Key Insights

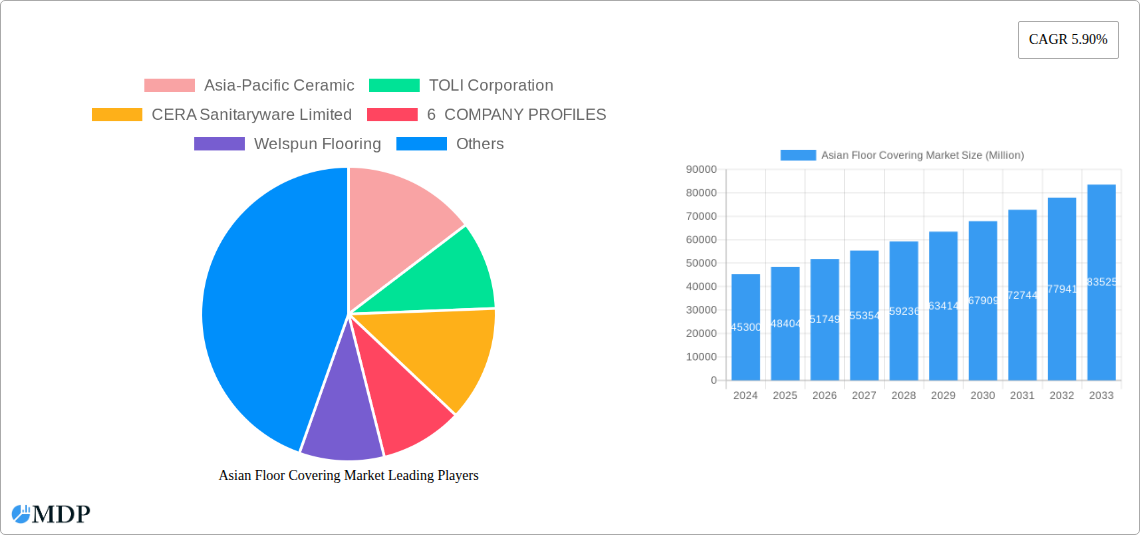

The Asian Floor Covering Market is poised for significant expansion, with an estimated market size of USD 45.3 billion in 2024, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. This upward trajectory is underpinned by a confluence of factors, including rising disposable incomes, rapid urbanization across the region, and a burgeoning construction sector. Increasing consumer preference for aesthetically pleasing and durable flooring solutions is driving demand for a diverse range of materials, from traditional ceramic tiles and wood to modern vinyl and carpet options. The growing emphasis on interior design and renovation, particularly in emerging economies, further fuels market growth. Furthermore, government initiatives promoting sustainable building practices and infrastructure development are expected to contribute to sustained market expansion.

Asian Floor Covering Market Market Size (In Billion)

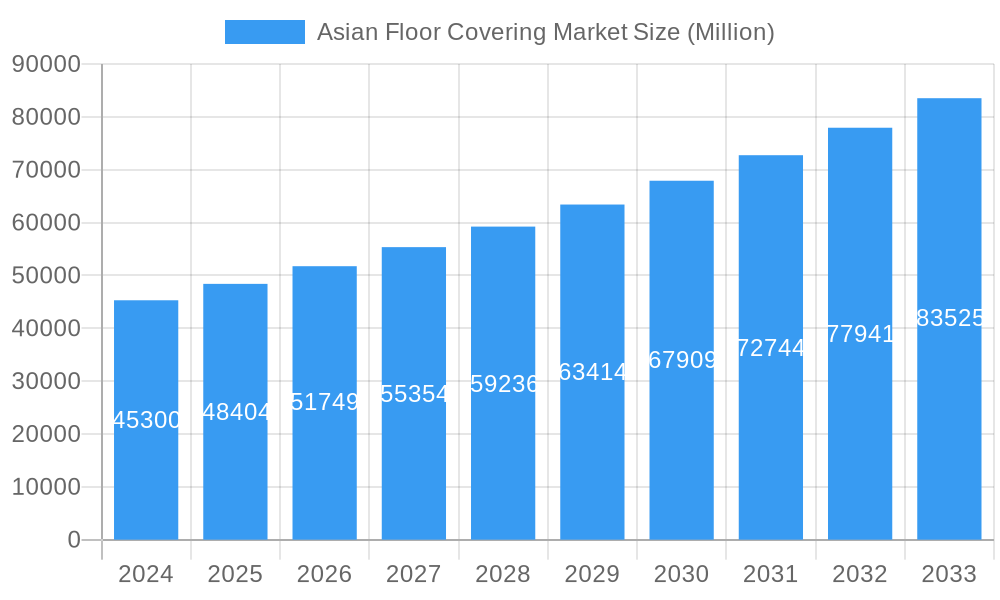

Key market drivers include the increasing demand for residential replacements and new constructions, coupled with a significant presence in the commercial sector. The growth in the 'Builder' segment, catering to new housing projects, is a major contributor to this expansion. The distribution channels are also evolving, with a notable reliance on contractors and specialty stores, alongside the increasing influence of home centers. Asia-Pacific Ceramic, TOLI Corporation, and CERA Sanitaryware Limited are among the prominent players actively shaping the market landscape. Trends such as the growing adoption of eco-friendly and sustainable flooring materials, alongside the integration of smart flooring technologies, are set to redefine consumer choices and product innovation in the coming years. While rapid growth is anticipated, potential challenges related to fluctuating raw material prices and intense market competition will require strategic navigation by market participants.

Asian Floor Covering Market Company Market Share

Dive into the dynamic Asian floor covering market, a rapidly expanding sector driven by burgeoning construction, evolving consumer tastes, and significant technological advancements. This in-depth report provides critical insights into the market's trajectory from 2019 to 2033, with a focus on the base and estimated year of 2025 and a robust forecast period of 2025–2033. Discover the key drivers, emerging trends, and competitive landscape shaping this multi-billion dollar industry.

Asian Floor Covering Market Dynamics & Concentration

The Asian floor covering market is characterized by a moderately concentrated landscape, with key players like Asia-Pacific Ceramic, TOLI Corporation, and CERA Sanitaryware Limited holding significant market share. Innovation is a primary driver, fueled by the demand for sustainable, aesthetically pleasing, and durable flooring solutions. Regulatory frameworks, while varied across countries, are increasingly focusing on environmental standards and building codes, influencing material choices and manufacturing processes. Product substitutes, such as advancements in decorative concrete and resinous flooring, present a growing challenge to traditional materials. End-user trends are shifting towards a preference for wood flooring, ceramic floor and wall tile, and vinyl sheet and floor tile, driven by both aesthetic appeal and practicality. Mergers and acquisitions (M&A) activities, though not at an exceptionally high volume, are strategically focused on consolidating market presence and acquiring innovative technologies. The market for M&A deals is projected to be in the hundreds of millions, with key transactions aimed at expanding product portfolios and geographical reach.

- Market Concentration: Moderate, with a few dominant players and a growing number of regional manufacturers.

- Innovation Drivers: Sustainability, design aesthetics, durability, ease of installation, and smart flooring technologies.

- Regulatory Frameworks: Increasing emphasis on eco-friendly materials, VOC emissions, and fire safety standards.

- Product Substitutes: Growing adoption of polished concrete, epoxy flooring, and advanced composite materials.

- End-User Trends: Rising demand for natural materials, water-resistant options, and customizable designs.

- M&A Activities: Strategic acquisitions to enhance technological capabilities and market penetration.

Asian Floor Covering Market Industry Trends & Analysis

The Asian floor covering market is poised for significant growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is primarily attributed to robust economic development across the Asia-Pacific region, leading to increased disposable incomes and a higher propensity for home improvements and new construction projects. The residential replacement segment, alongside the burgeoning commercial construction sector, are major demand generators. Technological disruptions are playing a pivotal role, with advancements in digital printing for ceramic tiles and the development of eco-friendly, high-performance vinyl flooring. Consumer preferences are increasingly leaning towards materials that offer a blend of aesthetics, functionality, and sustainability. Wood flooring, especially engineered wood, is gaining traction due to its natural appeal and improved durability. Ceramic floor and wall tile continue to dominate due to their versatility, water resistance, and wide range of design options. Laminate flooring offers a cost-effective alternative with improving aesthetics and performance. Stone flooring, while a premium segment, is also experiencing steady demand for high-end residential and commercial applications. The market penetration of advanced flooring solutions is expected to rise as awareness and affordability increase. The competitive dynamics are intense, with both global brands and local manufacturers vying for market share through product innovation, strategic pricing, and expanded distribution networks. The overall market size is estimated to reach over 300 billion USD by 2033.

Leading Markets & Segments in Asian Floor Covering Market

Ceramic Floor and Wall Tile stands out as the dominant segment within the Asian floor covering market, projected to account for a substantial market share exceeding 30% by 2033. This dominance is propelled by rapid urbanization, a booming construction industry, and a growing preference for durable, aesthetically versatile, and easy-to-maintain flooring solutions in both residential and commercial spaces. Countries like China, India, and Southeast Asian nations are key growth engines for this segment, driven by government initiatives promoting infrastructure development and affordable housing.

Material Segment Dominance:

- Ceramic Floor and Wall Tile: Leads due to its durability, design flexibility, water resistance, and affordability in many applications. The increasing demand for large-format tiles and intricate patterns further fuels its popularity. Economic policies supporting construction and renovation activities directly benefit this segment.

- Wood Flooring: Experiencing significant growth, particularly engineered wood, driven by consumer demand for natural aesthetics and improved sustainability. Its market share is projected to increase, supported by increasing disposable incomes and a growing appreciation for premium finishes in residential spaces.

- Vinyl Sheet and Floor Tile: This segment is gaining traction due to its water resistance, ease of installation, and cost-effectiveness, making it ideal for high-traffic areas and renovations. Advancements in design technology have significantly improved its aesthetic appeal.

- Carpet and Area Rugs: While a traditional segment, its growth is somewhat moderated by the rising popularity of hard surface flooring. However, its demand remains strong in certain comfort-oriented residential applications and specific commercial spaces.

- Laminate Flooring: Offers a budget-friendly alternative to wood flooring, with continuous improvements in durability and design. Its market penetration is steady, particularly in the mid-range residential sector.

- Stone Flooring: Remains a premium segment, catering to luxury residential and high-end commercial projects where durability and aesthetic sophistication are paramount.

Distribution Channel Dominance:

- Contractors: Play a crucial role, especially in large-scale commercial projects and new residential constructions. Their expertise and direct relationships with builders and developers make them indispensable for market penetration.

- Specialty Stores: Cater to discerning consumers seeking premium products and expert advice, contributing significantly to the sales of wood and stone flooring.

- Home Centers: Drive volume sales of DIY-friendly products like vinyl and laminate flooring, appealing to a broad consumer base undertaking renovation projects.

End-User Dominance:

- Commercial: This segment is a major contributor, fueled by the expansion of retail spaces, hospitality, healthcare facilities, and corporate offices. The need for durable, aesthetically pleasing, and easy-to-maintain flooring solutions drives demand.

- Residential Replacement: A consistently strong segment, driven by homeowners undertaking renovations and upgrades to enhance their living spaces. The growing middle class and increasing disposable incomes further bolster this demand.

- Builder: Essential for new residential and commercial construction projects, this segment's growth is intrinsically linked to the overall construction activity in the region.

Asian Floor Covering Market Product Developments

The Asian floor covering market is witnessing a surge in product innovations focused on sustainability, enhanced durability, and sophisticated aesthetics. Manufacturers are investing in eco-friendly materials, such as recycled content in vinyl flooring and sustainably sourced wood. Advanced printing technologies are revolutionizing ceramic tiles, allowing for intricate designs and realistic textures. The development of waterproof and scratch-resistant laminate and wood flooring solutions is meeting the demand for high-performance materials in busy households. Smart flooring technologies, integrating features like underfloor heating control and even mood lighting, are emerging as niche but growing applications. These innovations provide a competitive advantage by addressing evolving consumer needs for both form and function, offering enhanced performance, reduced environmental impact, and superior visual appeal.

Key Drivers of Asian Floor Covering Market Growth

Several key drivers are propelling the Asian floor covering market forward. Rapid urbanization and infrastructure development across the Asia-Pacific region are fueling substantial growth in the construction sector, directly translating to increased demand for flooring solutions. A rising middle class with growing disposable incomes is driving demand for home renovations and upgrades, particularly for aesthetically pleasing and durable options. Technological advancements in manufacturing processes, such as digital printing and eco-friendly material development, are enhancing product quality and expanding design possibilities. Government initiatives promoting green building and sustainable construction practices are also influencing material choices, favoring environmentally responsible flooring. Furthermore, the increasing adoption of advanced flooring materials like engineered wood and high-performance vinyl in both residential and commercial segments contributes significantly to market expansion.

Challenges in the Asian Floor Covering Market Market

Despite its robust growth, the Asian floor covering market faces several challenges. Fluctuations in raw material prices, particularly for natural resources like wood and stone, can impact manufacturing costs and profit margins. Stringent environmental regulations in some countries, while beneficial in the long run, can increase compliance costs for manufacturers. Intense competition among a large number of players, both domestic and international, leads to price pressures and the need for continuous innovation. Supply chain disruptions, as seen in recent global events, can affect the availability of raw materials and the timely delivery of finished products. Moreover, counterfeiting and the prevalence of low-quality products in some markets can dilute brand value and erode consumer trust, posing a significant barrier to market penetration for premium offerings.

Emerging Opportunities in Asian Floor Covering Market

The Asian floor covering market is ripe with emerging opportunities. The growing demand for sustainable and eco-friendly products presents a significant avenue for growth, with manufacturers focusing on recycled content, renewable materials, and low VOC emissions. The increasing popularity of smart homes is creating opportunities for intelligent flooring solutions, such as those integrating heating and lighting controls. The expansion of e-commerce platforms is providing new distribution channels, allowing manufacturers to reach a wider customer base directly. Furthermore, strategic partnerships and collaborations between material suppliers, manufacturers, and designers can lead to innovative product development and market penetration. The development of specialized flooring for emerging sectors like healthcare and education, focusing on hygiene and durability, also represents a promising growth area.

Leading Players in the Asian Floor Covering Market Sector

- Asia-Pacific Ceramic

- TOLI Corporation

- CERA Sanitaryware Limited

- Welspun Flooring

- Flooring India Company

- Fujian Floors China Co Ltd

- DAIKEN Corporation

- Pergo

- Inovar Resources Sdn Bhd

- Hanhent International China Co Ltd

Key Milestones in Asian Floor Covering Market Industry

- 2019: Increased focus on sustainable sourcing and manufacturing processes across the region.

- 2020: Rise in demand for DIY-friendly flooring solutions amidst increased home-centric activities.

- 2021: Significant investment in advanced digital printing technologies for ceramic tiles.

- 2022: Growing adoption of engineered wood flooring due to its enhanced durability and stability.

- 2023: Introduction of more water-resistant and scratch-proof laminate flooring options.

- 2024: Increased emphasis on smart flooring technologies with integrated features.

- 2025 (Base Year): Market consolidation through strategic acquisitions and partnerships.

- 2026-2033 (Forecast Period): Continued innovation in eco-friendly materials and expansion into emerging market segments.

Strategic Outlook for Asian Floor Covering Market Market

The strategic outlook for the Asian floor covering market is exceptionally positive, driven by sustained urbanization, rising disposable incomes, and a strong emphasis on quality and design. Growth accelerators include continued investment in research and development for sustainable and high-performance materials, the expansion of distribution networks through e-commerce and strategic retail partnerships, and a focus on niche markets such as luxury residential and specialized commercial applications like healthcare. The market is expected to witness a steady increase in the adoption of premium and technologically advanced flooring solutions, further solidifying its position as a key global market. The strategic imperative for players will be to balance innovation with cost-effectiveness while navigating evolving regulatory landscapes and consumer preferences.

Asian Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Non Resilient Flooring

- 1.2.1. Wood Flooring

- 1.2.2. Ceramic Floor and Wall Tile

- 1.2.3. Laminate Flooring

- 1.2.4. Stone Flooring

- 1.3. Vinyl sheet and Floor Tile

- 1.4. Other Resilient Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

Asian Floor Covering Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Floor Covering Market Regional Market Share

Geographic Coverage of Asian Floor Covering Market

Asian Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential.

- 3.3. Market Restrains

- 3.3.1 In many Asian markets

- 3.3.2 consumers are highly price-sensitive

- 3.3.3 which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 sustainably sourced wood

- 3.4.3 and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Non Resilient Flooring

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Ceramic Floor and Wall Tile

- 5.1.2.3. Laminate Flooring

- 5.1.2.4. Stone Flooring

- 5.1.3. Vinyl sheet and Floor Tile

- 5.1.4. Other Resilient Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Asia-Pacific Ceramic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TOLI Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CERA Sanitaryware Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 COMPANY PROFILES

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Welspun Flooring

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flooring India Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujian Floors China Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DAIKEN Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pergo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inovar Resources Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hanhent International China Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Asia-Pacific Ceramic

List of Figures

- Figure 1: Asian Floor Covering Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asian Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Asian Floor Covering Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Asian Floor Covering Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Floor Covering Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Asian Floor Covering Market?

Key companies in the market include Asia-Pacific Ceramic, TOLI Corporation, CERA Sanitaryware Limited, 6 COMPANY PROFILES, Welspun Flooring, Flooring India Company, Fujian Floors China Co Ltd, DAIKEN Corporation, Pergo, Inovar Resources Sdn Bhd, Hanhent International China Co Ltd.

3. What are the main segments of the Asian Floor Covering Market?

The market segments include Material, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials. sustainably sourced wood. and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity..

7. Are there any restraints impacting market growth?

In many Asian markets. consumers are highly price-sensitive. which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Floor Covering Market?

To stay informed about further developments, trends, and reports in the Asian Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence