Key Insights

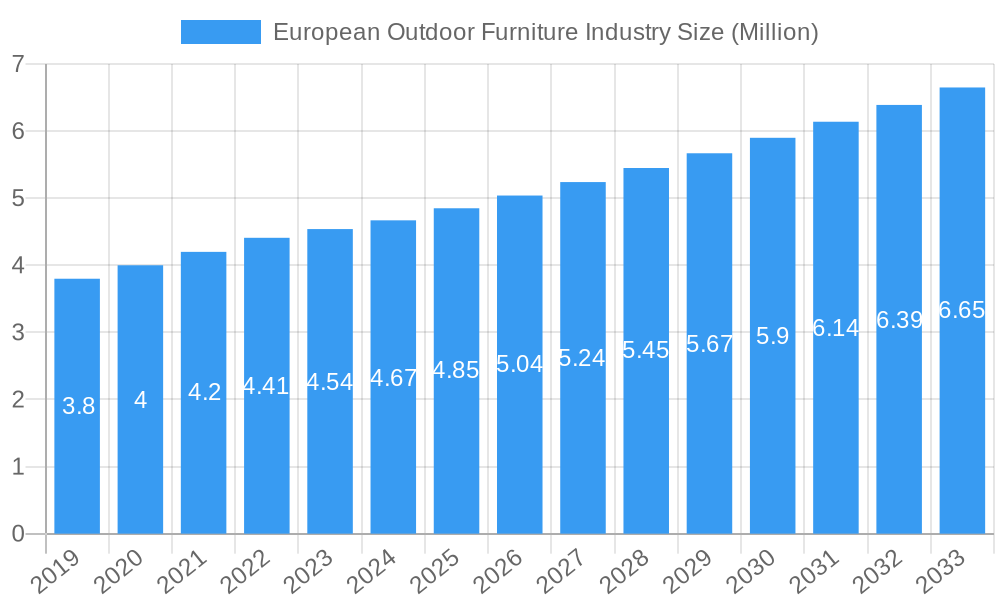

The European Outdoor Furniture Industry is projected for robust growth, currently valued at approximately $4.67 billion and expected to expand at a Compound Annual Growth Rate (CAGR) of 5.14% from 2019 to 2033. This expansion is primarily fueled by an increasing consumer desire for enhanced outdoor living spaces, driven by factors such as growing urbanization, a stronger emphasis on home improvement, and a burgeoning trend towards outdoor entertaining and relaxation. The demand for durable, aesthetically pleasing, and sustainable outdoor furniture is on the rise, with consumers actively seeking products that offer both functionality and style. This heightened interest is further bolstered by innovative designs and the integration of smart features into outdoor furniture, catering to a more discerning and quality-conscious customer base. The market is witnessing a significant shift towards premium and eco-friendly materials, reflecting a broader societal move towards sustainability and a conscious effort to minimize environmental impact.

European Outdoor Furniture Industry Market Size (In Million)

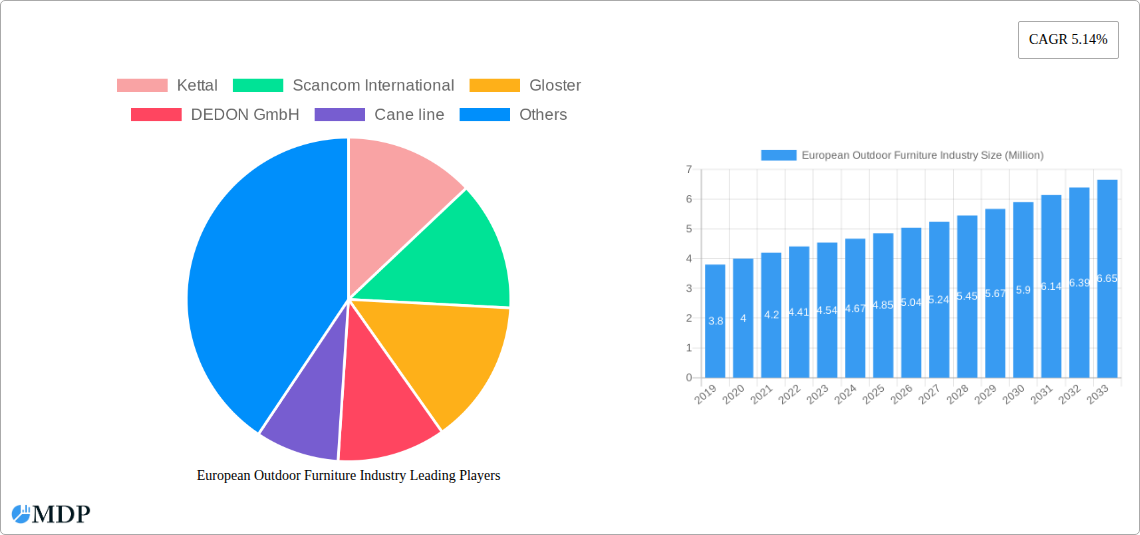

The market is segmented across various materials, with Wood and Metal emerging as dominant categories, while Plastic and Other Materials also hold significant shares. In terms of product types, Chairs, Tables, and Seating Sets are leading the charge, followed by Loungers and Daybeds, and Dining Sets. The residential sector represents the largest end-user segment, driven by individual homeowners investing in their outdoor spaces. However, the commercial sector, encompassing hospitality, corporate spaces, and public areas, is also showing considerable growth, demanding durable and stylish solutions. Multi-brand stores and specialty stores continue to be key distribution channels, but the rapid expansion of online platforms is revolutionizing how consumers access and purchase outdoor furniture, offering convenience and wider product selection. Europe, with its diverse climate and strong culture of outdoor living, remains a crucial market, with countries like the United Kingdom, Germany, France, and Italy leading the demand. Key players like Kettal, Scancom International, Gloster, and DEDON GmbH are continuously innovating to capture market share by focusing on design, quality, and sustainable practices.

European Outdoor Furniture Industry Company Market Share

Unveiling the European Outdoor Furniture Industry: A Comprehensive Market Analysis and Forecast

Gain unparalleled insights into the thriving European Outdoor Furniture Industry. This definitive report, covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, delves deep into market dynamics, trends, leading players, and future opportunities. Optimize your strategy with data-driven analysis and actionable intelligence for the European outdoor furniture market, outdoor living solutions, and premium garden furniture.

European Outdoor Furniture Industry Market Dynamics & Concentration

The European outdoor furniture market, valued at over €10 Million, exhibits moderate to high concentration, with key players like Kettal, Scancom International, Gloster, DEDON GmbH, and Cane line holding significant market share. Innovation is a primary driver, fueled by demand for sustainable materials, smart furniture integration, and customizable designs. Regulatory frameworks primarily focus on material safety and environmental impact, influencing production processes and material choices. While direct product substitutes are limited, indoor furniture adapted for outdoor use and DIY solutions pose indirect competition. End-user preferences are shifting towards durability, comfort, and aesthetic appeal, with residential consumers increasingly seeking to extend their living spaces outdoors. Mergers and acquisitions (M&A) are sporadic but strategic, aimed at expanding product portfolios and market reach. For instance, the acquisition of smaller, niche brands by larger entities allows for market consolidation and enhanced competitive positioning. The M&A deal count is projected to remain steady, with an estimated xx deals annually.

European Outdoor Furniture Industry Industry Trends & Analysis

The European Outdoor Furniture Industry is experiencing robust growth, driven by a convergence of societal trends and economic factors. A key growth driver is the increasing emphasis on outdoor living and the desire to extend interior living spaces into gardens, patios, and balconies. This trend is particularly pronounced in urban areas where outdoor spaces are highly valued. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period, reaching a market value of over €20 Million by 2033. Technological disruptions are also reshaping the industry, with advancements in material science leading to more durable, weather-resistant, and sustainable options. The integration of smart technology for features like integrated lighting and charging capabilities is also gaining traction. Consumer preferences are evolving towards personalized and modular furniture that can adapt to various spatial needs and aesthetic styles. Sustainability is no longer a niche concern but a mainstream expectation, with consumers actively seeking eco-friendly materials and production processes. Competitive dynamics are characterized by a mix of established premium brands and mass-market retailers, each vying for market share through product differentiation, pricing strategies, and brand storytelling. Market penetration is high, especially in Western European countries like Germany, the UK, and France, but significant growth potential exists in emerging markets within Eastern Europe.

Leading Markets & Segments in European Outdoor Furniture Industry

The European Outdoor Furniture Industry is dominated by several key markets and segments, each contributing significantly to the overall market value.

Dominant Regions & Countries:

- Germany leads the market, driven by a strong economy, a high disposable income, and a deeply ingrained culture of outdoor leisure. The country's robust demand for high-quality and durable furniture, coupled with an aging population seeking comfort and accessibility in their outdoor spaces, fuels this dominance.

- France follows closely, with its emphasis on lifestyle and aesthetics driving demand for designer outdoor furniture. The prevalence of balconies and terraces in urban settings also contributes to sustained growth.

- The United Kingdom exhibits strong growth, particularly in the residential segment, as homeowners invest in their gardens and outdoor entertaining spaces.

- Emerging markets in Spain and Italy are witnessing rapid expansion due to favorable climates and a growing appreciation for outdoor living.

Dominant Material Segments:

- Wood remains a perennial favorite, especially teak and acacia, valued for its natural aesthetics and durability. The demand for sustainably sourced wood is a significant driver.

- Metal (aluminum and steel) is gaining traction due to its sleek design potential, durability, and low maintenance. Powder-coated finishes offer excellent weather resistance.

- Plastic/Resin continues to hold a significant share, particularly in the mid-range and budget segments, owing to its affordability, versatility, and weather resistance. Recycled plastics are also becoming increasingly popular.

Dominant Product Segments:

- Seating Sets are the highest revenue-generating category, encompassing sofas, armchairs, and modular configurations designed for comfort and social gatherings.

- Chairs and Tables are essential components, with demand for dining sets and individual casual seating options remaining consistently strong.

- Loungers and Daybeds are experiencing increased demand as consumers focus on relaxation and creating resort-like experiences at home.

Dominant End-User Segments:

- The Residential segment represents the largest portion of the market, driven by homeowners investing in their outdoor spaces for personal enjoyment and entertainment.

- The Commercial segment, including hotels, restaurants, cafes, and public spaces, also represents a substantial market, prioritizing durability, aesthetics, and ease of maintenance.

Dominant Distribution Channels:

- Multi-brand Stores and Specialty Stores continue to be dominant channels, offering a curated selection and expert advice.

- Online Platforms are experiencing rapid growth, providing convenience and a wider selection, with brands increasingly investing in their e-commerce capabilities.

European Outdoor Furniture Industry Product Developments

Product innovations in the European Outdoor Furniture Industry are increasingly focused on sustainability, durability, and multi-functionality. Brands are exploring advanced, eco-friendly materials like recycled plastics, bamboo, and bio-composites. Designers are emphasizing modular systems that allow for flexible configurations, catering to diverse spatial needs. Technological integration, such as built-in LED lighting and charging ports, is enhancing the user experience. The competitive advantage lies in offering aesthetically pleasing, weather-resistant, and ergonomically designed furniture that seamlessly blends indoor comfort with outdoor resilience, meeting the growing consumer demand for premium, long-lasting outdoor living solutions.

Key Drivers of European Outdoor Furniture Industry Growth

Several key factors are propelling the growth of the European Outdoor Furniture Industry. The pervasive trend towards outdoor living and the desire to maximize home usable space is a primary driver. An increasing disposable income across many European nations allows consumers to invest more in high-quality outdoor furniture. Furthermore, a growing awareness of sustainability and a preference for eco-friendly products are pushing manufacturers to innovate with recycled and responsibly sourced materials. Technological advancements in material science are leading to more durable and weather-resistant furniture, reducing the need for frequent replacements and appealing to consumers seeking long-term value.

Challenges in the European Outdoor Furniture Industry Market

Despite its strong growth, the European Outdoor Furniture Industry faces several challenges. Supply chain disruptions, exacerbated by global events, can lead to increased costs and lead times for raw materials and finished products. Intense competition from both established brands and emerging low-cost manufacturers can put pressure on pricing and profit margins. Fluctuations in raw material costs, particularly for wood and metals, can impact manufacturing expenses. Moreover, navigating diverse regulatory frameworks across different European countries regarding material sourcing and product safety can add complexity to operations. Economic downturns and reduced consumer spending power could also pose a significant threat to market expansion.

Emerging Opportunities in European Outdoor Furniture Industry

The European Outdoor Furniture Industry is ripe with emerging opportunities. The increasing demand for sustainable and circular economy solutions presents a significant avenue for innovation and market differentiation. The expansion of smart home technology into outdoor spaces, offering integrated lighting, heating, and charging functionalities, is a growing trend. Strategic partnerships between furniture manufacturers and landscape designers or architects can unlock new project opportunities in both residential and commercial sectors. Furthermore, tapping into the untapped potential of Eastern European markets, with their growing economies and increasing disposable incomes, offers substantial growth prospects for furniture companies willing to adapt their offerings.

Leading Players in the European Outdoor Furniture Industry Sector

- Kettal

- Scancom International

- Gloster

- DEDON GmbH

- Cane line

- Hartman

- Alexander Rose

- IKEA

- Sieger

- Fermob

- Royal Botania

- Grosfillex

- EMU Group SpA

- Fischer Mobel GmbH

Key Milestones in European Outdoor Furniture Industry Industry

- February 2022: IKEA announced it would invest £1 billion in London over three years as it opened the doors to its first high street IKEA store in Britain, anchoring its first-ever inner-city mall in the capital's Hammersmith district. This move signaled a significant shift in retail strategy for large furniture retailers, impacting accessibility and urban market penetration.

- June 2022: The Italy-based company Poltrona Frau added new products to its outdoor furniture portfolio, the Boundless Living Collection. The Boundless Living Collection includes products specially designed for residential back gardens, boat decks, and bar terraces, among others, that can offer durability during all seasons. This highlights the growing sophistication and demand for specialized, high-performance outdoor furniture.

Strategic Outlook for European Outdoor Furniture Industry Market

The strategic outlook for the European Outdoor Furniture Industry remains highly positive, driven by sustained consumer interest in enhancing outdoor living experiences and a growing preference for sustainable products. Key growth accelerators include continued investment in innovative materials and design, the expansion of e-commerce channels, and a focus on smart furniture integration. Companies that can effectively leverage digital marketing and direct-to-consumer models, while maintaining a commitment to environmental responsibility and product quality, are well-positioned for long-term success. Strategic partnerships and potential market consolidation will further shape the competitive landscape, offering opportunities for market expansion and portfolio diversification.

European Outdoor Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Chairs

- 2.2. Tables

- 2.3. Seating Sets

- 2.4. Loungers and Daybeds

- 2.5. Dining Sets

- 2.6. Other Products

-

3. End User

- 3.1. Commercial

- 3.2. Residential

-

4. Distribution Channel

- 4.1. Multi-brand Stores

- 4.2. Specialty Stores

- 4.3. Online Platforms

- 4.4. Other Distribution Channels

European Outdoor Furniture Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

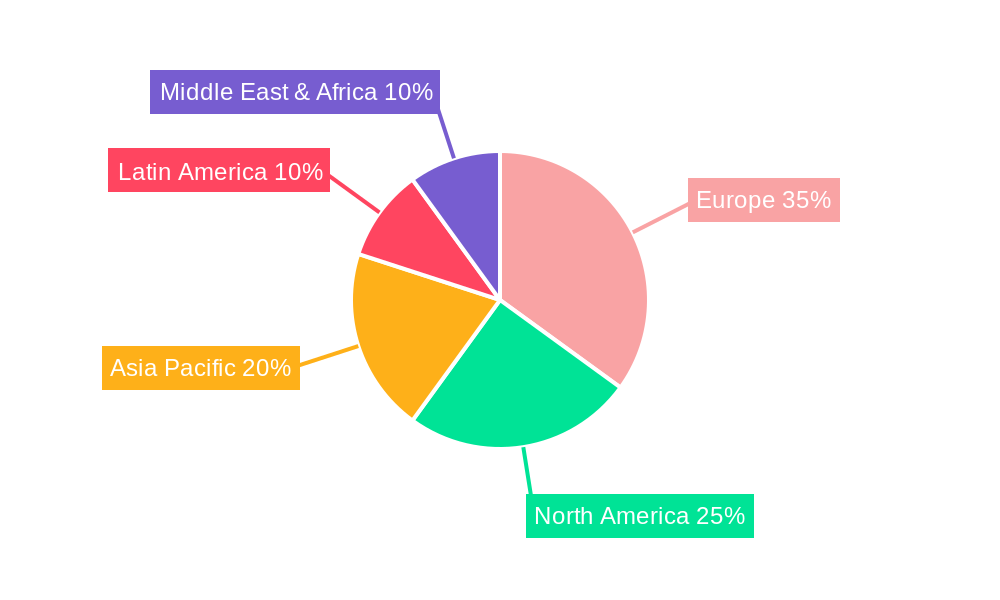

European Outdoor Furniture Industry Regional Market Share

Geographic Coverage of European Outdoor Furniture Industry

European Outdoor Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage

- 3.4. Market Trends

- 3.4.1. Italy Held the Largest Share in the Production of Outdoor Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Outdoor Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chairs

- 5.2.2. Tables

- 5.2.3. Seating Sets

- 5.2.4. Loungers and Daybeds

- 5.2.5. Dining Sets

- 5.2.6. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-brand Stores

- 5.4.2. Specialty Stores

- 5.4.3. Online Platforms

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kettal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Scancom International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gloster

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DEDON GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cane line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hartman

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alexander Rose

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sieger

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fermob

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Royal Botania

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grosfillex

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 EMU Group SpA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Fischer Mobel GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Kettal

List of Figures

- Figure 1: European Outdoor Furniture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Outdoor Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: European Outdoor Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: European Outdoor Furniture Industry Volume K Unit Forecast, by Material 2020 & 2033

- Table 3: European Outdoor Furniture Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 4: European Outdoor Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: European Outdoor Furniture Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: European Outdoor Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: European Outdoor Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Outdoor Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: European Outdoor Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: European Outdoor Furniture Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: European Outdoor Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 12: European Outdoor Furniture Industry Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: European Outdoor Furniture Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: European Outdoor Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: European Outdoor Furniture Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: European Outdoor Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: European Outdoor Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Outdoor Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 19: European Outdoor Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: European Outdoor Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United Kingdom European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Germany European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Italy European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Spain European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Netherlands European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Belgium European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Sweden European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Norway European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Poland European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Denmark European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Outdoor Furniture Industry?

The projected CAGR is approximately 5.14%.

2. Which companies are prominent players in the European Outdoor Furniture Industry?

Key companies in the market include Kettal, Scancom International, Gloster, DEDON GmbH, Cane line, Hartman, Alexander Rose, IKEA, Sieger, Fermob, Royal Botania, Grosfillex, EMU Group SpA, Fischer Mobel GmbH.

3. What are the main segments of the European Outdoor Furniture Industry?

The market segments include Material, Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth.

6. What are the notable trends driving market growth?

Italy Held the Largest Share in the Production of Outdoor Furniture.

7. Are there any restraints impacting market growth?

Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage.

8. Can you provide examples of recent developments in the market?

February, 2022: IKEA announced it would invest £1 billion in London over three years as it opened the doors to its first high street IKEA store in Britain, anchoring its first-ever inner-city mall in the capital's Hammersmith district.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Outdoor Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Outdoor Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Outdoor Furniture Industry?

To stay informed about further developments, trends, and reports in the European Outdoor Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence