Key Insights

The Brazilian office furniture market, valued at approximately 19.43 billion in 2025, is projected for significant expansion. This growth is propelled by increasing business establishment, ongoing urbanization, and a heightened demand for contemporary and ergonomic workspaces. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 4.2%. Key segments like meeting chairs, desks, and storage solutions are experiencing strong demand, largely influenced by the widespread adoption of hybrid and flexible work arrangements. Emerging trends encompass the incorporation of smart technology into furniture designs, a strong emphasis on sustainable and eco-friendly materials, and the burgeoning popularity of e-commerce sales channels. While economic volatility and rising material costs present potential challenges, the long-term economic development and robust business environment in Brazil indicate a positive market outlook. The extensive product range, featuring both traditional and modern aesthetics, effectively serves a wide array of office environments, from startups to large enterprises. The competitive arena features established domestic manufacturers such as Todeschini, Florense, and Politorno Moveis, alongside specialized niche players. The continued expansion of online retail platforms is expected to broaden market accessibility and reach.

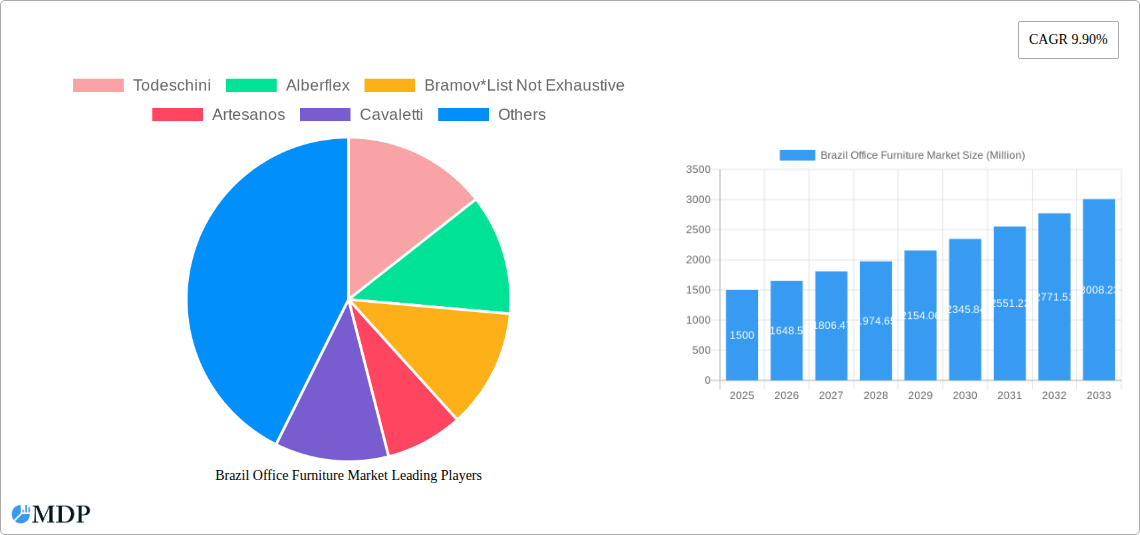

Brazil Office Furniture Market Market Size (In Billion)

Currently, the offline distribution channel holds a dominant position. However, the expanding online segment offers substantial growth opportunities. Material preferences are diverse, with wood, metal, and plastic consistently favored. Future market expansion will be shaped by factors including governmental support for sustainable manufacturing, evolving consumer preferences for modular and customizable furniture, and global commodity price fluctuations impacting material expenditures. A thorough analysis of these dynamics offers crucial insights for market stakeholders and potential investors.

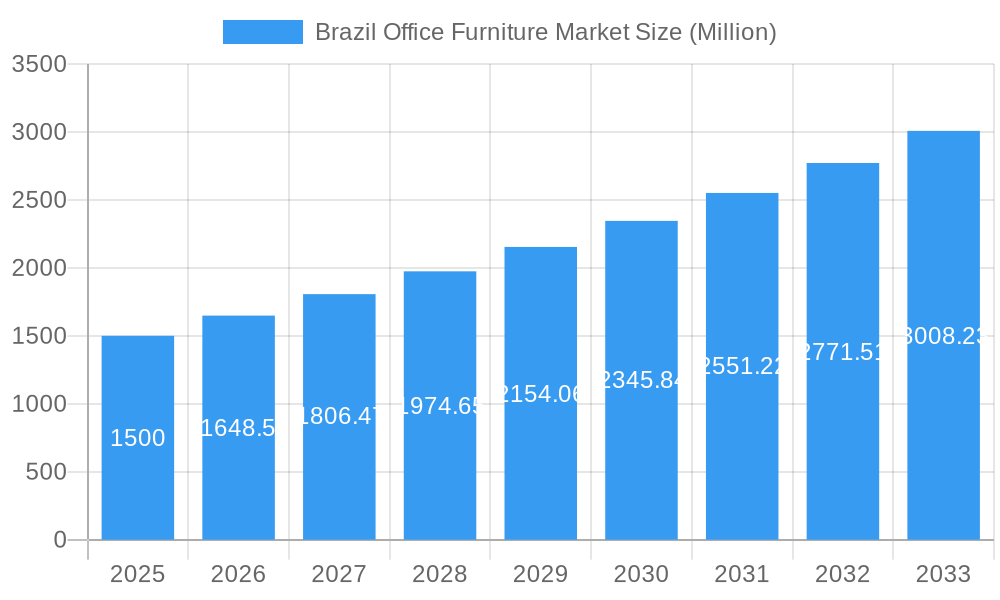

Brazil Office Furniture Market Company Market Share

Brazil Office Furniture Market Report: 2019-2033

Unlocking Growth Opportunities in a Thriving Market

This comprehensive report provides an in-depth analysis of the Brazil office furniture market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. Benefit from detailed segmentation analysis across product types (Meeting Chairs, Lounge Chairs, Swivel Chairs, Office Tables, Storage Cabinets, Desks), distribution channels (Offline, Online), and materials (Wood, Metal, Plastic, Other Materials), enabling informed strategic planning and investment decisions. The market is estimated to be worth xx Million in 2025.

Brazil Office Furniture Market Market Dynamics & Concentration

The Brazilian office furniture market exhibits a moderately concentrated landscape, with key players like Todeschini, Alberflex, and Bramov holding significant market share. However, the presence of numerous smaller, specialized companies, including Artesanos, Cavaletti, Florense, Politorno Moveis, Dalla Costa, Functional Corporate Furniture, and Brv Moveis, creates a dynamic competitive environment. Market concentration is estimated at xx% in 2025, indicating a healthy balance between established players and emerging businesses. Innovation, driven by evolving workplace designs and technological advancements, is a significant factor shaping market dynamics. Regulatory frameworks concerning safety and environmental standards also play a role. Product substitutes, such as repurposed or modular furniture, are gaining traction, challenging traditional manufacturers. The increasing adoption of open-plan offices and flexible workspaces is influencing end-user trends, with a shift towards ergonomic and collaborative furniture designs. M&A activity within the sector has remained moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Share: Todeschini holds an estimated xx% market share in 2025.

- Innovation Drivers: Sustainable materials, smart office technologies, and ergonomic designs are key drivers.

- Regulatory Frameworks: Brazilian safety and environmental regulations influence manufacturing processes and material choices.

- M&A Activity: Approximately xx M&A deals were recorded between 2019 and 2024.

Brazil Office Furniture Market Industry Trends & Analysis

The Brazil office furniture market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several factors. The growth of the service sector and the increasing number of startups are fueling demand for office furniture. Technological disruptions, such as the rise of smart office technologies and automation in manufacturing, are increasing efficiency and improving product offerings. Consumer preferences are shifting towards sustainable and ergonomic furniture, prompting manufacturers to adopt eco-friendly materials and design principles. The competitive landscape is characterized by both intense price competition and innovation-driven differentiation. Market penetration of online sales channels is steadily increasing, reaching an estimated xx% in 2025. The growing adoption of hybrid work models is expected to further shape the market in the coming years, leading to demand for adaptable and versatile furniture solutions.

Leading Markets & Segments in Brazil Office Furniture Market

The São Paulo region dominates the Brazilian office furniture market, driven by a concentration of businesses and a robust commercial real estate sector. Key factors driving this dominance include strong economic activity, well-developed infrastructure, and a large pool of skilled labor. The desk segment exhibits the highest demand due to its essential nature in any office environment. Offline distribution channels still hold the largest market share, although online sales are steadily gaining traction. Wood continues to be the preferred material due to its aesthetic appeal and perceived durability.

- Regional Dominance: São Paulo accounts for approximately xx% of the market.

- Product Segment: Desks hold the largest market share (xx%), followed by office tables (xx%) and storage cabinets (xx%).

- Distribution Channel: Offline channels hold a significant majority (xx%) of the market share.

- Material: Wood remains the leading material, accounting for approximately xx% of the market.

Brazil Office Furniture Market Product Developments

Recent product innovations focus on incorporating smart technologies, enhancing ergonomics, and using sustainable materials. Features like adjustable height desks, integrated power solutions, and modular designs are gaining popularity. These innovations address the growing demand for flexible workspaces and improved employee well-being. The market is witnessing a shift towards multifunctional furniture, blurring the lines between traditional office furniture and home office solutions.

Key Drivers of Brazil Office Furniture Market Growth

Several factors contribute to the growth of the Brazilian office furniture market. Economic growth and increasing urbanization are boosting demand for office space, leading to higher furniture purchases. The expanding service sector, especially in major cities like São Paulo and Rio de Janeiro, further fuels this demand. Government initiatives promoting infrastructure development and supporting small and medium-sized enterprises (SMEs) also contribute to market growth. The increasing adoption of hybrid work models is creating opportunities for adaptable and multifunctional furniture.

Challenges in the Brazil Office Furniture Market Market

The market faces challenges such as fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions can lead to delays and shortages. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. Economic volatility in Brazil can influence consumer spending and investment decisions in the office furniture sector.

Emerging Opportunities in Brazil Office Furniture Market

The growing adoption of smart office technologies and the increasing demand for sustainable and ergonomic furniture present significant opportunities. Strategic partnerships between furniture manufacturers and technology companies can lead to innovative product offerings. Expanding into new regions and targeting niche market segments, such as co-working spaces and home offices, can further drive growth.

Leading Players in the Brazil Office Furniture Market Sector

- Todeschini

- Alberflex

- Bramov

- Artesanos

- Cavaletti

- Florense

- Politorno Moveis

- Dalla Costa

- Functional Corporate Furniture

- Brv Moveis

Key Milestones in Brazil Office Furniture Market Industry

- 2020: Increased focus on hygiene and sanitation in office furniture design.

- 2021: Several manufacturers launched new lines of ergonomic and sustainable furniture.

- 2022: Significant investment in automation and digitalization within the manufacturing processes.

- 2023: Growing adoption of online sales channels and e-commerce platforms.

- 2024: Several mergers and acquisitions between smaller and larger companies consolidate the market.

Strategic Outlook for Brazil Office Furniture Market Market

The Brazil office furniture market is poised for continued growth, driven by long-term economic development and evolving workplace trends. Opportunities lie in developing sustainable and technologically advanced products, expanding into untapped markets, and forging strategic alliances. Focusing on customer experience and providing customized solutions will be crucial for success in this dynamic market.

Brazil Office Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Meeting Chairs

- 2.2. Lounge Chairs

- 2.3. Swivel Chairs

- 2.4. Office Tables

- 2.5. Storage Cabinets

- 2.6. Desks

-

3. Distribution Channel

- 3.1. Offline

- 3.2. Online

Brazil Office Furniture Market Segmentation By Geography

- 1. Brazil

Brazil Office Furniture Market Regional Market Share

Geographic Coverage of Brazil Office Furniture Market

Brazil Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Rising Start-Ups is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Office Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Meeting Chairs

- 5.2.2. Lounge Chairs

- 5.2.3. Swivel Chairs

- 5.2.4. Office Tables

- 5.2.5. Storage Cabinets

- 5.2.6. Desks

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Todeschini

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alberflex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bramov*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Artesanos

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cavaletti

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Florense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Politorno Moveis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dalla Costa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Functional Corporate Furniture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brv Moveis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Todeschini

List of Figures

- Figure 1: Brazil Office Furniture Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Office Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Office Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Brazil Office Furniture Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Brazil Office Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Brazil Office Furniture Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Office Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Brazil Office Furniture Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Brazil Office Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Brazil Office Furniture Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Office Furniture Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Brazil Office Furniture Market?

Key companies in the market include Todeschini, Alberflex, Bramov*List Not Exhaustive, Artesanos, Cavaletti, Florense, Politorno Moveis, Dalla Costa, Functional Corporate Furniture, Brv Moveis.

3. What are the main segments of the Brazil Office Furniture Market?

The market segments include Material, Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture.

6. What are the notable trends driving market growth?

Rising Start-Ups is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Office Furniture Market?

To stay informed about further developments, trends, and reports in the Brazil Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence