Key Insights

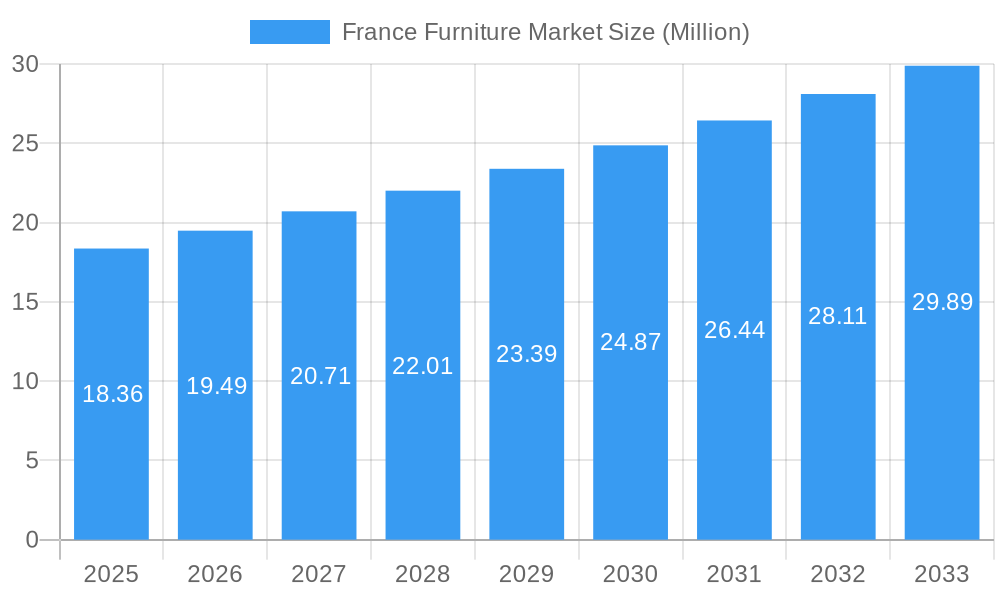

The France Furniture Market is poised for significant growth, with a current estimated market size of USD 18.36 million. This upward trajectory is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.25%, projecting a healthy expansion over the forecast period of 2025-2033. The market's dynamism is driven by evolving consumer preferences for stylish, functional, and sustainable furniture, alongside increasing disposable incomes and a strong demand for home renovation and furnishing projects. Key growth drivers include the rising trend of smart home integration, the demand for customizable furniture solutions to optimize space, and the growing popularity of eco-friendly and ethically sourced materials. The increasing emphasis on interior design and the influence of digital platforms showcasing innovative home aesthetics are also playing a crucial role in shaping consumer purchasing decisions.

France Furniture Market Market Size (In Million)

The competitive landscape of the France Furniture Market is characterized by a blend of established global brands and innovative local players, each vying for market share through product differentiation, strategic partnerships, and omnichannel sales approaches. While the market benefits from strong domestic demand and a supportive economic environment, it also faces certain restraints. These include fluctuations in raw material prices, particularly for wood and metals, which can impact production costs and profitability. Furthermore, stringent environmental regulations, while promoting sustainability, can sometimes add to manufacturing complexities and costs. However, the sustained interest in high-quality, durable, and aesthetically pleasing furniture, coupled with ongoing innovation in materials and design, is expected to overcome these challenges, ensuring a promising outlook for the market. The segmentation analysis reveals substantial opportunities across production, consumption, and international trade, with a particular focus on import and export dynamics.

France Furniture Market Company Market Share

Unlock unparalleled insights into the dynamic French furniture market with this in-depth report. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into production, consumption, import/export dynamics, pricing trends, and crucial industry developments. Discover market concentration, innovation drivers, regulatory landscapes, and emerging opportunities within this thriving sector. Essential for manufacturers, retailers, investors, and industry stakeholders seeking to capitalize on the French furniture industry's growth.

France Furniture Market Market Dynamics & Concentration

The French furniture market exhibits a moderate to high concentration, with a few dominant players and a significant number of smaller, specialized manufacturers. Market concentration is influenced by factors such as brand recognition, design innovation, and established distribution networks. Key innovation drivers include sustainable materials, smart furniture technologies, and customizable designs, catering to evolving consumer preferences for personalized and eco-conscious products. Regulatory frameworks, primarily focused on environmental standards (e.g., REACH compliance, eco-labeling) and consumer safety, play a crucial role in shaping product development and market entry strategies. Product substitutes, such as modular shelving systems and adaptable furniture solutions, are gaining traction, offering increased flexibility and cost-effectiveness. End-user trends are increasingly driven by urbanization, a growing demand for home office furniture, and a preference for high-quality, durable, and aesthetically pleasing pieces. Merger and acquisition (M&A) activities, while not excessively high, are strategic, focusing on acquiring innovative technologies, expanding product portfolios, or gaining market share in specific segments. For instance, a recent trend involves established brands acquiring smaller, design-led companies to integrate fresh perspectives and talent. The market share distribution is dynamic, with the top 5 players holding an estimated 45-55% of the market value in 2025. M&A deal counts have averaged 3-5 significant transactions annually over the historical period.

France Furniture Market Industry Trends & Analysis

The France furniture market is poised for sustained growth, driven by a confluence of economic resilience, evolving consumer lifestyles, and a strong appreciation for design and quality. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 3.5% to 4.5% from 2025 to 2033, indicating a robust expansion trajectory. Technological disruptions are significantly reshaping the industry, with the integration of AI for personalized design recommendations, VR/AR for immersive customer experiences in showrooms and online, and advancements in manufacturing processes leading to increased efficiency and reduced waste. Consumer preferences are leaning towards sustainability, with a rising demand for furniture made from recycled, renewable, and responsibly sourced materials. French consumers are increasingly prioritizing functionality without compromising on aesthetics, leading to a demand for multi-functional furniture, adaptable storage solutions, and pieces that enhance well-being and comfort, especially within the home environment. The competitive dynamics are characterized by a blend of heritage brands, international giants, and agile niche players. Established brands leverage their legacy and quality reputation, while international players offer scale and broad product ranges. Niche brands focus on unique designs, sustainable practices, and specialized customer segments, fostering a vibrant and diverse competitive landscape. Market penetration of smart furniture is projected to reach 15-20% by 2033, indicating a significant shift towards technologically integrated home furnishings. The increasing adoption of e-commerce platforms for furniture purchases, coupled with a growing demand for bespoke and artisanal furniture, are key trends shaping the market's future.

Leading Markets & Segments in France Furniture Market

Production Analysis: The Île-de-France region, due to its strong industrial base and proximity to major markets, typically leads in furniture production volume. Key drivers include access to skilled labor, advanced manufacturing facilities, and supportive regional development policies. The production is characterized by a mix of large-scale factories and smaller, specialized workshops focusing on high-end and custom furniture.

Consumption Analysis: Consumption is highest in densely populated urban areas, particularly Paris and its surrounding regions, driven by a higher disposable income, a younger demographic with evolving housing needs, and a strong culture of interior design. The growth in apartment living and the increasing trend of home renovations are significant consumption drivers. The contract furniture segment, catering to hospitality and office spaces, also contributes substantially to overall consumption, bolstered by ongoing commercial development and modernization projects.

Import Market Analysis (Value & Volume): France is a significant importer of furniture, with key import markets including Italy (renowned for luxury and design), Germany (for quality and efficiency), and Eastern European countries (for competitive pricing). The value of imports is projected to reach xx Million Euros in 2025, with a volume of xx Million Units. Drivers include a demand for specific design styles not readily available domestically, competitive pricing for certain product categories, and the sourcing of specialized components.

Export Market Analysis (Value & Volume): French furniture, particularly high-end and designer pieces, enjoys a strong export market, with key destinations including neighboring European countries like the UK, Germany, and Belgium, as well as North America and the Middle East. The value of exports is estimated at xx Million Euros in 2025, with a volume of xx Million Units. Drivers include the "Made in France" prestige, superior craftsmanship, unique design aesthetics, and the strong reputation of French luxury brands.

Price Trend Analysis: Price trends are influenced by raw material costs (wood, metal, textiles), manufacturing overheads, labor costs, and currency fluctuations. The luxury and designer segments command premium prices, driven by brand equity and craftsmanship. The mid-range and mass-market segments are more sensitive to economic conditions and competition from imports. A gradual upward trend in prices is anticipated, averaging 2-3% annually, due to rising input costs and inflationary pressures.

France Furniture Market Product Developments

The French furniture market is witnessing a surge in product innovations focused on sustainability, modularity, and integrated technology. Expect to see more furniture crafted from recycled plastics, reclaimed wood, and bio-based materials, aligning with growing environmental consciousness. Modular designs that allow for flexible configurations and space optimization are becoming increasingly popular, catering to smaller living spaces and the rise of home offices. Smart furniture, featuring integrated charging stations, adjustable lighting, and even climate control, is poised for significant growth, offering enhanced comfort and convenience. These developments are driven by technological advancements in material science and electronics, coupled with a strong market demand for versatile, eco-friendly, and technologically advanced home furnishings.

Key Drivers of France Furniture Market Growth

Several key drivers are propelling the growth of the France furniture market. Economically, a stable and growing French economy with increasing disposable incomes directly translates to higher consumer spending on home furnishings. Technologically, innovations in smart furniture, AI-driven design tools, and advanced manufacturing processes are creating new product categories and enhancing production efficiency. Regulatory frameworks that promote sustainability and circular economy principles are also driving demand for eco-friendly furniture. Furthermore, the growing trend of home renovations and interior decoration, fueled by a desire for more comfortable and functional living spaces, is a significant growth accelerator. The demand for sustainable and ethically sourced products is also a powerful market force.

Challenges in the France Furniture Market Market

Despite its growth potential, the France furniture market faces several challenges. Regulatory hurdles, particularly those related to stringent environmental certifications and complex import/export regulations, can pose barriers to entry for smaller businesses. Supply chain disruptions, exacerbated by global events and geopolitical uncertainties, can lead to increased lead times and higher material costs. Intense competitive pressures from both domestic and international players, especially from low-cost manufacturing regions, necessitate continuous innovation and cost optimization. Rising raw material prices, including lumber and metals, also present a persistent challenge, impacting profit margins. Furthermore, adapting to the rapidly evolving online retail landscape and meeting the increasing demand for fast and efficient delivery are critical operational challenges.

Emerging Opportunities in France Furniture Market

Emerging opportunities in the France furniture market lie in the burgeoning demand for sustainable and circular furniture solutions, creating avenues for brands that prioritize eco-friendly materials and production methods. The growing popularity of the "work from home" culture presents a significant opportunity for home office furniture and adaptable living spaces. Technological advancements offer opportunities for smart furniture integration, personalization through AI, and immersive customer experiences via VR/AR. Strategic partnerships with interior designers, architects, and property developers can unlock new market segments and large-scale projects. Furthermore, expanding into underserved regional markets within France and exploring niche product categories such as adaptive furniture for the elderly or specific therapeutic furniture can foster long-term growth.

Leading Players in the France Furniture Market Sector

- Roche Bobois SA

- La Chance

- Cappelin

- Herman Miller

- Nobilia

- Steelcase

- USM Modular Furniture

- Conforama

- Pierre Yovanovitch

- IKEA

- BoConcept

- Guatier Furniture

- POPUS EDITIONS

- Cassina

- Ligne Roset

- Cinna

Key Milestones in France Furniture Market Industry

- February 2023: Ligne Roset, the French heritage furniture brand, returned to Houston, opening its new showroom. The company brought its iconic contemporary furnishings and accessories to an appointed showroom in BeDesign, making it the first French brand to join the sleek emporium of Italian brands.

- May 2022: Steelcase Inc. agreed to buy Halcon, a Minnesota-based designer and manufacturer of precision-tailored wood furniture for the workplace. The acquisition expanded on earlier growth acquisitions by delivering a broad array of goods, including Viccarbe, Orangebox, AMQ, and Smith System acquisitions, bolstering a leading portfolio and offering additional choice and value to Steelcase consumers worldwide.

Strategic Outlook for France Furniture Market Market

The strategic outlook for the France furniture market is optimistic, driven by a continued focus on innovation, sustainability, and customer-centric approaches. Growth accelerators will stem from the increasing adoption of smart furniture technologies, the development of eco-friendly and circular product lines, and the expansion of online sales channels coupled with enhanced omnichannel experiences. Strategic partnerships with real estate developers and interior designers will be crucial for securing large-scale projects and tapping into new consumer segments. Furthermore, investing in research and development for personalized furniture solutions and advanced manufacturing techniques will solidify market leadership. The French furniture market is well-positioned to capitalize on evolving consumer demands for quality, design, and sustainability, ensuring a promising future.

France Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

France Furniture Market Segmentation By Geography

- 1. France

France Furniture Market Regional Market Share

Geographic Coverage of France Furniture Market

France Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation; Technical Difficulties Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Furniture is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche Bobois SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 La Chance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cappelin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Herman Miller

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nobilia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Steelcase

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 USM Modular Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Conforama

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pierre Yovanovitch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IKEA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BoConcept

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guatier Furniture

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 POPUS EDITIONS - Products

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Cinna**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cassina

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Ligne Roset

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Roche Bobois SA

List of Figures

- Figure 1: France Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: France Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: France Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: France Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: France Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: France Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: France Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: France Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: France Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: France Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: France Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: France Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: France Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Furniture Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the France Furniture Market?

Key companies in the market include Roche Bobois SA, La Chance, Cappelin, Herman Miller, Nobilia, Steelcase, USM Modular Furniture, Conforama, Pierre Yovanovitch, IKEA, BoConcept, Guatier Furniture, POPUS EDITIONS - Products, Cinna**List Not Exhaustive, Cassina, Ligne Roset.

3. What are the main segments of the France Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market.

6. What are the notable trends driving market growth?

Increasing Demand for Office Furniture is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation; Technical Difficulties Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Ligne Roset, the French heritage furniture brand, returned to Houston, opening its new showroom. The company brought its iconic contemporary furnishings and accessories to an appointed showroom in BeDesign, making it the first French brand to join the sleek emporium of Italian brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Furniture Market?

To stay informed about further developments, trends, and reports in the France Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence