Key Insights

The Oman microwave oven market is projected for significant expansion, with an estimated market size of 8.52 million in the base year 2024 and a Compound Annual Growth Rate (CAGR) of 2.52% through 2033. This growth is propelled by increasing disposable incomes and urbanisation, driving demand in residential sectors. Enhanced accessibility through multibrand stores and online retail further fuels market expansion. The market is segmented by product type (grill, solo, convection), distribution channel (multibrand, exclusive, online, other), and application (residential, commercial), with residential applications anticipated to dominate. A competitive landscape featuring international brands like Panasonic, LG, Samsung, and Bosch, alongside regional players such as Super General, Kenwood, Candy, Nikai, and Ikon, offers diverse consumer choices. Technological advancements, including energy efficiency and smart connectivity, coupled with government economic development initiatives, are expected to sustain market growth.

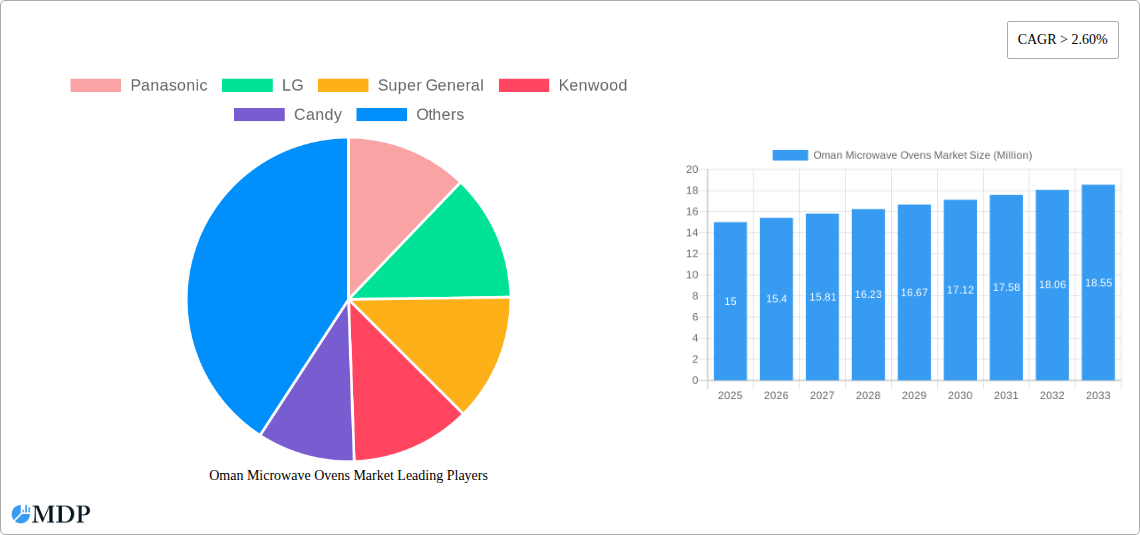

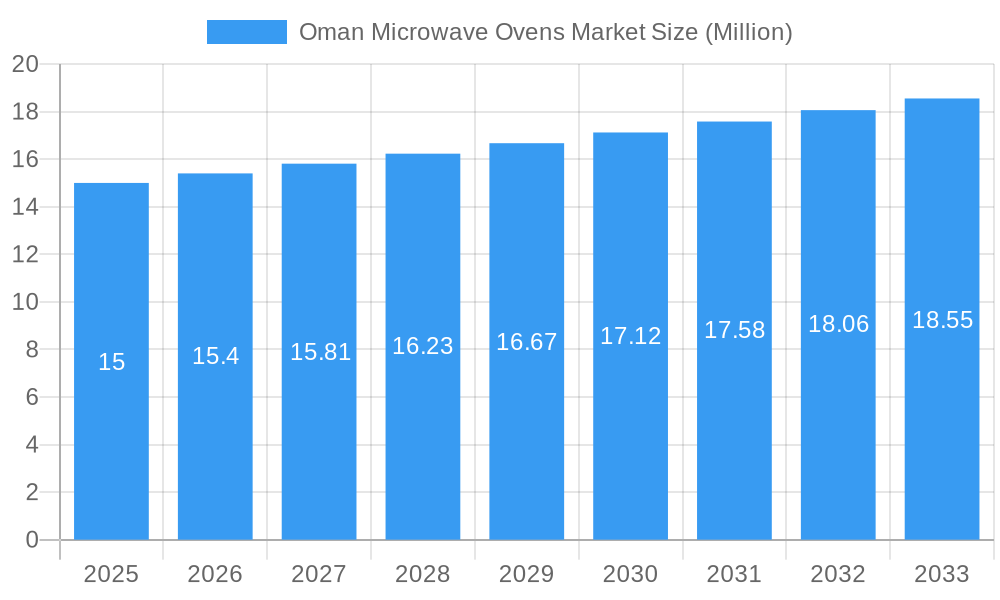

Oman Microwave Ovens Market Market Size (In Million)

Sustained growth in the Oman microwave oven market will be supported by the adoption of modern lifestyles favouring quick meal preparation. Investments in Oman's tourism and hospitality sectors are also anticipated to increase commercial demand from hotels, restaurants, and food service establishments. Potential challenges may arise from raw material price fluctuations and competition from alternative cooking appliances. However, the overall market outlook remains robust, driven by consistent economic development and evolving consumer preferences throughout the forecast period (2024-2033).

Oman Microwave Ovens Market Company Market Share

Oman Microwave Ovens Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Oman microwave ovens market, offering invaluable insights for industry stakeholders, investors, and market entrants. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. Discover key market trends, competitive landscapes, and growth opportunities within this dynamic sector. This report leverages extensive research and data analysis to provide a clear and actionable understanding of the Oman microwave ovens market, enabling informed decision-making.

Oman Microwave Ovens Market Dynamics & Concentration

The Oman microwave ovens market exhibits a moderately concentrated landscape, with key players such as Panasonic, LG, Super General, Kenwood, Candy, Nikai, Ikon, Bosch, and Samsung holding significant market share. Market concentration is influenced by factors including brand recognition, product innovation, distribution networks, and pricing strategies. The market's dynamics are shaped by several key factors:

- Innovation Drivers: Continuous innovation in microwave oven technology, including features like convection, grill, and smart functionalities, fuels market growth. The incorporation of AI and IoT capabilities is expected to further drive demand.

- Regulatory Framework: Government regulations pertaining to energy efficiency and safety standards impact market dynamics. Compliance requirements influence product design and manufacturing processes.

- Product Substitutes: Other cooking appliances, such as conventional ovens and induction cooktops, compete for market share. However, the convenience and speed offered by microwave ovens maintain their strong appeal.

- End-User Trends: Changing lifestyles, increased urbanization, and a growing preference for quick and easy meal preparation contribute significantly to market expansion. The rising disposable income within Oman also fuels market growth.

- M&A Activities: The number of mergers and acquisitions in the industry is relatively low. However, strategic partnerships and collaborations amongst players are frequent, aimed at expanding market reach and enhancing product offerings. The estimated market share held by the top 5 players is approximately xx%. The number of significant M&A deals over the last five years was approximately xx.

Oman Microwave Ovens Market Industry Trends & Analysis

The Oman microwave ovens market has experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is anticipated to continue during the forecast period (2025-2033), albeit at a potentially moderated rate due to market saturation in certain segments. Several factors drive market expansion:

The increasing adoption of microwave ovens in residential settings is a primary growth driver. Consumer preference for time-saving and convenient cooking methods contributes significantly to this trend. The market penetration of microwave ovens in residential households stands at approximately xx%. Technological advancements, such as smart features and improved energy efficiency, continue to enhance the appeal of microwave ovens. Competitive dynamics are primarily characterized by price competition, product differentiation, and brand loyalty. Market growth is also being impacted by factors such as fluctuations in disposable incomes and changing consumer preferences.

Leading Markets & Segments in Oman Microwave Ovens Market

- By Product Type: The convection microwave oven segment holds the largest market share, driven by consumer demand for versatile cooking capabilities. The solo microwave oven segment maintains a significant presence due to its affordability and simplicity. The grill microwave oven segment demonstrates a moderate growth rate.

- By Distribution Channel: Multibrand stores represent the dominant distribution channel, providing broad reach and accessibility to consumers. Exclusive brand stores are becoming increasingly prevalent, facilitating enhanced customer experience and brand building. Online sales channels exhibit growth potential, benefiting from expanding internet penetration and e-commerce adoption.

- By Application: The residential segment dominates the market, driven by increasing household ownership of microwave ovens. The commercial segment displays moderate growth, fueled by the increasing demand from restaurants and food service establishments.

Key drivers of dominance in specific segments include:

- Economic Policies: Government initiatives promoting consumer spending and infrastructure development influence market growth.

- Infrastructure: Improved infrastructure, particularly electricity accessibility, supports the wider adoption of microwave ovens.

Oman Microwave Ovens Market Product Developments

Recent product innovations focus on enhanced functionalities, such as smart connectivity, improved energy efficiency, and advanced cooking modes. The integration of AI-powered features is gaining traction, enabling personalized cooking experiences. These innovations aim to cater to evolving consumer preferences and provide competitive advantages.

Key Drivers of Oman Microwave Ovens Market Growth

Technological advancements, including the incorporation of smart features and improved energy efficiency, are key drivers. Economic factors, such as rising disposable incomes and increased urbanization, contribute significantly. Regulatory support, in the form of favorable policies and standards, further facilitates market growth.

Challenges in the Oman Microwave Ovens Market Market

Intense competition among established brands and emerging players puts pressure on pricing and profitability. Supply chain disruptions can impact product availability and lead times. Regulatory changes and compliance requirements can also present challenges to manufacturers and importers.

Emerging Opportunities in Oman Microwave Ovens Market

Expanding into untapped market segments, such as commercial kitchens and institutional settings, presents significant opportunities. Developing innovative products with smart functionalities and incorporating sustainable materials can offer a competitive edge. Strategic partnerships and collaborations can facilitate market penetration and brand building.

Leading Players in the Oman Microwave Ovens Market Sector

- Panasonic (https://www.panasonic.com/)

- LG (https://www.lg.com/)

- Super General

- Kenwood (https://www.kenwoodworld.com/)

- Candy

- Nikai

- Ikon

- Bosch (https://www.bosch-home.com/)

- Samsung (https://www.samsung.com/)

Key Milestones in Oman Microwave Ovens Market Industry

- May 10, 2022: Samsung's launch of AI-enabled washing machines highlights the increasing focus on smart home appliances, indirectly influencing consumer expectations for smart microwave ovens. The increase in washing machine capacity suggests a shift towards larger appliances and could influence design trends in other kitchen appliances.

- April 20, 2022: Panasonic's investment in Conductive Ventures III underscores the ongoing interest in technological advancements impacting various sectors, potentially including innovative microwave oven technologies. This could lead to future collaborations or investments in the microwave oven industry.

Strategic Outlook for Oman Microwave Ovens Market Market

The Oman microwave ovens market exhibits substantial long-term growth potential, driven by favorable economic conditions, evolving consumer preferences, and ongoing technological advancements. Strategic opportunities exist for players to expand product offerings, enhance brand visibility, and foster strategic partnerships to secure a leading market position. Companies focused on innovation, product differentiation, and strategic market expansion are poised to capitalize on the market's future growth trajectory.

Oman Microwave Ovens Market Segmentation

-

1. Product Type

- 1.1. Grill

- 1.2. Solo

- 1.3. Convection

-

2. Distribution Channel

- 2.1. Multibrand Stores

- 2.2. Exclusive stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Application

- 3.1. Residential

- 3.2. Commercial

Oman Microwave Ovens Market Segmentation By Geography

- 1. Oman

Oman Microwave Ovens Market Regional Market Share

Geographic Coverage of Oman Microwave Ovens Market

Oman Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional Flour

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. COVID-19 has Increased the Demand for Residential Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Microwave Ovens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Grill

- 5.1.2. Solo

- 5.1.3. Convection

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multibrand Stores

- 5.2.2. Exclusive stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Super General

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Candy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nikai

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ikon**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Oman Microwave Ovens Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Oman Microwave Ovens Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Microwave Ovens Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Oman Microwave Ovens Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Oman Microwave Ovens Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Oman Microwave Ovens Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Oman Microwave Ovens Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Oman Microwave Ovens Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Oman Microwave Ovens Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Oman Microwave Ovens Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Microwave Ovens Market?

The projected CAGR is approximately 2.52%.

2. Which companies are prominent players in the Oman Microwave Ovens Market?

Key companies in the market include Panasonic, LG, Super General, Kenwood, Candy, Nikai, Ikon**List Not Exhaustive, Bosch, Samsung.

3. What are the main segments of the Oman Microwave Ovens Market?

The market segments include Product Type, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.52 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional Flour.

6. What are the notable trends driving market growth?

COVID-19 has Increased the Demand for Residential Application.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

On 10th May 2022, Samsung announced the launch of its 2022 range of artificial intelligence enabled bi-lingual AI EcoBubble™ fully automatic front load washing machines. The new line-up comes with all new AI Wash feature for an effortless laundry experience and larger capacity models going up to 12 kg, as consumers shift their preference to bigger washing machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Oman Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence