Key Insights

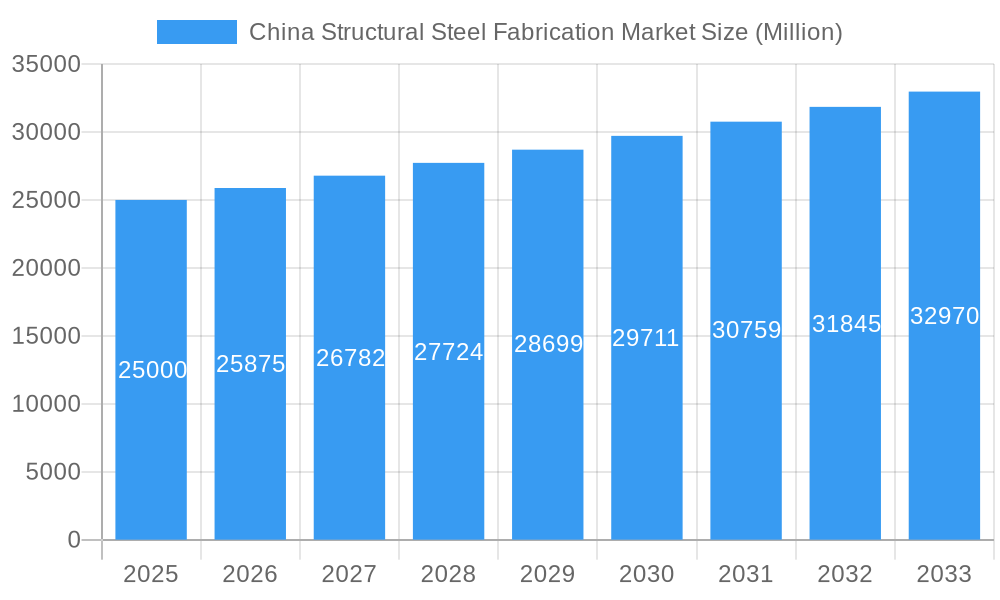

China's structural steel fabrication market is projected for significant growth, estimated to reach $43.4 billion by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. This expansion is driven by extensive infrastructure development, rapid urbanization, and rising demand from key industries. The manufacturing and construction sectors, fueled by residential and commercial projects, will be primary consumers. The automotive sector's adoption of advanced manufacturing and the growing renewable energy sector, requiring substantial steel frameworks, will also contribute significantly to market demand. The energy and power sector, in particular, shows a surge in demand for specialized steel structures for power plants and transmission networks.

China Structural Steel Fabrication Market Market Size (In Billion)

Key growth drivers include government initiatives promoting infrastructure upgrades, smart city development, and high-tech manufacturing. Advancements in fabrication technologies, such as automated welding and cutting systems, are boosting efficiency and reducing costs. Emerging trends like the use of high-strength steel and sustainable fabrication practices are shaping the market. While potential challenges include raw material price fluctuations and environmental regulations, China's vast industrial and construction activities, coupled with a strong manufacturing base and focus on innovation, ensure a positive outlook for the structural steel fabrication sector.

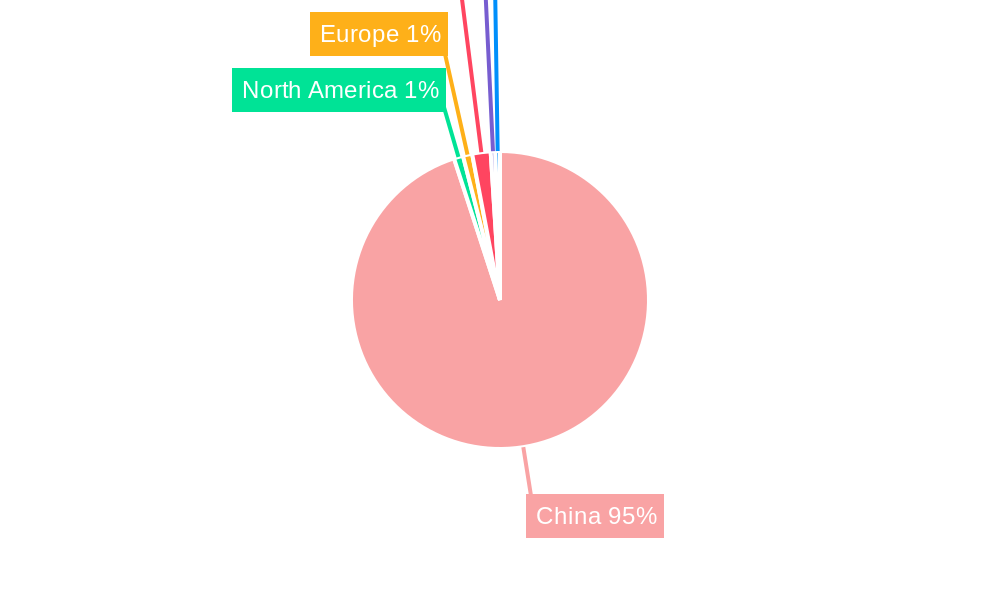

China Structural Steel Fabrication Market Company Market Share

China Structural Steel Fabrication Market: Comprehensive Industry Analysis & Forecast (2019-2033)

Unlock unparalleled insights into the dynamic China Structural Steel Fabrication Market with this in-depth report. Covering the historical period (2019-2024), base year (2025), and a robust forecast period (2025-2033), this analysis delves into market drivers, trends, competitive landscapes, and future opportunities. Discover the intricacies of metal welding, metal forming, metal cutting, metal shearing, metal stamping, machining, metal rolling, and other key services across diverse applications including construction, automotive, manufacturing, energy & power, electronics, defense & aerospace, and more. With a market size estimated at USD 75.5 Million in 2025, this report provides critical data for industry stakeholders seeking to capitalize on the burgeoning Chinese market.

China Structural Steel Fabrication Market Market Dynamics & Concentration

The China Structural Steel Fabrication Market exhibits a moderate to high concentration, characterized by the presence of several large, established players alongside a significant number of smaller, specialized fabricators. Market dynamics are heavily influenced by government infrastructure spending, technological advancements in fabrication processes, and evolving regulatory frameworks aimed at ensuring safety and environmental compliance. Innovation drivers include the increasing demand for high-strength, lightweight steel structures, advancements in automation and robotics for precision fabrication, and the integration of Building Information Modeling (BIM) for design and construction efficiency. Product substitutes, while present in certain niche applications, are generally outcompeted by the cost-effectiveness and structural integrity of fabricated steel. End-user trends lean towards pre-engineered and modular steel solutions for faster project completion and reduced on-site labor costs. Mergers and acquisitions (M&A) activities are a key feature, with major steel groups consolidating to enhance their market reach and vertical integration. The report details key M&A transactions, providing insights into deal values and strategic implications.

China Structural Steel Fabrication Market Industry Trends & Analysis

The China Structural Steel Fabrication Market is poised for significant growth, driven by a confluence of robust economic development and increasing urbanization. The Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period underscores the market's upward trajectory. Key growth drivers include the continuous expansion of the construction sector, fueled by extensive government investments in infrastructure projects such as high-speed rail, airports, and urban renewal initiatives. Furthermore, the burgeoning manufacturing sector, with its increasing demand for industrial buildings and complex machinery components, significantly contributes to market penetration. Technological disruptions are reshaping the industry, with the adoption of advanced welding techniques, laser cutting, and robotic automation enhancing precision, speed, and cost-efficiency in fabrication processes. Consumer preferences are shifting towards sustainable and energy-efficient building solutions, prompting fabricators to explore the use of recycled steel and develop lighter, more resilient structural designs. The competitive dynamics are characterized by intense price competition, but also by a growing emphasis on quality, customization, and value-added services. The market penetration of specialized fabrication services is expected to rise as industries seek tailored solutions to meet their unique operational requirements.

Leading Markets & Segments in China Structural Steel Fabrication Market

The Construction application segment overwhelmingly dominates the China Structural Steel Fabrication Market, driven by the nation's ongoing urbanization and massive infrastructure development programs. The sheer scale of projects, from residential complexes to large-scale industrial facilities and transportation networks, necessitates a vast quantity of fabricated steel. Key drivers for this dominance include supportive government economic policies focused on infrastructure investment and rapid urbanization, which directly translate into sustained demand for structural steel.

Within the service segments, Metal Welding holds the largest market share due to its fundamental role in joining steel components to create robust structures. This is closely followed by Metal Forming and Metal Cutting, essential processes for shaping steel to meet precise design specifications.

Construction Dominance:

- Economic Policies: Government initiatives promoting affordable housing, urban development, and infrastructure upgrades are primary catalysts.

- Urbanization Rate: The continuous migration of populations to cities fuels the demand for new buildings and urban infrastructure.

- Infrastructure Projects: Large-scale investments in transportation (high-speed rail, highways, airports), energy (power plants, substations), and industrial parks create substantial demand.

- Building Codes & Standards: Increasingly stringent safety and structural integrity standards necessitate reliable and high-quality fabricated steel.

Dominant Service Segments:

- Metal Welding: Crucial for structural integrity, with advancements in automated welding technologies enhancing efficiency and quality.

- Metal Forming: Essential for creating complex shapes and profiles required for modern architectural designs and specialized industrial applications.

- Metal Cutting: Precision cutting is vital for material optimization and creating components that fit seamlessly, reducing waste and labor.

While other applications like Automotive and Manufacturing are significant contributors, their demand is dwarfed by the sheer volume required by the construction sector. The growth in renewable energy projects also presents a growing, albeit smaller, demand for specialized steel structures.

China Structural Steel Fabrication Market Product Developments

Product developments in the China Structural Steel Fabrication Market are increasingly focused on enhancing strength-to-weight ratios, improving corrosion resistance, and enabling faster on-site assembly. Innovations in pre-fabricated and modular steel components are gaining traction, offering significant advantages in construction speed and cost reduction. Advancements in laser cutting and robotic welding technologies are enabling the fabrication of more complex and precise geometries, allowing for greater design flexibility and improved structural performance. These developments contribute to competitive advantages by reducing material waste, minimizing labor requirements, and delivering higher quality, more durable structures that meet evolving industry standards.

Key Drivers of China Structural Steel Fabrication Market Growth

Several key factors are propelling the growth of the China Structural Steel Fabrication Market. Government investment in infrastructure remains a primary driver, with continuous spending on transportation networks, urban development, and industrial zones creating sustained demand. The manufacturing sector's expansion, particularly in high-tech industries requiring specialized facilities, also contributes significantly. Technological advancements in fabrication processes, such as automation and precision cutting, are improving efficiency and enabling more complex designs. Furthermore, an increasing emphasis on sustainable construction practices is driving the demand for recyclable and durable steel structures.

Challenges in the China Structural Steel Fabrication Market Market

Despite its growth, the China Structural Steel Fabrication Market faces several challenges. Fluctuations in raw material prices, particularly steel, can significantly impact profitability and project costs. Intense price competition among a large number of fabricators can erode profit margins. Stringent environmental regulations and the need for compliance with evolving safety standards can increase operational costs and necessitate significant investment in new technologies and processes. Skilled labor shortages in specialized fabrication roles can also hinder production capacity and quality. Finally, supply chain disruptions, as evidenced by recent global events, can impact the timely delivery of raw materials and finished products.

Emerging Opportunities in China Structural Steel Fabrication Market

Emerging opportunities in the China Structural Steel Fabrication Market lie in several key areas. The growing demand for high-rise buildings and complex architectural designs presents opportunities for fabricators offering specialized engineering and advanced fabrication capabilities. The expansion of renewable energy projects, including wind farms and solar power installations, requires custom-engineered steel structures. Strategic partnerships between fabricators and technology providers can drive the adoption of smart manufacturing solutions and Industry 4.0 technologies, enhancing efficiency and competitiveness. Furthermore, the increasing focus on green building initiatives opens avenues for developing and supplying eco-friendly steel fabrication solutions.

Leading Players in the China Structural Steel Fabrication Market Sector

- China Steel Structure Co Ltd

- Hebei Baofeng Steel Structure Co Ltd

- Qingdao Xinguangzheng Steel Structure Co Ltd

- United Steel Structures Ltd

- Qingdao Havit Steel Structure Co Ltd

- Huayin Group

- Qingdao Tailong Steel Structure Co Ltd

- Hongfeng Industrial Group

- Wuxi Chuxin Steel Structure Project Co Ltd

- Guangdong Dongji Intelligent Device Co Ltd

- Rizhao Steel Holding Group Co Ltd

- Dingli Steel Structure Co Ltd

Key Milestones in China Structural Steel Fabrication Market Industry

- August 2022: China Baowu Steel Group, a state-owned enterprise and the world's largest iron and steel company, acquired a 51% stake in XinSteel, the biggest steelmaker in Jiangxi province. This significant M&A activity, valued at CNY 4.26 billion (USD 630 million), signals consolidation and strategic expansion within the Chinese steel industry, impacting raw material availability and pricing for structural steel fabricators.

- December 2022: China Baowu Steel Group, further solidifying its dominant position, received approval to take over Sinosteel Group. This merger, overseen by the state assets regulator, is poised to enhance Baowu Steel's global footprint and overseas rights and interests, potentially influencing global steel supply chains and market dynamics for fabricated steel products.

Strategic Outlook for China Structural Steel Fabrication Market Market

The strategic outlook for the China Structural Steel Fabrication Market is highly positive, driven by sustained government support for infrastructure development and the country's ongoing industrial modernization. Growth accelerators include the increasing adoption of advanced manufacturing technologies, such as AI-powered design optimization and robotic fabrication, which will enhance productivity and customization. The rise of prefabricated and modular construction presents a significant opportunity for fabricators to offer integrated solutions. Furthermore, a growing emphasis on sustainable and high-performance steel structures will create demand for innovative material solutions and fabrication techniques. Strategic partnerships and vertical integration will be crucial for companies looking to secure supply chains and expand their market reach.

China Structural Steel Fabrication Market Segmentation

-

1. Service

- 1.1. Metal Welding

- 1.2. Metal Forming

- 1.3. Metal Cutting

- 1.4. Metal Shearing

- 1.5. Metal Stamping

- 1.6. Machining

- 1.7. Metal Rolling

- 1.8. Others

-

2. Application

- 2.1. Construction

- 2.2. Automotive

- 2.3. Manufacturing

- 2.4. Energy & Power

- 2.5. Electronics

- 2.6. Defense & Aerospace

- 2.7. Others

China Structural Steel Fabrication Market Segmentation By Geography

- 1. China

China Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of China Structural Steel Fabrication Market

China Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Prefabricated Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Metal Welding

- 5.1.2. Metal Forming

- 5.1.3. Metal Cutting

- 5.1.4. Metal Shearing

- 5.1.5. Metal Stamping

- 5.1.6. Machining

- 5.1.7. Metal Rolling

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Automotive

- 5.2.3. Manufacturing

- 5.2.4. Energy & Power

- 5.2.5. Electronics

- 5.2.6. Defense & Aerospace

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Steel Structure Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hebei Baofeng Steel Structure Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qingdao Xinguangzheng Steel Structure Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Steel Structures Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qingdao Havit Steel Structure Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huayin Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Tailong Steel Structure Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hongfeng Industrial Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wuxi Chuxin Steel Structure Project Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guangdong Dongji Intelligent Device Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rizhao Steel Holding Group Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dingli Steel Structure Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China Steel Structure Co Ltd

List of Figures

- Figure 1: China Structural Steel Fabrication Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Structural Steel Fabrication Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: China Structural Steel Fabrication Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Structural Steel Fabrication Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the China Structural Steel Fabrication Market?

Key companies in the market include China Steel Structure Co Ltd, Hebei Baofeng Steel Structure Co Ltd, Qingdao Xinguangzheng Steel Structure Co Ltd, United Steel Structures Ltd, Qingdao Havit Steel Structure Co Ltd, Huayin Group, Qingdao Tailong Steel Structure Co Ltd, Hongfeng Industrial Group, Wuxi Chuxin Steel Structure Project Co Ltd, Guangdong Dongji Intelligent Device Co Ltd, Rizhao Steel Holding Group Co Ltd, Dingli Steel Structure Co Ltd.

3. What are the main segments of the China Structural Steel Fabrication Market?

The market segments include Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Prefabricated Buildings.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022; The world's largest iron and steel company China Baowu Steel Group, a state-owned enterprise, acquired a 51% stake in XinSteel, the biggest steelmaker in Jiangxi province. JunHe and Clifford Chance advised this CNY 4.26 billion (USD 630 million) deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the China Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence