Key Insights

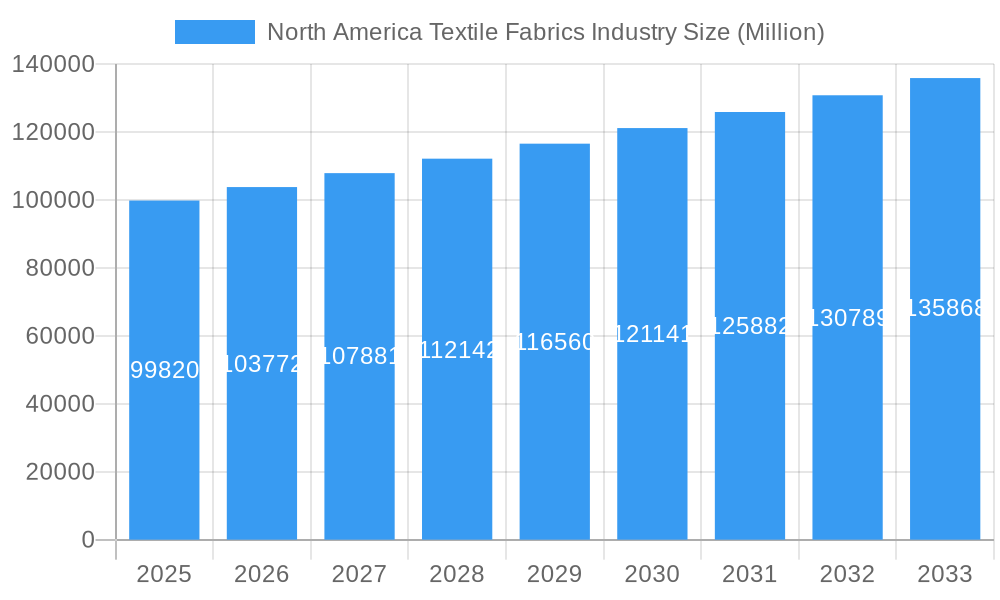

The North American textile fabrics industry, valued at $99.82 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.85% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for comfortable and durable apparel, driven by evolving consumer preferences and rising disposable incomes, significantly contributes to market expansion. Furthermore, the burgeoning home textile sector, encompassing bedding, upholstery, and curtains, presents a substantial growth opportunity. Technological advancements in textile manufacturing, leading to improved efficiency and the creation of innovative fabrics with enhanced performance characteristics (such as moisture-wicking or stain-resistant properties), also contribute positively. The industry benefits from a robust domestic manufacturing base, though it faces challenges related to import competition and fluctuating raw material prices. Growth is expected to be relatively consistent across various segments, with apparel fabrics maintaining a significant market share due to consistent consumer demand. However, the home textile segment is expected to see accelerated growth driven by renovation and new construction activities.

North America Textile Fabrics Industry Market Size (In Billion)

Despite the positive outlook, the industry faces certain constraints. Increased labor costs and environmental regulations related to sustainable manufacturing practices can put pressure on profit margins. Competition from low-cost producers in Asia remains a significant challenge. However, North American manufacturers are increasingly focusing on niche markets and value-added products, emphasizing sustainability and high-quality craftsmanship to differentiate themselves and maintain competitiveness. The industry's future success will hinge on its ability to adapt to evolving consumer preferences, embrace technological advancements, and prioritize sustainable production methods. Major players like Nike, Levi Strauss & Co., and Mohawk Industries will likely lead the charge in innovation and market share expansion during the forecast period.

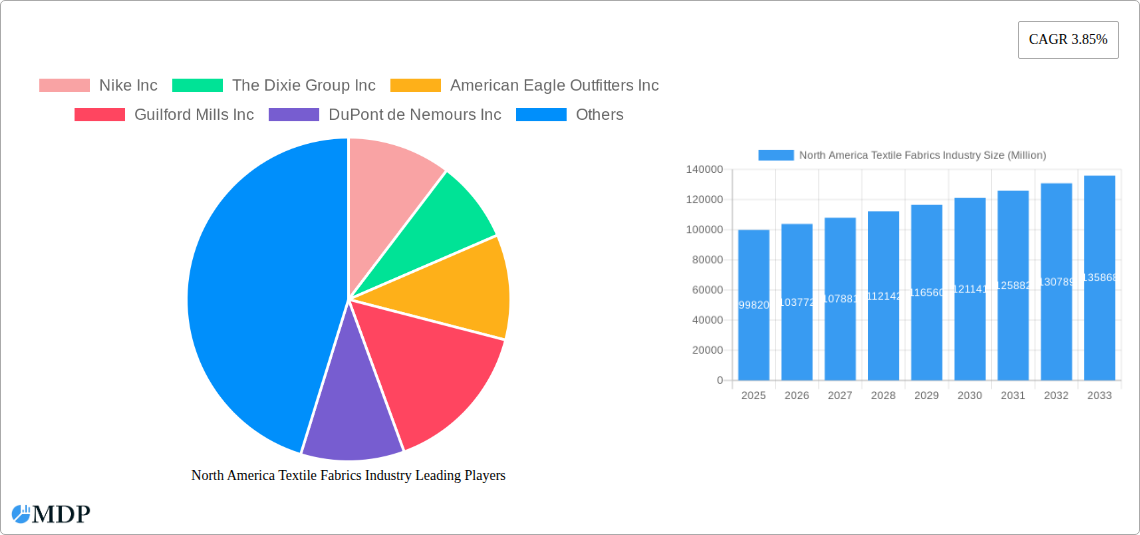

North America Textile Fabrics Industry Company Market Share

North America Textile Fabrics Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America textile fabrics industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market dynamics, key trends, leading players, and future opportunities within this dynamic sector. The report projects a xx Million USD market size by 2033, indicating significant growth potential.

North America Textile Fabrics Industry Market Dynamics & Concentration

The North American textile fabrics market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the landscape is dynamic, influenced by ongoing innovation, evolving regulatory frameworks, the emergence of substitute materials, and shifting end-user preferences. Mergers and acquisitions (M&A) play a crucial role in shaping market dynamics. The historical period (2019-2024) saw approximately xx M&A deals, resulting in a xx% increase in market concentration.

- Market Concentration: The top 5 players collectively hold an estimated xx% market share in 2025.

- Innovation Drivers: Sustainability initiatives (recycled fibers, eco-friendly dyes), technological advancements (smart fabrics, 3D printing), and customization are driving innovation.

- Regulatory Frameworks: Regulations regarding labor practices, environmental standards, and product safety significantly impact market operations.

- Product Substitutes: The rise of plant-based and recycled materials poses a challenge to traditional textile fabrics.

- End-User Trends: Growing demand for performance fabrics, comfort, and sustainable products is reshaping the market.

- M&A Activities: The recent acquisition of Huntsman Corporation's Textile Effects division by Archroma for USD 593 Million highlights the ongoing consolidation within the sector.

North America Textile Fabrics Industry Industry Trends & Analysis

The North American textile fabrics industry is experiencing significant transformation driven by several factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the rising demand for apparel and home furnishings, the increasing adoption of sustainable and eco-friendly materials, and technological advancements in fabric production. Consumer preferences are shifting towards higher quality, functional fabrics with unique properties, leading to increased demand for specialized textiles. The industry faces challenges from rising raw material costs and increased competition from global players. Market penetration of sustainable fabrics is projected to reach xx% by 2033.

Leading Markets & Segments in North America Textile Fabrics Industry

The United States dominates the North American textile fabrics market, driven by a large consumer base, established manufacturing infrastructure, and robust retail sector.

- Key Drivers in the US Market:

- Strong consumer spending on apparel and home furnishings.

- Well-developed textile manufacturing infrastructure.

- Presence of major textile brands and retailers.

- Favorable government policies supporting the industry.

The apparel segment holds the largest market share, followed by the home furnishings segment. This dominance is fueled by increasing disposable incomes, changing fashion trends, and a preference for comfortable and aesthetically pleasing home environments. Further analysis reveals that the growth of the sportswear segment is outpacing other segments due to increased participation in athletic activities.

North America Textile Fabrics Industry Product Developments

Recent product innovations focus on enhancing functionality, sustainability, and performance. This includes the development of high-performance fabrics with moisture-wicking, antimicrobial, and UV-protective properties. The integration of smart technologies in textiles, such as embedded sensors and conductive threads, is gaining traction. These innovations cater to the growing demand for specialized textiles in various applications, including sportswear, medical, and industrial settings.

Key Drivers of North America Textile Fabrics Industry Growth

The North American textile fabrics industry is propelled by several key factors. Technological advancements in fabric production, leading to improved efficiency and product quality, play a vital role. Economic factors, such as rising disposable incomes and increased consumer spending, also contribute significantly. Furthermore, supportive government policies promoting sustainable practices and domestic manufacturing further stimulate growth.

Challenges in the North America Textile Fabrics Industry Market

The industry faces several challenges, including rising raw material costs which increased by xx% in 2024 impacting profit margins. Supply chain disruptions and global competition from low-cost producers pose significant threats. Stricter environmental regulations also add to the operational complexities. These challenges necessitate innovative strategies for cost optimization, supply chain resilience, and sustainable production practices.

Emerging Opportunities in North America Textile Fabrics Industry

The industry presents several promising opportunities. The increasing demand for sustainable and recycled fabrics opens avenues for eco-friendly textile production. Strategic partnerships and collaborations among textile manufacturers, technology providers, and brands can foster innovation and market expansion. Furthermore, exploring new markets and expanding product applications, such as in the medical and industrial sectors, can drive long-term growth.

Leading Players in the North America Textile Fabrics Industry Sector

- Nike Inc

- The Dixie Group Inc

- American Eagle Outfitters Inc

- Guilford Mills Inc

- DuPont de Nemours Inc

- Levi Strauss & Co

- Hennes & Mauritz AB

- WestPoint Home Inc

- Welspun India Ltd

- Standard Textile Co Inc

- Mohawk Industries Inc

- Elevate Textiles Inc

Key Milestones in North America Textile Fabrics Industry Industry

- February 2023: Huntsman Corporation completes the sale of its Textile Effects division to Archroma for USD 593 Million, impacting market consolidation.

- December 2022: India and Canada negotiate a free trade agreement, potentially influencing trade dynamics and impacting Canadian textile imports.

- August 2022: Huntsman Corporation announces the definitive agreement for the sale of its Textile Effects business to Archroma, signaling a shift in market ownership.

Strategic Outlook for North America Textile Fabrics Industry Market

The North American textile fabrics industry is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing demand for sustainable products. Strategic investments in research and development, sustainable manufacturing practices, and strategic partnerships will be crucial for capturing future market opportunities. Focus on niche markets and product differentiation will also be key success factors in this competitive landscape.

North America Textile Fabrics Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

North America Textile Fabrics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

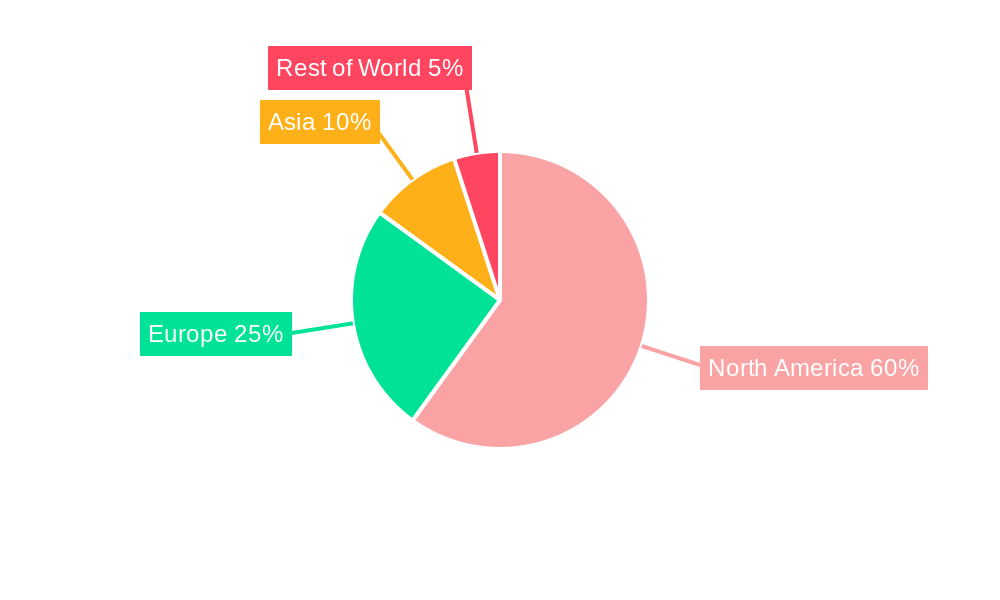

North America Textile Fabrics Industry Regional Market Share

Geographic Coverage of North America Textile Fabrics Industry

North America Textile Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.3. Market Restrains

- 3.3.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.4. Market Trends

- 3.4.1. Increasing demand for North America's apparels driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Textile Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nike Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dixie Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 American Eagle Outfitters Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guilford Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont de Nemours Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Levi Strauss & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hennes & Mauritz AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WestPoint Home Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Welspun India Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Textile Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mohawk Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Elevate Textiles Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nike Inc

List of Figures

- Figure 1: North America Textile Fabrics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Textile Fabrics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: North America Textile Fabrics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Textile Fabrics Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: North America Textile Fabrics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Textile Fabrics Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Textile Fabrics Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the North America Textile Fabrics Industry?

Key companies in the market include Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, Elevate Textiles Inc **List Not Exhaustive.

3. What are the main segments of the North America Textile Fabrics Industry?

The market segments include Application, Material Type, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

6. What are the notable trends driving market growth?

Increasing demand for North America's apparels driving the market.

7. Are there any restraints impacting market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

8. Can you provide examples of recent developments in the market?

February 2023: Huntsman Corporation (NYSE: HUN) announced that it has completed the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The agreed purchase price was USD 593 million in cash plus assumed pension liabilities. Huntsman expects the net after-tax cash proceeds to be approximately USD 540 million before customary post-closing adjustments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Textile Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Textile Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Textile Fabrics Industry?

To stay informed about further developments, trends, and reports in the North America Textile Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence