Key Insights

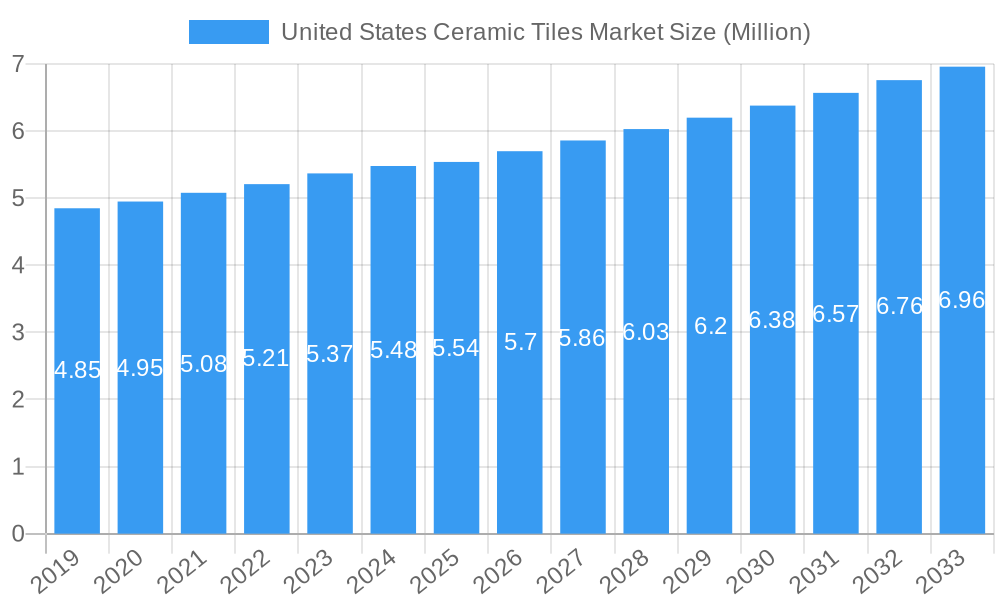

The United States Ceramic Tiles Market is poised for steady growth, projected to reach a substantial value by 2033. The market's current size is approximately USD 5.54 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 2.97% anticipated throughout the forecast period. This expansion is primarily fueled by the robust demand in new construction projects and the significant renovation and replacement activities occurring across the nation. The residential sector, in particular, continues to be a dominant end-user, driven by evolving consumer preferences for aesthetic and durable flooring and wall solutions. Commercial applications, while also contributing, are seeing consistent uptake in hospitality, retail, and office spaces.

United States Ceramic Tiles Market Market Size (In Million)

The market's product segmentation highlights the popularity of Glazed and Porcelain tiles, known for their versatility, durability, and aesthetic appeal, which are extensively used in both floor and wall applications. The "Other Products" category likely encompasses specialty tiles and innovative materials catering to niche demands. Driving this growth are key factors such as increasing disposable incomes, a growing emphasis on interior design and home improvement, and advancements in tile manufacturing technology leading to more attractive and functional products. However, potential restraints like the fluctuating costs of raw materials and the emergence of alternative flooring solutions could present challenges. The distribution landscape is diverse, with Home Centers and Specialty Stores remaining crucial, while online channels are experiencing a notable surge in adoption.

United States Ceramic Tiles Market Company Market Share

United States Ceramic Tiles Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock in-depth insights into the dynamic United States ceramic tiles market with this exhaustive report. Covering the period from 2019 to 2033, with a base year of 2025, this study provides a detailed analysis of market size, trends, drivers, challenges, and opportunities. Our research forecasts robust growth for the US ceramic tile industry, driven by evolving consumer preferences, technological advancements in porcelain tiles and glazed tiles, and significant investments in both residential and commercial construction. The report delves into the competitive landscape, highlighting key players and their strategic initiatives, crucial for tile manufacturers, distributors, and construction companies seeking to capitalize on this expanding market.

United States Ceramic Tiles Market Market Dynamics & Concentration

The United States ceramic tiles market exhibits a moderate level of concentration, with several dominant players alongside a growing number of smaller, specialized manufacturers. Innovation is a key driver, fueled by advancements in scratch-free tile technology and sustainable manufacturing practices. Regulatory frameworks, primarily concerning environmental impact and building codes, influence product development and market entry. Product substitutes, such as vinyl flooring and natural stone, present a competitive challenge, but the durability, aesthetic versatility, and cost-effectiveness of ceramic tiles continue to maintain their market share. End-user trends favor products that offer enhanced performance, aesthetic appeal, and ease of maintenance, particularly for residential floor tiles and commercial wall tiles. Mergers and acquisitions (M&A) activities are strategic tools for consolidation and expansion; the market has witnessed at least 5 significant M&A deals in the historical period (2019-2024), with an estimated market share of the top 5 players hovering around 60%.

United States Ceramic Tiles Market Industry Trends & Analysis

The United States ceramic tiles market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). This growth is underpinned by a confluence of favorable industry trends and evolving consumer demands. The increasing adoption of porcelain tiles due to their superior durability, water resistance, and aesthetic versatility, mimicking natural materials like wood and stone, is a primary growth driver. Furthermore, advancements in digital printing technology allow for intricate designs and high-definition finishes, catering to the growing demand for customizable and visually appealing wall tiles and floor tiles. The robust performance of the new construction sector, coupled with a steady demand for replacement & renovation projects, particularly in the residential segment, fuels market penetration. The rising popularity of large-format tiles and mosaic patterns is also shaping product development. The commercial sector, including hospitality, healthcare, and retail spaces, continues to invest in durable and aesthetically pleasing tile solutions. Online sales channels are gaining traction, offering greater convenience and wider product selections for consumers. The market penetration for ceramic tiles in the overall flooring market is estimated to be around 35% in the base year 2025.

Leading Markets & Segments in United States Ceramic Tiles Market

Within the United States ceramic tiles market, Porcelain tiles command the largest market share, accounting for an estimated 45% of the total market value in 2025. This dominance is attributed to their exceptional durability, water resistance, and versatility in replicating natural materials. Glazed tiles follow closely, valued for their aesthetic appeal and wide range of finishes, making them popular for both floor tiles and wall tiles.

Product Segment Dominance:

- Porcelain Tiles: Driven by their superior performance characteristics, making them ideal for high-traffic areas in both residential and commercial settings. Their aesthetic versatility, mimicking wood, stone, and concrete, also contributes significantly to their popularity.

- Glazed Tiles: Their extensive design options and cost-effectiveness make them a favored choice for decorative and functional applications.

Application Segment Dominance:

- Floor Tiles: This segment holds the largest share due to the widespread use of ceramic tiles in kitchens, bathrooms, and living areas, where durability and ease of maintenance are paramount. The residential segment significantly drives demand for floor tiles.

- Wall Tiles: Experiencing substantial growth, particularly in kitchen backsplashes, shower enclosures, and accent walls, driven by design trends and the availability of innovative finishes.

Construction Type Segment Dominance:

- New Construction: This segment is a key growth engine, fueled by ongoing housing development and commercial building projects across the nation. Economic policies supporting housing starts directly impact this segment.

- Replacement & Renovation: A consistent and significant contributor, driven by homeowners and businesses seeking to update aesthetics, improve functionality, or repair existing installations.

End User Segment Dominance:

- Residential: This segment represents the largest portion of the market, driven by new home builds, renovations, and the increasing demand for aesthetically pleasing and durable flooring and wall solutions.

- Commercial: This segment is experiencing rapid growth, with sectors like hospitality, retail, and healthcare opting for ceramic tiles due to their hygiene, durability, and design flexibility.

Distribution Channel Dominance:

- Home Centers: These retailers offer wide accessibility and a broad product range, making them a primary channel for a significant portion of consumers.

- Distributors: Crucial for supplying larger projects and specialty retailers, ensuring efficient product flow throughout the supply chain.

United States Ceramic Tiles Market Product Developments

Innovations in the United States ceramic tiles market are centered on enhancing durability, aesthetics, and sustainability. The development of ultra-hard, scratch-free porcelain tiles with improved stain resistance addresses key consumer pain points. Advanced digital inkjet printing technologies enable photorealistic replication of natural materials like marble and wood, alongside intricate artistic designs. Furthermore, manufacturers are focusing on producing eco-friendly tiles using recycled content and energy-efficient firing processes. Application developments include large-format tiles that minimize grout lines for a seamless look and antimicrobial surfaces for enhanced hygiene in healthcare and food service environments. These advancements provide manufacturers with a competitive edge and cater to evolving market demands for performance, beauty, and sustainability.

Key Drivers of United States Ceramic Tiles Market Growth

The United States ceramic tiles market is propelled by several key drivers. The robust growth in the residential construction sector, fueled by increasing housing demand and favorable mortgage rates, is a primary accelerator. The continuous demand for renovation and remodeling projects in both residential and commercial spaces, driven by a desire for updated aesthetics and improved functionality, provides a steady revenue stream. Technological advancements, particularly in digital printing and manufacturing processes, allow for the creation of more realistic and diverse designs, appealing to a broader consumer base. Government initiatives supporting infrastructure development and commercial building projects also contribute to market expansion. The increasing popularity of porcelain tiles for their durability and aesthetic versatility further bolsters market growth.

Challenges in the United States Ceramic Tiles Market Market

Despite strong growth prospects, the United States ceramic tiles market faces several challenges. Supply chain disruptions, exacerbated by global events, can lead to increased raw material costs and extended lead times, impacting production and delivery schedules. Fluctuations in raw material prices, such as clay, feldspar, and energy, can affect manufacturing costs and profit margins. Intense price competition among manufacturers and the availability of lower-cost substitutes can pressure profit margins. Evolving environmental regulations and sustainability demands require continuous investment in eco-friendly manufacturing processes, which can be costly. Furthermore, the skilled labor shortage in manufacturing and installation can hinder production capacity and project timelines.

Emerging Opportunities in United States Ceramic Tiles Market

The United States ceramic tiles market presents significant emerging opportunities. The growing demand for sustainable and eco-friendly building materials opens avenues for manufacturers focusing on recycled content and energy-efficient production. Advancements in smart tile technology, such as integrated heating or lighting, represent a nascent but promising area for innovation. The expansion of online distribution channels offers retailers and manufacturers opportunities to reach a wider customer base and streamline sales processes. The increasing adoption of large-format tiles and the growing popularity of decorative and uniquely patterned tiles are creating niche markets for specialized manufacturers. Furthermore, the sustained demand for high-performance porcelain tiles in both residential and commercial applications continues to present opportunities for market penetration and expansion.

Leading Players in the United States Ceramic Tiles Market Sector

- Crossville Inc

- Daltile Corporation

- Marazzi

- Porcelanosa Group

- American Olean Tile Company

- Shaw Industries

- Emser Tile

- Roca Tile

- Florida Tile Inc

- Jeffrey Court

- Mohawk Industries

- Other Prominent Players

Key Milestones in United States Ceramic Tiles Market Industry

- February 2023: Shaw Industries Group, Inc. announced that it completed the purchase of a controlling interest in Watershed Solar LLC. Watershed Solar provides patented renewable energy solutions. The technology, branded PowerCap, supplies low-profile, high-output solar arrays on top of landfills, coal ash closures, and rooftops, turning liabilities or underused spaces into renewable energy assets.

- June 2022: Mohawk Industries, Inc. announced that it agreed to purchase the Vitromex ceramic tile business from Grupo Industrial Saltillo (GIS) for approximately USD 293 million in cash. The transaction was expected to close in the second half of 2022 and was subject to the approval of GIS's shareholders, as well as customary government approvals and closing conditions. The Vitromex business was expected to be accretive to Mohawk's earnings.

Strategic Outlook for United States Ceramic Tiles Market Market

The United States ceramic tiles market is set for sustained growth, driven by innovation, evolving consumer preferences, and robust demand from both new construction and renovation sectors. Strategic initiatives focusing on product differentiation through advanced aesthetics and enhanced performance, particularly in porcelain tiles and scratch-free varieties, will be crucial for maintaining a competitive edge. Manufacturers are advised to invest in sustainable production methods to align with growing environmental consciousness and regulatory trends. Expanding online presence and exploring partnerships with home centers and specialty stores will be vital for market reach. Furthermore, a keen understanding of regional market nuances and targeted marketing campaigns for both residential and commercial segments will accelerate future growth.

United States Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Products

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End User

- 4.1. Residential

- 4.2. Commercial

-

5. Distribution Channel

- 5.1. Home Centers

- 5.2. Specialty Stores

- 5.3. Online

- 5.4. Distributors

- 5.5. Other Distribution Channels

United States Ceramic Tiles Market Segmentation By Geography

- 1. United States

United States Ceramic Tiles Market Regional Market Share

Geographic Coverage of United States Ceramic Tiles Market

United States Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction and Renovation Activities; Rising Preference for Sustainable and Eco-Friendly Materials

- 3.3. Market Restrains

- 3.3.1. Price and Installation Costs; Competition from Alternative Materials

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Ceramic Tiles is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Home Centers

- 5.5.2. Specialty Stores

- 5.5.3. Online

- 5.5.4. Distributors

- 5.5.5. Other Distribution Channels

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Crossville Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daltile Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marazzi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porcelanosa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Olean Tile Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shaw Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emser Tile

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roca Tile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Florida Tile Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jeffrey Court

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Other Prominent Players**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mohawk Industries

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Crossville Inc

List of Figures

- Figure 1: United States Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramic Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: United States Ceramic Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: United States Ceramic Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Ceramic Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: United States Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: United States Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 10: United States Ceramic Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: United States Ceramic Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: United States Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramic Tiles Market?

The projected CAGR is approximately 2.97%.

2. Which companies are prominent players in the United States Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Daltile Corporation, Marazzi, Porcelanosa Group, American Olean Tile Company, Shaw Industries, Emser Tile, Roca Tile, Florida Tile Inc, Jeffrey Court, Other Prominent Players**List Not Exhaustive, Mohawk Industries.

3. What are the main segments of the United States Ceramic Tiles Market?

The market segments include Product, Application, Construction Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction and Renovation Activities; Rising Preference for Sustainable and Eco-Friendly Materials.

6. What are the notable trends driving market growth?

Increasing Consumption of Ceramic Tiles is Driving the Market.

7. Are there any restraints impacting market growth?

Price and Installation Costs; Competition from Alternative Materials.

8. Can you provide examples of recent developments in the market?

February 2023: Shaw Industries Group, Inc. announced that it completed the purchase of a controlling interest in Watershed Solar LLC. Watershed Solar provides patented renewable energy solutions. The technology, branded PowerCap, supplies low-profile, high-output solar arrays on top of landfills, coal ash closures, and rooftops, turning liabilities or underused spaces into renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the United States Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence