Furniture Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Folding Furniture Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Folding Furniture Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Folding Furniture Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Folding Furniture Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Folding Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Folding Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Folding Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Folding Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Folding Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Folding Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Folding Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Folding Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Folding Furniture Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Folding Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Folding Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Folding Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Folding Furniture Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Folding Furniture Industry?

Key companies in the market include Ashley Furniture Industries Inc, Maxchief Europe, Dorel Industries Inc, Haworth Inc, Leggett & Platt Inc, Murphy Wall Beds Hardware Inc, IKEA, Expand Furniture, Hussey Seating Company**List Not Exhaustive, Flexsteel Industries Inc.

3. What are the main segments of the Folding Furniture Industry?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment.

6. What are the notable trends driving market growth?

The Residential Application Dominates the Market.

7. Are there any restraints impacting market growth?

Changes in Consumer Preferences and Behavior.

8. Can you provide examples of recent developments in the market?

Apr 2022: Dorel Home, a segment of Dorel Industries Inc., reopened its 9th-floor C&D Building showroom at the High Point Market to showcase both new products and its growing portfolio of high-profile licensed brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Folding Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Folding Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Folding Furniture Industry?

To stay informed about further developments, trends, and reports in the Folding Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence