Key Insights

The Canadian metal fabrication equipment market is poised for significant expansion, driven by robust demand across key sectors like automotive, construction, and aerospace. With a projected Compound Annual Growth Rate (CAGR) of 1.6%, the market is estimated to reach 6.5 billion by 2025. This growth trajectory is underpinned by increasing infrastructure investments, the adoption of advanced manufacturing technologies such as automation and robotics, and a concentrated effort towards enhancing operational efficiency across the supply chain. While challenges like raw material price volatility and skilled labor scarcity persist, the industry's future is bright. A notable trend is the increasing demand for sophisticated, technologically advanced equipment and integrated solutions, compelling manufacturers to innovate and deliver customized offerings with strong after-sales support to maintain market leadership.

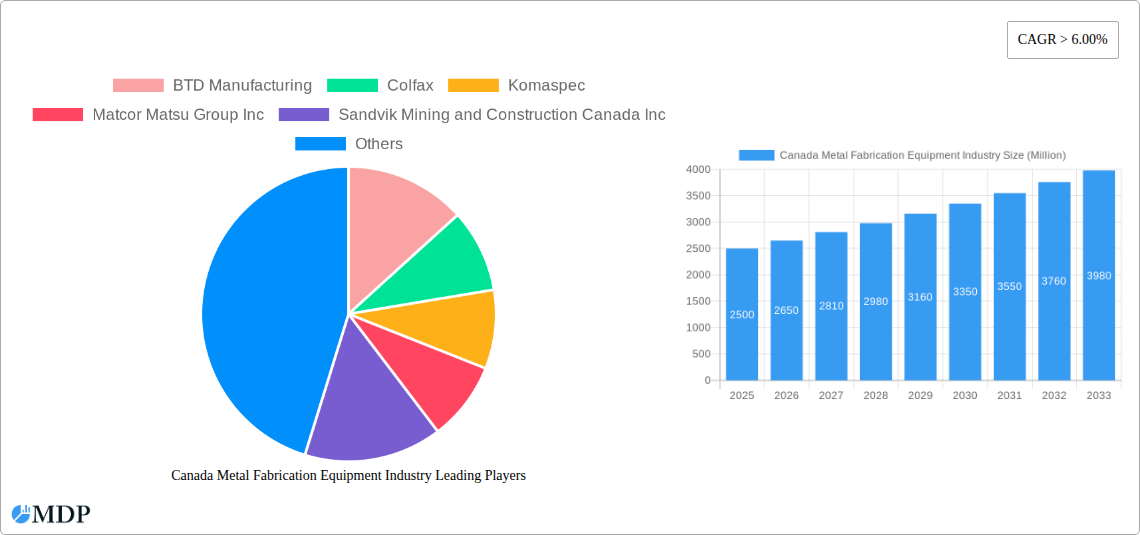

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

Leading companies including BTD Manufacturing and Colfax are strategically positioned to leverage market opportunities. Niche players also play a vital role by addressing specialized demands. The market segmentation is expected to align with diverse equipment types, such as laser cutting machines, press brakes, and welding equipment, as well as specific end-use industries. Regional economic activity and industrial concentration within Canada will likely influence market dynamics. To secure a competitive advantage, companies must prioritize research and development, cultivate strategic alliances, and deeply understand evolving customer requirements. The forecast period from 2025 to 2033 anticipates sustained market growth, potentially surpassing earlier projections, propelled by continuous technological advancements and ongoing infrastructure development in Canada's metal fabrication landscape.

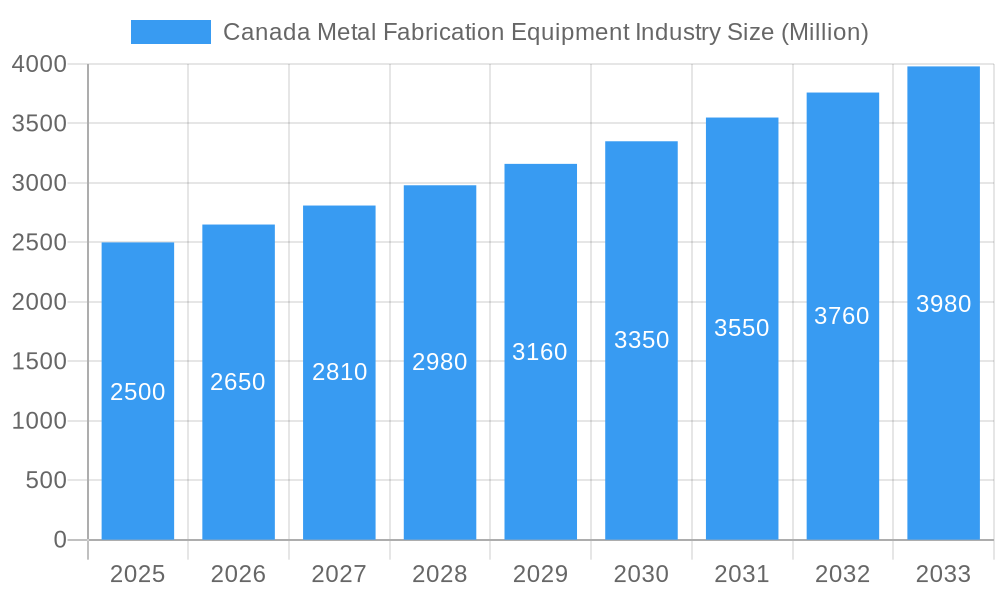

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canadian metal fabrication equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key players shaping its evolution. The report uses Million for all values.

Canada Metal Fabrication Equipment Industry Market Dynamics & Concentration

This section analyzes the Canadian metal fabrication equipment market's concentration, exploring key drivers of innovation, regulatory landscapes, substitute products, end-user trends, and mergers & acquisitions (M&A) activity. The market is moderately concentrated, with several major players holding significant market share, but also featuring a substantial number of smaller, specialized firms.

Market Concentration: The top five players command an estimated xx% of the market share in 2025, while the remaining xx% is distributed among numerous smaller businesses. This indicates a competitive landscape with opportunities for both established players and emerging companies.

Innovation Drivers: Technological advancements like automation, AI-powered systems, and additive manufacturing are driving innovation, improving efficiency, and enhancing product quality. The increasing demand for customized solutions fuels the demand for flexible and adaptable fabrication technologies.

Regulatory Framework: Compliance with safety, environmental, and labor regulations is paramount. These regulations influence the design and operation of equipment, as well as impacting manufacturing costs.

Product Substitutes: While direct substitutes are limited, alternative manufacturing processes such as 3D printing and advanced casting techniques pose a level of competitive pressure in specific niche segments.

End-User Trends: Growing industrial automation across various sectors, including automotive, aerospace, and construction, fuels demand for advanced metal fabrication equipment. Emphasis on sustainable practices also drives demand for energy-efficient and environmentally friendly technologies.

M&A Activity: The industry has witnessed a moderate level of M&A activity in recent years, with xx major deals recorded between 2019 and 2024. Examples include the February 2022 acquisition of Steelcraft by Arrow Machine and Fabrication Group and the January 2022 acquisition of Eastern Fabricators by Ag Growth International Inc. These acquisitions highlight a trend towards consolidation and expansion of capabilities within the industry.

Canada Metal Fabrication Equipment Industry Industry Trends & Analysis

This section provides a detailed analysis of the industry’s growth trajectory, exploring key market drivers, technological disruptions, consumer preferences, and competitive dynamics. The Canadian metal fabrication equipment market demonstrates a robust growth trend, driven primarily by investments in infrastructure projects, rising demand from the automotive and construction industries, and technological innovations.

The market is anticipated to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033. Several factors contribute to this growth. Firstly, government investments in infrastructure development projects create significant demand for metal fabrication equipment. Secondly, the automotive sector's ongoing modernization efforts, including electric vehicle manufacturing, fuel demand for high-precision fabrication equipment. Thirdly, increasing automation across industrial sectors and adoption of advanced technologies such as robotics and AI-driven solutions further propel market expansion. The competitive landscape features both established international players and local companies, leading to a dynamic and evolving market. Pricing strategies, product differentiation, and technological advancements heavily influence market share amongst competitors.

Leading Markets & Segments in Canada Metal Fabrication Equipment Industry

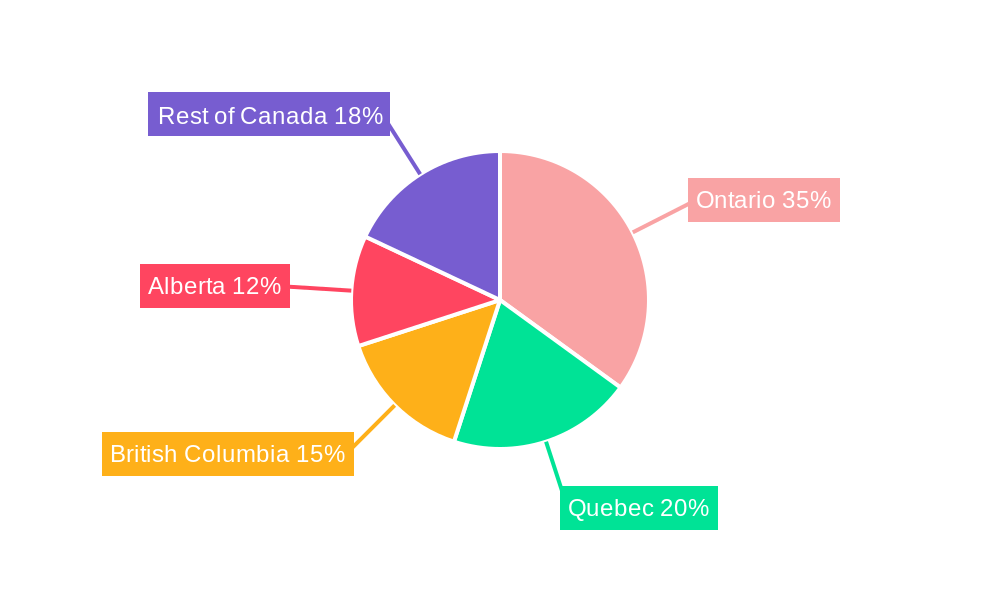

The Canadian metal fabrication equipment market is geographically diverse, with significant demand across various regions. Ontario, Quebec, and British Columbia are the leading markets, driven by strong industrial activity and infrastructure development.

- Ontario: High concentration of manufacturing industries, automotive plants, and robust infrastructure projects.

- Quebec: Strong presence of aerospace and transportation sectors, fueling demand for precision metal fabrication equipment.

- British Columbia: Growing resource extraction industry and expansion of construction projects supporting demand.

The dominant segments within the Canadian market are:

- Sheet metal fabrication equipment: High demand driven by automotive, construction and consumer goods sectors.

- Tube and pipe bending equipment: Strong demand from the energy, oil & gas and automotive industries.

- Welding equipment: Essential across various industries; sustained demand is expected due to automation adoption.

These segments benefit from favorable economic policies supporting industrial growth, along with robust infrastructure development that necessitate advanced metal fabrication capabilities. The competitive intensity within these segments is high, with both domestic and international players vying for market share.

Canada Metal Fabrication Equipment Industry Product Developments

Recent product developments highlight a strong focus on automation, precision, and efficiency. New equipment incorporates advanced sensors, robotics, and AI-driven controls, enabling high-speed and precise fabrication processes. This enhances productivity, reduces waste, and improves product quality, particularly within the sheet metal and tube bending segments. The emphasis is on delivering solutions that meet increasingly stringent industry standards for quality and sustainability. The market also sees the integration of digital technologies, including cloud-based data analytics, enabling better process optimization and remote monitoring capabilities.

Key Drivers of Canada Metal Fabrication Equipment Industry Growth

Several factors fuel the growth of the Canadian metal fabrication equipment industry. Firstly, increasing government investments in infrastructure projects across the country directly stimulate demand for fabrication equipment. Secondly, the growing automotive sector, particularly electric vehicle manufacturing, necessitates high-precision fabrication equipment and processes. Thirdly, technological advancements, including automation and AI-powered systems, lead to higher efficiency and productivity.

Challenges in the Canada Metal Fabrication Equipment Industry Market

The industry faces challenges like fluctuating raw material prices, which impact manufacturing costs and profitability. Supply chain disruptions can delay projects and increase production costs, impacting overall market performance. Intense competition from established international players and the emergence of new technologies requires constant adaptation and innovation to maintain a competitive edge.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

Several emerging opportunities exist within the industry. Strategic partnerships between equipment manufacturers and end-users can lead to the development of specialized solutions that meet specific needs. The ongoing development and integration of advanced technologies like additive manufacturing and automation are expected to drive new market segments. Expansion into new markets or diversification of product offerings can offer significant growth potential for companies.

Leading Players in the Canada Metal Fabrication Equipment Industry Sector

- BTD Manufacturing

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc

- Atlas Copco

- AMADA Canada

- DMG MORI Canada

List Not Exhaustive

Key Milestones in Canada Metal Fabrication Equipment Industry Industry

- February 2022: Arrow Machine and Fabrication Group acquired Steelcraft, expanding its global reach and manufacturing capabilities. This acquisition reflects a broader trend towards consolidation within the industry.

- January 2022: Ag Growth International Inc. acquired Eastern Fabricators, further strengthening its presence in the food processing equipment market segment. This highlights the growing importance of specialized fabrication in niche markets.

Strategic Outlook for Canada Metal Fabrication Equipment Industry Market

The Canadian metal fabrication equipment market shows strong potential for growth driven by continued infrastructure investments, technological advancements, and the growing needs of various industrial sectors. Strategic partnerships, investments in research and development, and focusing on sustainable and efficient solutions will be key factors for success in this competitive but promising market. The industry is set for significant expansion over the forecast period, offering attractive opportunities for both established and new market entrants.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence