Key Insights

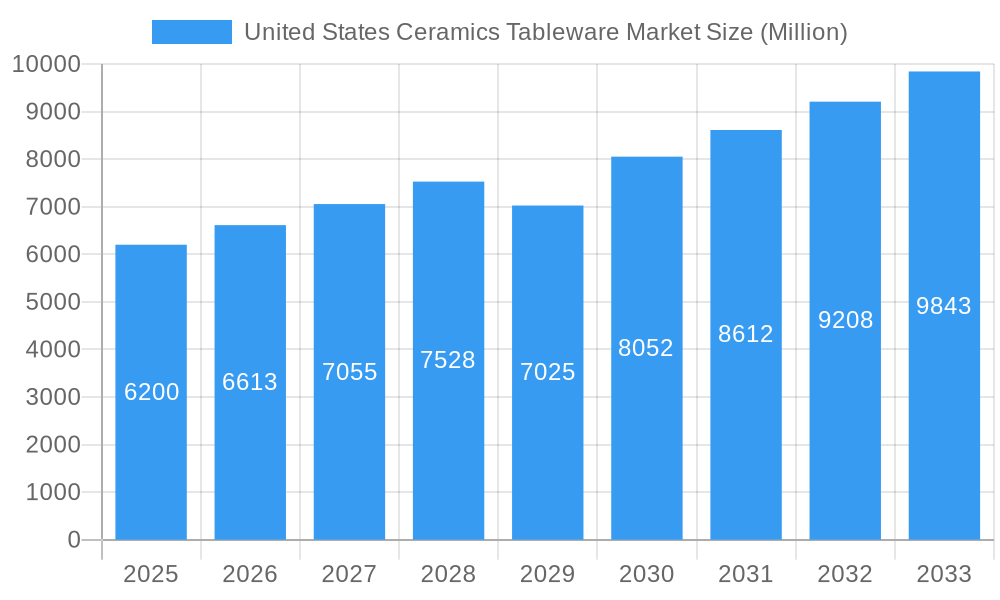

The United States ceramics tableware market, valued at $6.20 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing popularity of home-cooked meals and entertaining, coupled with a rising demand for aesthetically pleasing and durable tableware, fuels market expansion. Consumers are increasingly seeking high-quality, versatile pieces that can transition seamlessly between casual and formal settings, leading to a preference for durable materials like porcelain and stoneware. Furthermore, the growth of online retail channels provides convenient access to a wide array of styles and brands, further boosting market sales. While the market faces challenges such as fluctuating raw material costs and competition from alternative materials like melamine, these are expected to be offset by the continuing trend towards premiumization and a willingness to invest in quality tableware. The segment breakdown reveals a strong preference for porcelain and bone china, reflecting a consumer focus on both elegance and practicality. Household consumption dominates the end-user segment, suggesting a strong correlation between market performance and broader economic conditions. The presence of established players like JARS CERAMISTES, Oneida Group, and Mikasa indicates a competitive landscape with established brands focusing on innovation and brand building to maintain market share. Future growth will likely be influenced by evolving consumer preferences, innovative designs, and sustainable manufacturing practices within the industry.

United States Ceramics Tableware Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a continuation of this positive trajectory, with a Compound Annual Growth Rate (CAGR) of 6.69%. This growth will be fueled by the anticipated increase in disposable income, particularly within the higher income brackets, leading to greater spending on premium tableware. Further segmentation analysis reveals that supermarkets and hypermarkets represent a dominant distribution channel, showcasing the importance of strategic partnerships with major retailers. However, the growing popularity of online sales channels provides opportunities for niche brands and smaller businesses to reach a broader customer base. Understanding evolving consumer tastes, focusing on sustainable materials and practices, and leveraging effective e-commerce strategies will be crucial for companies seeking to maximize their share of this expanding market.

United States Ceramics Tableware Market Company Market Share

United States Ceramics Tableware Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States ceramics tableware market, covering market dynamics, industry trends, leading segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis to project a xx Million USD market value by 2033, highlighting significant growth opportunities and challenges within the sector.

United States Ceramics Tableware Market Market Dynamics & Concentration

The United States ceramics tableware market exhibits a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as brand recognition, economies of scale, and established distribution networks. The market is characterized by ongoing innovation, driven by consumer demand for aesthetically pleasing, durable, and functional tableware. Regulatory frameworks concerning material safety and labeling play a crucial role in shaping market practices. Substitute products, including melamine and plastic tableware, pose a competitive threat, especially within the price-sensitive segment. Consumer trends towards sustainable and ethically sourced products are also significantly impacting market dynamics. Mergers and acquisitions (M&A) activity within the sector has been moderate, with xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Aesthetic appeal, durability, functionality, sustainability.

- Regulatory Frameworks: FDA regulations on food safety and material composition.

- Product Substitutes: Melamine, plastic, and other materials.

- End-User Trends: Growing demand for eco-friendly and ethically sourced tableware.

- M&A Activity: xx M&A deals recorded between 2019-2024.

United States Ceramics Tableware Market Industry Trends & Analysis

The US ceramics tableware market exhibits robust growth, propelled by several converging factors. While precise CAGR figures for the historical period (2019-2024) require further specification, the market's expansion is undeniable. Increased household disposable incomes, a renewed emphasis on home dining experiences, and a rising appreciation for aesthetically pleasing tableware are key drivers. Technological advancements in materials science and manufacturing processes continuously enhance product durability, aesthetics, and affordability. Consumers are increasingly drawn to unique designs and personalized tableware options, fueling demand for diverse product offerings. The competitive landscape remains dynamic, with both established players and emerging brands engaging in intense competition through product differentiation, strategic marketing, and innovative distribution strategies. Online sales channels are experiencing significant market penetration, reflecting evolving consumer shopping behaviors and the expanding reach of e-commerce.

Leading Markets & Segments in United States Ceramics Tableware Market

The household segment reigns supreme in the end-user market, capturing approximately [Insert Percentage]% of total revenue. Within product types, Porcelain and Bone China maintain the largest market share, valued for their perceived superior quality and aesthetic appeal, followed closely by Stoneware (Ceramic). Traditional distribution channels, such as supermarkets and hypermarkets, remain significant; however, the rapid growth of online sales is reshaping the market landscape and offering new avenues for reaching consumers.

- Dominant Segment: Household (End User), Porcelain and Bone China (Product Type), Supermarkets and Hypermarkets (Distribution Channel).

- Key Drivers (Household Segment): Rising disposable income, increasing preference for home-cooked meals and elevated dining experiences.

- Key Drivers (Porcelain/Bone China): Perceived higher quality, aesthetic appeal, and suitability for formal and informal settings.

- Key Drivers (Supermarkets/Hypermarkets): Wide reach, established distribution networks, and convenient access for consumers.

United States Ceramics Tableware Market Product Developments

Recent innovations focus on enhancing durability, aesthetic appeal, and functionality. Manufacturers are increasingly incorporating sustainable materials and eco-friendly manufacturing practices. Technological advancements in glazing techniques and designs have led to a broader range of styles and colors, catering to diverse consumer preferences. The market is witnessing a growing demand for personalized and customized tableware.

Key Drivers of United States Ceramics Tableware Market Growth

The US ceramics tableware market's expansion is fueled by a confluence of factors. Rising disposable incomes empower consumers to invest in higher-quality tableware, while a resurgence in home cooking and entertaining further enhances demand. The growing popularity of hosting dinner parties and creating memorable dining experiences fuels the demand for sophisticated and stylish tableware. Technological advancements in manufacturing processes result in greater efficiency, cost reductions, and improved product quality, benefiting both manufacturers and consumers. Favorable government policies and regulations concerning food safety and product standards create a stable and supportive market environment.

Challenges in the United States Ceramics Tableware Market Market

The market faces several challenges. Increasing raw material costs and supply chain disruptions impact production costs and profitability. Intense competition from both domestic and international players necessitates ongoing innovation and differentiation. Growing environmental concerns necessitate the adoption of sustainable manufacturing practices and the use of eco-friendly materials. Fluctuations in consumer spending due to economic factors can also influence demand.

Emerging Opportunities in United States Ceramics Tableware Market

The market presents several promising opportunities. The growing popularity of personalized and customized tableware presents a significant opportunity for manufacturers. Expanding into new markets and exploring alternative distribution channels, such as online marketplaces, can drive growth. Strategic partnerships with designers and retailers can enhance market visibility and reach. The development of innovative and sustainable products will attract environmentally conscious consumers.

Leading Players in the United States Ceramics Tableware Market Sector

- JARS CERAMISTES

- The Oneida Group

- Raynaud Limoges

- Lifetime Brands

- Newell Brands

- Homer Laughlin China

- International Tableware

- Meyer Corporation

- CuisinArt

- Mikasa

Key Milestones in United States Ceramics Tableware Market Industry

- October 2022: Jars Ceramics launches a new showroom showcasing innovative stoneware collections, demonstrating a commitment to product innovation and market expansion. This highlights a strategic move to enhance brand visibility and attract new customer segments.

- March 2022: Lifetime Brands' acquisition of Can't Live Without It (S'well Bottle) signifies a strategic diversification into complementary product categories, expanding its market reach and capitalizing on emerging consumer trends in sustainable and reusable products.

- [Add another relevant milestone here with date and description]

Strategic Outlook for United States Ceramics Tableware Market Market

The US ceramics tableware market is poised for sustained growth, driven by dynamic consumer preferences, continuous technological innovation, and strategic market expansion efforts by key players. Companies emphasizing sustainability, personalization, and exceptional design are well-positioned for success. The market's long-term potential hinges on effectively leveraging technological advancements in areas such as 3D printing and sustainable materials, coupled with exploration of emerging distribution channels, including direct-to-consumer online sales and strategic partnerships to reach broader consumer segments and enhance brand visibility.

United States Ceramics Tableware Market Segmentation

-

1. Type

- 1.1. Porcelain and Bone China

- 1.2. Stoneware (Ceramic)

- 1.3. Other Types

-

2. End User

- 2.1. Household

-

2.2. Commercial

- 2.2.1. Accomodation and Hospitality Segment

- 2.2.2. Food Service Segment

- 2.2.3. Other End Users

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online

- 3.5. Other Distribution Channels

United States Ceramics Tableware Market Segmentation By Geography

- 1. United States

United States Ceramics Tableware Market Regional Market Share

Geographic Coverage of United States Ceramics Tableware Market

United States Ceramics Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods

- 3.3. Market Restrains

- 3.3.1. Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power

- 3.4. Market Trends

- 3.4.1. Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramics Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Porcelain and Bone China

- 5.1.2. Stoneware (Ceramic)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.2.2.1. Accomodation and Hospitality Segment

- 5.2.2.2. Food Service Segment

- 5.2.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JARS CERAMISTES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Oneida Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raynaud Limoges

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lifetime Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newell Brands

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homer Laughlin China

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tableware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meyer Coroporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CuisinArt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mikasa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JARS CERAMISTES

List of Figures

- Figure 1: United States Ceramics Tableware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramics Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Ceramics Tableware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Ceramics Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Ceramics Tableware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Ceramics Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramics Tableware Market?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the United States Ceramics Tableware Market?

Key companies in the market include JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Coroporation, CuisinArt, Mikasa.

3. What are the main segments of the United States Ceramics Tableware Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods.

6. What are the notable trends driving market growth?

Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market.

7. Are there any restraints impacting market growth?

Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power.

8. Can you provide examples of recent developments in the market?

In October 2022, Jars Ceramics launches a new showroom at 41 Madison during the New York Tabletop Show. The company will showcase new stoneware pieces with rich glazes and colors including deep and moody blues, greens, and blacks in the Wabi and Dashi collections and vintage, charming pastels in the Canine collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramics Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramics Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramics Tableware Market?

To stay informed about further developments, trends, and reports in the United States Ceramics Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence