Key Insights

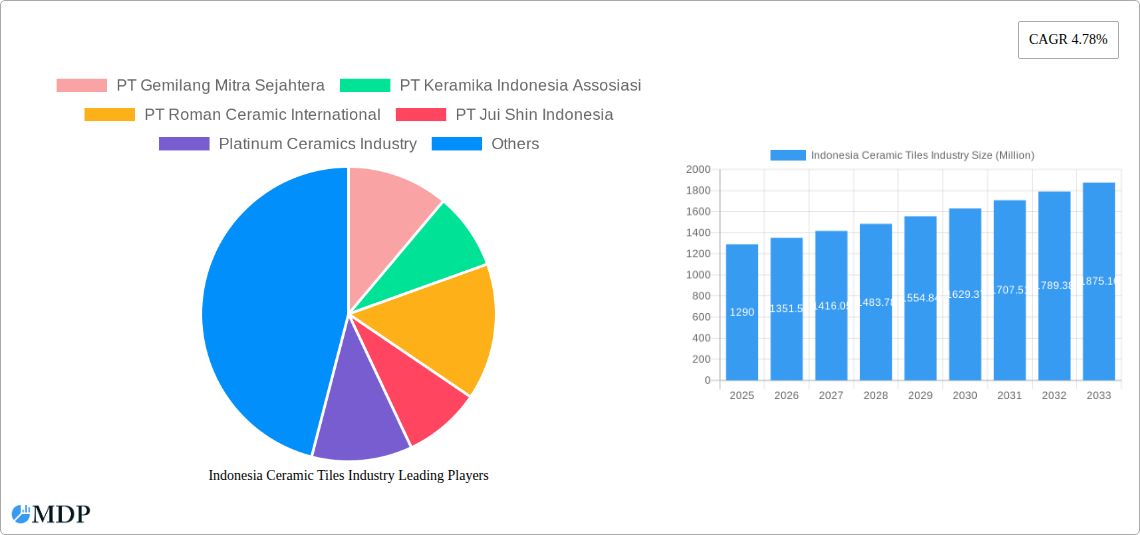

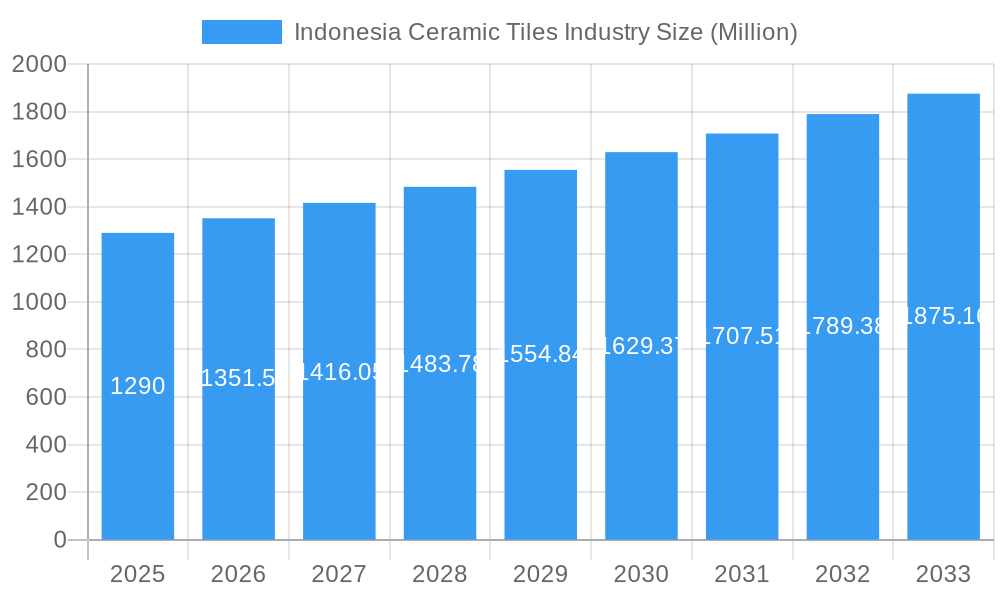

The Indonesian Ceramic Tiles Industry is poised for significant growth, with a current market size estimated at USD 1.29 billion in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 4.78% through 2033. This robust expansion is primarily fueled by a burgeoning construction sector, driven by increasing urbanization and a growing middle-class population demanding modern housing and commercial spaces. Government initiatives focused on infrastructure development, including housing projects and public facilities, further bolster demand for ceramic tiles. The industry's dynamics are also shaped by evolving consumer preferences towards aesthetically pleasing, durable, and sustainable building materials, leading to a higher demand for innovative designs and eco-friendly tile options.

Indonesia Ceramic Tiles Industry Market Size (In Billion)

While the market is experiencing strong upward momentum, certain factors could influence its trajectory. The increasing cost of raw materials, coupled with fluctuating energy prices, presents potential challenges to manufacturers' profitability and can impact the final pricing of ceramic tiles. However, the industry is actively seeking to mitigate these restraints through process optimization, adoption of advanced manufacturing technologies, and strategic sourcing of materials. The competitive landscape is characterized by the presence of both established domestic players and emerging international brands, fostering innovation and driving efforts to enhance product quality and customer service. Key market segments, including production, consumption, imports, exports, and price trends, all indicate a dynamic and evolving marketplace, reflecting the overall health and potential of the Indonesian ceramic tile sector.

Indonesia Ceramic Tiles Industry Company Market Share

Indonesia Ceramic Tiles Industry Market Dynamics & Concentration

The Indonesian ceramic tiles market is characterized by a moderate level of concentration, with a few dominant players controlling a significant share. Key companies such as PT Arwana Citramulia TBK, Platinum Ceramics Industry, and PT Muliakeramik Indahraya are recognized for their substantial production capacities and extensive distribution networks. The industry's innovation drivers are primarily linked to advancements in manufacturing technology, leading to the development of more durable, aesthetically pleasing, and eco-friendly ceramic tiles. Regulatory frameworks, including import tariffs and environmental standards, play a crucial role in shaping market dynamics and influencing competitive landscapes. The availability of abundant raw materials, such as clay and feldspar, provides a cost advantage for domestic manufacturers.

Product substitutes, while present in the form of natural stone and other flooring materials, are largely differentiated by price, durability, and maintenance requirements, with ceramic tiles offering a compelling value proposition. End-user trends are shifting towards larger format tiles, digital printing technology for intricate designs, and sustainable, low-VOC (Volatile Organic Compound) products, driven by increased consumer awareness and environmental consciousness. Mergers and acquisitions (M&A) activities, though not excessively frequent, are strategic moves by larger players to consolidate market share, acquire new technologies, or expand their product portfolios. For instance, the acquisition of smaller regional players by established entities can significantly alter market concentration. The Indonesia ceramic tiles market size is projected to witness steady growth, with a particular focus on residential and commercial construction projects.

Indonesia Ceramic Tiles Industry Industry Trends & Analysis

The Indonesian ceramic tiles industry is poised for robust growth, driven by a confluence of factors including rapid urbanization, a burgeoning middle class, and significant government investment in infrastructure development. The CAGR of the Indonesia ceramic tiles market is estimated to be robust, reflecting strong demand from both domestic and international markets. Technological disruptions are at the forefront of this growth, with manufacturers increasingly adopting digital printing technology that allows for highly customized and complex designs, mimicking natural materials like wood and stone with unprecedented realism. This innovation not only enhances product aesthetics but also contributes to cost-effectiveness in production.

Consumer preferences are evolving, with a growing demand for larger format tiles that offer a seamless and modern look, as well as for tiles with superior durability, slip resistance, and ease of maintenance. The trend towards sustainable building materials is also influencing purchasing decisions, leading to a rise in demand for eco-friendly ceramic tiles produced with reduced energy consumption and waste. Market penetration is deepening in secondary cities and rural areas as disposable incomes rise and housing development expands beyond major metropolitan centers. The competitive dynamics within the Indonesian ceramic tile industry are intense, with both domestic giants and international players vying for market share. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage each other's strengths in distribution, technology, and market access. The demand for ceramic tiles in Indonesia is further boosted by the thriving renovation and refurbishment sector, as homeowners and businesses seek to upgrade their spaces. The global ceramic tile market outlook also indicates positive trends for emerging economies like Indonesia.

Leading Markets & Segments in Indonesia Ceramic Tiles Industry

Production Analysis: Indonesia's production of ceramic tiles is heavily concentrated in Java, particularly in regions with readily available raw materials and established industrial infrastructure. The economic policies promoting local manufacturing and industrial development have significantly boosted production capacity. Infrastructure development, such as improved logistics and transportation networks, further facilitates efficient raw material sourcing and finished product distribution, underpinning the dominance of these regions. The sheer volume of ceramic tile production in Indonesia is a testament to the country's growing manufacturing prowess.

Consumption Analysis: The largest segment of ceramic tile consumption in Indonesia is driven by the residential construction sector, followed by commercial projects including hotels, retail spaces, and office buildings. Economic growth and rising disposable incomes are key drivers of this demand. Government initiatives aimed at increasing homeownership and developing affordable housing also contribute significantly to consumption. The Indonesian construction market's expansion is a direct correlate to ceramic tile demand.

Import Market Analysis (Value & Volume): While Indonesia is a significant producer, certain high-end and specialized ceramic tiles are imported to meet specific design and quality demands. The import market is influenced by international trade agreements, fluctuating foreign exchange rates, and the availability of niche products not produced domestically. The value of ceramic tile imports is often higher due to the premium nature of these products.

Export Market Analysis (Value & Volume): Indonesia's export market for ceramic tiles is growing, primarily driven by competitive pricing and improving product quality. Neighboring Southeast Asian countries represent key export destinations. The government's export promotion policies and trade missions have played a vital role in expanding Indonesia's global footprint in the ceramic tile sector. The export of Indonesian ceramic tiles is a growing contributor to the national economy.

Price Trend Analysis: Price trends in the Indonesian ceramic tiles market are influenced by raw material costs, energy prices, production efficiency, and competitive pressures. Domestic manufacturers strive to offer competitive pricing while maintaining profitability. The price of ceramic tiles in Indonesia is also subject to import duties and taxes. Fluctuations in global commodity prices can indirectly impact the cost of raw materials, leading to price adjustments in the domestic market.

Indonesia Ceramic Tiles Industry Product Developments

Recent product developments in the Indonesian ceramic tiles industry are heavily focused on embracing digital printing technology, enabling the creation of hyper-realistic designs that mimic natural materials like marble, wood, and stone with exceptional detail. There's also a significant push towards larger format tiles, offering a more expansive and seamless aesthetic for modern interiors. Innovations in surface treatments are yielding tiles with enhanced durability, superior slip resistance for safety, and improved stain and scratch resistance for longevity. Furthermore, the industry is increasingly emphasizing the production of eco-friendly tiles, utilizing sustainable manufacturing processes and materials with low VOC emissions, catering to a growing demand for healthier and environmentally conscious building solutions.

Key Drivers of Indonesia Ceramic Tiles Industry Growth

Several key drivers are propelling the growth of the Indonesia ceramic tiles industry. Firstly, rapid urbanization and a burgeoning middle class are fueling increased demand for new residential and commercial construction. Secondly, government initiatives focused on infrastructure development and affordable housing projects directly translate into higher consumption of building materials like ceramic tiles. Thirdly, technological advancements in manufacturing, particularly digital printing, are enabling manufacturers to offer a wider array of aesthetically appealing and cost-effective products. Finally, a growing consumer awareness and preference for durable, low-maintenance, and aesthetically pleasing flooring solutions further solidifies the market's upward trajectory.

Challenges in the Indonesia Ceramic Tiles Industry Market

Despite the positive growth trajectory, the Indonesia ceramic tiles industry faces several challenges. Intense competition, both from domestic players and imports, exerts downward pressure on prices and profit margins. Fluctuations in the cost of raw materials and energy can significantly impact production costs and overall competitiveness. Navigating complex regulatory frameworks and ensuring compliance with evolving environmental standards can also pose hurdles for manufacturers. Furthermore, logistical challenges related to the archipelago's geography can increase distribution costs and affect supply chain efficiency.

Emerging Opportunities in Indonesia Ceramic Tiles Industry

Emerging opportunities within the Indonesia ceramic tiles industry are ripe for exploration. The increasing adoption of smart building technologies presents an opportunity for innovative ceramic tiles with integrated functionalities, such as self-cleaning or temperature-regulating properties. Strategic partnerships with interior designers and architects can unlock new market segments and drive demand for bespoke tile solutions. Furthermore, the growing trend of home renovation and remodeling, fueled by rising disposable incomes and a desire for updated living spaces, offers a significant avenue for market expansion. Exploring export markets beyond Southeast Asia, particularly in regions with developing economies, also represents a substantial growth catalyst.

Leading Players in the Indonesia Ceramic Tiles Industry Sector

- PT Gemilang Mitra Sejahtera

- PT Keramika Indonesia Assosiasi

- PT Roman Ceramic International

- PT Jui Shin Indonesia

- Platinum Ceramics Industry

- PT Eleganza Tile Indonesia

- PT Arwana Citramulia TBK

- PT Terracotta Indonesia

- PT Muliakeramik Indahraya

- PT Niro Ceramic Nasional Indonesia

Key Milestones in Indonesia Ceramic Tiles Industry Industry

- September 2023: PT Keramika Indonesia Assosiasi Tbk (KIAS) secured a loan of IDR 30 billion to expand its ceramic business line.

- November 2022: Platinum Ceramics initiated a significant plant modernization project to enhance productivity and product quality, partnering with System Ceramics to incorporate technological advancements.

Strategic Outlook for Indonesia Ceramic Tiles Industry Market

The strategic outlook for the Indonesia ceramic tiles industry is optimistic, driven by sustained demand from domestic infrastructure and housing development. Key growth accelerators include continued investment in advanced manufacturing technologies, such as digital printing, to enhance product differentiation and competitiveness. Companies are expected to focus on expanding their product portfolios to include more sustainable and high-performance tiles, catering to evolving consumer preferences. Furthermore, strategic collaborations and potential M&A activities will likely shape the market landscape, leading to consolidation and greater operational efficiencies, ultimately positioning Indonesia as a significant player in the regional and global ceramic tile market.

Indonesia Ceramic Tiles Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Ceramic Tiles Industry Segmentation By Geography

- 1. Indonesia

Indonesia Ceramic Tiles Industry Regional Market Share

Geographic Coverage of Indonesia Ceramic Tiles Industry

Indonesia Ceramic Tiles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Real Estate Construction is Driving the Market; Rise in Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Installation is Difficult

- 3.3.2 Pricey

- 3.3.3 and Time-Consuming; Long-term Heat Retention is Difficult

- 3.4. Market Trends

- 3.4.1. Consumption of Ceramic Tiles in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Gemilang Mitra Sejahtera

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Keramika Indonesia Assosiasi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Roman Ceramic International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Jui Shin Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Platinum Ceramics Industry

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Eleganza Tile Indonesia**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Arwana Citramulia TBK

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Terracotta Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Muliakeramik Indahraya

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Niro Ceramic Nasional Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Gemilang Mitra Sejahtera

List of Figures

- Figure 1: Indonesia Ceramic Tiles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Ceramic Tiles Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Ceramic Tiles Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the Indonesia Ceramic Tiles Industry?

Key companies in the market include PT Gemilang Mitra Sejahtera, PT Keramika Indonesia Assosiasi, PT Roman Ceramic International, PT Jui Shin Indonesia, Platinum Ceramics Industry, PT Eleganza Tile Indonesia**List Not Exhaustive, PT Arwana Citramulia TBK, PT Terracotta Indonesia, PT Muliakeramik Indahraya, PT Niro Ceramic Nasional Indonesia.

3. What are the main segments of the Indonesia Ceramic Tiles Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Real Estate Construction is Driving the Market; Rise in Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Consumption of Ceramic Tiles in Indonesia.

7. Are there any restraints impacting market growth?

Installation is Difficult. Pricey. and Time-Consuming; Long-term Heat Retention is Difficult.

8. Can you provide examples of recent developments in the market?

In September 2023, PT Keramika Indonesia Assosiasi Tbk (KIAS) secured a loan of IDR 30 billion to expand its ceramic business line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Ceramic Tiles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Ceramic Tiles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Ceramic Tiles Industry?

To stay informed about further developments, trends, and reports in the Indonesia Ceramic Tiles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence