Key Insights

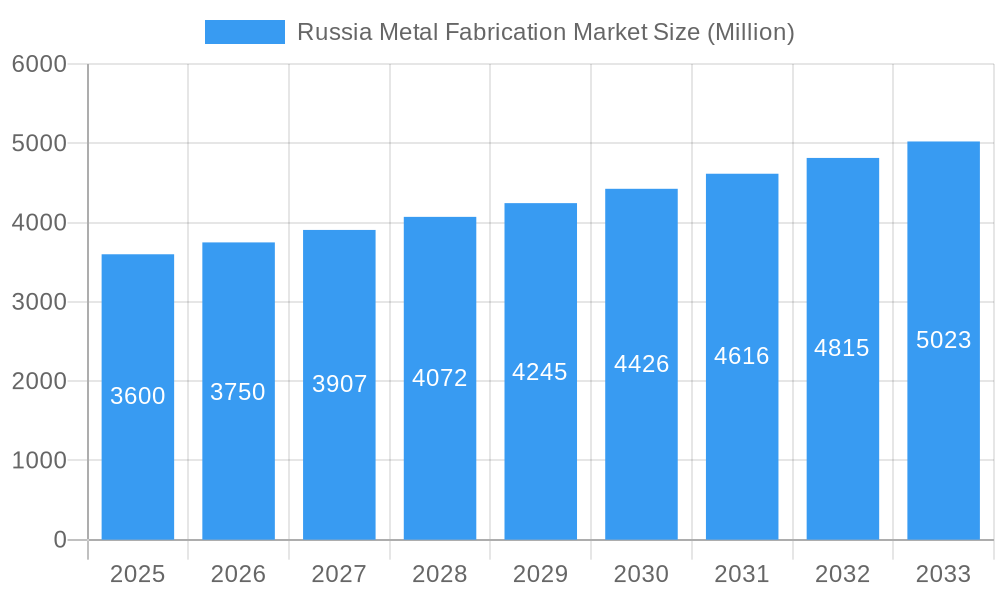

The Russia metal fabrication market, valued at approximately $3.6 billion in 2025, is projected to experience steady growth, driven by increasing investments in infrastructure development, particularly in construction and transportation sectors. The market's Compound Annual Growth Rate (CAGR) of 4.31% from 2025 to 2033 indicates a consistent expansion, fueled by rising demand for fabricated metal products across various industries. Key drivers include government initiatives promoting industrial modernization, the growth of the automotive and machinery sectors, and a resurgence in construction projects following periods of economic fluctuation. While potential geopolitical factors and fluctuations in raw material prices present challenges, the long-term outlook remains positive due to the inherent resilience of the Russian domestic market and ongoing efforts to diversify the economy. Companies such as Severstal-metiz, NLMK, and MMK play a significant role, contributing to the market's overall volume and influencing its competitive landscape. Increased automation and technological advancements within fabrication processes are anticipated to further boost efficiency and market expansion, contributing to the continued growth trajectory.

Russia Metal Fabrication Market Market Size (In Billion)

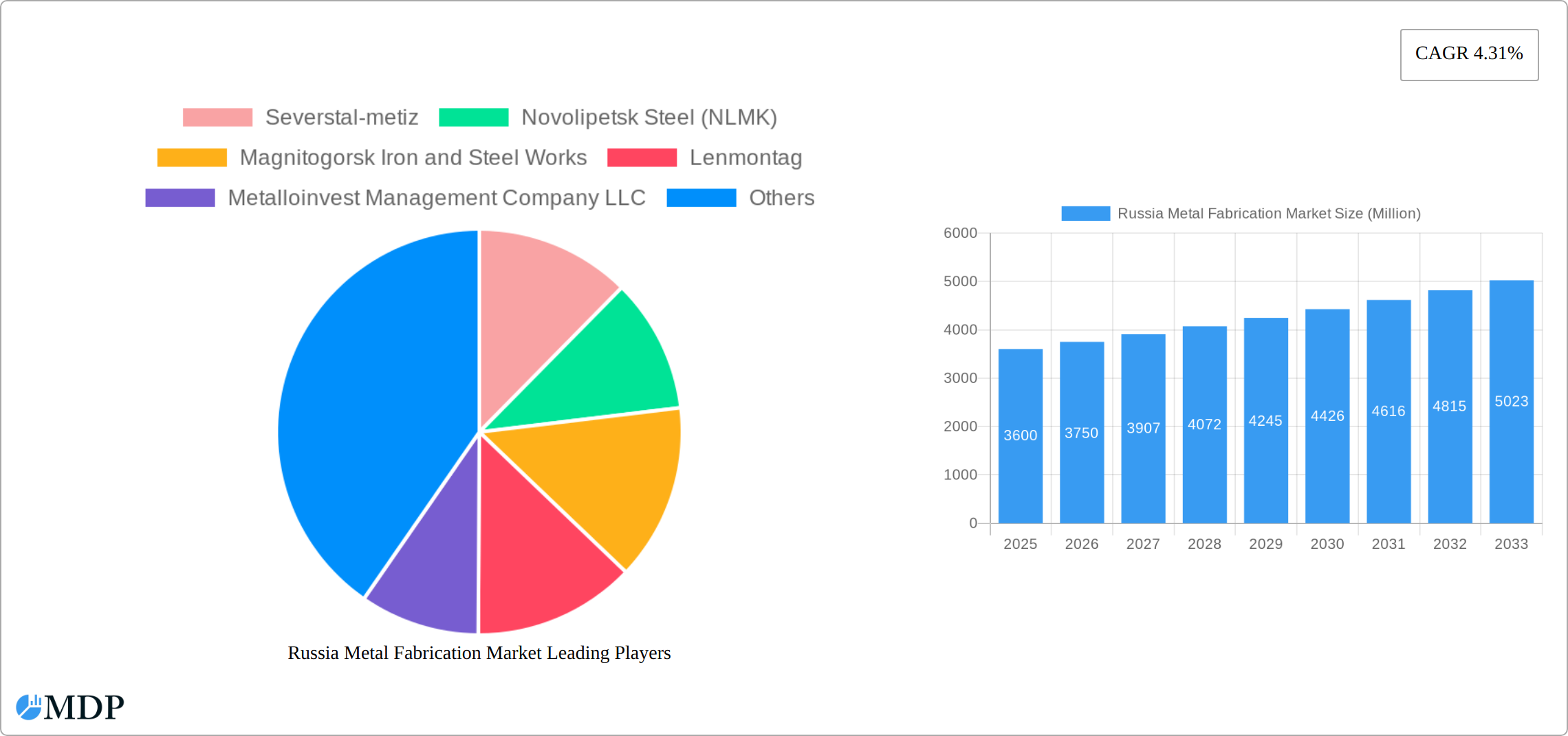

The competitive landscape is characterized by a mix of large integrated steel producers and specialized metal fabrication companies. The largest players benefit from backward integration, controlling significant portions of the raw material supply chain. Smaller players often focus on niche markets or specific fabrication techniques. The market is expected to witness consolidation over the forecast period, with larger players acquiring smaller ones to enhance their market share and product portfolio. The expansion of the energy sector and the need for enhanced pipeline infrastructure will also fuel demand for specialized metal fabrication services, creating opportunities for market expansion in specific segments. Challenges, however, include maintaining a consistent supply of high-quality raw materials and adapting to fluctuating global economic conditions. Further, the development of sustainable and environmentally friendly fabrication processes will be crucial for long-term market success in the face of growing environmental concerns.

Russia Metal Fabrication Market Company Market Share

Russia Metal Fabrication Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Metal Fabrication Market, covering market dynamics, industry trends, leading players, and future growth opportunities. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand the complexities and potential of this dynamic market. The report uses Million for all values.

Russia Metal Fabrication Market Market Dynamics & Concentration

The Russia Metal Fabrication Market is characterized by a moderately concentrated landscape, where established large-scale players command a substantial market share. This is complemented by a vibrant ecosystem of smaller, highly specialized fabrication companies, contributing to the market's overall complexity and diversity. A key driver of innovation is the persistent demand for materials that offer enhanced strength-to-weight ratios and improved cost-effectiveness, particularly from the burgeoning construction and automotive sectors. Environmental stewardship is also a significant influencer, with stringent regulations governing emissions and waste management actively shaping operational strategies. The market faces competitive pressure from substitute materials like advanced composites and specialized polymers, which are finding increasing traction in specific, high-performance applications. End-user preferences are clearly leaning towards bespoke, customized solutions and a greater emphasis on the utilization of sustainable and eco-friendly materials. Merger and acquisition (M&A) activity has maintained a steady, albeit moderate, pace in recent years, with an estimated [Insert Number] deals observed between 2019 and 2024. This trend has contributed to a market concentration ratio of approximately [Insert Percentage]%.

- Market Share: Severstal-metiz currently holds an estimated market share of [Insert Percentage]%, closely followed by NLMK at [Insert Percentage]%. The remaining market share, totaling [Insert Percentage]%, is distributed among other significant industry participants.

- M&A Activity: The period between 2019 and 2024 saw an average of approximately [Insert Number] M&A deals annually. Future consolidation is anticipated, driven by the pursuit of operational efficiencies through economies of scale and enhanced access to cutting-edge technologies.

- Regulatory Landscape: The Russian government's strategic initiatives focused on industrial modernization and fostering domestic production through import substitution present a dual-edged sword, offering both substantial opportunities and unique challenges for market participants.

Russia Metal Fabrication Market Industry Trends & Analysis

The Russia Metal Fabrication Market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately [Insert Percentage]% during the forecast period spanning from 2025 to 2033. This upward trajectory is primarily propelled by intensified infrastructure development initiatives, particularly within the vital energy and transportation networks, alongside a growing demand for sophisticated materials across a multitude of industries. Technological advancements, including the widespread adoption of automation and advanced manufacturing methodologies, are playing a pivotal role in elevating operational efficiency and boosting overall productivity. Shifting consumer preferences towards personalized and environmentally conscious products are compelling metal fabricators to innovate and adapt their product portfolios accordingly. The competitive arena is characterized by a dynamic interplay of aggressive pricing strategies, a relentless pursuit of technological innovation, and a strategic focus on expanding market share. The integration of advanced materials, such as high-strength steels and specialized aluminum alloys, is witnessing a steady increase in market penetration, largely attributed to the burgeoning requirements of the aerospace and automotive sectors.

Leading Markets & Segments in Russia Metal Fabrication Market

The dominant segment within the Russia Metal Fabrication Market is the construction sector, accounting for an estimated xx% of total market value in 2025. This is primarily driven by large-scale infrastructure projects and urban development initiatives across the country. Other significant segments include automotive, machinery, and energy, each contributing around xx%, xx%, and xx% respectively to the market.

- Key Drivers for Construction Dominance:

- Government investment in infrastructure projects.

- Rapid urbanization and growing housing demand.

- Increasing adoption of advanced metal fabrication techniques in construction.

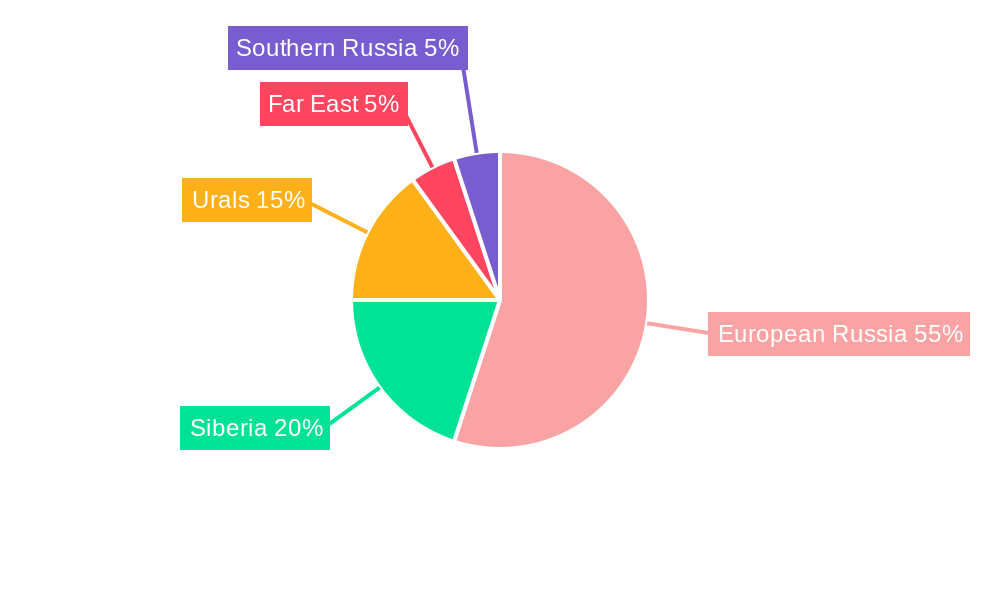

- Regional Analysis: The Western Federal District and Central Federal District represent the most significant regional markets due to higher industrial activity and population density.

Russia Metal Fabrication Market Product Developments

Recent advancements in product development within the Russia Metal Fabrication Market have centered on the creation of materials exhibiting superior lightness, enhanced strength characteristics, and improved resistance to corrosion. These innovations are finding diverse applications across a broad spectrum of industries, including but not limited to, automotive, aerospace, construction, and the energy sector. Competitive advantages are increasingly being forged through groundbreaking technological innovations, the implementation of more efficient manufacturing processes, and the demonstrated capability to deliver highly customized fabrication solutions. A prominent ongoing trend is the seamless integration of smart manufacturing technologies, which are instrumental in achieving greater precision in production and significantly reducing manufacturing lead times.

Key Drivers of Russia Metal Fabrication Market Growth

The Russia Metal Fabrication Market's growth is driven by several factors, including significant government investment in infrastructure development, particularly in energy and transportation, as well as rising demand for durable and versatile materials in various sectors such as construction and machinery. The adoption of advanced manufacturing technologies improves production efficiency and reduces costs. Favorable government policies promoting industrialization further accelerate market expansion.

Challenges in the Russia Metal Fabrication Market

The Russia Metal Fabrication Market faces challenges including fluctuations in raw material prices, impacting production costs and profitability. Geopolitical instability and sanctions can disrupt supply chains and hinder access to essential technologies. Intense competition from both domestic and international players puts downward pressure on prices and profit margins. The overall market is estimated to experience a xx% reduction in growth if these challenges are not addressed efficiently.

Emerging Opportunities in Russia Metal Fabrication Market

The long-term growth of the Russia Metal Fabrication Market is driven by the increasing adoption of sustainable materials and environmentally friendly manufacturing processes, aligning with global sustainability goals. Strategic partnerships and collaborations between metal fabricators and technology providers will create innovative solutions. Expansion into new and emerging markets, both domestically and internationally, presents significant opportunities for growth.

Leading Players in the Russia Metal Fabrication Market Sector

- Severstal-metiz

- Novolipetsk Steel (NLMK)

- Magnitogorsk Iron and Steel Works

- Lenmontag

- Metalloinvest Management Company LLC

- Mechel

- Ruspolimet

- Pic Metall

- Evraz Group

- TMK

- List Not Exhaustive

Key Milestones in Russia Metal Fabrication Market Industry

- November 2022: Novolipetsk Steel (NLMK) successfully upgraded its Blast Furnace No. 3 dedusting system. This significant enhancement resulted in an exceptional dust capture rate of 99.9%, marking a substantial improvement in the company's environmental performance.

- December 2022: Metalloinvest completed a comprehensive modernization of kiln No. 4 at its Lebedinsky GOK pellet plant. This strategic investment led to an increase in production capacity by nearly 10% and concurrently achieved a reduction in energy consumption.

Strategic Outlook for Russia Metal Fabrication Market Market

The Russia Metal Fabrication Market presents a compelling outlook for sustained long-term growth. This optimistic forecast is underpinned by ongoing investments in critical infrastructure development, continuous technological advancements, and a rising demand for sophisticated materials across a diverse array of industries. To navigate this dynamic market successfully, strategic alliances, dedicated investments in research and development (R&D), and the proactive adoption of sustainable operational practices will be paramount. The market is projected to achieve a valuation of approximately [Insert Value] Million by the year 2033.

Russia Metal Fabrication Market Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Utilities

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Other Material Types

-

3. Service Type

- 3.1. Casting

- 3.2. Forging

- 3.3. Machining

- 3.4. Welding & Tubing

- 3.5. Other Service Types

Russia Metal Fabrication Market Segmentation By Geography

- 1. Russia

Russia Metal Fabrication Market Regional Market Share

Geographic Coverage of Russia Metal Fabrication Market

Russia Metal Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Number of Manufacturing Plants in Russia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Metal Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Utilities

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Casting

- 5.3.2. Forging

- 5.3.3. Machining

- 5.3.4. Welding & Tubing

- 5.3.5. Other Service Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Severstal-metiz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novolipetsk Steel (NLMK)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Magnitogorsk Iron and Steel Works

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lenmontag

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metalloinvest Management Company LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mechel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ruspolimet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pic Metall

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evraz Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TMK**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Severstal-metiz

List of Figures

- Figure 1: Russia Metal Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Metal Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 7: Russia Metal Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russia Metal Fabrication Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 15: Russia Metal Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Russia Metal Fabrication Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Metal Fabrication Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Russia Metal Fabrication Market?

Key companies in the market include Severstal-metiz, Novolipetsk Steel (NLMK), Magnitogorsk Iron and Steel Works, Lenmontag, Metalloinvest Management Company LLC, Mechel, Ruspolimet, Pic Metall, Evraz Group, TMK**List Not Exhaustive.

3. What are the main segments of the Russia Metal Fabrication Market?

The market segments include End-user Industry, Material Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Number of Manufacturing Plants in Russia.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Novolipetsk Steel (NLMK) Lipetsk, one of the main production sites of NLMK Group, Russia's biggest producer of steel and high-valued steel products and steel makers, has upgraded its Blast Furnace No. 3 dedusting system, achieving a 99.9% dust capture rate. As a result of NLMK's ongoing environmental improvements, all of its blast furnaces now have advanced dedusting systems that are on par with the best global technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Metal Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Metal Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Metal Fabrication Market?

To stay informed about further developments, trends, and reports in the Russia Metal Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence