Key Insights

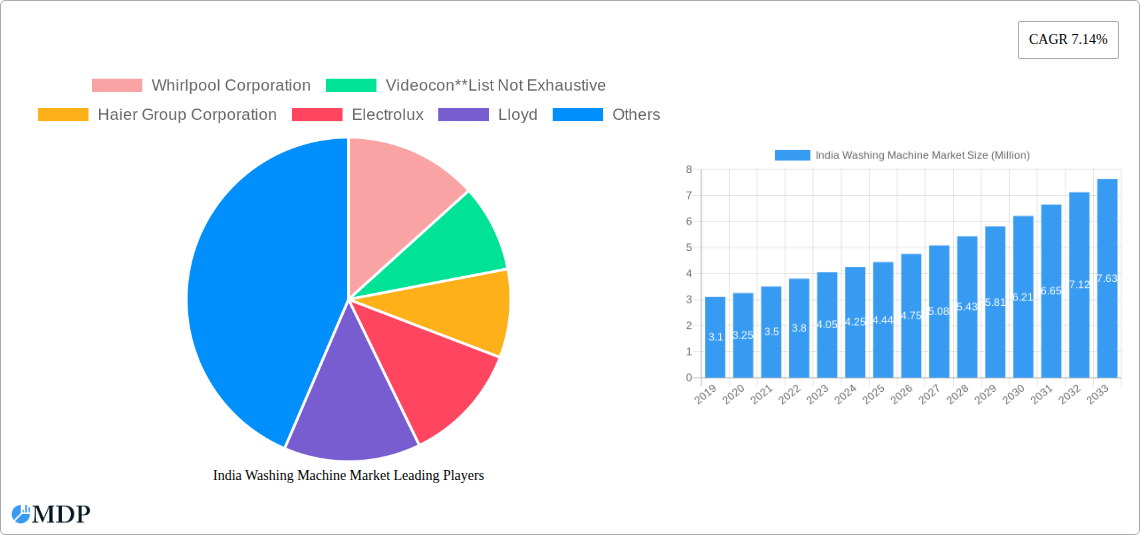

The Indian washing machine market is poised for robust expansion, currently valued at an estimated $4.44 billion and projected to grow at a Compound Annual Growth Rate (CAGR) of 7.14% through 2033. This significant growth is propelled by a confluence of powerful drivers, including the rising disposable incomes, increasing urbanization, and a growing preference for automated and convenience-driven home appliances. The escalating demand for fully automatic washing machines, which offer superior cleaning performance and ease of use, is a key trend shaping the market. Furthermore, a burgeoning middle class with a greater appreciation for modern living standards is actively investing in advanced home appliances, directly fueling market expansion. The shift towards larger household sizes in certain regions and the persistent need for efficient laundry solutions in both urban and semi-urban areas also contribute to this upward trajectory.

India Washing Machine Market Market Size (In Million)

Despite the optimistic outlook, the market faces certain restraints that could temper its growth pace. Intense competition among domestic and international brands, leading to price wars and margin pressures, is a significant factor. Additionally, the dependence on imported components for certain advanced technologies can lead to supply chain disruptions and impact manufacturing costs. The rural penetration of washing machines, while improving, still presents an opportunity for greater market reach. However, the increasing availability of a diverse range of products across different price points, coupled with strategic marketing initiatives and the expansion of distribution channels, particularly online platforms and specialized appliance stores, is expected to mitigate these challenges and sustain the market's upward momentum. The continuous innovation in energy-efficient models and smart features will also be critical in attracting a wider consumer base.

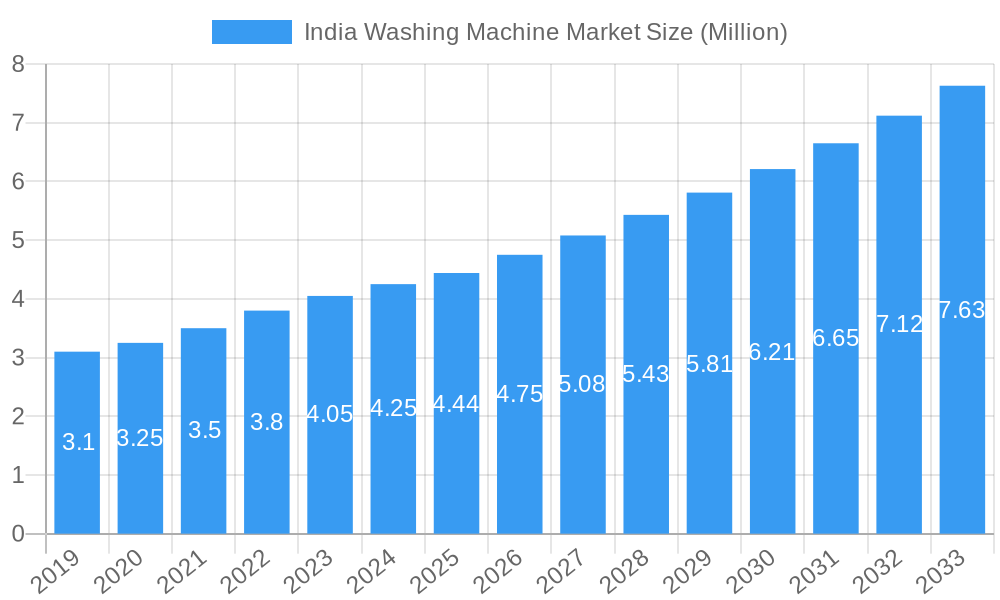

India Washing Machine Market Company Market Share

Unlock critical insights into the rapidly expanding India Washing Machine Market with our in-depth report. This comprehensive analysis covers market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook for the period 2019–2033, with 2025 as the base year. Our report leverages high-traffic keywords such as "India washing machine market," "fully automatic washing machines," "front load washing machine," "top load washing machine," "smart washing machines India," "consumer durables India," and "home appliance market India" to ensure maximum search visibility and attract industry stakeholders, including manufacturers, distributors, investors, and policymakers.

India Washing Machine Market Market Dynamics & Concentration

The India Washing Machine Market is characterized by a dynamic interplay of innovation, evolving consumer preferences, and a moderately concentrated competitive landscape. Market concentration is influenced by the presence of established global and domestic brands, with key players like Samsung India Electronics Ltd, LG Electronic Inc, Whirlpool Corporation, and Haier Group Corporation holding significant market shares. The innovation drivers are largely centered around energy efficiency, smart features powered by AI and IoT, and enhanced fabric care technologies. Regulatory frameworks, primarily driven by energy star ratings and BIS standards, are increasingly shaping product development and consumer choices. Product substitutes, while present in the form of manual washing or laundry services, have a limited impact on the overall market penetration of washing machines. End-user trends showcase a growing demand for convenience, automation, and advanced features, particularly among urban and semi-urban households. Merger and Acquisition (M&A) activities, though not extensive in recent years, remain a potential avenue for market consolidation and expansion for key players. The M&A deal count is estimated to be between 5-10 significant strategic alliances or acquisitions over the forecast period. Market share distribution is dynamic, with the top 5 players estimated to command over 70% of the market by 2025.

India Washing Machine Market Industry Trends & Analysis

The India Washing Machine Market is poised for robust growth, driven by a confluence of factors including rising disposable incomes, increasing urbanization, and a growing nuclear family structure, all contributing to a heightened demand for automated and convenient home appliances. The market penetration of washing machines in India is projected to reach over 55% by 2025, indicating substantial room for expansion. Technological disruptions are at the forefront, with a clear shift towards fully automatic washing machines, both front load and top load variants. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is revolutionizing product offerings, enabling features like smart diagnostics, remote operation, and personalized wash cycles. Consumer preferences are increasingly leaning towards energy-efficient models, driven by rising electricity costs and environmental consciousness. The average annual growth rate (CAGR) for the India Washing Machine Market is estimated to be around 12-15% during the forecast period (2025–2033). Competitive dynamics are intensifying, with brands focusing on product differentiation through advanced features, aesthetic designs, and competitive pricing strategies. The rise of online sales channels is also transforming the distribution landscape, offering consumers wider choices and greater accessibility. The demand for larger capacity machines to cater to growing household sizes is another significant trend. The market is also witnessing a growing interest in specialized wash programs for different fabric types and stain removal capabilities. The increasing adoption of smart home ecosystems further fuels the demand for connected washing machines.

Leading Markets & Segments in India Washing Machine Market

The Fully Automatic segment, encompassing both Front Load and Top Load types, is the dominant force within the India Washing Machine Market. The Front Load sub-segment is experiencing particularly rapid growth due to its superior washing performance, energy efficiency, and gentler fabric care capabilities. The Top Load segment continues to hold a significant share, driven by its affordability and ease of use, especially in Tier 2 and Tier 3 cities.

Dominant Technology: Fully Automatic

- Key Drivers: Increasing consumer preference for convenience, time-saving solutions, and advanced fabric care. Growing disposable incomes empowering consumers to invest in premium appliances.

- Market Share: Estimated to command over 65% of the total market by 2025.

- CAGR: Projected to grow at a CAGR of approximately 14% during the forecast period.

Leading Type: Front Load

- Key Drivers: Superior cleaning efficiency, water and energy savings, and the ability to handle delicate fabrics. Growing adoption among the urban middle and upper-middle class.

- Market Share: Expected to capture over 40% of the fully automatic segment by 2025.

- Technological Advancements: Features like AI-powered wash cycles, steam wash, and inverter technology are driving demand.

Significant Type: Top Load

- Key Drivers: Affordability, faster wash cycles, and user-friendliness. Strong presence in semi-urban and rural markets.

- Market Share: Continues to be a substantial segment, especially in the semi-automatic category.

- Market Penetration: High penetration in price-sensitive segments.

Dominant Distribution Channel: Online

- Key Drivers: E-commerce platforms offer a wide selection, competitive pricing, convenient home delivery, and easy comparison of features.

- Market Share: Estimated to contribute over 35% of total sales by 2025.

- Impact of Digitalization: Growing internet penetration and smartphone usage in India.

Other Key Distribution Channels:

- Supermarkets and Hypermarkets: Offer touch-and-feel experience and immediate purchase options.

- Specialty Stores: Provide expert advice and a curated range of premium products.

- Other Distribution Channels: Include direct-to-consumer sales and smaller electronics retailers.

India Washing Machine Market Product Developments

Product development in the India Washing Machine Market is intensely focused on enhancing user experience through smart technologies and improved efficiency. Innovations include AI-driven wash cycles that automatically detect fabric type and load size, optimizing water and detergent usage. Advanced features like auto-dispensing of detergent, steam wash for sanitization, and quieter motor technologies are becoming standard in premium models. The emphasis is on creating appliances that are not only efficient but also aesthetically pleasing and seamlessly integrated into smart home ecosystems. Competitive advantages are being carved out through unique selling propositions such as eco-friendly modes, faster wash cycles, and enhanced durability.

Key Drivers of India Washing Machine Market Growth

The growth of the India Washing Machine Market is propelled by several key factors. Increasing disposable incomes and a rising standard of living are empowering consumers to invest in modern home appliances. The rapid pace of urbanization, leading to smaller households and a greater need for convenience, is a significant driver. Technological advancements, particularly the integration of AI and IoT for smarter functionalities, are creating aspirational value and driving upgrades. Furthermore, government initiatives promoting energy efficiency and smart manufacturing under the 'Make in India' campaign are fostering a favorable market environment. The growing awareness of hygiene and cleanliness, amplified by recent global events, further bolsters demand for automated washing solutions.

Challenges in the India Washing Machine Market Market

Despite the strong growth trajectory, the India Washing Machine Market faces certain challenges. Intense price competition, particularly in the semi-automatic and entry-level fully automatic segments, can impact profit margins for manufacturers. Fluctuations in raw material prices and supply chain disruptions can affect production costs and lead times. The availability of counterfeit products and the need for robust after-sales service infrastructure, especially in remote areas, remain areas of concern. Moreover, educating a diverse consumer base about the benefits of advanced technologies and ensuring accessibility to servicing can be a logistical hurdle. The high initial cost of some premium features can also be a barrier for a segment of the population.

Emerging Opportunities in India Washing Machine Market

Emerging opportunities in the India Washing Machine Market are abundant, driven by untapped potential and evolving consumer needs. The rapid growth of the Tier 2 and Tier 3 cities presents a significant expansion opportunity for manufacturers and distributors. The increasing adoption of smart home technology will fuel demand for connected washing machines, offering opportunities for app-based controls and integration with other smart devices. The development of specialized washing machines catering to specific needs, such as those for sensitive skin or larger households, will also gain traction. Strategic partnerships with e-commerce players for exclusive launches and targeted marketing campaigns can further accelerate market penetration. The growing focus on sustainability will drive demand for energy-efficient and water-saving models.

Leading Players in the India Washing Machine Market Sector

- Whirlpool Corporation

- Videocon

- Haier Group Corporation

- Electrolux

- Lloyd

- Godrej

- IFB

- Bosch

- Samsung India Electronics Ltd

- LG Electronic Inc

Key Milestones in India Washing Machine Market Industry

- March 2024: Samsung launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines, pioneering the 11 kg category with features like AI Wash, Q-DriveTM, and Auto Dispense.

- September 2023: Haier India introduced AI-enabled 959 Direct Motion Motor Fully Automatic Front Load Washing Machines, aligning with its 'Make in India, Made for India' mission, integrating AI, IoT, and advanced fabric care.

- May 2023: Samsung unveiled its latest range of semi-automatic washing machines in India, featuring enhancements like Soft Closing, Toughened Glass Lid, and Dual Magic Filter to improve the consumer laundry experience.

Strategic Outlook for India Washing Machine Market Market

The strategic outlook for the India Washing Machine Market is exceptionally positive, driven by sustained economic growth, demographic advantages, and ongoing technological advancements. Manufacturers are expected to focus on product innovation, emphasizing smart features, energy efficiency, and enhanced user convenience to cater to the evolving demands of Indian consumers. Strategic emphasis will be placed on expanding distribution networks, particularly in Tier 2 and Tier 3 cities, and leveraging the growing dominance of online sales channels. Building brand loyalty through superior after-sales service and innovative marketing campaigns will be crucial. Investments in domestic manufacturing and R&D will further strengthen the competitive positioning of players in this dynamic market. The focus on sustainability and eco-friendly appliances will also be a key differentiator.

India Washing Machine Market Segmentation

-

1. Type

- 1.1. Front Load

- 1.2. Top Load

-

2. Technology

- 2.1. Fully Automatic

- 2.2. Semi Automatic

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

India Washing Machine Market Segmentation By Geography

- 1. India

India Washing Machine Market Regional Market Share

Geographic Coverage of India Washing Machine Market

India Washing Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization

- 3.3. Market Restrains

- 3.3.1. Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Washing Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Front Load

- 5.1.2. Top Load

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fully Automatic

- 5.2.2. Semi Automatic

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videocon**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lloyd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IFB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung India Electronics Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronic Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: India Washing Machine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Washing Machine Market Share (%) by Company 2025

List of Tables

- Table 1: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Washing Machine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: India Washing Machine Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Washing Machine Market?

The projected CAGR is approximately 7.14%.

2. Which companies are prominent players in the India Washing Machine Market?

Key companies in the market include Whirlpool Corporation, Videocon**List Not Exhaustive, Haier Group Corporation, Electrolux, Lloyd, Godrej, IFB, Bosch, Samsung India Electronics Ltd, LG Electronic Inc.

3. What are the main segments of the India Washing Machine Market?

The market segments include Type, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization.

6. What are the notable trends driving market growth?

The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry..

7. Are there any restraints impacting market growth?

Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2024, Samsung, the leading consumer electronics brand in India, launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines. This latest series of washing machines is the pioneer in the 11 kg category, offering innovative features such as AI Wash, Q-DriveTM, and Auto Dispense.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Washing Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Washing Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Washing Machine Market?

To stay informed about further developments, trends, and reports in the India Washing Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence