Key Insights

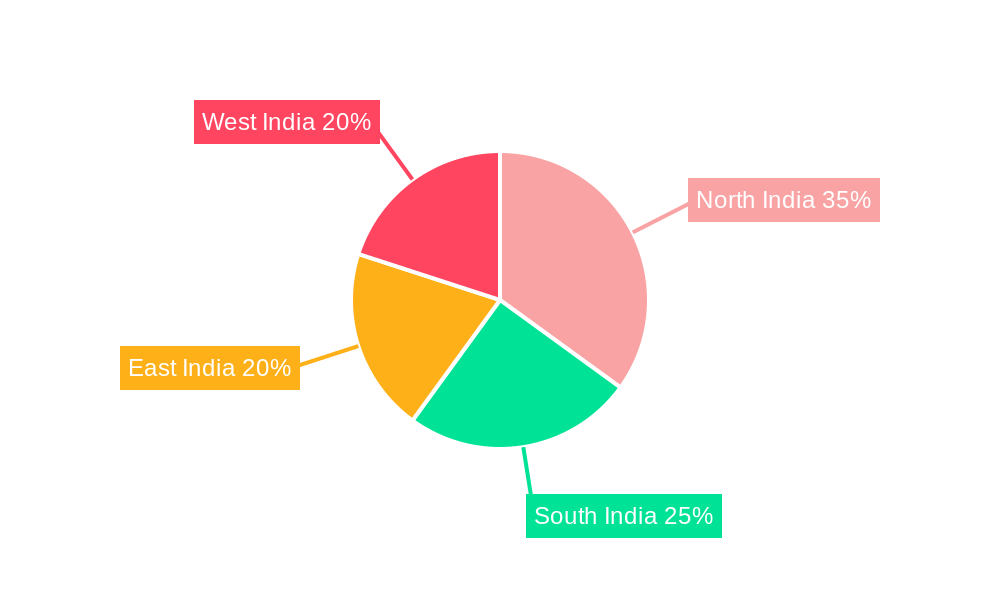

India's commercial shower cubicle market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 7.2% from 2024 to 2033. This growth is underpinned by robust demand from the expanding hospitality sector, which requires modern and hygienic shower solutions. Increased commercial construction across metropolitan and tier-II cities, serving office buildings, gyms, and other commercial establishments, further fuels this demand. Rising disposable incomes and a preference for enhanced lifestyle amenities in commercial spaces also contribute to market growth. Stainless steel cubicles currently dominate, valued for their durability and hygiene, while plastic and glass options offer diverse aesthetic and budget-friendly choices. The commercial application segment leads, reflecting strong construction and renovation activity. Key industry players like Dornbracht, Kohler, Cera Sanitaryware, and Jaquar are driving innovation through advanced designs, water-saving technologies, and aesthetically appealing products. Market growth may be moderated by price sensitivity in certain segments and the availability of lower-cost alternatives. North and West India are leading adoption due to higher commercial activity and infrastructure development.

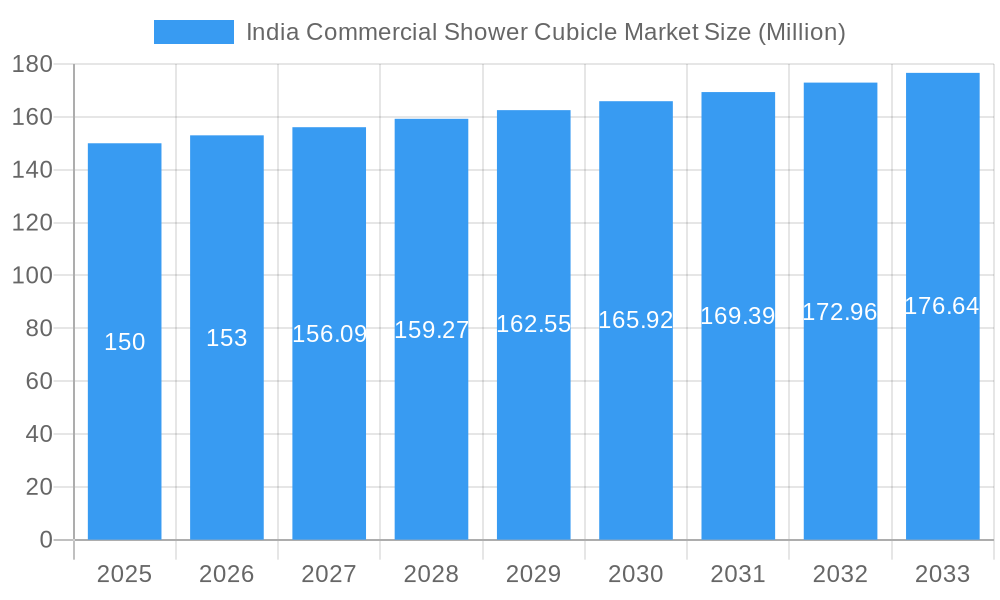

India Commercial Shower Cubicle Market Market Size (In Million)

The forecast period anticipates sustained expansion driven by government initiatives supporting sustainable construction and the integration of smart technology in shower cubicles. Heightened awareness of hygiene and sanitation, amplified by recent global health events, is also shaping market trends, encouraging a shift towards eco-friendly materials and designs. Competitive strategies will focus on product diversification, strategic alliances, and expanded distribution channels to meet evolving market needs and geographical expansion. The market size is estimated at 88.5 million in the base year 2024, with consistent annual revenue growth expected despite potential restraints.

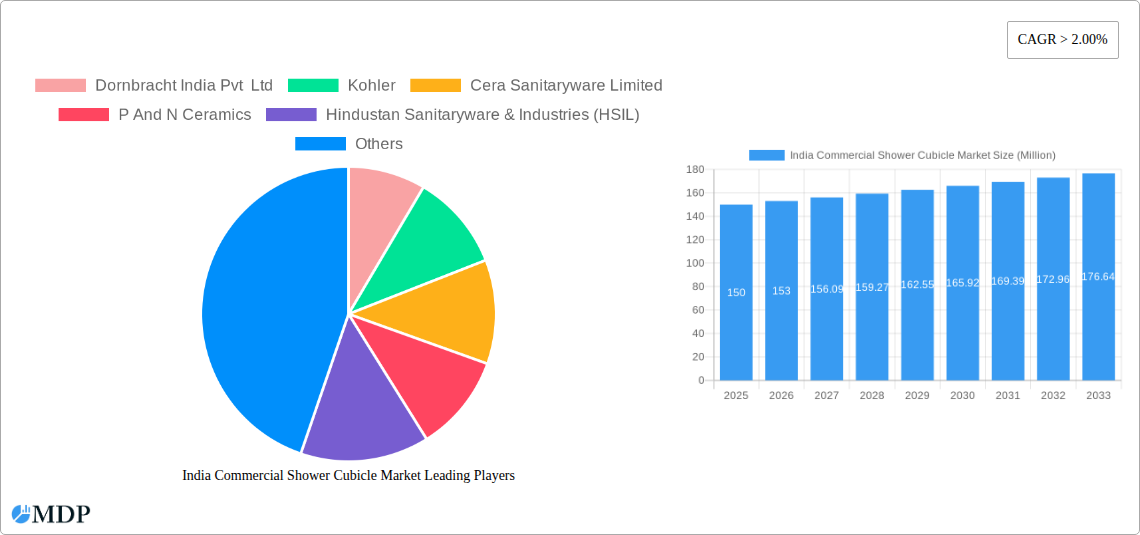

India Commercial Shower Cubicle Market Company Market Share

India Commercial Shower Cubicle Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Commercial Shower Cubicle Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a meticulous overview of market trends, competitive landscapes, and future growth prospects. The report covers key segments including Stainless Steel, Plastic, Glass, and Other product types, across Residential and Commercial applications. Leading players like Dornbracht India Pvt Ltd, Kohler, Cera Sanitaryware Limited, P And N Ceramics, Hindustan Sanitaryware & Industries (HSIL), Saint Gobain, Jaquar, TOTO Sanitary India, Parryware, and H & R Johnson are analyzed, providing a holistic view of the market. The report’s extensive data and analysis makes it an essential resource for strategic decision-making.

India Commercial Shower Cubicle Market Market Dynamics & Concentration

The India Commercial Shower Cubicle Market is experiencing significant growth driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for modern and hygienic bathroom solutions in commercial spaces. Market concentration is moderate, with several established players vying for market share. Innovation in materials, designs, and functionalities is a key driver, with manufacturers continuously striving to offer advanced shower cubicles with features like water-saving technologies and customizable designs. Regulatory frameworks focused on water conservation and building codes are shaping market dynamics, influencing the adoption of water-efficient products. Substitute products like walk-in showers exist, but shower cubicles maintain a substantial market presence due to their space efficiency and enhanced privacy. M&A activity in the sector has been moderate, with xx deals recorded in the past five years, primarily focused on expanding market reach and product portfolios. The market share of the top 5 players is estimated at xx% in 2025.

India Commercial Shower Cubicle Market Industry Trends & Analysis

The India Commercial Shower Cubicle Market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This robust growth is fueled by several factors. The burgeoning hospitality sector, including hotels and resorts, is a significant driver, with a growing demand for upscale and aesthetically pleasing shower cubicles. Similarly, the expansion of commercial real estate, particularly in metropolitan areas, is boosting market demand. Technological advancements, such as the integration of smart features and the use of sustainable materials, are shaping consumer preferences. The market is witnessing increased adoption of stainless steel cubicles due to their durability and hygiene benefits, while the glass segment is gaining traction owing to its aesthetic appeal. Competitive dynamics are intensifying, with established players focusing on brand building and product diversification while new entrants are exploring niche segments. Market penetration for shower cubicles in commercial spaces is currently estimated at xx%, with significant untapped potential in smaller cities and towns.

Leading Markets & Segments in India Commercial Shower Cubicle Market

The commercial segment dominates the Indian shower cubicle market, accounting for xx% of total revenue in 2025. This is primarily driven by the rapid growth of the hospitality, healthcare, and corporate sectors. Among product types, the stainless steel segment holds the largest market share (xx%) due to its durability, ease of maintenance, and hygiene properties.

Key Drivers for Commercial Segment Dominance:

- Rising Commercial Construction: Rapid urbanization and economic growth are driving significant investments in commercial real estate.

- Growing Hospitality Sector: The expansion of the hotel and hospitality industry contributes significantly to demand.

- Emphasis on Hygiene: Commercial establishments are increasingly prioritizing hygiene and sanitation standards.

Key Drivers for Stainless Steel Segment Dominance:

- Durability & Longevity: Stainless steel cubicles offer superior durability compared to other materials.

- Hygiene & Easy Maintenance: Stainless steel is easy to clean and maintain, preventing the growth of bacteria.

- Cost-Effectiveness in the Long Run: While initial investment may be higher, the long lifespan reduces overall costs.

India Commercial Shower Cubicle Market Product Developments

Recent product innovations focus on improving water efficiency, incorporating smart features like digital controls and lighting integration, and using eco-friendly materials. Manufacturers are increasingly emphasizing modular designs allowing for customization and space optimization. These developments cater to the growing demand for sophisticated, sustainable, and technologically advanced shower solutions. The competitive advantage lies in offering value-added features such as improved aesthetics, hygiene features, and enhanced durability.

Key Drivers of India Commercial Shower Cubicle Market Growth

Growth is driven by factors such as rising disposable incomes, increasing urbanization leading to higher density living spaces, and a shift towards modern and aesthetically pleasing bathroom fittings. Government initiatives promoting water conservation are also influencing the adoption of water-efficient shower cubicles. Technological advancements such as smart features, digital controls and innovative materials are further boosting the market.

Challenges in the India Commercial Shower Cubicle Market Market

The market faces challenges like fluctuating raw material prices impacting production costs, and a complex supply chain network. The presence of unorganized players offering lower-priced products creates competitive pressure. Furthermore, stringent building codes and water regulations can add complexity to product design and manufacturing. These factors contribute to xx% of the overall market uncertainty.

Emerging Opportunities in India Commercial Shower Cubicle Market

The market presents numerous opportunities. The growing adoption of smart home technology offers avenues for integrating smart features into shower cubicles. Strategic partnerships between manufacturers and developers of commercial buildings can unlock substantial market potential. Expanding into tier-II and tier-III cities presents significant untapped growth possibilities. Lastly, focusing on sustainable and eco-friendly materials will resonate with the growing environmental consciousness among consumers and businesses.

Leading Players in the India Commercial Shower Cubicle Market Sector

- Dornbracht India Pvt Ltd

- Kohler

- Cera Sanitaryware Limited

- P And N Ceramics

- Hindustan Sanitaryware & Industries (HSIL)

- Saint Gobain

- Jaquar

- TOTO Sanitary India

- Parryware

- H & R Johnson

Key Milestones in India Commercial Shower Cubicle Market Industry

- 2020: Launch of a new range of water-efficient shower cubicles by Jaquar.

- 2021: Kohler introduces smart shower cubicles with digital controls.

- 2022: Cera Sanitaryware Limited expands its manufacturing capacity to meet growing demand.

- 2023: Government introduces stricter water conservation regulations for commercial buildings.

- 2024: A significant merger between two mid-sized players leading to increased market consolidation.

Strategic Outlook for India Commercial Shower Cubicle Market Market

The India Commercial Shower Cubicle Market is poised for continued growth, driven by strong demand from the hospitality and commercial construction sectors. Focusing on product innovation, strategic partnerships, and expanding market reach into untapped regions will be key to success. Companies should prioritize sustainability and water efficiency to align with evolving consumer preferences and environmental regulations. The market presents substantial opportunities for both established players and new entrants to achieve considerable growth in the coming years.

India Commercial Shower Cubicle Market Segmentation

-

1. Product

- 1.1. Stainless Steel

- 1.2. Plastic

- 1.3. Glass

- 1.4. Other

-

2. Application

- 2.1. Residential

- 2.2. Commercial

India Commercial Shower Cubicle Market Segmentation By Geography

- 1. India

India Commercial Shower Cubicle Market Regional Market Share

Geographic Coverage of India Commercial Shower Cubicle Market

India Commercial Shower Cubicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Improved Ventilation in GCC Countries

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Shower Cubicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Stainless Steel

- 5.1.2. Plastic

- 5.1.3. Glass

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dornbracht India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kohler

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cera Sanitaryware Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 P And N Ceramics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hindustan Sanitaryware & Industries (HSIL)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saint Gobain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jaquar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TOTO Sanitary India*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Parryware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & R Johnson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dornbracht India Pvt Ltd

List of Figures

- Figure 1: India Commercial Shower Cubicle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Commercial Shower Cubicle Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Shower Cubicle Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: India Commercial Shower Cubicle Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: India Commercial Shower Cubicle Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Commercial Shower Cubicle Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: India Commercial Shower Cubicle Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Commercial Shower Cubicle Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Shower Cubicle Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the India Commercial Shower Cubicle Market?

Key companies in the market include Dornbracht India Pvt Ltd, Kohler, Cera Sanitaryware Limited, P And N Ceramics, Hindustan Sanitaryware & Industries (HSIL), Saint Gobain, Jaquar, TOTO Sanitary India*List Not Exhaustive, Parryware, H & R Johnson.

3. What are the main segments of the India Commercial Shower Cubicle Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Improved Ventilation in GCC Countries.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Shower Cubicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Shower Cubicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Shower Cubicle Market?

To stay informed about further developments, trends, and reports in the India Commercial Shower Cubicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence